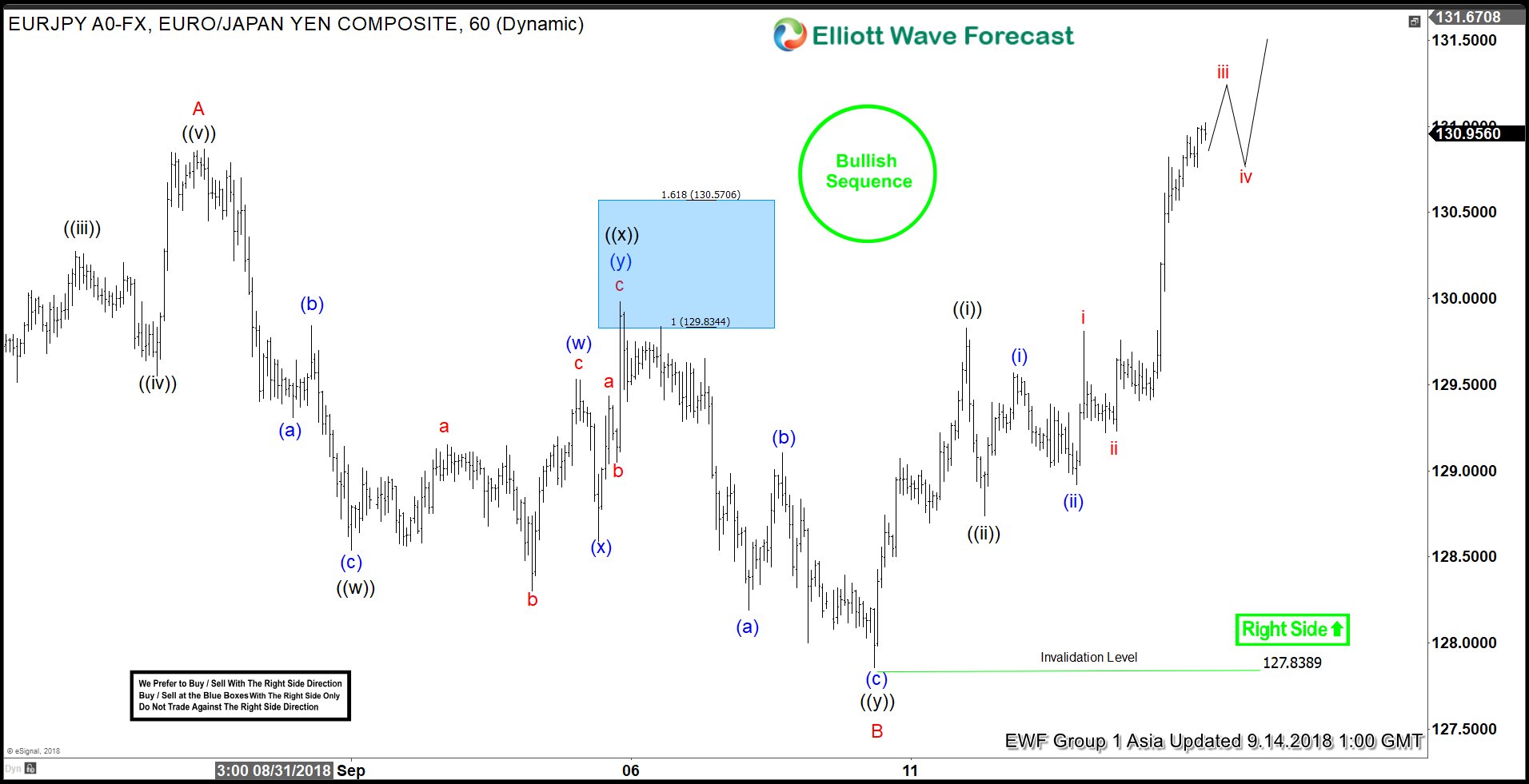

EURJPY short-term Elliott wave analysis suggests that the rally to 130.85 high ended Minor wave A of a Zigzag structure. The internals of that rally higher unfolded in 5 waves impulse structure with the sub-division of 5 waves structure as mentioned previously in the previous post. Down from there, the pullback to 127.83 low ended Minor wave B pullback. The internals of that pullback unfolded as double three structure with the sub-division of 3-3-3 swings in Minute wave ((w))-((x))-((y)).

Below from 130.85 high, the initial decline to 128.54 low ended Minute wave ((w)) in lesser degree zigzag structure. Up from there, the bounce to 129.97 high ended Minute wave ((x)) bounce as double three structure. Then finally, a decline towards 127.83 ended Minute wave ((y)) & also completed the Minor wave B pullback. Up from there, the pair has managed to make a new high above 130.85 creating a cycle from 8/15 low (124.91) incomplete to the upside & also confirms the Minor C. Which can be either impulse or ending diagonal structure. Near-term, while dips remain above 127.83 low pair is expected to see more upside. The 100%-123.6% Fibonacci extension area of Minor A-B comes at 133.76-135.18 to the upside. We don’t like selling it as the right side & sequence tag is suggesting more upside, therefore, expect buyers to appear in 3, 7 or 11 swings against 127.83 low.