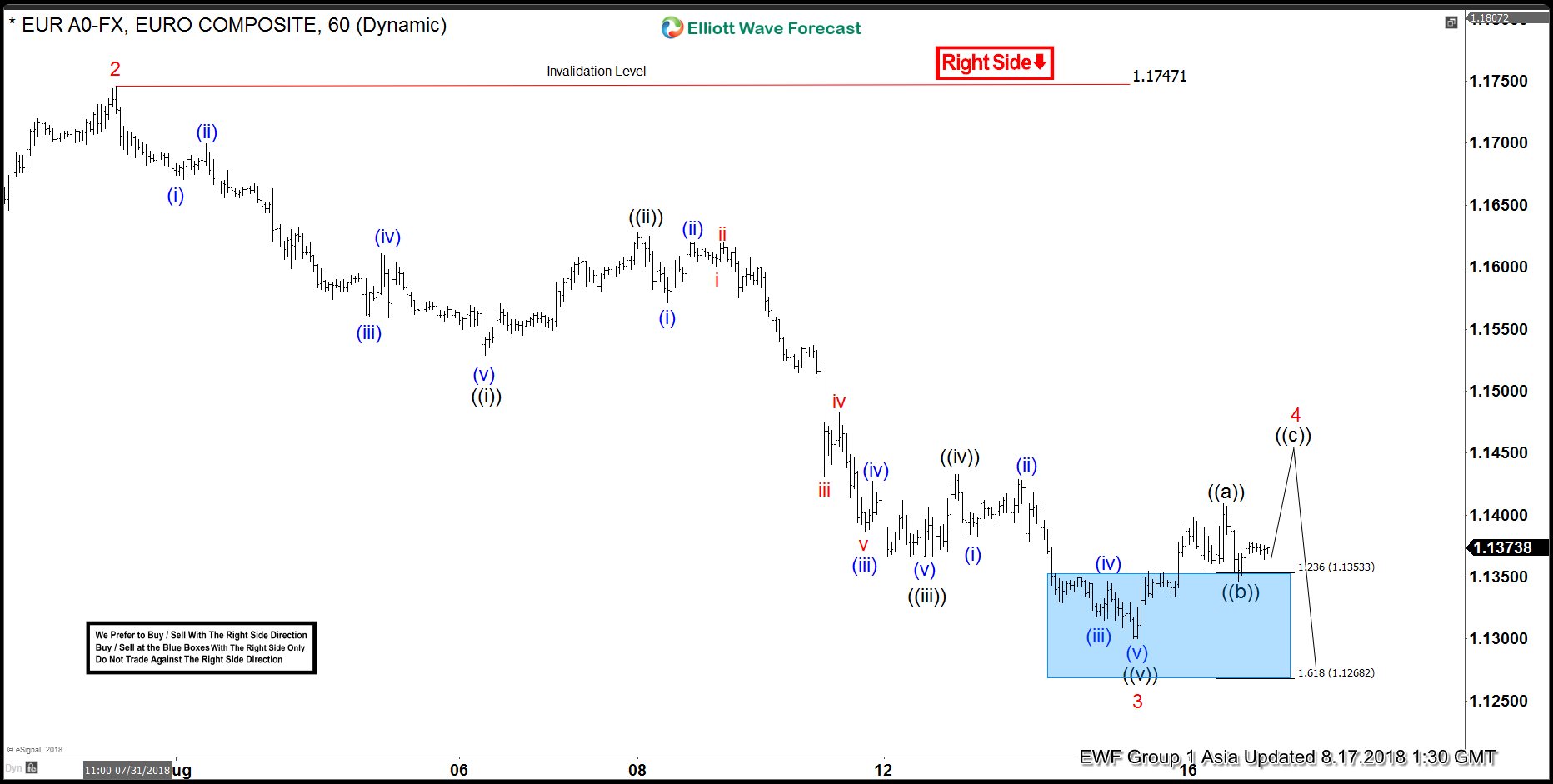

EURUSD short-term Elliott Wave analysis suggests that the bounce to 1.1747 high ended Minor wave 2. Down from there, Minor wave 3 ended at 1.1299 low. The internals of that decline unfolded as impulse structure with lesser degree cycles are showing sub-division of 5 waves structure lower in it’s each leg lower i.e Minute wave ((i)), ((iii)) & ((v)). While the sub-division in Minute wave ((ii)) & ((iv)) unfolded in 3 wave corrective sequence.

Down from 1.1747 high, the initial decline to 1.1529 low ended Minute wave ((i)) in 5 waves structure. The bounce to 1.1627 high ended Minute wave ((ii)). Below from there, the decline to 1.1364 low unfolded in 5 waves structure & ended Minute wave ((iii)). Up from there, the 3 wave bounce to 1.1431 high ended Minute wave ((iv)). Then the decline to 1.1299 low ended Minute wave ((v)) & also completed the Minor wave 3 lower. Above from there, Minor wave 4 bounce remains in progress in 3, 7 or 11 swings for the correction of 1.1747 high before further downside is seen provided the pivot at 1.1747 high stays intact. We don’t like buying the pair and prefer more downside against 1.1747 high in the first degree.