Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Trade Selection Process using Elliott Wave Theory

Read MoreMany traders overlook the process of selecting the right instruments to trade. Trading is a process which requires a lot of discipline and a good technique to be consistently profitable. Selection is one of the aspects which can define the life of a trader because without the right selection process, most traders are going to […]

-

$AUDUSD Elliottwaves forecasting the rally and buying the dips

Read MoreThe Video below is a short capture from the Live Trading Room held on September 13th by EWF Technical analyst Hendra Lau. In the first part, Hendra explained some basic rules of money management that every trader should be aware of, how to avoid overleveraging by spliting the position size within the instruments of the […]

-

$CADJPY Elliott Wave Zig Zag pattern

Read MoreHello fellow traders, in this technical blog we’re going to explain what Elliott Wave Zig Zag pattern looks like on real market example CADJPY price structure. Before we take a look at the $CADJPY chart, lets get through some basic EW theory and explain Zig Zag in a few words. Zig zag is the most […]

-

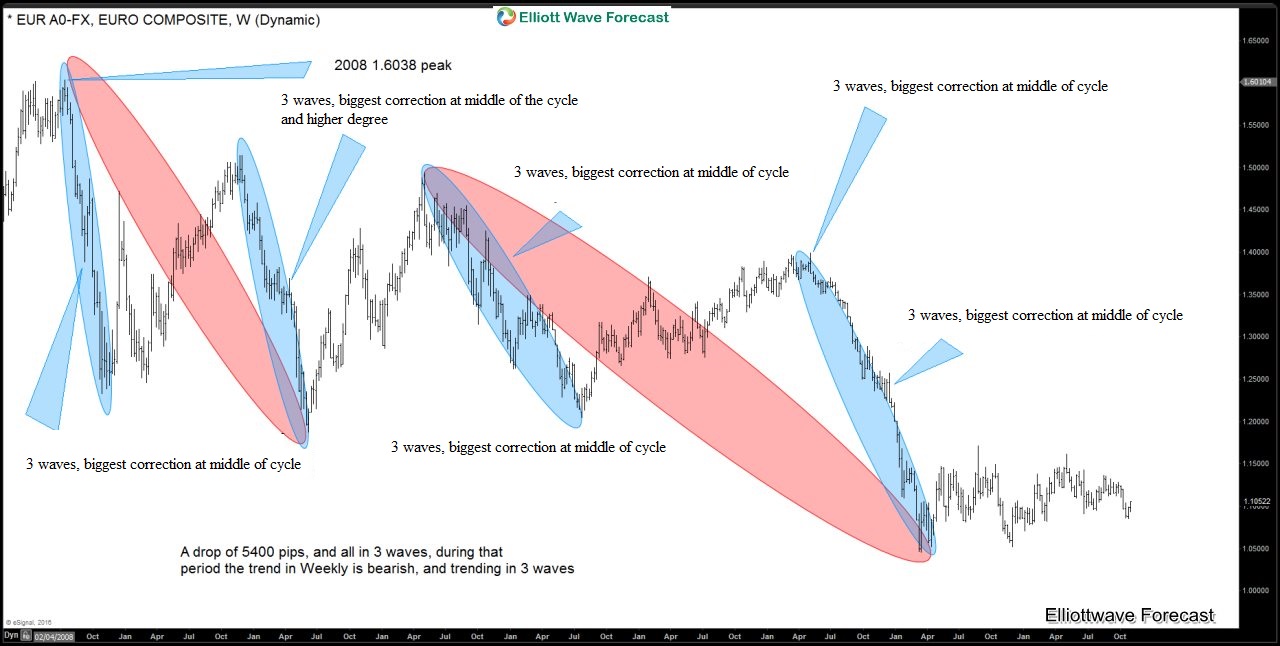

Elliott wave Theory: The Truth behind the subjection

Read MoreElliott wave Theory : The Truth behind the subjection As everyone knows by now, we at Elliottwave-Forecast, are always betting in the future. When you do forecasting for a living, it become a habit looking ahead everyday instead of looking behind. During the history of mankind, many theories and projects have been developed and created, but […]

