The Importance of Trend Trading

As many traders know, one of the most important aspects of the Trading profession is understanding the trend and how to develop a trend trading system. Many traders wants to trade every single line or move in the Market and that is the major reason why 95%-97% of the traders end up losing within the first year and lose all or most of their capital within the same time period. Trading execution technique is very important yet also very hard as there are hundreds of techniques which can be used for this purpose. The key to trading execution however is to do the same thing every time and also have a set of rules in place in order to survive as a trader and possibly be called a professional trader.

The Mental Aspect of Trading

Execution needs a mental aspect and also understanding how and where to enter or exit the Market. Greed cannot be in place and neither should be fear, because both will end up costing money. Reality is also key and we need to be realistic above everything. We do over 3600 charts every month at EWF and we have realized that nobody called the Market 100% correct and the Market always has more than one possible path and each path has either higher or lower probability for it to happen.

Our Developed Trading System

After all this year, we have come to develop a system which is not perfect, but provide traders with a logical thinking. The system includes Sequences either correctives or impulses , cycle , Time, Distribution , correlation and Elliott wave Theory as a language to explain our views.

Modern Market Mapping Technique

This system is based in a Mapping technique which subdivides the Market in Time frames and also in groups to see the Market as a whole. Time has changed and applying Elliott wave as it was developed in 1930 is not enough and we have explained the reason in the following blogs “Elliott Wave Theory: The truth behind the subjection” and “Elliott Wave Principle: Now and Then”

Why Pure Elliott Wave Isn’t Enough for traders

The articles above explain the reason why we look at the Market differently and why we used Elliott wave Theory mostly as a language, because applying the theory by itself is not enough and it doesn’t worth risking your money. It’s easy to see that trading signal services in the market do not last long and the reason is due to the request and pressure by members to provide signals everyday, this type of services end up trading every single move either with the trend and against the trend, something which end up costing the services.

Our Trading Room Approach

At Elliott wave Forecast, we do provide signals in the Live Trading Room, but only one type of signal which comes either with the trend or justify the sequences. Even when we use a conservative approach and only send signals following these rules, we still do not win all of them, but we stay in the business, because we believe in the rules and we follow them.

Step-by-Step Market Mapping Process

The following steps will help you with the process to map the Market and trade as professionals.

- Take any Instrument and start from the Yearly or higher degree time frame.

- Start counting swings and create a sequence either impulsive or corrective.

- Locate targets within the higher degree sequences and then locate invalidation levels within the sequences.

- Locate cycles within the sequences and match the cycles with the targets, respect the target until it is invalidated .

- Start downgrading the time frames and repeat previous steps from step 2.

- Create groups and relate them in sequences, cycles, time and distribution.

- The same group (e.g. AUDUSD, NZDUSD, USDCAD are all within the same group) should follow the same sequences and cycles. A trader needs to relate them all (Groups and Instruments ) and looks at the Market as a whole. For example, a trader cannot be Bullish USDJPY and bearish SPX at the same time, it is a simple process.

