Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

$DAX : Elliott Wave Zig Zag Pattern

Read MoreZig-Zag is the most famous corrective pattern in Elliott Wave Theory, but in reality we don’t see it very often. These days we could see very nice zig zag pattern that forming in DAX h1 chart. Before we take a look at real example we will explain the Elliott Wave pattern first. Zig zag iz 3 wave corrective […]

-

$EURAUD: Elliott Wave Flat structure

Read MoreIn this technical blog we’re going to explain what Elliott Wave Flat Pattern should look like. Flat pattern is corrective structure which could be often seen in the market nowadays.There are 3 types of Flats: Regular, Expanded and Running flat. In this technical blog we’re going to run through the Regular flat example. At the […]

-

$TLT iShares Barclays 20+ Year Treasury Bond from June, 2015

Read MoreSince the 26th of June, 2015 the TLT has rallied & continues to appear it will go higher once again while yields go lower. That said and knowing the correlation with yields as well as the maturity of that cycle lower from the 1980’s highs this market is in dangerous territory. It is not clear yet […]

-

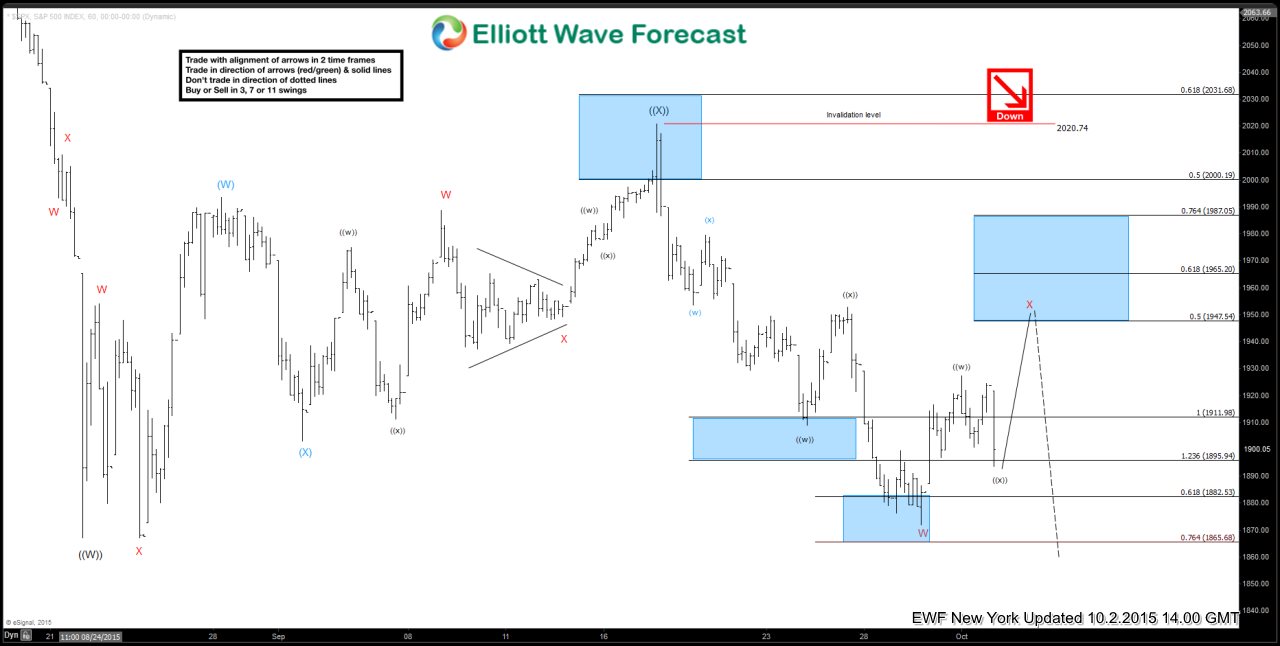

$SPX and $ES_F – Long Term Technical Review

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. $SPX and […]

