We get asked a lot from novice Elliott Wave traders on why our counts change as the market progresses. One day we may have a bullish count, the next day it is bearish. We could be calling a corrective pattern a Zig-Zag, then a Double Correction and then next thing you know it turned into a whole Expanded Flat. Feels frustrating right?

Now, the worst thing you can do as an Elliott Wave Theorist is be loyal to your count. Do not marry it. You must be willing to change and adjust it as more price action on the chart has been released.

There are several reasons on why counts or patterns would change. I will break them down now.

1, One of the most common reasons is, we may have a count, but price has completely invalidated a rule. For example, wave 4 cannot enter the territory of wave 1, especially when unfolding within wave 3.

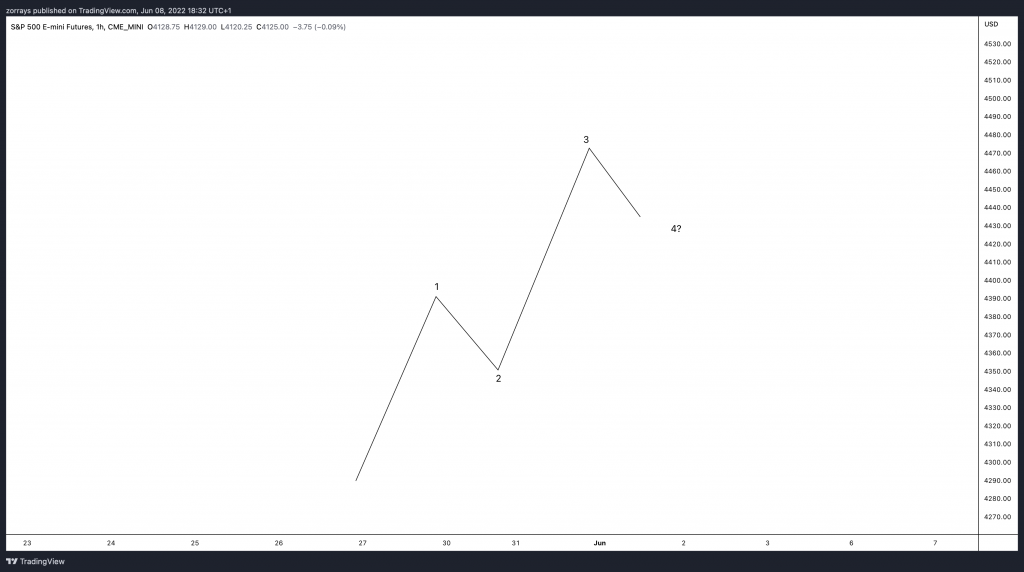

Day 1

Today we may be thinking an instrument has been bottomed out and we are potentially going into a 5 wave sequence to the upside. We see a 5 wave within wave 1, then 3 wave down and then another 5 wave up into 3. We are not committed to this count yet but if wave 4 unfolds in a 3 wave sequence, then the next thing we can expect is another 5 wave up.

Lets see what happens the next day….