Impulse vs. Corrective Sequences

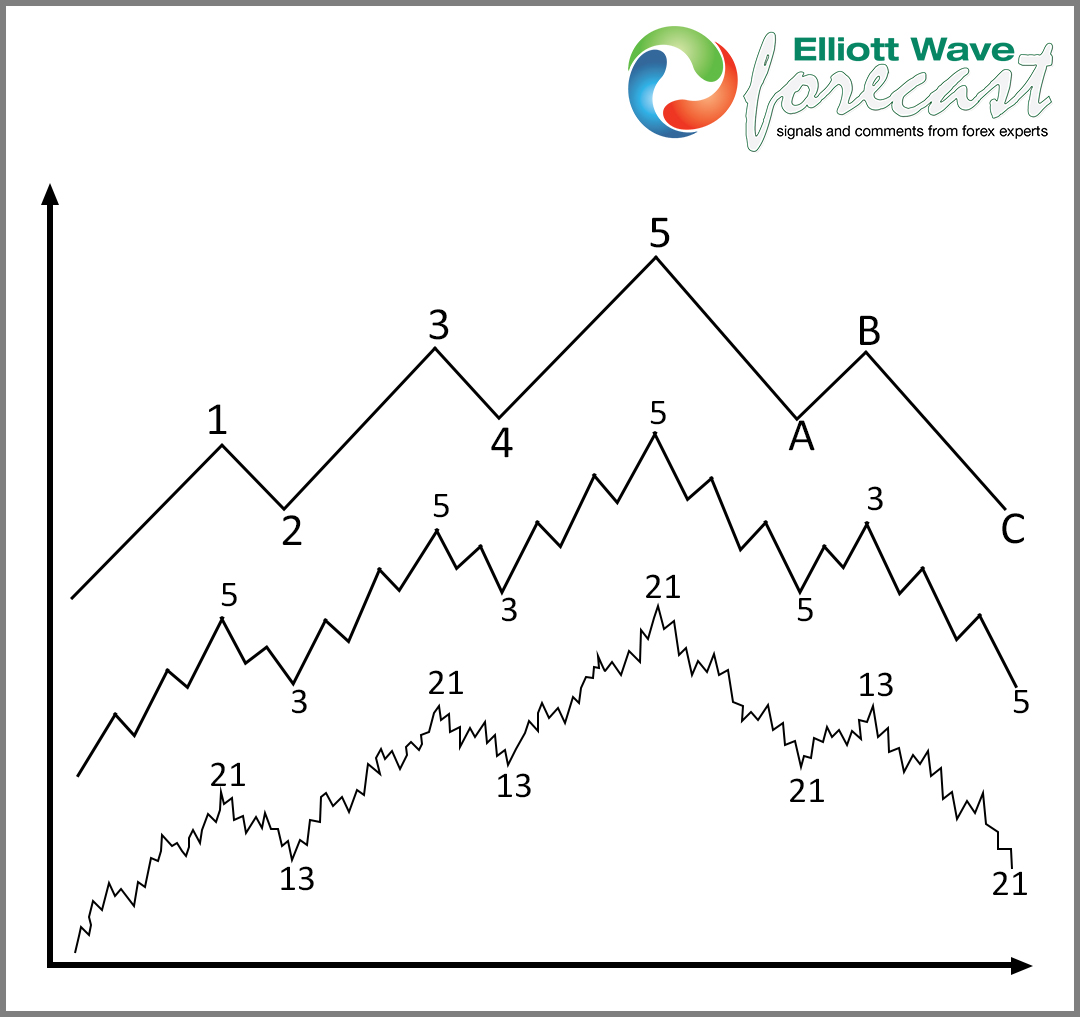

Based in Elliott wave Theory, below is an impulse sequences and come in a way of 5 waves up and 3 waves back, the sequences is 5-9-13 and runs until it ends.

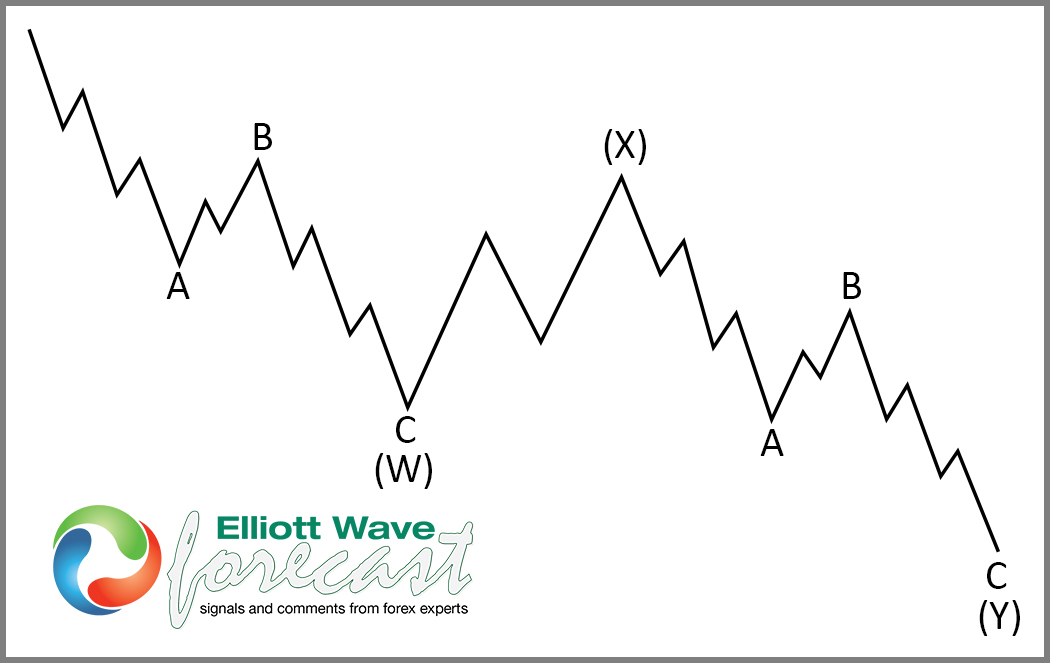

Based in Elliott wave Theory, below is a corrective sequences which is very popular in Forex trading because of the nature of the trade.

Final Trading Recommendations

Following the steps above, traders will locate the trend, sequence, cycles, and targets of each instrument, then traders will see the Market as a whole. The only thing left is the execution when need to wait for areas and trade with the trend of the higher degrees by buying / selling pullbacks. We do not recommend trading the pullbacks because trend can and most of the time extends, but there’s no guarantee how big the pullback can be and traders can end up being in a the wrong side of the trend. With the wrong money management, over leveraging and bad execution, being in the wrong side of the trend can take all your money.

The Path to Successful Trading

We hope this blog open your eyes and allow you to see the Market differently, and it will help you understand why most trading signals services do not last and understand that trading with the trend and sequences is the most profitable way to be part of the 5 percent.

Back