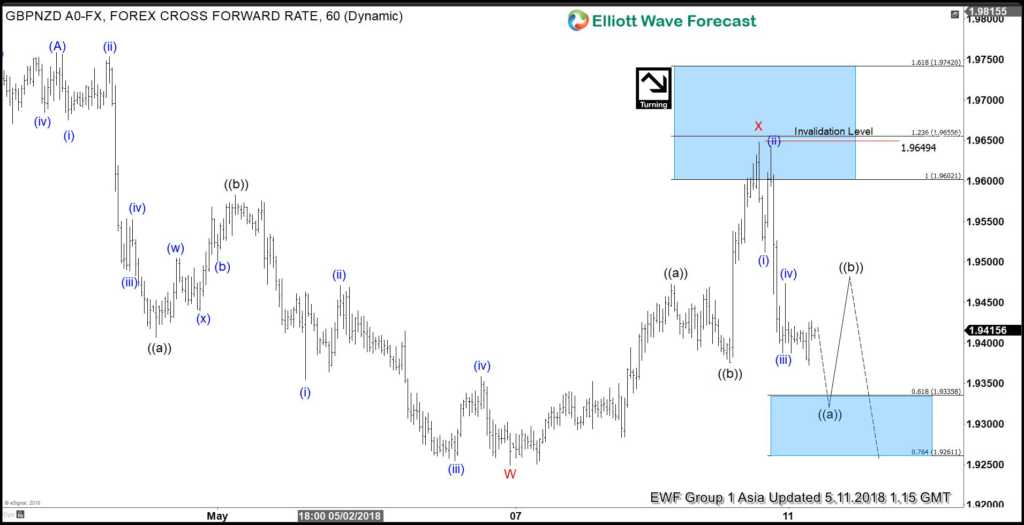

GBPNZD short-term Elliott wave view suggests that the rally to 1.9758 on 4/26 high ended Intermediate wave (A). Down from there, Intermediate wave (B) remains in progress as a double three Elliott Wave structure. The internals of each leg in double three (WXY) sub-divides into 3 waves corrective sequence and usually is the combination of two corrective patterns i.e Flat, Zigzag, triangle etc.

Down from 1.9758 high, Minor wave W ended as a zigzag Elliott Wave structure (5-3-5) where Minute wave ((a)) ended at 1.9407, Minute wave ((b)) ended at 1.9582, and Minute wave ((c)) of W ended at 1.925. Above from there, the pair bounced higher in Minor wave X with internals also unfolded as a zigzag Elliott Wave structure. Minute wave ((a)) of X ended at 1.9472, Minute wave ((b)) of X ended at 1.9376 and Minute wave ((c)) of X ended at 1.9648 high.

Below from there, the pair is expected to resume lower in Minor wave Y of (B) as a zigzag structure. Minute wave ((a)) of Y is in progress looking for another extension lower towards 1.9261 – 1.9335, which is 0.618%-0.764% Fibonacci extension area of Minor wave W-X from Intermediate wave (A). Afterwards, the pair should bounce in 3, 7 or 11 swings in Minute wave ((b)) to correct cycle from 5/10 high before pair resumes lower again.