AUDJPY sank to 11 year low last week as the market is pricing in a drastically lower Australia’s growth outlook. The coronavirus outbreak around the world has disrupted everything from travel, supply chain, and daily activities. The virus first originated in Wuhan, China and has infected 81,000 people globally and killed more than 2700 people. Most cases happened in China, forcing the Chinese government to quarantine whole cities and closing up factories.

Australian Dollar suffers heavy losses against other major currencies as it has strong trading ties with China. In addition, Australia is also dealing with other issues such as drought and bush fires. Three areas in particular likely will be the hardest hit: Exports, education, and tourism. In the area of exports, China buys 34% of the total Australia exports and the big purchases include iron ore and coal. As factories in China remain closed or only partially opens, the demand for coal and iron ore declines.

In the area of education, Australian universities will lose significant portion of revenue as Australian government introduces ban to non-resident foreigners from China. If China can’t contain the virus in the next few months, Australian universities will lose significant source of revenue. The ban also affect tourism as Chinese visitors account for 27% of the tourism industry. Virus cases are now spreading to other parts of the world. The countries outside China which has the biggest infections so far are Italy, South Korea, and Iran. The U.S. has started to expect the disease to reach and spread over the U.S. in the weeks to come. The full global economic damage has not fully materialized, but the market has started to price in the impact.

AUDJPY Shows Bearish Elliott Wave Sequence

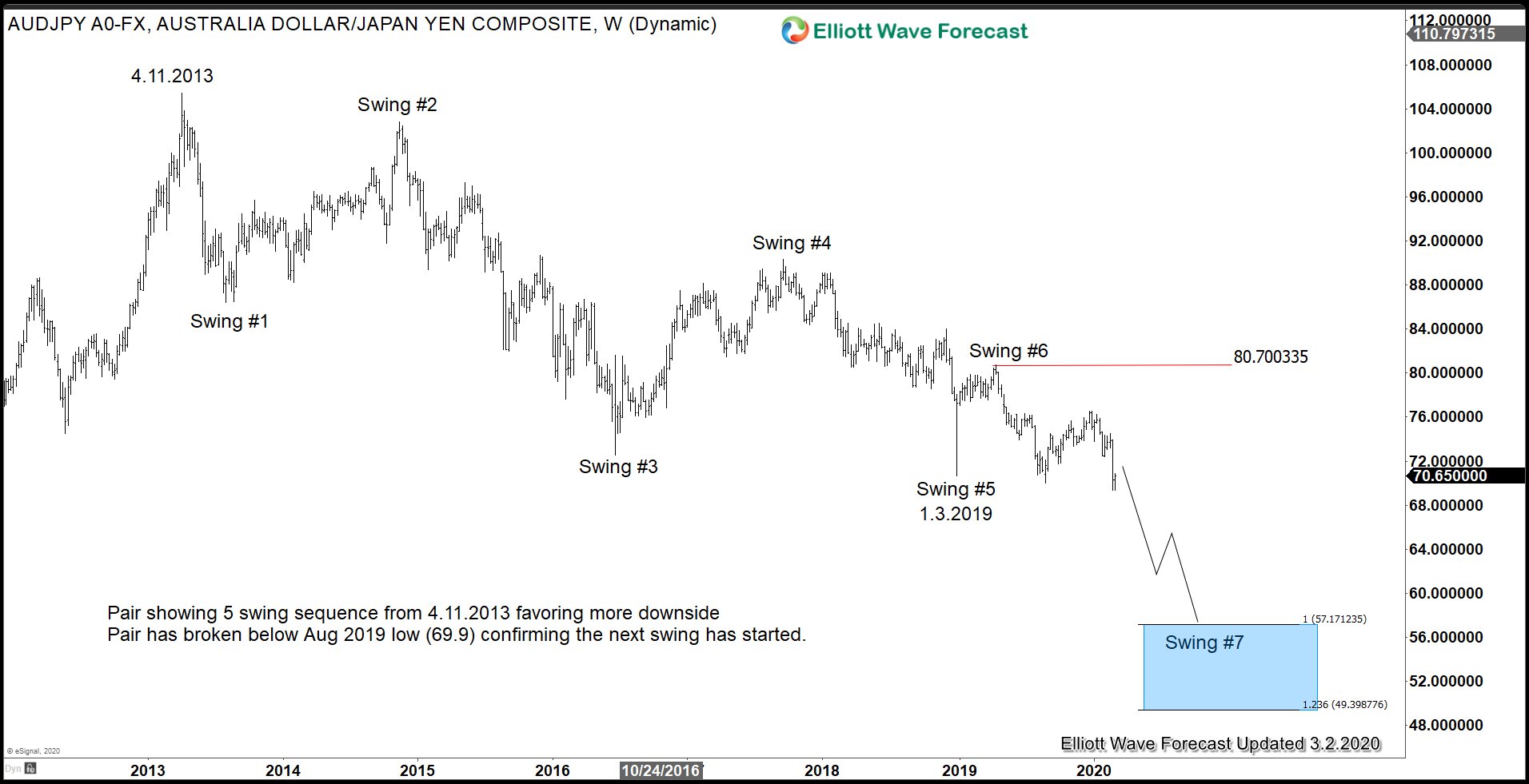

AUDJPY shows an incomplete sequence from April 11, 2013 peak favoring further downside to reach 49.4 – 57.1 area to end a 7 swing sequence. Last week, the pair broke below the previous low on August 2019 (71) suggesting the next leg lower has resumed. The pair technically suggests Australian Dollar likely continues to see selling pressure and any rally therefore should fail in the sequence of 3, 7, or 11 swing.

EURAUD Shows Bullish Elliott Wave Sequence

EURAUD shows an incomplete sequence from July 2012 low favoring more upside to reach 1.858 – 1.976 to end a double zigzag structure. Last week, pair broke above December 2018 high (1.679) suggesting the next leg higher has started. Near term, expect dips to continue to find support in 3, 7, or 11 swing for further upside in the pair. This pair also suggests Australian Dollar should continue to be under pressure.

Conclusion

Concern on economic impact as the result pf worldwide coronavirus infection has put pressure on Australian Dollar. Being the largest trading partner of China, Australia likely will suffer economic pain in the first quarter of 2020. The RBA has also expressed willingness to cut interest rate further thus further putting pressure to Australian Dollar. The Elliott Wave technical outlook in AUDJPY and EURAUD also support a lower Australian Dollar.

For further Elliott Wave technical update on forex, stock, and commodity market, feel free to try our service here –> 14 days Free Trial.

Back