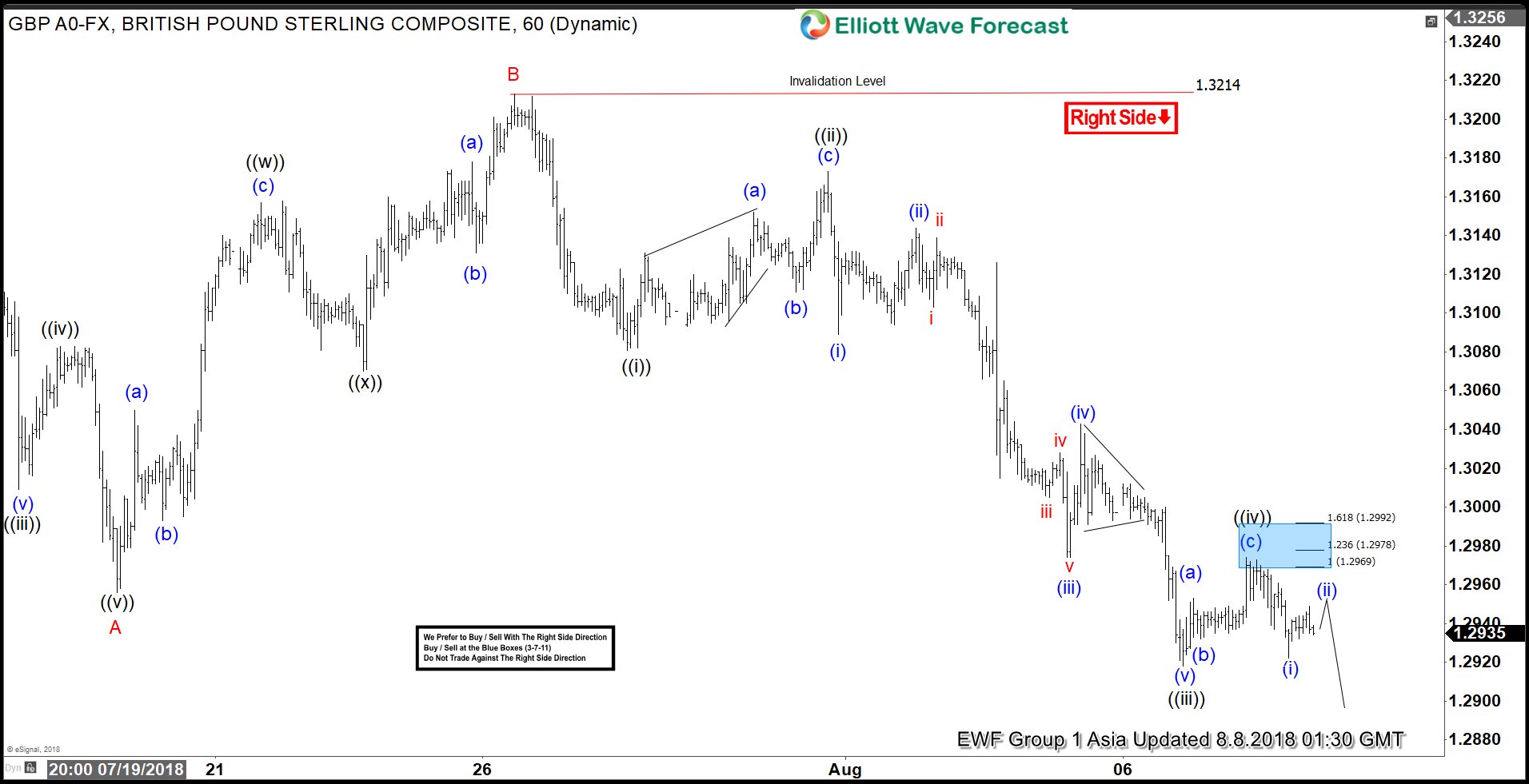

GBPUSD short-term Elliott Wave analysis suggests that the decline from 7/09/2018 peak (1.3361) is unfolding as Elliott wave zigzag when Minor wave A ended in 5 waves structure at 1.2956 low. Up from there, the bounce to 1.3214 high ended Minor wave B. The internals of that bounce unfolded as a Double three structure where Minute wave ((w)) ended at $1.3157. Minute wave ((x)) ended at 1.3070 low. And Minute wave ((y)) of B ended at 1.3214 high.

Down from there, Minor wave C remains in progress in another 5 waves. The internals of wave C is unfolding as an impulse & decline to 1.3081 ended Minute wave ((i)) in 5 waves. Up from there, the bounce to 1.3173 high ended Minute wave ((ii)) in 3 waves. Afterwards, pair declined lower in another 5 waves structure with lesser degree cycles showing sub-division of 5 waves structure. And ended Minute wave ((iii)) at 1.2918 low. Above from there, Minute wave ((iv)) is proposed complete at 1.2974 high. At this stage, a break below 1.2919 low remains to be seen for final confirmation and to avoid double correction in Minute wave ((iv)).

Near-term, while bounces fail below 1.2974 high and more importantly the pivot from 1.3214 high stays intact, expect pair to resume lower in Minute wave ((v)) before ending Minor wave C. The minimum extension area for Minute wave ((v)) i.e inverse 1.236%-161.8% Fibonacci extension area of Minute wave ((iv)) comes at 1.2906 – 1.2884. In case of further extension, Minute wave ((v))=((i)) target area can reach 1.2842 – 1.2810 before ending the zigzag structure & a bounce could then take place. We don’t like buying the pair as the right side tag is calling the pair lower.