In this technical blog we’re going to take a look at the Elliott Wave charts of OIL ( $CL_F ) published in members area of the website. The Commodity corrected the cycle from the 66.69 peak recently, when recovery unfolded as Irregular Elliott Wave Flat structure. These kinds of movements are Traps for traders as the market gives 5 waves structure in the direction against the trend. Many traders believe that new trend started, but unfortunately, those 5 waves present the wave C – last leg of Irregular Flat. These Irregular movements are nightmares for many traders who play breakout strategies. However Elliott Wave practitioners are familiar with this pattern and they recognize it as Expanded Flat. We at Elliott Wave Forecast can spot such patterns early by looking at the structure of internal subdivision, looking at price distribution and using market correlation strategies.

In further text we’re going to explain the forecast and Elliott Wave Pattern. Before we take a look at the real market example of Expanded Flat, let’s explain the pattern in a few words.

Elliott Wave Expanded Flat Theory

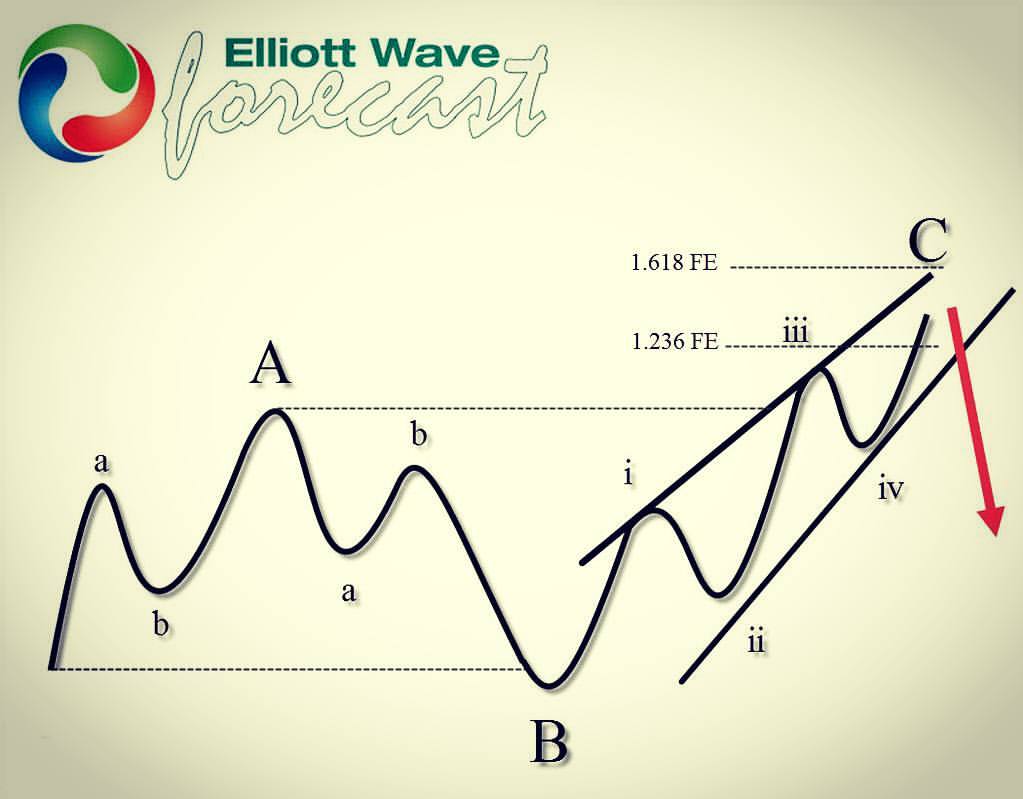

Elliott Wave Expanded Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Expanded Flat Pattern wave B completes below the start point of wave A, and wave C ends above the ending point of wave A which makes it Expanded. Wave C of expanded completes usually close to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

At the graphic below, we can see what Expanded Flat structure looks like.

Now, let’s take a look at real market example and see what that pattern looks like.

OIL 4 Hour Elliott Wave Analysis 9.16.2019.

Recovery against the 66.72 peak is unfolding as Elliott Wave Expanded Flat Structure. We can see A and B red waves are 3 waves structures.Wave A unfolded as FLAT and has ((a))((b))((c)) inner labeling. Wave B red unfolded as Double Three ((w))((x))((y)),, while wave C red is unfolding as 5 waves rally.

