Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

$TNX 10 yr yields 1 Hour Elliott Wave Analysis 7.17.2014

Read MoreUS 10 year yields preferred Elliott Wave count shows a drop with a corrective sequence from 2.691 – 2.494. We have labelled this as wave A. Yields then recovered in 3 waves to 2.57% and started dropping again. Recovery to 2.57% consisted of ((a )) – (( b )) – (( c )) when wave (( […]

-

$TNX (US 10 year yields) 1 Hour Elliott Wave Analysis 7.10.2014

Read MorePreferred Elliott wave view is that dip to 2.402% completed wave ( W ) and recovery to 2.692% was a corrective wave ( X ). Decline from 2.692% high is so far in 5 swings and while below 2.601% high, we expect to see 1 more push lower toward 2.433 – 2.465% area to complete 7 […]

-

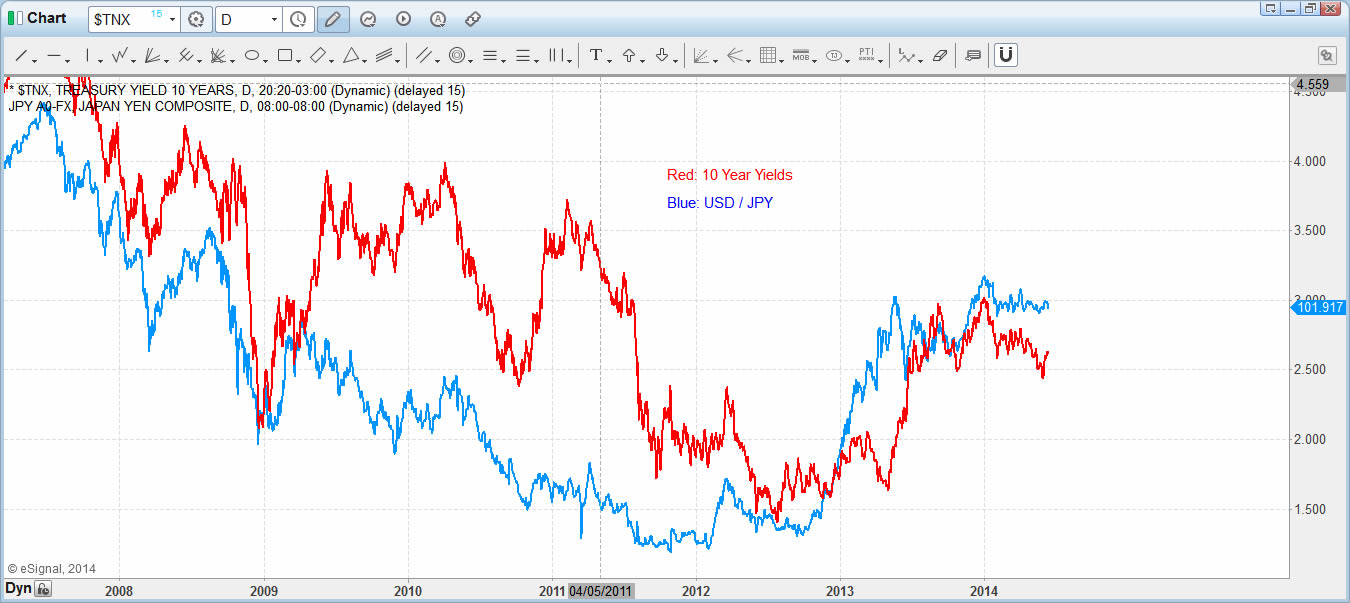

Elliott Wave Theory 2.0 : Market Correlation secrets for better Forecasting

Read MoreOne of the common challenges to practitioners of Elliott Wave principle is that the technique is subjective. There’s a saying that if you put 10 different Ellioticians together in the same room, they will all come up with a different Elliott Wave count. During our 20 years of experience with Elliott Wave Theory, we find […]

-

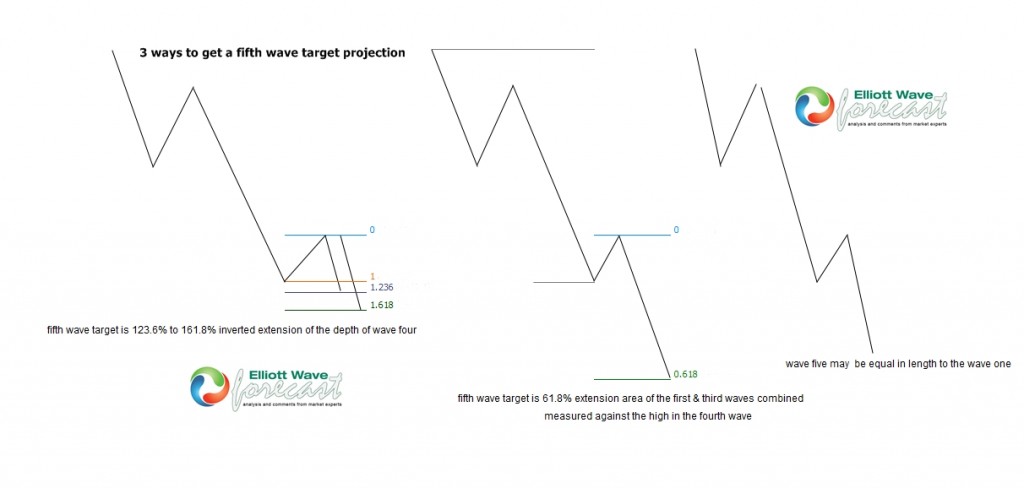

How to Get an Elliott Wave Fifth Wave Target

Read MoreIn either a bullish or bearish market, whether the Elliott Wave trend is up, down, or the cycle and degree of the wave is either bullish or bearish, wave five targets can be obtained these following three ways in any degree of trend. This list is not definitive in any particular order of preference because […]

-

Nikkei Futures from 6/2 short term corrective structures

Read MoreNikkei Futures is one of our indices related instruments we cover here at elliottwave-forecast.com. The instrument has been trending higher & we expect will continue while the shorter term ((b)) triangle lows remain intact at 15019 . Beginning with the corrective (b) that began on 6/2 the shorter term structure was w, x, y with a triangle […]

-

SPX – 2014 Targets Hit, Time for a Pullback?

Read MoreHere is a quick video blog from our Live Trading Room host, Dan Hussey. In this Tech Blog Video Post, Dan takes a look at the $ES_F targets that have been hit at 1930, and the probable levels of support that should ensue. The Live Trading Room is held daily from 11:30 AM EST until […]