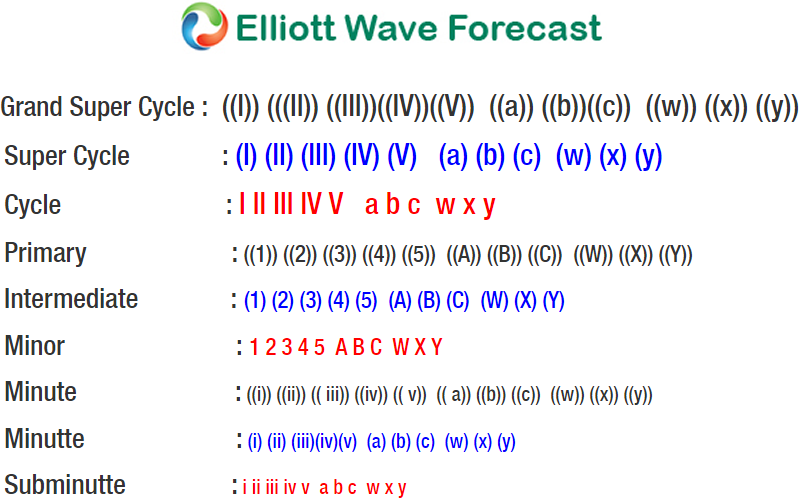

EURAUD short-term Elliott wave view suggests that the rally to 1.6353 high ended intermediate wave (1) higher. The internals of that degree unfolded as impulse structure with lesser degree cycles showing the sub-division of 5 waves structure. Below from 1.6353 high, the pair is doing an intermediate wave (2) pullback in 3, 7 or 11 swings before upside renew. We don’t like selling the pair as the right side tag favoring more upside.

Down from 1.6353, the pair is doing a 3 wave pullback with lesser degree cycles showing the sub-division of 5-3-5 structure thus favored it to be doing a zigzag correction. The initial decline to 1.6282 low ended Minor wave ((i)), Minor wave ((ii)) bounce ended at 1.6339. Minute wave ((iii)) ended at 1.6152 & Minute wave ((iv)) ended at 1.6192 high. Then finally a move lower to 1.6136 low ended Minute wave ((v)) & also the Minor wave A.

Up from there, the bounce to 1.6332 high ended Minor wave B bounce in lesser degree zigzag correction where Minute wave ((a)) ended at 1.6285. Minute wave ((b)) ended at 1.6226 and Minute wave ((c)) of B 1.6332 high. Near-term focus remains towards 1.6107-1.5969 100%-161.8% Fibonacci extension area of A-B to complete Minor wave C lower in another 5 waves structure and should ideally complete intermediate wave (2) pullback as well. Afterwards, the pair is expected to find buyers looking for new highs or for 3 wave bounce at least.