Pan American Silver is a Canadian mining company that owns and operates mines in Mexico, Peru, Bolivia, and Argentina. As one of the world’s premier silver producers, they focus on silver and gold mining throughout the Americas. Their vision emphasizes excellence in discovery, engineering, innovation, and sustainable development. Below we update the Elliott Wave outlook of the company.

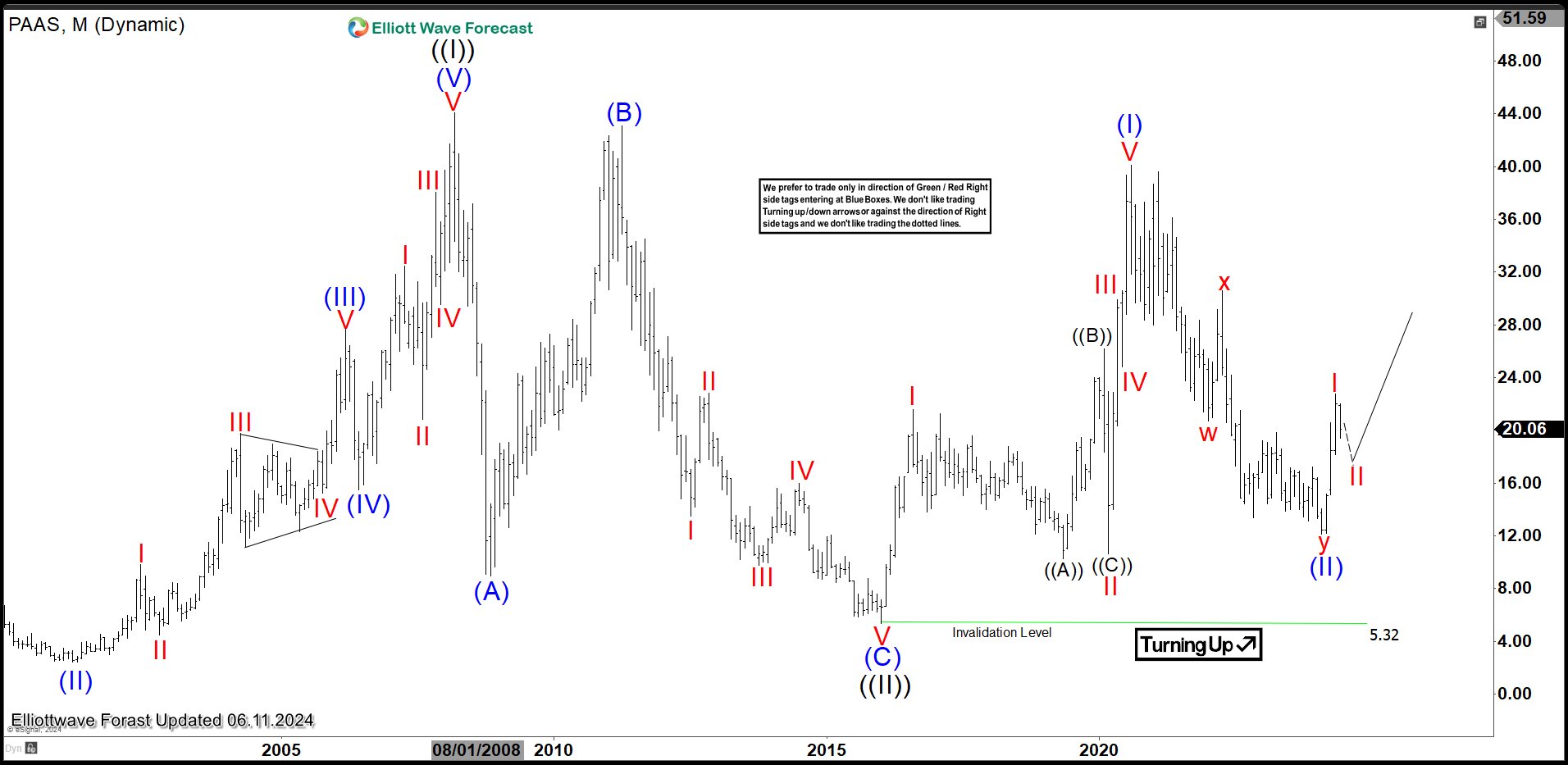

PAAS Monthly Elliott Wave Chart

Monthly Elliott Wave chart of Pan American Silver (PAAS) above shows the stock ended wave ((II)) pullback at 5.32 on January 2016 low. The stock then started to rally in wave ((III)) as an impulse. Up from wave ((II)), wave (I) ended at 40.11. Pullback in wave (II) has also completed at 12.18. The stock has since rallied higher again as an impulse. While pullback stays above 5.32, expect the stock to extend higher.

Monthly Elliott Wave chart of Pan American Silver (PAAS) above shows the stock ended wave ((II)) pullback at 5.32 on January 2016 low. The stock then started to rally in wave ((III)) as an impulse. Up from wave ((II)), wave (I) ended at 40.11. Pullback in wave (II) has also completed at 12.18. The stock has since rallied higher again as an impulse. While pullback stays above 5.32, expect the stock to extend higher.

PAAS Daily Elliott Wave Chart

Daily Elliott Wave Chart of Pan American Silver (PAAS) above shows the rally from wave (II) low at 12.18 unfolded as an impulsive structure. Up from wave (II), wave ((1))) ended at 13.28 and wave ((2)) pullback ended at 12.19. The stock then extended higher with separation wave ((3)) which ended at 20.6. Pullback in wave ((4)) has ended at 18.01 and the stock resumed higher in wave ((5)) towards 22.75 which completed wave I in higher degree. Pullback in wave II is currently in progress to correct cycle from 2.13.2024 low in 3, 7, or 11 swing before it resumes higher. Near term, as far as pivot at 12.18 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

To get regular technical updates on 72 instrument from stocks, Indices, forex, and commodities, feel free to try our service –> 14 days Trial.

Back