Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Market Nature and The Elliott wave Theory

Read MoreThe human nature by definition is the general psychological characteristics, feelings, and behavioral traits of humankind. As such, everyone shares this nature. Similarly, the market also has a market nature and since it is created by humans, we can try to understand what the market nature is. Today’s market is the result of either manual […]

-

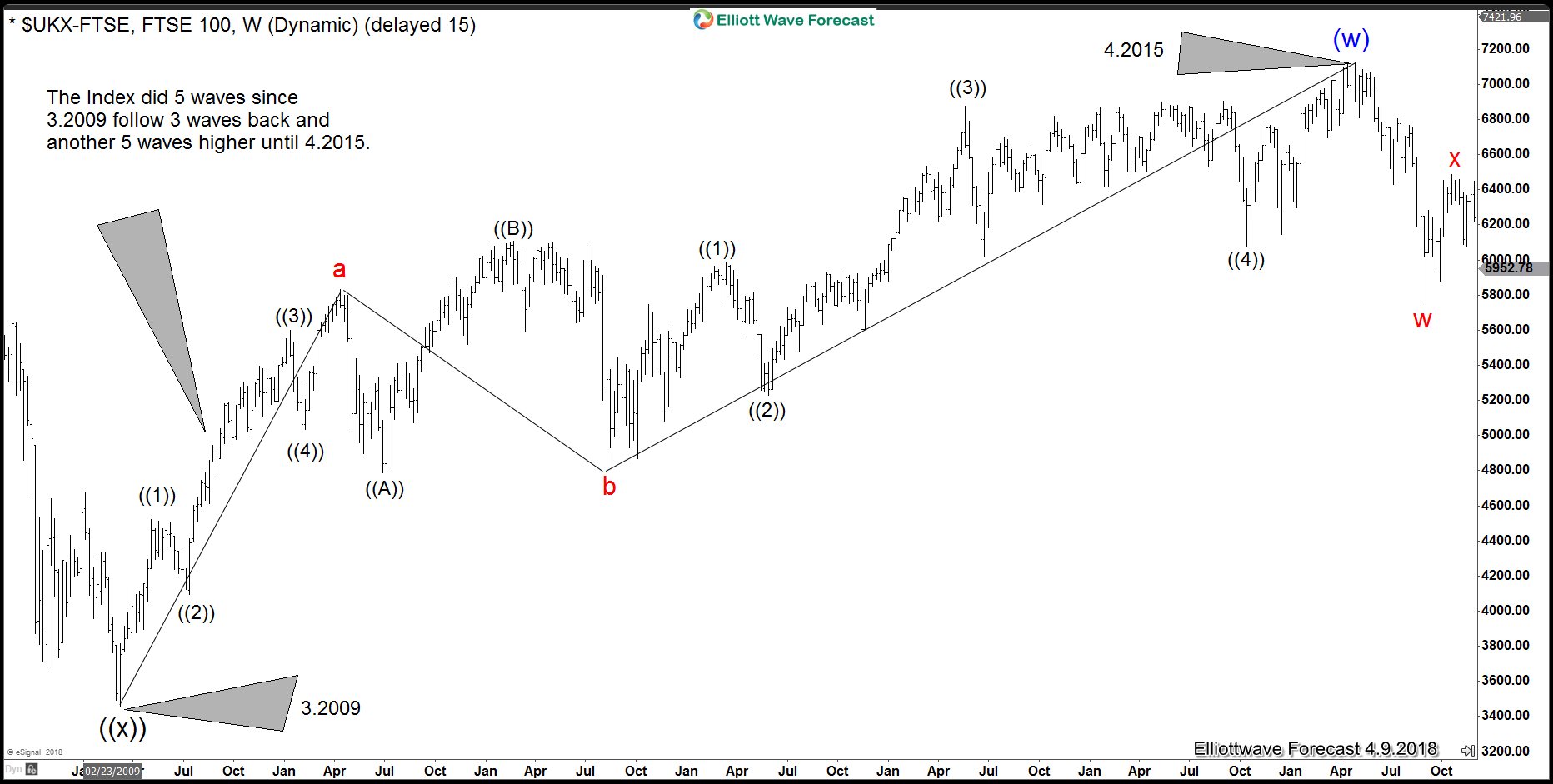

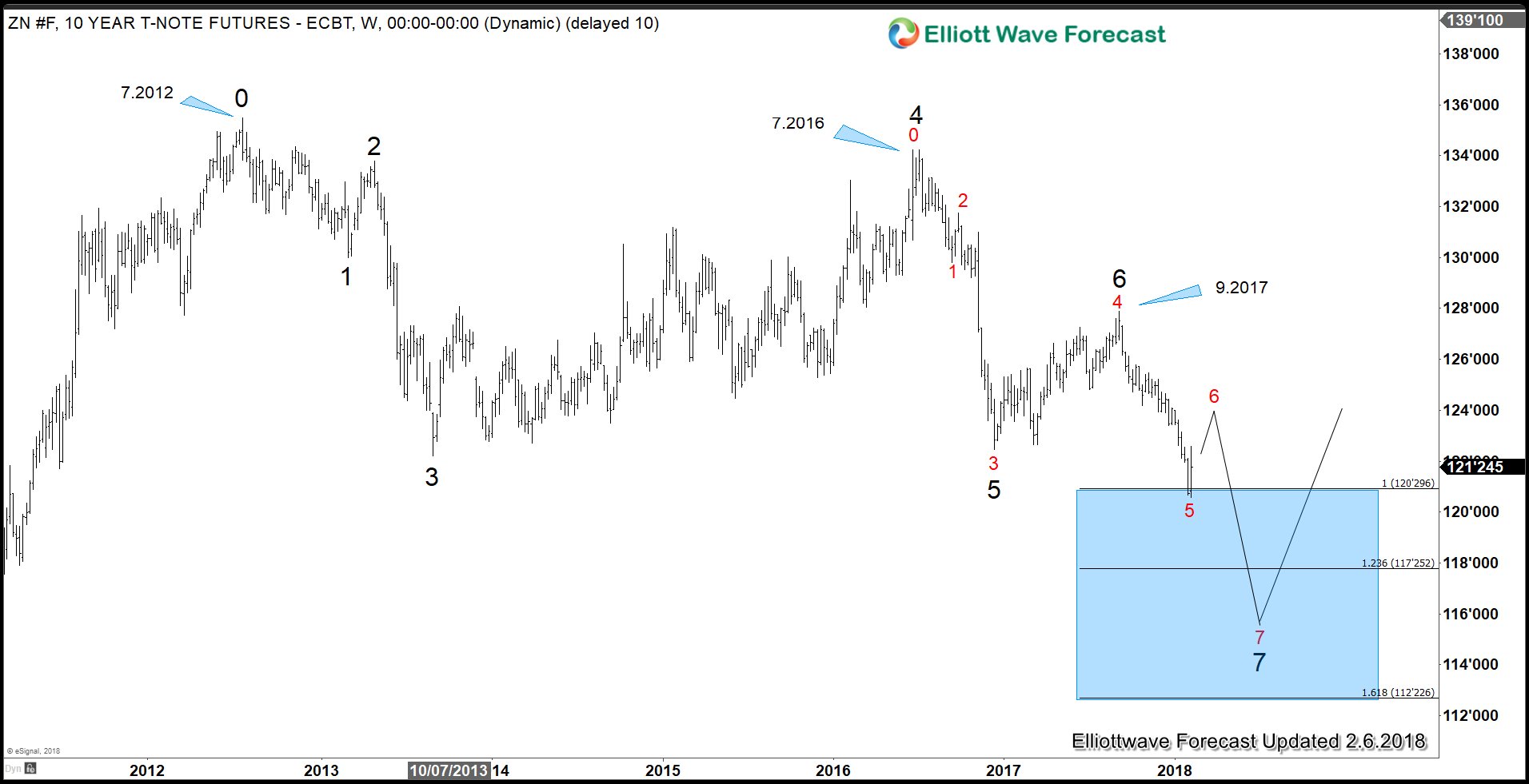

Is The 37 Year Bullish Bond Market Ending?

Read MoreThe bond market has enjoyed a strong bull market for nearly four decades with yields continuing to go lower. The bull market has been going on for so long that no current active fund manager can imagine what it looks like when interest rates were to be like the 1980s at 20%. If people in […]