As we can see on the chart below OIL made price structure that is characteristic for bearish Expanded Flat. Wave B completed below the start point of wave A red, and wave C broke above the ending point of wave A. We’re already having enough number of swings in wave C red leg, and expect sellers to appear soon for proposed decline.

You can learn more about Elliott Wave FLAT Patterns at our Free Elliott Wave Educational Web Page.

Let’s downgrade to 1 Hour chart, so we can see better wave C red subdivisions.

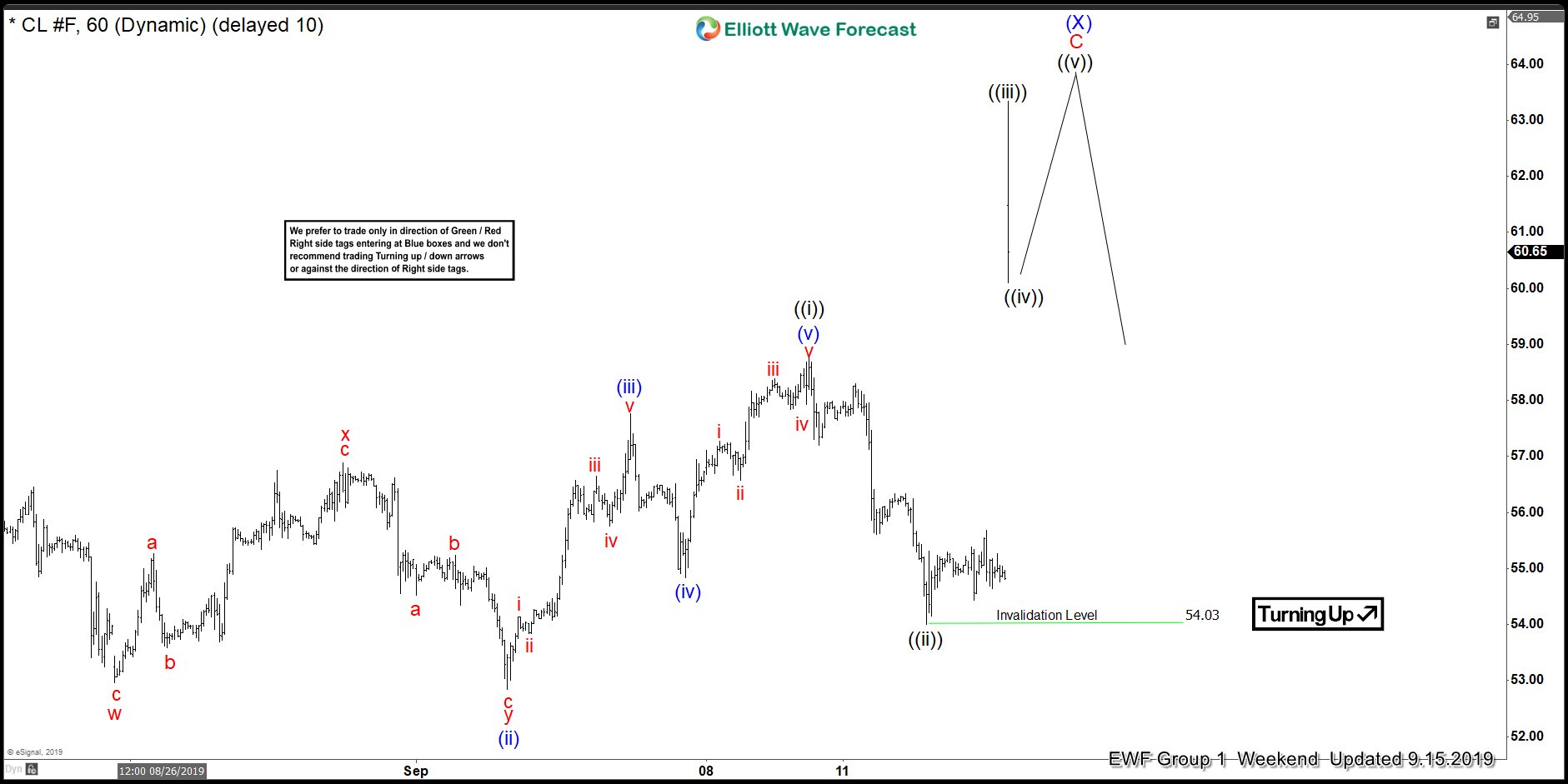

OIL 1 Hour Elliott Wave Analysis 9.15.2019.

