The Expanded Flat correction is a common corrective structure seen in:

-

- Wave 2 and Wave 4 of a Motive Wave

- The connector wave in a Zig Zag pattern

- Any part of a Double or Triple Correction

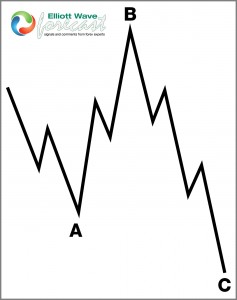

Structure of an Expanded Flat Correction

In a Bullish Trend Scenario:

- Wave A – Price moves against the trend in a 3-wave structure.

- Wave B – Also a 3-wave structure that advances beyond the origin of wave A, typically reaching 123.6% of wave A.

- Invalidation level: Above 161.8% of wave A

- Wave C – Must be a 5-wave (Motive Wave) structure with RSI divergence between wave 3 and 5.

- Common completion zones: 100% – 123.6% extension of wave A

- Invalidation: Beyond 161.8% extension

- Running Flat: When wave C ends above wave A

Sign up for a 14-Day Trial HERE

Visual Example of an Expanded Flat Correction

Why Traders Get Confused

Expanded Flat corrections often mislead traders because:

-

- After Wave A completes as a 3-wave move, price retraces beyond Wave A’s origin, making traders think the correction is over.

- However, a sharp 5-wave reversal (Wave C) follows, completing the structure.

Real Market Example (Bearish Trend)

Here is a real market example that features a bearish trend.

Safe Trading

Graham Lowe

Back