In this technical blog, we will look at the past performance of 4 hour Elliott Wave Charts of AUDUSD. In which, the decline from 25 February 2021 high is unfolding as a 7 swing corrective structure and showing a lower low sequence favoring more downside. Therefore, we knew that the structure in AUDUSD is incomplete to the downside & should see more weakness. So, we advised members not to buy the pair & sell the bounce in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

AUDUSD 4 Hour Elliott Wave Chart

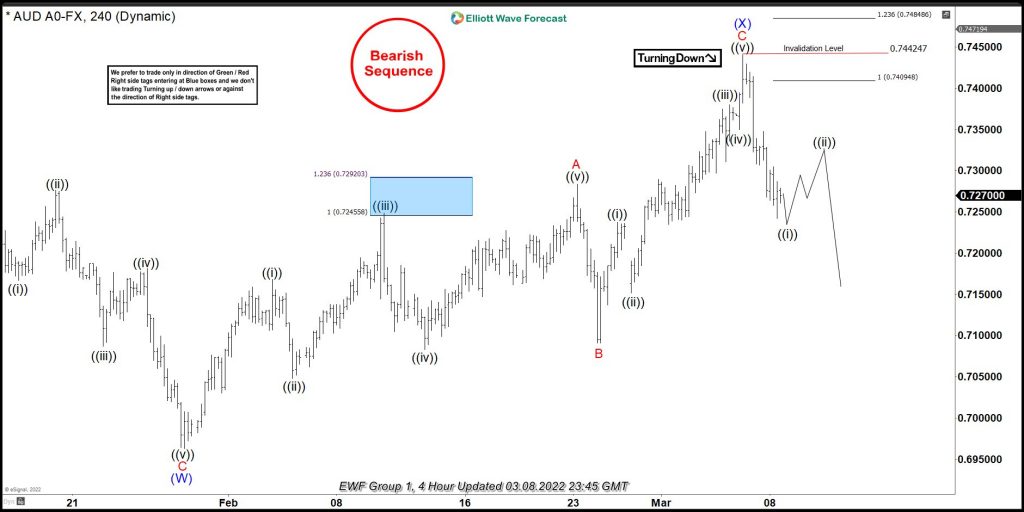

Here’s the 4 Hour Elliott wave chart from the 3/05/2022 weekend update. In which the decline to $0.6963 low ended higher degree wave (W). Up from there, the pair bounced in wave (X) to correct the cycle from 10/28/2021 high. The internals of that bounce unfolded as a double three structure where wave W ended at $0.7248 high. Wave X ended as a flat at $0.7089 low and wave Y was expected to reach $0.7409- $$0.7484 100%-123.6% Fibonacci extension area of W-X. From there, sellers were expected to appear looking for more downside or for a 3 wave reaction lower at least.

AUDUSD 4 Hour Elliott Wave Chart

Above is the latest 4hr view from the 3/08/2022 update. In which the pair is showing reaction lower taking place as expected so far. Allowing shorts to get into a risk-free position shortly after taking the position at the equal legs area. Now as far as bounces fail below $0.7442 high then the pair is expected to resume lower. However, a break below $0.6963 level remains to be seen to confirm the next leg lower & avoid double correction higher.

If you are looking for real-time analysis in AUDUSD along with the other Forex, commodities, stocks, ETFs, indices then join us with a 14-Day Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial.

Back