Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

SPX – Elliot Wave Confirmation With Equal Legs Inflection

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones to your advantage. The Live Trading Room is held daily from 11:30 AM EST until 1:30 PM EST, join Dan there for more insight into these proven methods of […]

-

$TNX (US 10 year yields) 1 Hour Elliott Wave Analysis (5.19.2014)

Read MorePreferred Elliott Wave view suggests US 10 year yields have completed a cycle from ( B ) high i.e. (2.748%). As it was a corrective drop so we have labelled it as wave “W” and treating the current bounce as wave “X”. Yields are showing just 1 swing up from the low and corrections run […]

-

SPX – Live Trading Room Targets Hit

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones to your advantage. The Live Trading Room is held daily from 11:30 AM EST until 1:30 PM EST, join Dan there for more insight into these proven methods of […]

-

SPX bullish Elliott Wave Setup

Read MoreUS Indices remain bullish and dips have been presenting buying opportunities. Let’s take a look at a recent buy setup in SPX and INDU. Using Elliott Wave Principle we knew that initial drop in SPX from 1891 – 1866 was in 3 waves, so we were expecting this high to break once the correction finished. […]

-

A Look at the Monthly SPX – Targets Inbound

Read MoreHere is a quick video blog from our Live Trading Room host, Dan Hussey. In this Tech Blog Video Post, Dan takes a look at a comparison of 1970’s SPX price action to the SPX price action of the last decade to unveil how the 1950 targets (from 2010) were found. The Live Trading Room […]

-

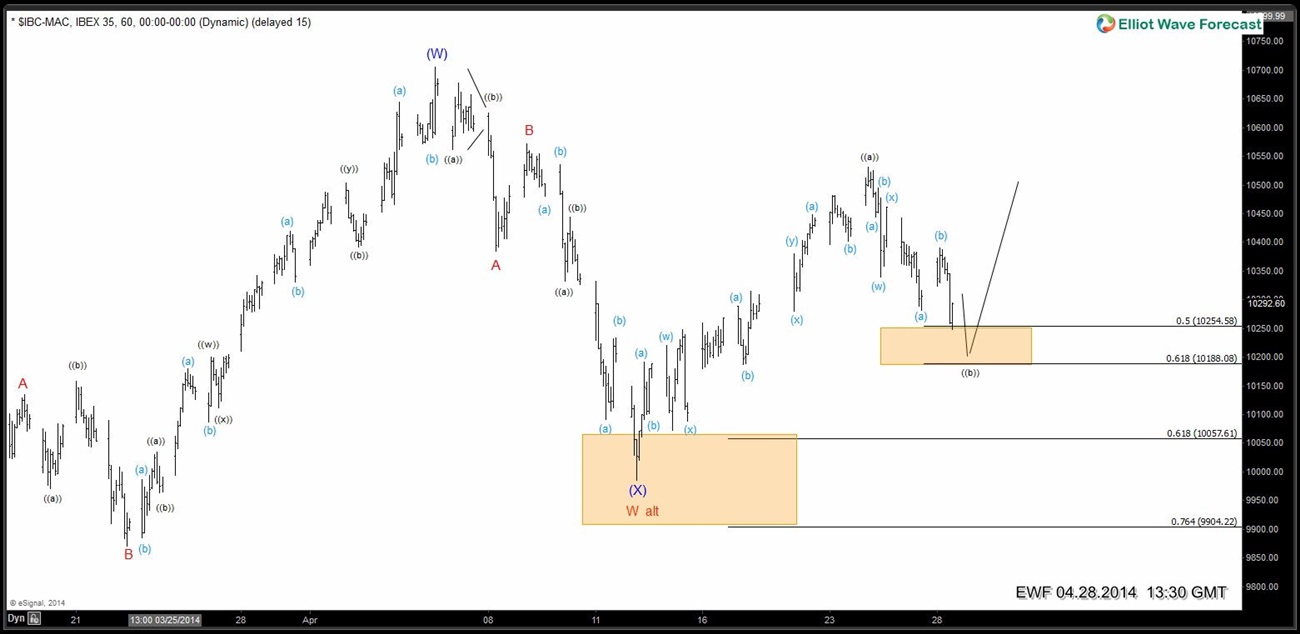

$IBEX (IBC-MAC) 1 Hour Elliott Wave Analysis (4.28.2014)

Read MorePreferred view now is that dip to 9655 completed wave ((B)) and wave ( X ) low is also proposed to be in place at 9984. Wave (( a )) high is in place at 10530 and wave (( b )) pull back is in progress. This pull back can reach as low as 10188 […]