Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Educational Video Series – Running Flat

Read MoreThere are three different types of Elliott Wave Flat structure: Regular, Irregular / Expanded, and Running Flat. In this video, we will take a look at an example of a Running Flat. Flat is a 3 waves corrective structure labelled as ABC. Internally it is a 3-3-5 structure. Wave A is subdivided into 3 waves […]

-

Educational Video Series – Regular Flat

Read MoreIn this video, we will look at the Flat Elliott wave structure, and we will take a look at an example of the Regular Flat. Flat is a corrective 3 wave structure labelled as ABC. Internally it is a 3-3-5 structure. Wave A is subdivided into 3 waves, wave B is subdivided into 3 waves, and wave […]

-

4 types of Emotions every trader needs to overcome

Read MoreThere are four psychological kinds of emotions that drive most individual decision making in any market in the world: Greed, Fear, Hope and Regret. The psychology behind trading is the force that makes the moves in the market. Besides a good Elliott Wave analysis and proper money management, trading psychology is crucial for being successful […]

-

AAPL (Apple) Elliott Wave (V) in progress

Read MoreFrom wave ((x)) low in May 2012, Apple moved in 5 impulsive waves. Wave I ended at 82.16 and is subdivided into 5 waves. Wave II ended at 70.51 and unfolded in 3 waves. Wave III unfolded in 5 waves and ended just beyond 1.618 ext of wave I-II ending at 119.75. and is subdivided into […]

-

Educational Video Series – Expanded / Irregular Flat

Read MoreIn this video, we will look at Elliottwave structure called a Flat, and we will focus at one type of Flat called the Irregular / Expanded Flat. Flat is a corrective 3 wave structure labelled as ABC. Internally it is a 3-3-5 structure. Wave A is subdivided into 3 waves, wave B is subdivided into […]

-

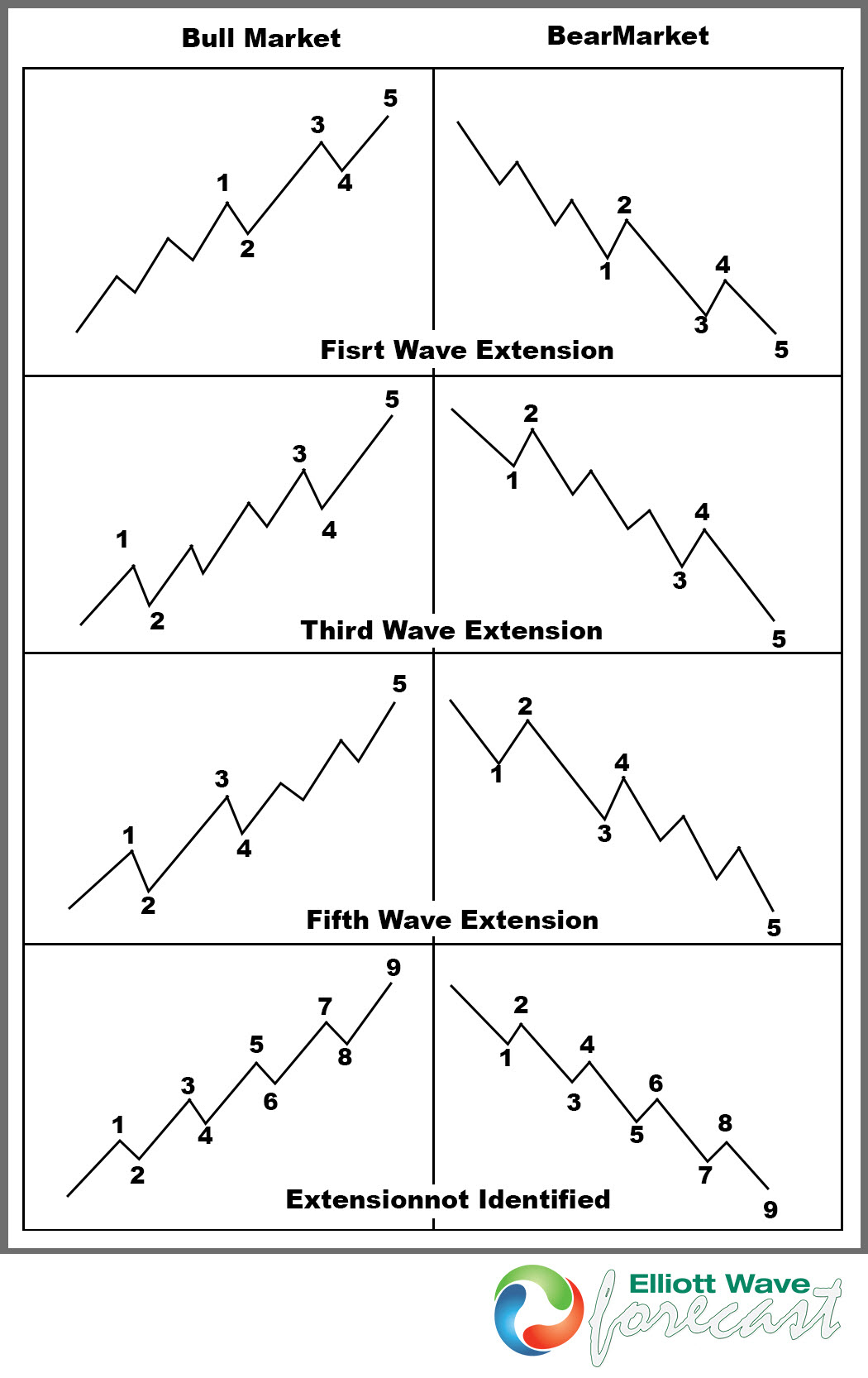

Elliott Wave Extensions within a 5 wave move

Read MoreIn this article, you will learn how to identify and trade Elliott Wave Extensions within impulsive structures. One of the core rules of Elliott Wave Theory states that in a 5-wave structure, Wave 3 cannot be the shortest. However, this doesn’t always mean Wave 3 must be extended. While extensions most commonly appear in Wave […]