-

$IWM Russell 2000 tracking ETF 9.30.2015

Read MoreIn our previous post on the $IWM Russell 2000 tracking ETF instrument from September 14th that can be seen here , we were looking for a swing higher into the 50%-.618 Fibonacci retracement zone at 118.69-121.15 in wave ((Y)) of x & did see a new high on the 17th. Since the wave x completion at 118.89 on […]

-

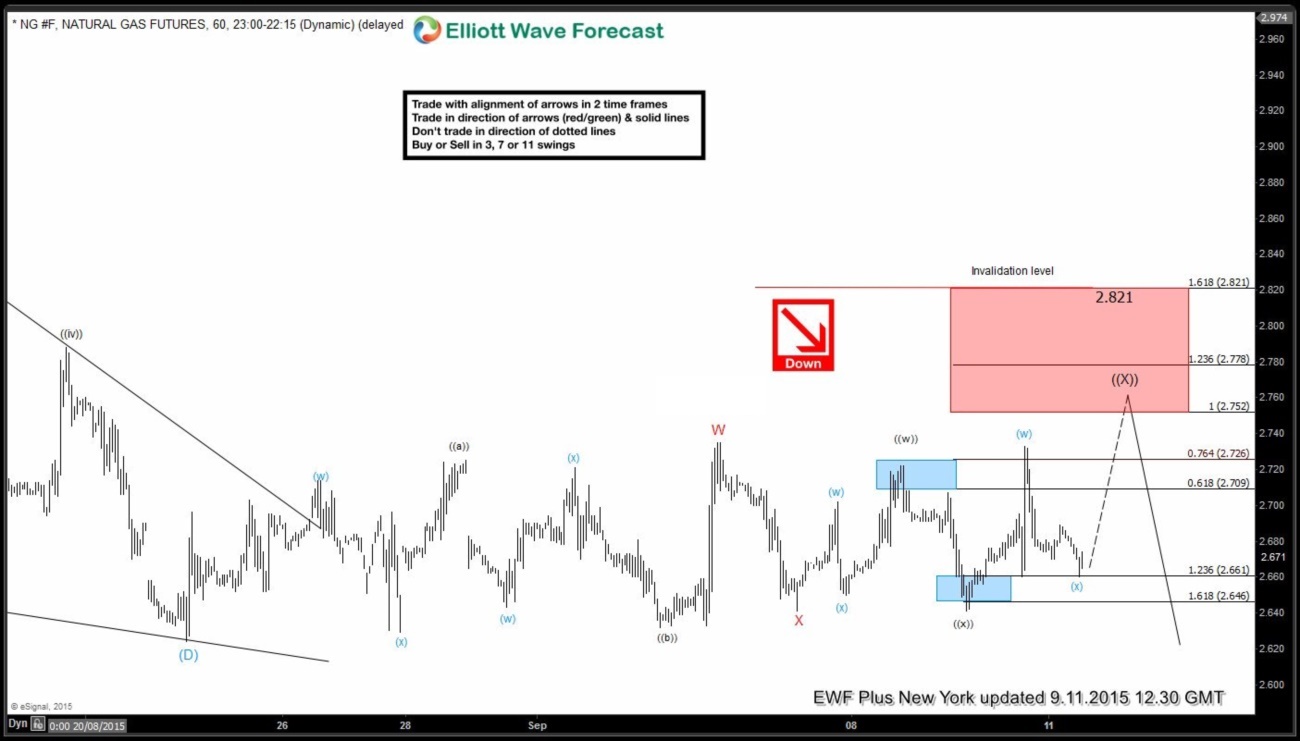

NG #F Elliott Waves Forecasting the decline

Read MoreAt EWF we are not just a market forecasting service, we also try to guide our clients to trade on the right side of the markets. And if our 24 hour chatroom, technical videos, live analysis sessions, live trading room, educational videos and market reports are not enough to help traders succeed, we also added Green […]