Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

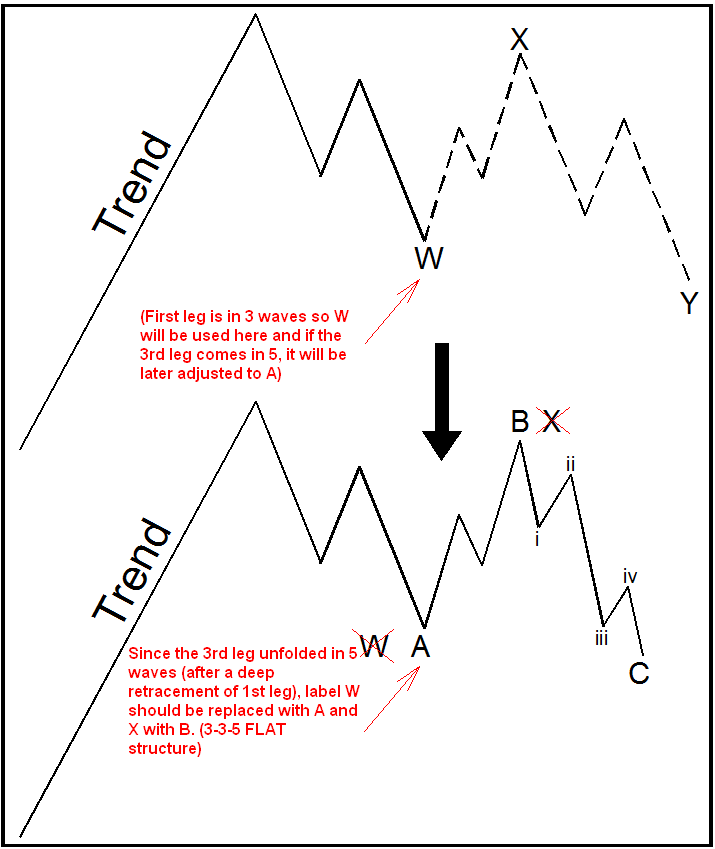

Educational Video Series – Expanded / Irregular Flat

Read MoreIn this video, we will look at Elliottwave structure called a Flat, and we will focus at one type of Flat called the Irregular / Expanded Flat. Flat is a corrective 3 wave structure labelled as ABC. Internally it is a 3-3-5 structure. Wave A is subdivided into 3 waves, wave B is subdivided into […]