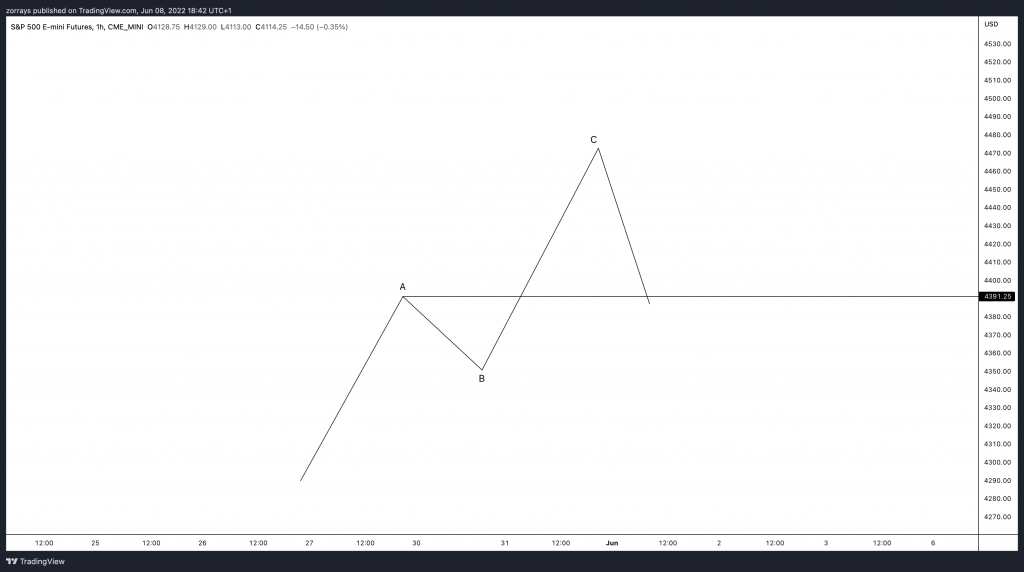

Day 2

As price went through wave 1 which is now wave A – you can see overall this move was just a 3 wave sequence as price has breached an important rule. So, the bigger picture means that this instrument is not ready as of yet and yet to form another low.

Remember, the primary value of the Wave Theory is that it provides a context for market analysis. Well, as new price action unfolds, it can and often does change the context of earlier price action.

2, Corrective patterns change as market evolves

This is an interesting one and I feel like you must always keep a close eye on corrective patterns as the market progresses. I will give an example now…

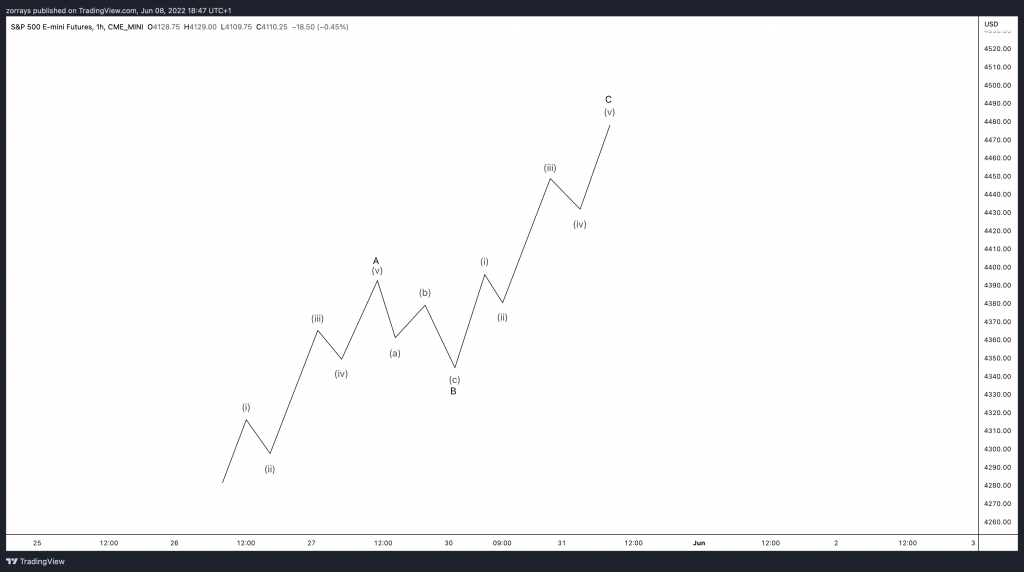

Day 1

Lets say now the market is correcting within a Zig Zag. We are exciting as this could be preparing us for a trade. Now lets see what happens next.