-

$TNX Elliott wave forecasting the rally

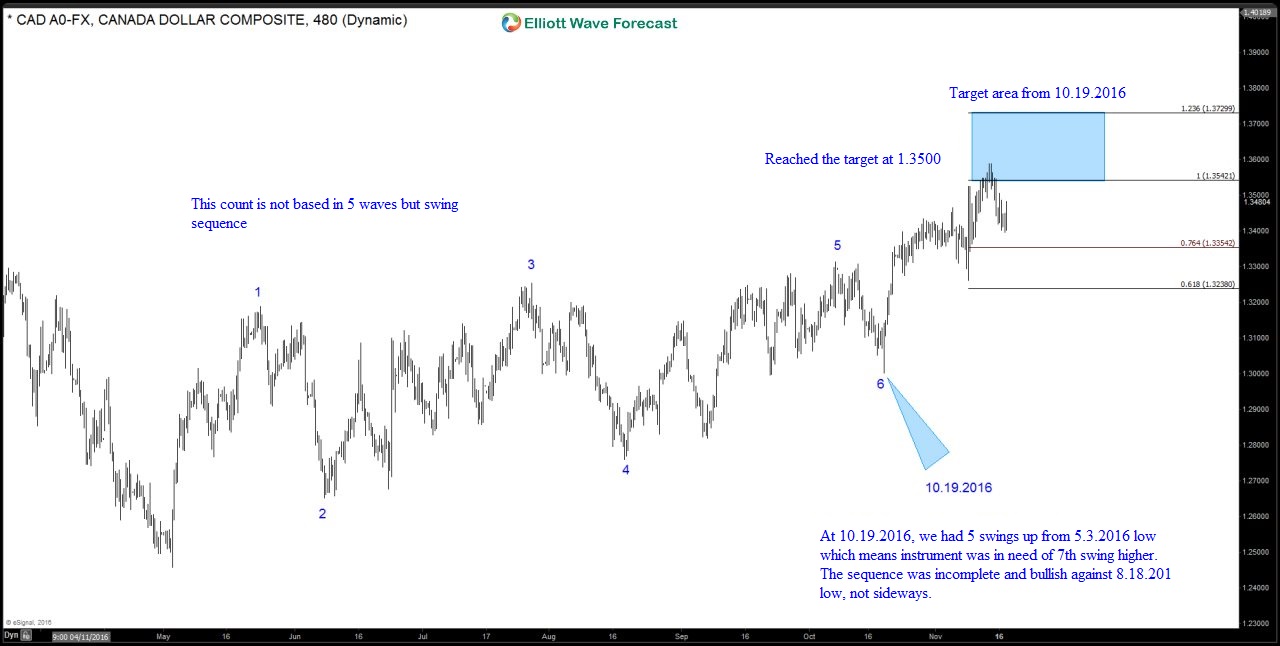

Read MoreHello fellow traders, in this technical blog we’re going to take a quick look of the price structure of $TNX and explain the swing sequences. The Elliott Wave chart below present EWF’s forecast from October 17th 2016 with added swings labelling . Back then, the instrument was showing incomplete bullish structure in the cycle from […]

-

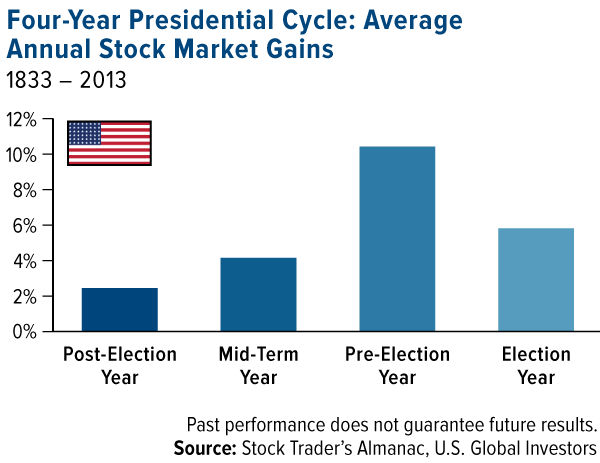

U.S. Presidential Election Cycle

Read MoreCycle, Trend, and Seasonality make up three components of price movement. There is also a fourth component which is noise. Noise is everything else that can’t be explained by the other three components. Cycles can be complex and difficult to see because there’s often a combination of large and smaller patterns, and cycles within cycles, […]