-

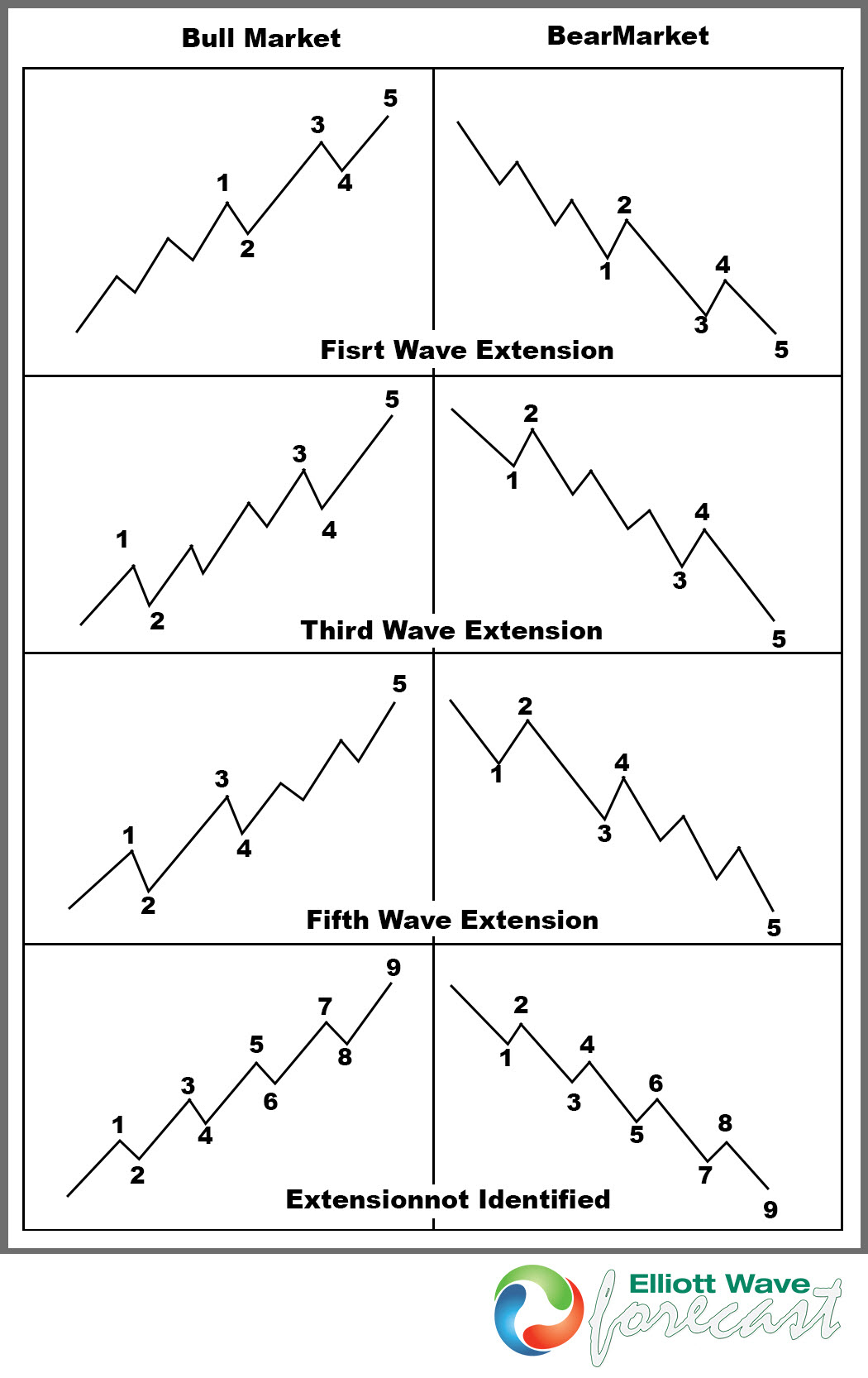

Elliott Wave Extensions within a 5 wave move

Read MoreIn this article, you will learn how to identify and trade Elliott Wave Extensions within impulsive structures. One of the core rules of Elliott Wave Theory states that in a 5-wave structure, Wave 3 cannot be the shortest. However, this doesn’t always mean Wave 3 must be extended. While extensions most commonly appear in Wave […]

-

Elliott Wave Pattern Labeling: A Step-by-Step Guide for Traders

Read MoreThe patterns that usually occur in the market can be subdivided in two main categories: Impulsive pattern and corrective pattern. The main difference between these two groups is in Impulsive pattern the move in the market is sharp and without overlap but in corrective pattern, we see sideway and overlapping price actions. Labeling the impulsive […]

-

Educational Series – Zig-Zag Elliott Wave Structure

Read MoreIn this educational video, we will talk about the Elliottwave zigzag structure. Zigzag is a corrective 3 wave move labelled as an ABC. Zigzag is a 5-3-5 Elliott wave structure but zigzag can also be the internal structure of a double three WXY or an internal structure of a triple three WXYZ. What are some of the […]

-

Criteria of Impulsive Elliott Wave structure

Read MoreIn this video we will explain how we can identify 5 waves impulsive move, which is the most popular structure and everyone with some knowledge of Elliott Wave are familiar with. However, this 5 waves move do not happen that often in today’s market, compared to the market in the past. So what are some of […]

-

5 Crucial tips on how to improve your Trading drastically

Read MoreThis is a non-technical blog that contains some facts and precious truths. These 5 tips could forever change your trading perspective in a better way. Let’s take a look at them: 1. Think about the risks. Before entering the trade, you should be aware that any trade could end up being negative one, regardless of […]