Currently the price is forming last leg of proposed Expanded Flat- wave C red. Wave ((ii)) of C ended at 54.03 low. We got gap higher in wave ((iii)) , and now looking for another leg up after short term ((iv)) pull back completes .

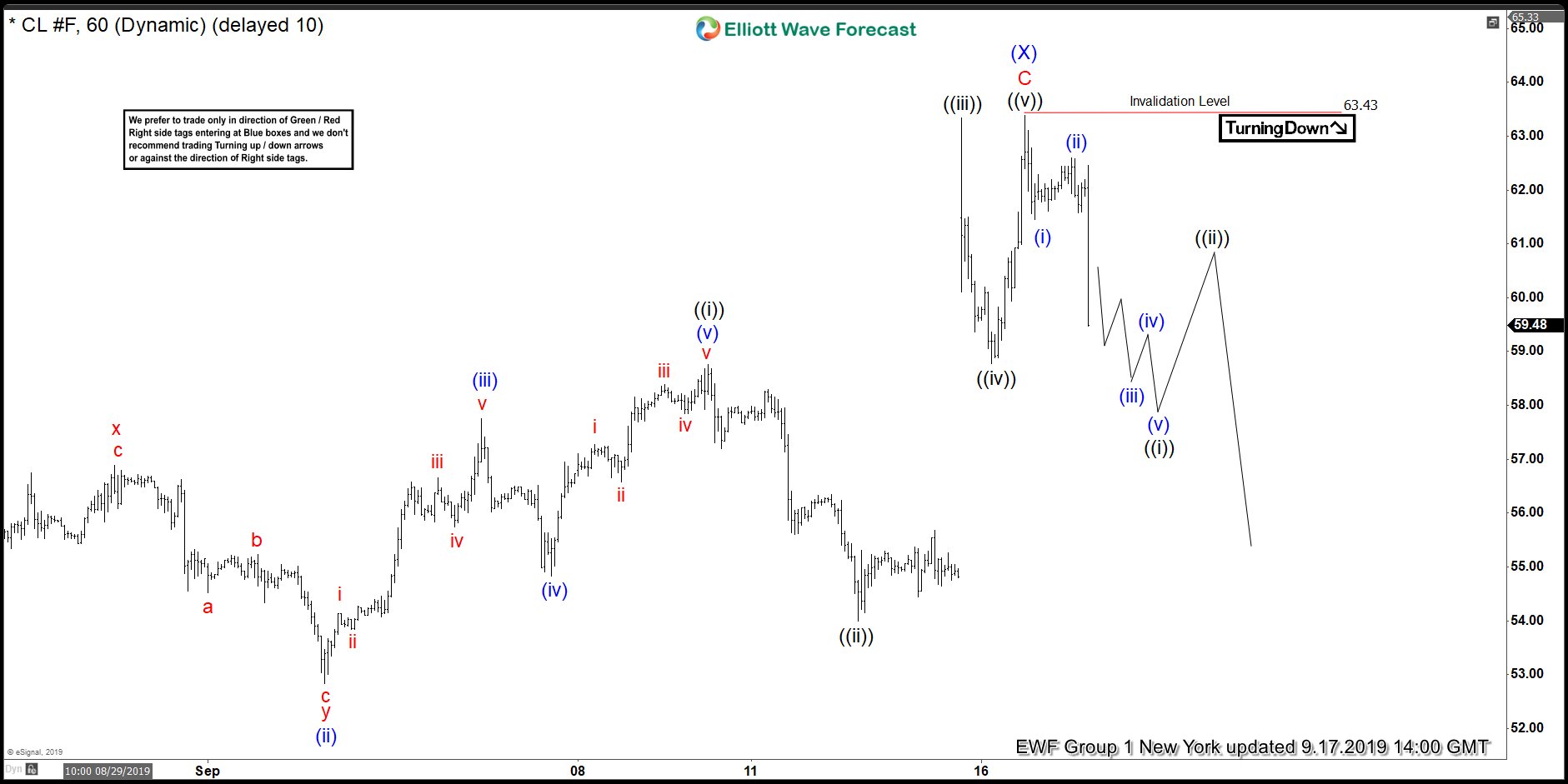

OIL 1 Hour Elliott Wave Analysis 9.17.2019.

At this stage we are calling expanded flat completed . As far as the price holds below 63.43 peak (X) recovery is counted completed and we get further weakness in the Commodity. Now we would like to see further separation down from the 63.43 peak.

Keep in mind market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !