Elliott Wave is one of the technical tools that traders use to determine the market’s path. Traders typically use the wave theory and apply it in different time frames to forecast a future path of the instrument. The smaller time frame would show the smaller cycles which together form the larger cycles in the larger time frame. Thus, there’s no contradiction between the smaller time frame (e.g. hourly chart) and the larger time frame (e.g. weekly chart). This is what traders often refer to as fractal in Elliott Wave Theory.

What new traders don’t realize is that Elliott Wave is a flexible Theory. Despite the various rules and guidelines, the theory is flexible enough that there could be several alternative paths in any given situation. Sure, more experienced and better wavers know the guidelines and market better. Thus they can come up with better and more accurate count. However, even within the context of a good count which follows rules and guidelines, there are still various possibilities. This is akin to playing chess. What separates good and professional chess players and the rest is that they understand all the possible moves they and the opponent can take. Then, using the theory of probability, they will then take a move which maximizes their positions.

In a similar way, understanding Elliott Wave Theory from the inside out does not guarantee they become profitable traders. Just like knowing all the chess rules does not guarantee they become professional chess players. In order to trade, traders need to develop a winning trading system which is based on Elliott Wave. Thus, forecasting using Elliott Wave is 1 thing, but to trade the forecast is another thing. Traders always have to update the forecast with the understanding that in any given situation, there is at least 1 alternative path. Traders however do not and should not try to trade every single swing of the forecast.

The reason is because not every swing has the same probability of winning. What separates good and experienced traders with the rest is that good traders patiently wait for a setup which follows certain rules and criteria to maximize their edge. By following a good trading system, they can maximize their dege, make sure they control the risk properly and have a reward which is greater than the risk. New traders, on the other hand, love to trade every time and everywhere, including all the tiny little swing in the smallest time frame. No wonder why statistics say that 90%+ traders lose money. Inexperienced and impulsive traders behave like gamblers by trading with leveraged position frequently. Worse, they trade without any system and robust use of risk management.

We at Elliottwave Forecast (EWF) always recommend our members to trade responsibly. Some of our members are experienced and professional traders. They have their own system and use our inputs to improve their edge. This category of traders should be doing okay since they already understand the concept of a trading system and risk management. Thankfully, EWF also has our own trading system for traders who are new or still struggle to be consistent.

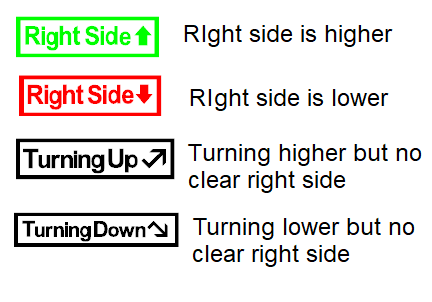

They could just adopt our trading system as a starting point. As they grow and become more experienced, they can then at later stage further tweak our system to suit their needs. We have our own system of trading with the right side in 3, 7, or 11 swing. Our chart update show if there’s a bullish or bearish sequence in the market. We denote this with different colors of the arrow. Green arrow means there is a bullish sequence. Red arrow means there’s a bearish sequence. Finally, black turning down or turning up arrow mean there’s currently no bullish/bearish sequence.

Right Side Arrow

Since we use a trading system with specific rules and conditions, this means that only those which fits the criteria will be traded. As a result, we do not trade everything and every time. The common issue that new traders encounter is that they only trade 1 instrument. For example, they only trade EURUSD or S&P 500 or Gold or Bitcoin. The problem is that if traders only trade 1 instrument, there might not be any trading opportunity for a period of time as long as the criteria within the system is not fulfilled. If traders are willing to trade various instrument however, it will greatly expands the number of potential trades.

We also have Live Trading Room session everyday where we scan the entire market to see if there’s any potential trade. We then explain the logic of the trades in the webinar and also put them in a trading journal. The webinar recording and journal would then later be posted for review or for those who are unable to attend live.

Our approach is conservative and our focus is to protect members account more than making profit. We believe the primary job of professional traders is to protect their account and apply rigorous risk management. If you’d like to learn more about our trading system and approach, feel free to take our Trial here –> 14 Days Trial

Back