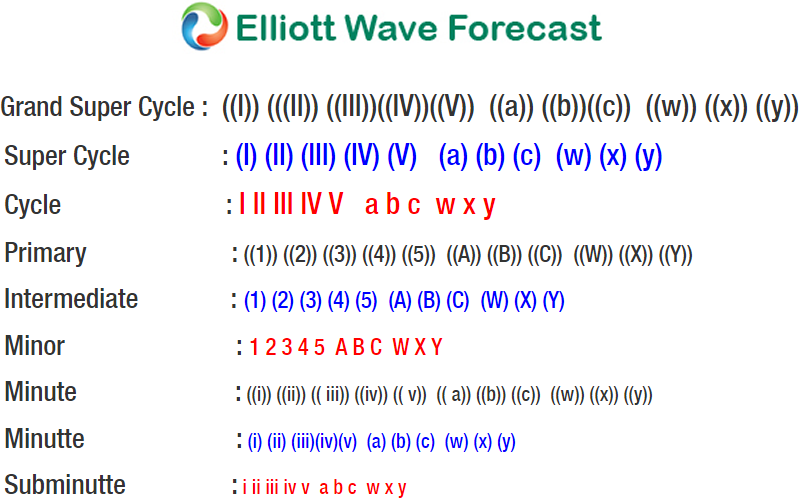

EURJPY short-term Elliott wave analysis suggests that the decline to 129.13 low ended Minor wave A. The internals of that decline unfolded in 5 waves impulse structure in a lesser degree cycle. Thus suggests that the pair can be doing a Zigzag correction lower. Up from there, a bounce to 130.18 high ended Minor wave B bounce as a Flat correction where Minute wave ((a)) ended in 3 swings at 130.30. A decline to 128.32 low ended 3 waves in Minute wave ((b)). Then a rally to 130.18 high ended 5 waves in Minute wave ((c)) & also completed Minor wave B bounce. Down from there, Minor wave C remain in progress & has managed to make a new low below 128.32 low confirming the next extension lower. Where Minute wave ((i)) of C ended in lesser degree 5 waves at 128.22 low. Up from there, pair is doing a 3 wave bounce in Minute wave ((ii)) of C towards 129.64-129.84 area. Then as far as a pivot from 130.18 high stays intact pair is expected to fail for more downside. We don’t like buying the pair and prefer more downside against 130.18 high in the first degree.