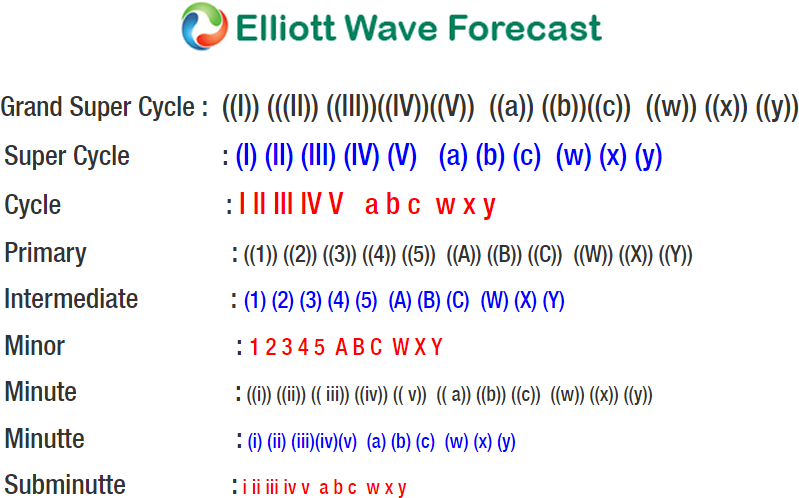

AUDUSD short-term Elliott wave view suggests that the bounce to 0.7384 high ended intermediate wave (X) bounce. Down from there, the pair has broken to new lows already confirming the intermediate wave (Y) lower. Thus suggesting that the right side in the pair is to the downside. The decline to 0.7084 low unfolded in 5 waves impulse structure. And should have completed the Minor wave A of a possible Zigzag structure.

The internals of lesser degree cycles within that decline also unfolded in 5 waves structure i.e Minute wave ((i)), ((iii)) & ((v)). Where the initial decline to 0.7237 low ended Minute wave ((i)) in 5 waves structure. Up from there, the bounce to 0.7361 high ended Minute wave ((ii)). Below from there the decline to 0.7165 low ended Minute wave ((iii)) in another 5 waves structure. Then a 3 wave bounce to 0.7234 high ended Minute wave ((iv)). Finally, a move lower to 0.7084 low completed Minute wave ((v)) of A as ending diagonal structure.

Up from there, the pair is doing a 3 wave bounce in Minor wave B bounce for the correction of 0.7384 high. The internals of that bounce also expected to be in a zigzag correction but expected to fail below 0.7384 high during the week. We don’t like buying the pair as the right side is calling pair to trade lower & expect sellers to appear at the completion of Minute wave ((a))-((b)).