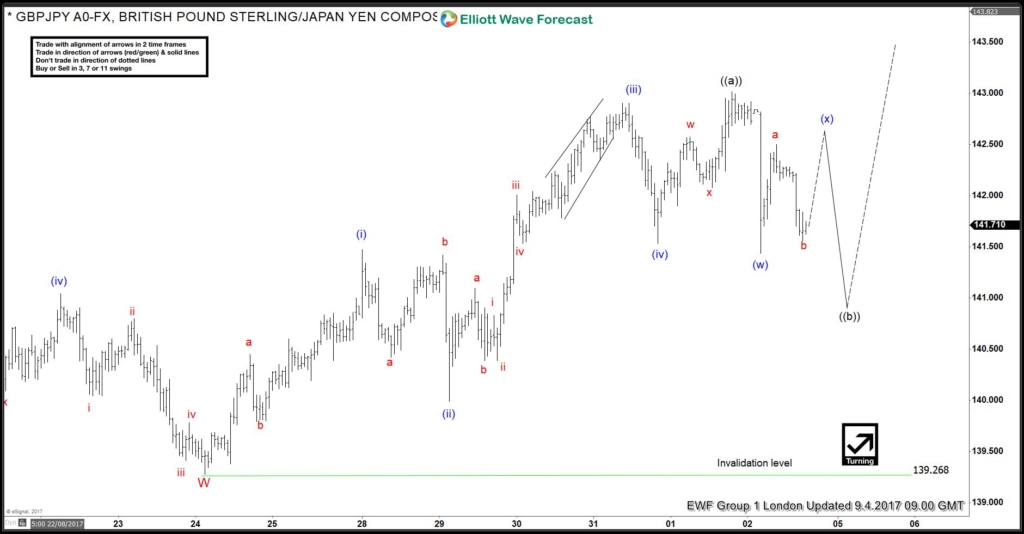

GBPJPY Short Term Elliott Wave suggests that the decline to 8/23 low at 139.26 ended Minor wave W. Up from there, the rally is unfolding as an Diagonal structure . Which we are viewing as part of Minute wave ((a)) of an Elliott wave zigzag structure. Where Minutte wave (i) ended at 141.40 and Minutte wave (ii) ended at 139.99 low. Minutte wave (iii) ended at 142.88 peak, Minutte wave (iv) ended at 141.53 low. Minutte wave (v) of ((a)) ended at 142.96. Below from there Minute wave ((b)) pullback remains in progress and expected to unfold as double three structure .

And as far as pivot from 139.26 low remains intact during the dip, pair has scope to see another extension higher in Minute wave ((c)) of X. If the pullback turns out to be rather strong and pair takes out the pivot at 139.26 low, that would suggest pair already ended the correction at 142.96 peak as a Elliottwave Flat structure from 8/18 lows (139.77) and may resume the decline instead of going higher. We don’t like buying or selling the pair at this stage.

GBPJPY 1 Hour Elliott Wave View

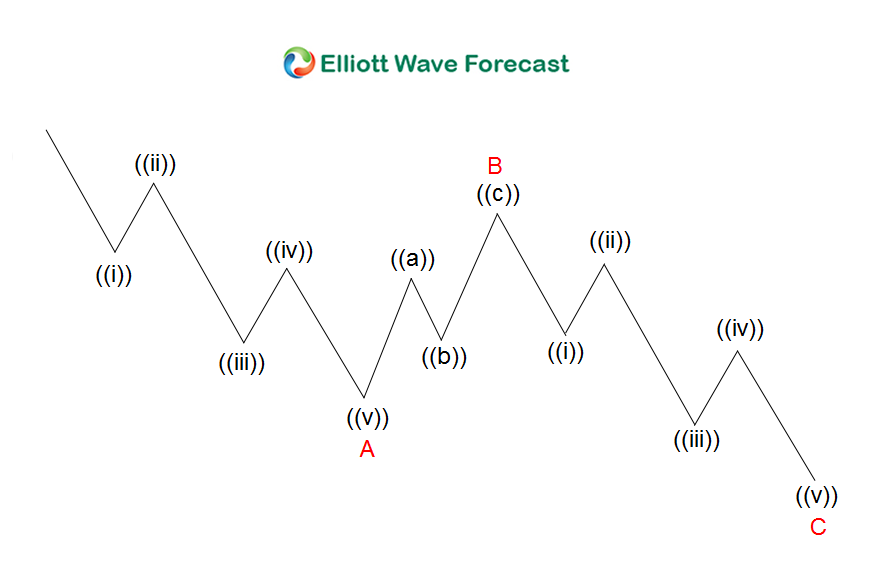

According to Elliott wave theory Zigzag is a 3 wave structure having internal subdivision of (5-3-5) swing sequence. The internal oscillations are labeled as A, B, C where A = 5 waves, B = 3 waves and C = 5 waves. This means that A and C can be impulsive or diagonal waves. The A and C waves must meet all the conditions of wave structure 5, such as: having an RSI divergence between wave subdivisions, ideal Fibonacci extensions, ideal retracements etc. At the graphic above, we can see what Elliott Wave ZigZag structure looks like. 5 waves down in A, 3 wave bounce in B and another 5 waves down in C.

Back