Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

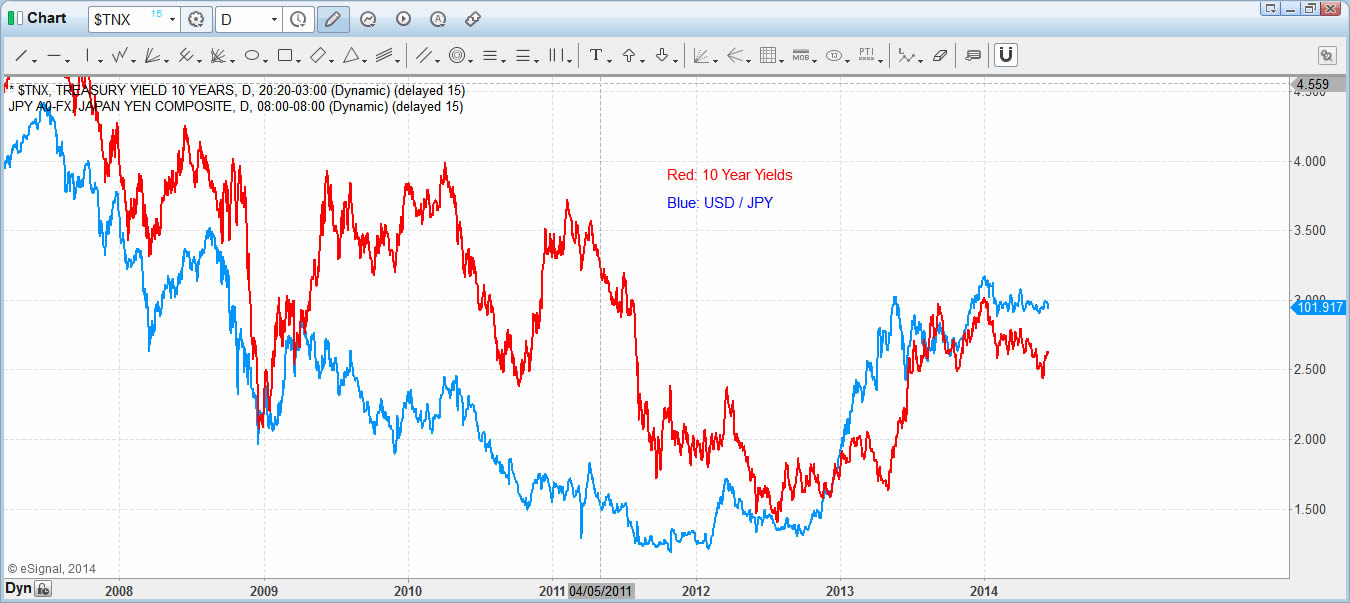

Using Market Correlation and RSI in the new EWF theory

Read MoreOne of the common challenges to practicioners of Elliott Wave principle is that the technique is subjective. There’s a saying that if you put 10 different Ellioticians together in the same room, they will all come up with a different Elliott Wave count. During our 20 years of experience with Elliott Wave Theory, we find […]

