Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Copper. As our members know , we were calling for decline in Copper. Recently Copper corrected cycle from the April 17th peak. Recovery unfolded as Elliott Wave Zig Zag pattern (A)(B)(C). Once the price reached equal legs (A)-(B) we knew that sellers will appear there for a 3 wave pull back at least. Consequently we recommended members to avoid buying the Commodity as decline was expected. We have been calling for extension down within the cycle from the April 17th peak.

In the further text we are going to explain the Elliott Wave Pattern and the Forecast.

Before we take a look at the real market example, let’s explain Elliott Wave Zigzag pattern.

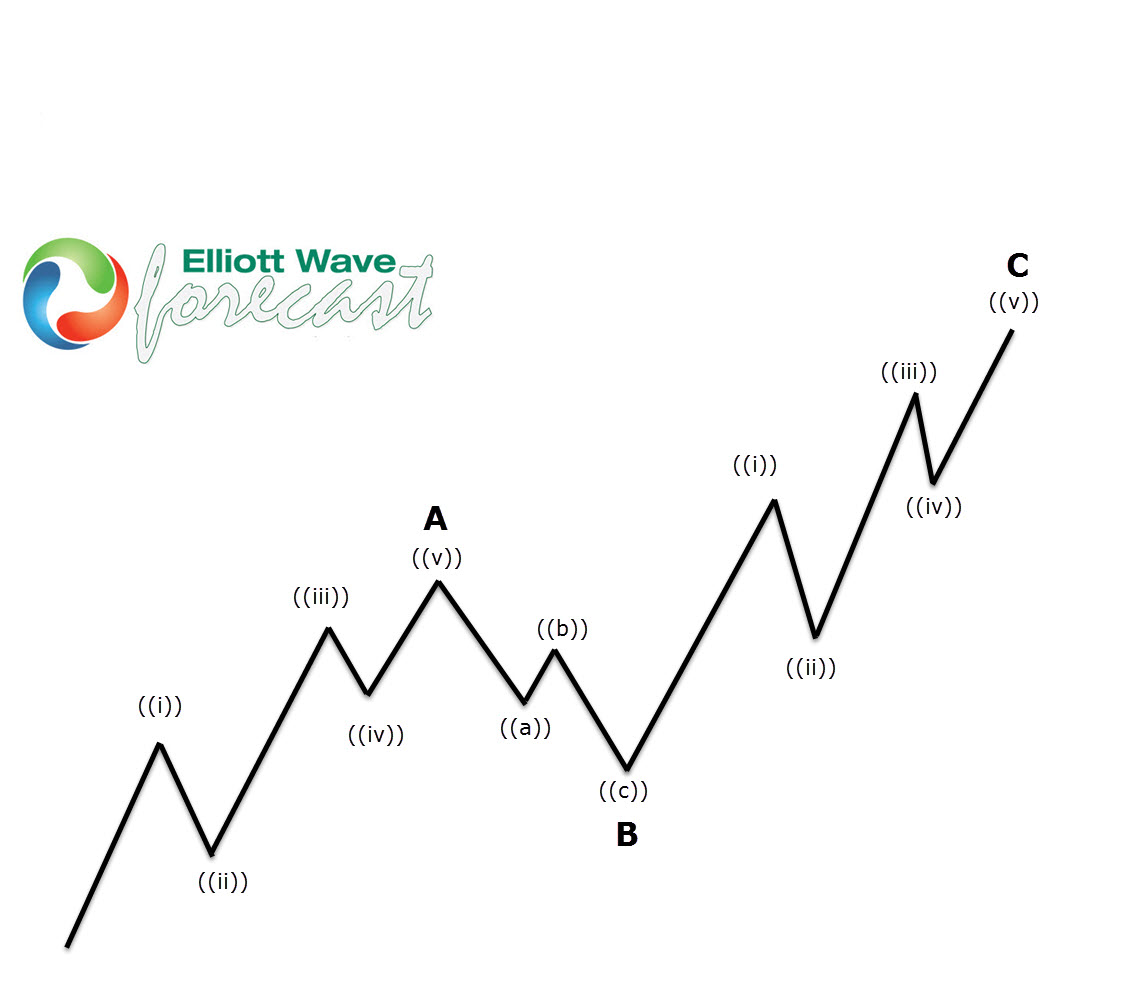

Elliott Wave Zigzag is the most popular corrective pattern in Elliott Wave theory . It’s made of 3 swings which have 5-3-5 inner structure. Inner swings are labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C can be either impulsive waves or diagonals. (Leading Diagonal in case of wave A or Ending in case of wave C) . Waves A and C must meet all conditions of being 5 wave structure, such as: having RSI divergency between wave subdivisions, ideal Fibonacci extensions and ideal retracements.

At the graphic below, we can see what Elliott Wave Zigzag structure looks like. 5 waves up in A, 3 wave pull back in B and another 5 waves up in C.

COPPER 4Hour Elliott Wave Analysis 07.27.2019

At the chart below we can see what Elliott Wave Zig Zag Pattern looks like in real market example. We got 5 waves up from the 06.07 low, that have completed at 07.01 peak. Then 3 waves pull back in wave (B) blue, after which we got another leg up (C) that also unfolded as 5 waves structure. That was classic example of Elliott Wave Zig Zag Pattern. The price reached equal legs area at 2.7747-2.875 ( blue box) and found sellers there. As our members know Blue Boxes are no enemy areas , giving us 85% chance to get a pull back. At this stage we are calling recovery completed at 2.804 high. We expect further weakness in Commodity toward new lows. Now we need to see break of 06.07 low to confirm next leg down is in progress.

You can learn more about Zig Zag Elliott Wave Patterns at our Free Elliott Wave Educational Web Page.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !

Back