-

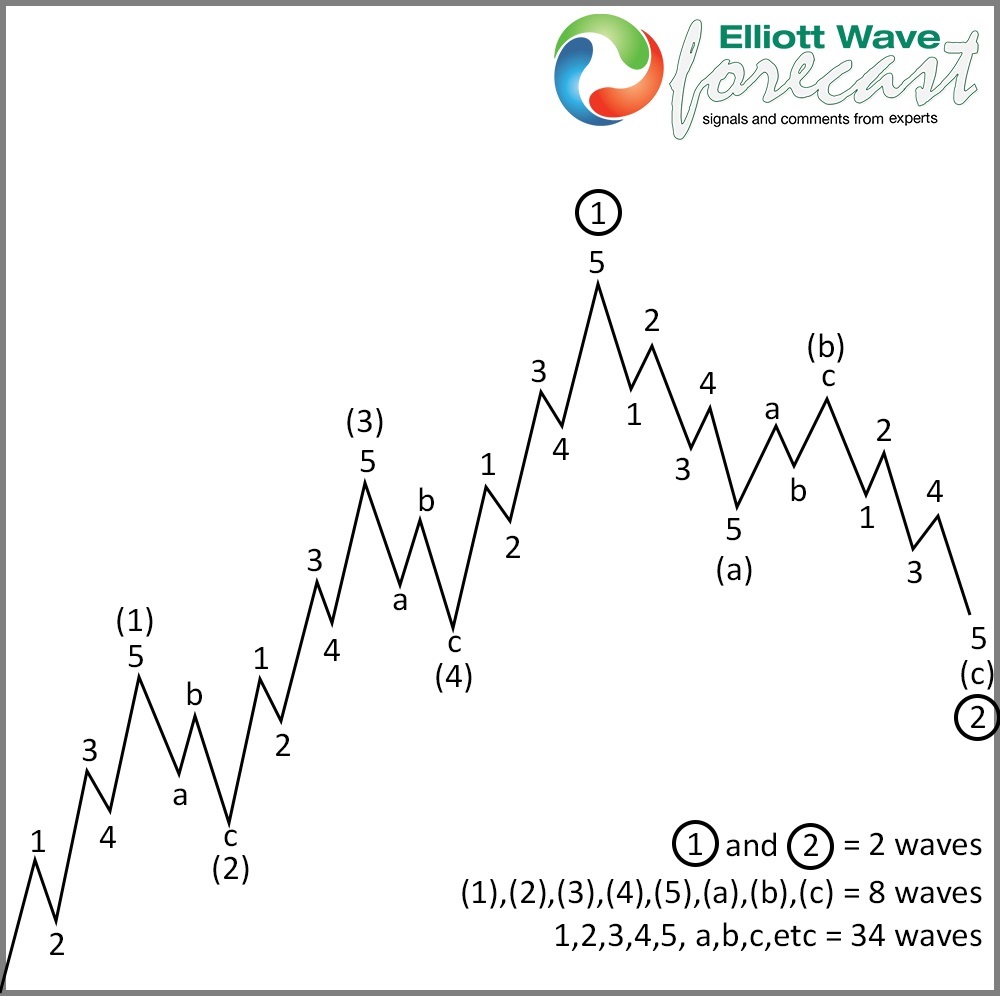

One Market concept and The Elliott wave Theory

Read MoreThe Elliott wave Theory is a form of Technical analysis that traders use to analyse the market and forecast the trend and we will explain how we use it for One Market Concept. The Theory was developed by Ralph Nelson Elliott, around 1930. The Theory is based on the idea that the Market advances in […]

-

Elliott Wave: Is The Theory Based in Social Mood?

Read MoreElliott Wave: Is the Theory Based in Social Mood? Ralph Nelson Elliott developed the Elliott Wave Theory in the 1920s by examining the underlying socio-psychological principles regarding investing habits. The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, shifts between optimistic and pessimistic extremes in natural sequences. These mood swings create patterns […]

-

Elliott wave Theory: The 5 Waves Advance

Read More5 Waves advance is a concept in Elliott Wave Theory which is named after Ralph Nelson Elliott (28 July 1871 – 15 January 1948). He was an American accountant and author. Inspired by the Dow Theory and by observations found throughout nature, Elliott concluded that the movement of the stock market could be predicted by […]

-

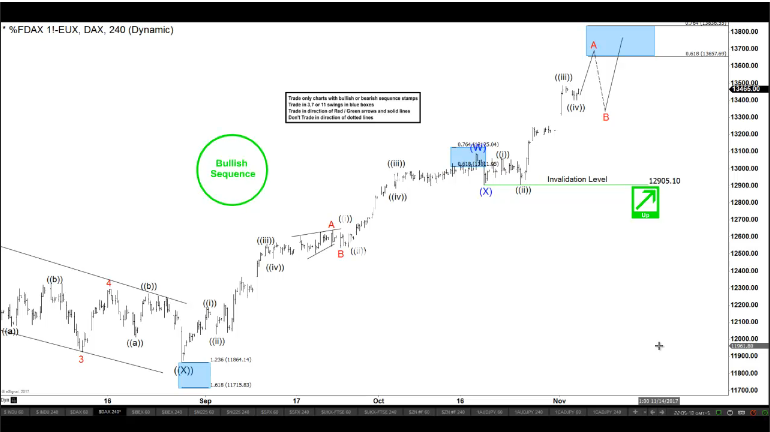

Market Dynamic requires Continuous Adjustment – Elliott Wave Forcast

Read MoreToday’s market trades 24 hours a day continuously for almost 6 days. In order to make money and beat the market, we need to keep up to date with the market and analyze it throughout the day. During the years that Elliottwave-forecast.com has been in the business, we understand the market is dynamic and therefore […]