-

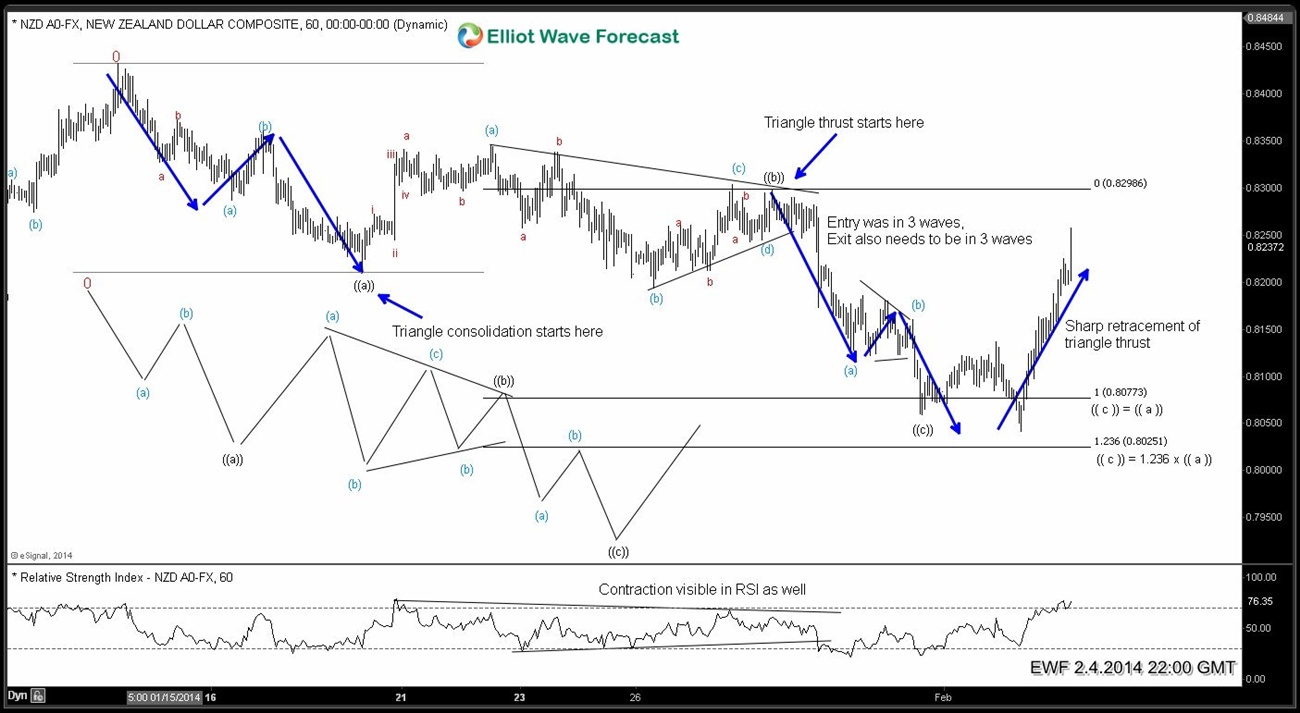

Elliott Wave Theory: Running Triangle

Read MoreTriangles are overlapping five wave affairs that subdivide 3-3-3-3-3. They appear to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and volatility. Triangles fall into four main categories i.e. ascending, descending, contracting, expanding. It is quite common, particularly in contracting triangles, for wave b to exceed the start […]

-

Nikkei looking for 15591 – 15782 area

Read MoreIn today’s video, we take a look at short-term Elliott Wave Structure of Japanese Nikkei 225. Initial move up from 14402 low was in 3 waves which completed wave (( w )). After that Index made a 50% pull back which completed wave (( x )) and has since made a new high to 0.618 […]

-

$SPX Elliott Wave IV (RED)

Read MoreIndices reflect human growth and hence have a bullish trend with declines being corrective in one degree or another. That’s why at Elliott Wave Forecast, we keep looking for a bullish path as far as that’s supported in our system. If the pivot gives up, then we look for a correction of a higher degree. […]

-

FLAT Elliott Wave Structure in SPX

Read MoreWe take a look at short-term price action in SPX500. We saw a perfect bounce from equal legs area in ( W ), rejection at 50% retracements, a marginal new low and then a very sharp rebound. Based on 9 swings down from 2019 and marginal new low before rallying impulsively, we think it’s doing a […]

-

Nikkei 7 swing Elliott Wave Structure

Read MoreToday, we take a look at structure of the decline in Nikkei futures from 9.25.2014 peak. This decline is unfolding as a ( W ) – ( X ) – ( Y ) structure when ( X ) failed between 50 – 61.8 fib retracement area of ( W ). From the secondary (X ) […]