Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Why people lose in Trading: Money Management

Read MorePoor money management is the reason why many traders end up losing even when they have access to a system with very good accuracy. In this video we talk about the importance of money management to success in trading, how to calculate the right position size, importance of risking the same percentage of capital on […]

-

Dynamics of a WXY Elliott Wave Structure

Read MoreIn this educational video, we are going to take a look at (W)-(X)-(Y) Elliott wave structure which is one of the most important structures in the market. It is a 7 swing Elliot Wave structure and is commonly known as a double zig-zag but we would like to point out that every (W)-(X)-(Y) structure is […]

-

How to trade with Elliott Wave Forecast- follow the chart arrows

Read MoreOur new clients usually need at least 2 weeks to get familiar with EWF Services and trading system before they start enjoying the profit in trading. Every day we receive questions like: “How to trade with Elliott Wave” or “Which pair is best to trade at this moment?” or “Chart of Gold is calling for […]

-

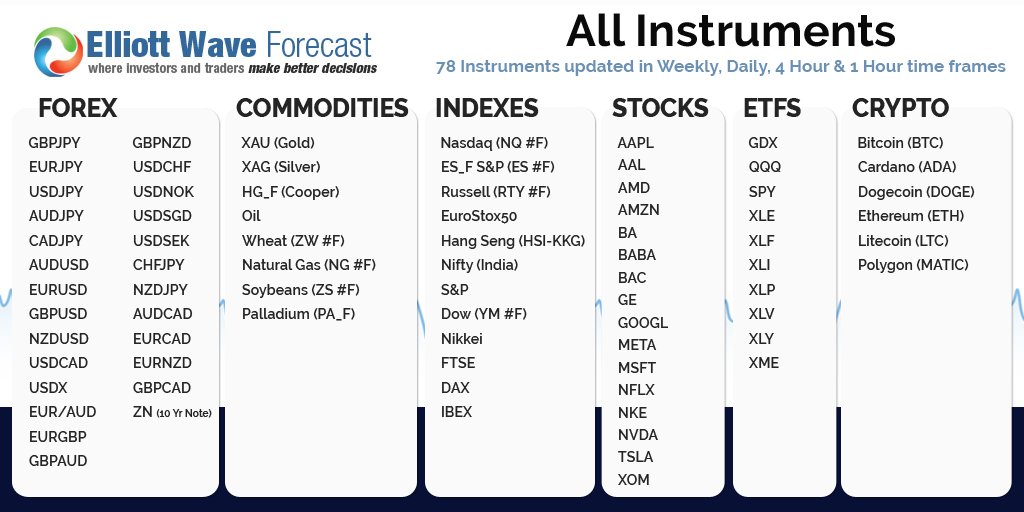

How to get the best of Free 14 day Trial

Read MoreBy signing up for Free 14 days Trial, you have taken the first step toward becoming a successful trader. We cover 78 instruments in total which are devided into 3 groups as listed below: Group 1: USD group : AUDUSD, EURUSD, NZDUSD, GBPUSD, USDCAD, USDX,ZN_F Yen group : GBPJPY, EURJPY , USDJPY, AUDJPY, CADJPY Crosses : […]

-

$INDU (Dow) and Elliott Wave Hedge

Read MoreIn this video we take a look at running FLAT Elliott Wave structure (3-3-5). In a running FLAT structure, wave C would fail to break the ending point of wave A. Dow (INDU) is showing an impulsive Elliott wave structure (5 wave move) up from 17037 (2/2) low and as far as RSI divergence remains […]

-

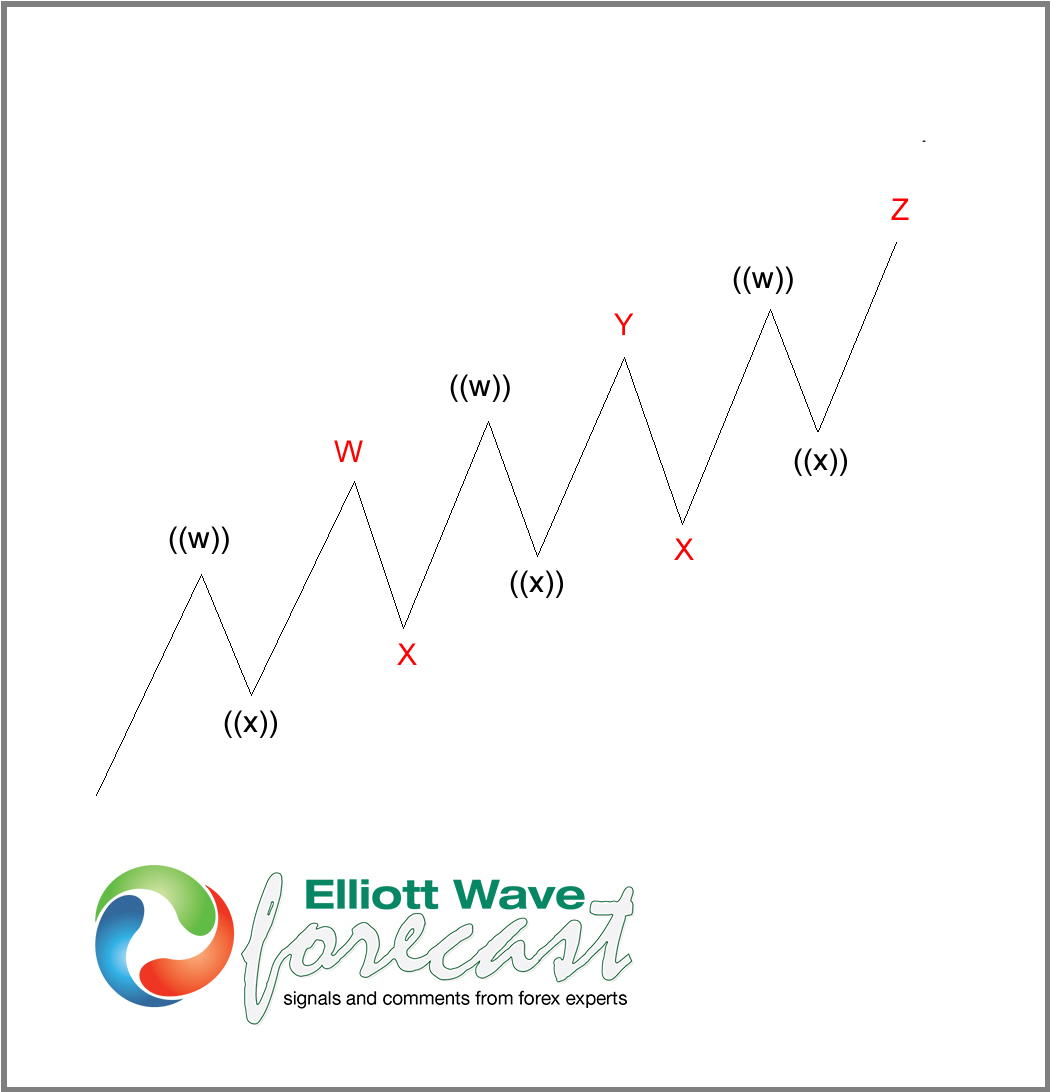

Triple Three Elliott Wave Structure

Read MoreIn this blog, we will take a look at Elliott Wave Triple Three structure wxyz. WXYZ is an 11 swing Elliott Wave structure which looks like below: From the chart above, we can see red W, red X, red Y, red X, and red Z. Each leg of WXYZ Elliott Wave structure has 3 swing subdivisions ((w)), ((x)), and ((y)). A […]