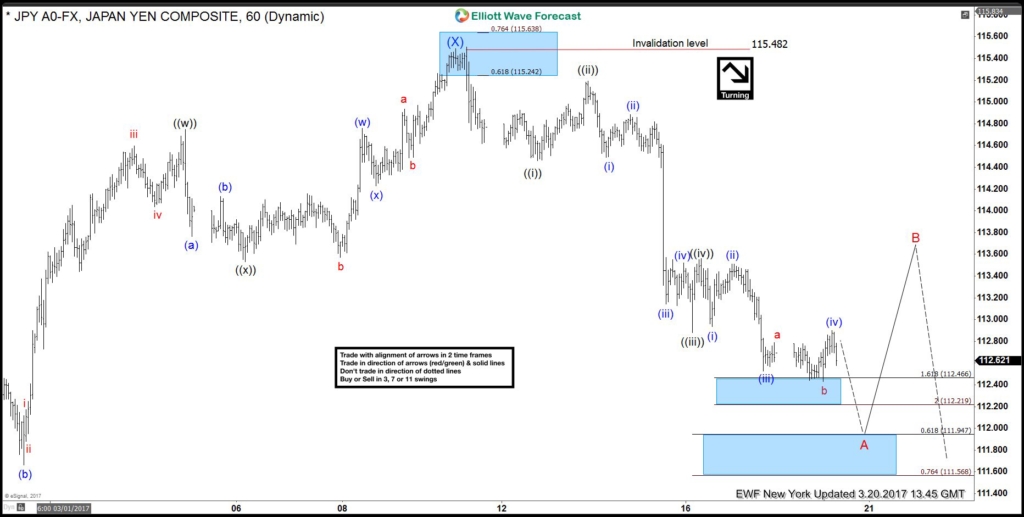

5th Wave Target Area in the $USDJPY move Lower from 3/10

The $USDJPY pair from the 3/10 highs at 115.50 is showing a 5 wave impulse lower that is beginning to look mature. How to get the target area to end the wave ((v)) of A is as follows. I will reference the 3 different methods we use to get a 5th wave target here.

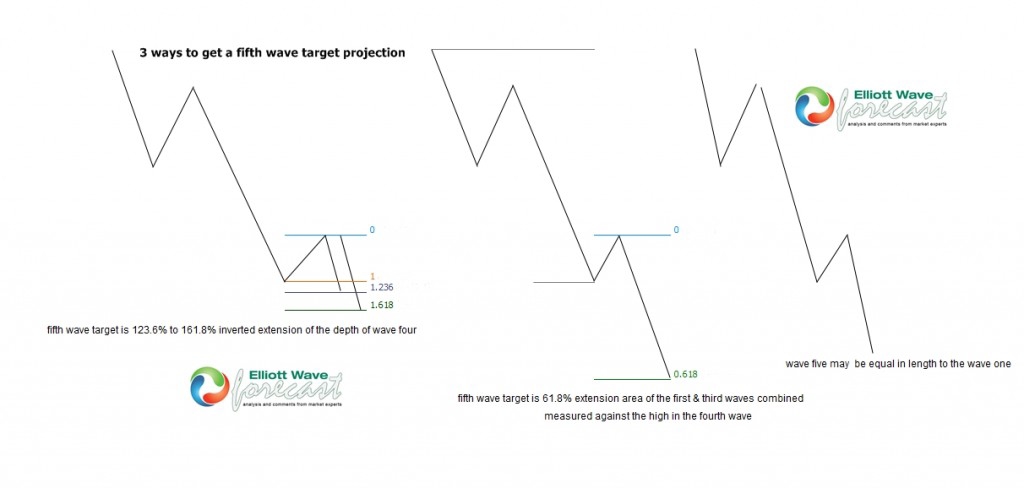

Firstly the 1st way we obtain a 5th wave target is where wave ((v)) equals wave ((i)) , which was at 112.51. Secondly the 2nd way we obtain a 5th wave target is as follows. The inverted extension of the depth of wave ((iv)) gave a 1.236 -1.618 extension area at 112.71-112.45. Price was seen so we say the impulse cycle lower from 115.50 is mature. However while a bounce remains below the ((iv)) highs at 113.56 the pair can see a little more weakness toward 111.94. Thirdly this is the .618 extension of the wave ((i)) and ((iii)) combined. That is the 3rd way we obtain a 5th wave target area. Ideally the pair will also show RSI divergence in the hourly to smaller time frames. That is when comparing the lows in the wave ((v)) to the wave ((iii)).

In conclusion. Impulse cycles move in 5, 9 or 13 swings. Corrective cycle move in 3, 7 or 11 swings. When this impulsive cycle lower from the 115.50 highs from 3/10 ends; It will be considered a 5th swing low. That from the 12/15 highs. Then expect a bounce develops to correct the cycle lower from the 3/10 highs in a wave B. That will be considered the 6th swing. Afterward expect the pair to continue with another swing lower. That will finish a larger degree corrective 7 swings sequence from the 12/15/2016 highs.

Thanks for looking. Feel free to come visit the website . Take a trial subscription to see if we can be of help in your trading.

Kind regards and good luck trading.

Lewis Jones of the ElliottWave-Forecast.com Team

USDJPY Hourly Chart

Back