Below is a recap of our call and forecast for Nikkei 225 from our Chart of The Day post from 5/5/2015 – 5/22/2015. You can click the underlined link to view the original post on that date.

Nikkei 225 Chart of The Day posted at 5/5/2015

In our Chart of The Day at 5/5/2015, we said Wave (Y) low is now in progress and ideally expected to test 19043 – 19192 area to complete wave ((X)) pullback. In this area, we expect to see buyers in the Index and a 3 wave reaction higher at least as per Elliott Wave hedging idea.

Nikkei 225 Chart of The Day posted at 5/6/2015

In our Chart of The Day at 5/6/2015, we said Wave (Y) of ((X)) is still in progress. We expected wave ((X)) to end at 18805 – 19045 area. The Index has reached equal leg of (W) and (X) at 19194. However, further low towards 19045 (1.236 extension) can’t be ruled out. We expect to see buyers from 18805 – 19045 area for a 3 waves reaction higher at minimum as per Elliott Wave hedging idea.

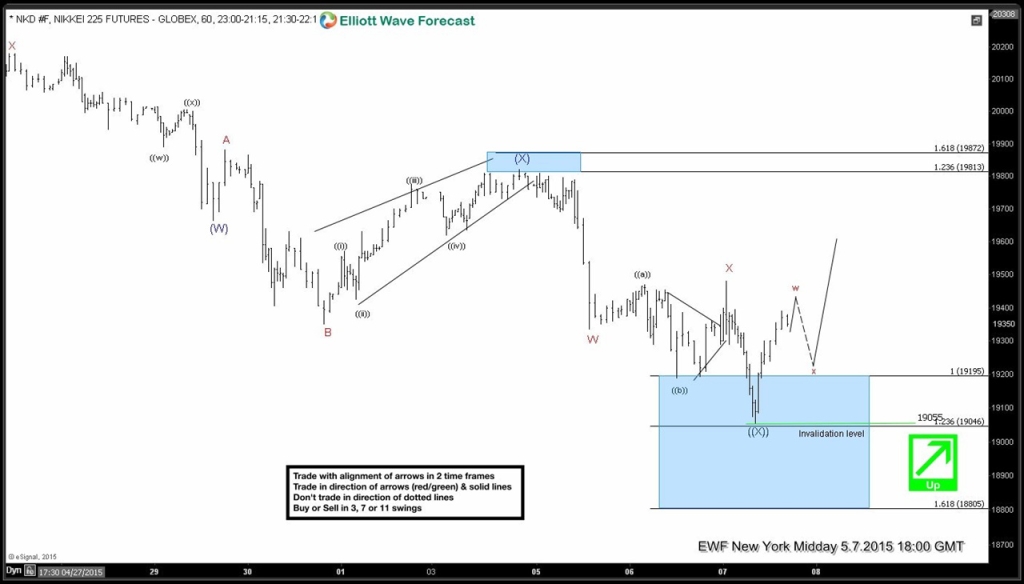

Nikkei 225 Chart of The Day posted at 5/7/2015

In our Chart of The Day at 5/7/2015, we said wave (Y) of ((X)) has completed at 19055. The Index has bounced as anticipated. Index is expected to bounce at least 3 waves higher with an ideal target of 19675 – 19821. Readers of our Chart of the Day who took a long position from 19043 – 19192 should have a risk free trade already.

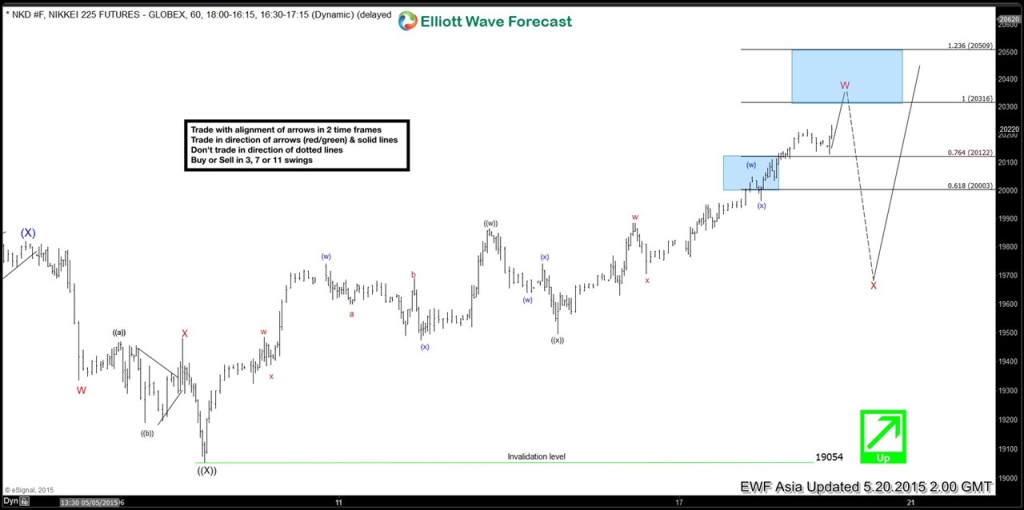

Nikkei 225 Chart of The Day posted at 5/20/2015

In our Chart of The Day at 5/20/2015, we said the decline to 19054 completed wave ((X)). The Index has since resumed the rally in wave W as a double correction. Wave ((y)) of W is in progress towards 20316 – 20509. Readers of our Chart of the Day who took a long position from 19043 – 19192 should take profit at 20316 – 20509. Index should pullback 3 waves lower in wave X to correct the rally from 19054.

Nikkei 225 Chart of The Day posted at 5/22/2015

Since our last update, current Elliottwave view suggests wave ((y)) of W has ended at 20350. Wave X pullback is in progress towards the ideal target of 19561 – 19714 (50 – 61.8 back). The pullback is unfolding as a double three. Wave ((w)) is expected to complete at 19996 – 20107. It should then bounce in wave ((x)) before turning lower to resume wave X towards 19561 – 19714. We do not like selling the proposed wave X pullback. As far as 19054 pivot holds, expect buyers to come for 3 waves higher at minimum.

Interested to see more? Sign up for 14 days trial now! We are running 14 days FREE trial until the end of May 2015.

At EWF we offer 24 hour coverage of 41 instruments from Monday – Friday using Elliott Wave Theory as primary tools of analysis. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more!

Back