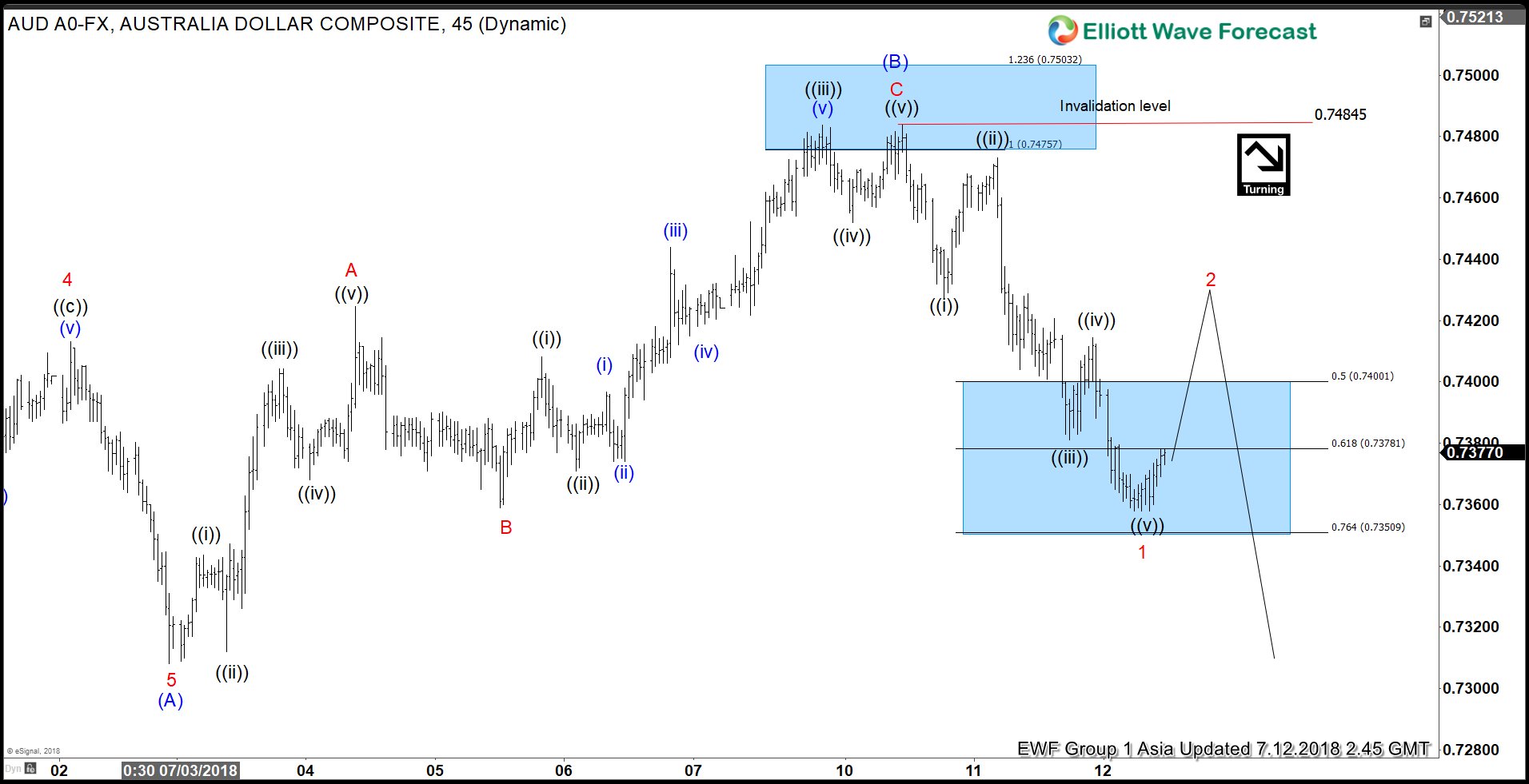

AUDUSD short-term Elliott Wave view suggests that the decline to $0.7308 low ended Intermediate wave (A) of a possible Zigzag structure coming from 6/06/2018 peak ($0.7676). Above from there, the 3 waves recovery to $0.7484 high ended Intermediate wave (B) bounce. The internals of that Intermediate wave (B) unfolded as Elliott Wave Zigzag correction where Minor wave A ended at $0.7424 high. Subdivision of Minor wave A of (B) unfolded as 5 waves where Minute wave ((i)) ended at $0.7342. Minute wave ((ii)) ended at $0.7312, Minute wave ((iii)) ended at $0.7404. Then Minute wave ((iv)) ended at $0.7368 and Minute wave ((v)) of A ended at $0.7424 high.

Down from there, Minor wave B ended at $0.7359 low. Up from there, Minor wave C of (B) ended at $0.7484 high with internals also unfolded in another 5 waves structure. Minute wave ((i)) ended at $0.7408. Minute wave ((ii)) ended at $0.7371, Minute wave ((iii)) ended at $0.7483. Then Minute wave ((iv)) ended at $0.7452 and Minute wave ((v)) of C ended at $0.7484 high. This rally also completed Intermediate wave (B) bounce there, after reaching the 100%-123.6% Fibonacci extension area of Minor A-B at $0.7475-$0.7503 area. Near-term, while bounces fail below there, expect pair to resume lower in Intermediate wave (C). However, a break below $0.7305 low remains to be seen to validate this view & until than a double correction higher in Intermediate wave (B) bounce can’t be ruled out. We don’t like buying it.

AUDUSD 1 Hour Elliott Wave Chart

Back