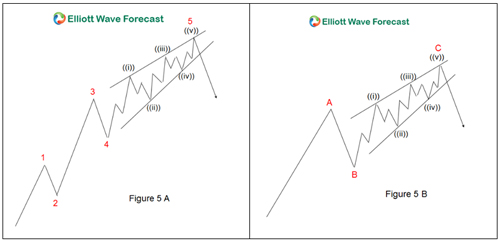

An ending diagonal is an Elliott Waves structure that is wedge-shaped and can appear within an impulse as wave 5 or within a correction as a wave C. This type of structure internally is composed of 5 waves and each of these 5 waves is subdivided into 3 or 5 waves creating two possible structures 3-3-3-3-3 or 5-3-5-3-5.

An ending diagonal indicates that the end of a cycle is near and this has two consequences: 1. The market corrects the finished cycle and then continue with the trend 2. We have a short, medium or long term trend change depending on the cycle that the market is ending. This makes the ending diagonal a very powerful technical structure because gives us great trading opportunities. For more information on Elliott’s Theory you can visit this link: Elliott’s Wave Theory.

Coffee Ending Diagonal

Above we can see in early November that an ending diagonal was forming in Coffee ($KC #F). We have a corrective structure (A) (B) (C) from the peak, where wave (C) is an ending diagonal indicating that the correction was about to finish and we should see a bounce in 3 swings at least or continue with the uptrend. For the moment Coffee continues with the bullish movement and does not indicate any change in the trend until it does not break the invalidation level of 102.14. To be informed day by day of the different structures make up by the market you can join us starting with 15 days trial totally free.

In Elliottwave Forecast we update the one-hour charts 4 times a day and the 4-hour charts once a day for all our 78 instruments and also the blue boxes and rigth side mark. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. Let’s trial for 14 days totally free here: I want a free trial.

Back