Day 2

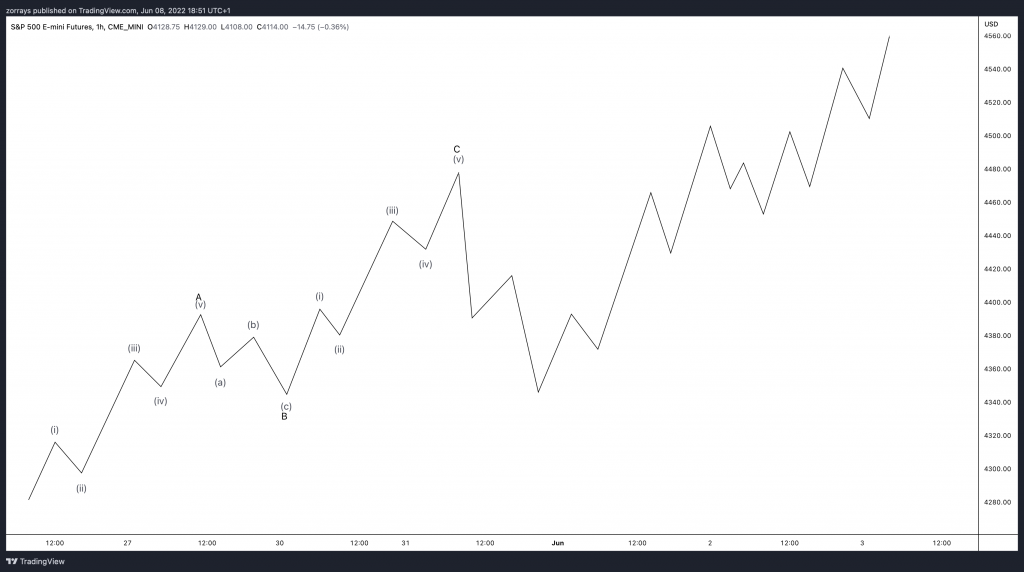

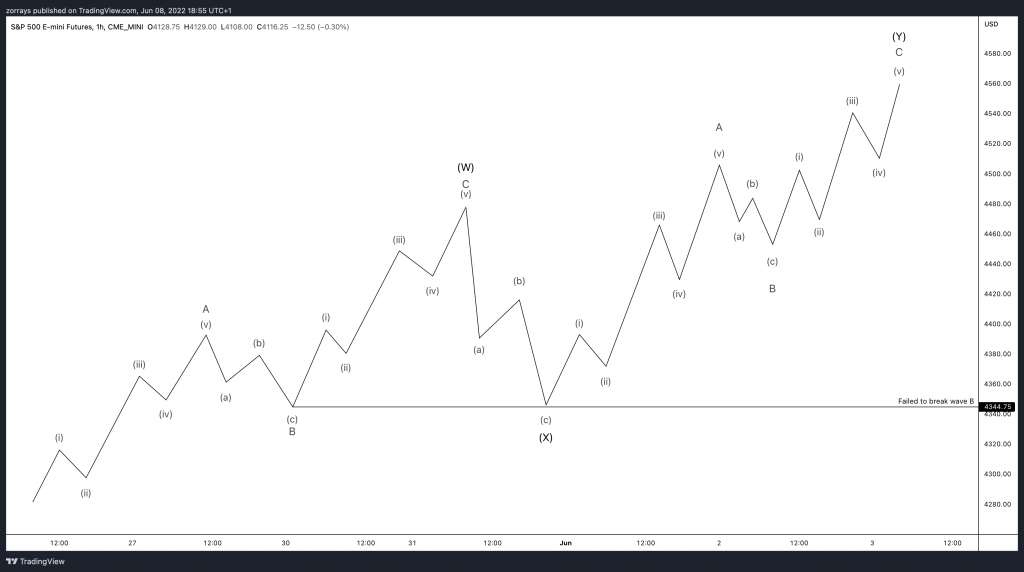

You are doubting not only yourself at this point but also the Elliott Wave Theory. You had it all planned out, this Zig Zag was going to make the cash register ring. So why did price move 3 waves down and then another 5 – 3 – 5 sequence to the upside? The answer is simple, it unfolded a complex correction. In this case, a double Zig Zag. I will explain how to avoid this.

This is how you would then count this. Price moved down in a 3-wave sequence to complete wave (X) – which you thought it was wave (1). It could’ve been wave (1) but it did not unfold in a 5 wave sequence. Wave (W) represents the 1st Zig Zag and wave (Y) represents the 2nd Zig Zag. Often, price is probably done with correcting and ready for the next motive wave!

To wrap it up, to be a successful trader who uses Elliott Wave Theory as one of the main tools in their toolbox, you must be ready to adjust your count as the market progresses. This way you are complete in sync with the market!

Back