Palladium recently broke above January 2018 peak which has brought about a new wave of optimism in the commodity but is it the right time to jump into the longs or there could be a better time and levels to buy the commodity. In June 2018, Palladium was in a pull back to correct the cycle from January 2016 low and we said the pull back was a buying opportunity.

Palladium Bullish Elliott Wave Sequence from January 2016 low

Below is the weekly chart of Palladium which shows rally to January 2018 was an ((A))-((B))-((C)) which completed wave “w” and hence 3 swings. Dip to August 2018 low was wave “x” and completed 4th swing while new high above January 2018 is the 5th swing and has created a bullish 5 swings sequence. Cycle from August 2018 low has ended at 1137.30, this was an impulsive rally and has been labelled as wave (A). Palladium is currently in a pull back to correct the cycle from August 2018 low and that’s why we believe now is not the right time to jump into the longs and we like waiting for a pull back in wave (B) in 3-7-11 swings to buy the commodity. We will highlight the buying area with a blue box in the charts presented inside members area when we see it developing.

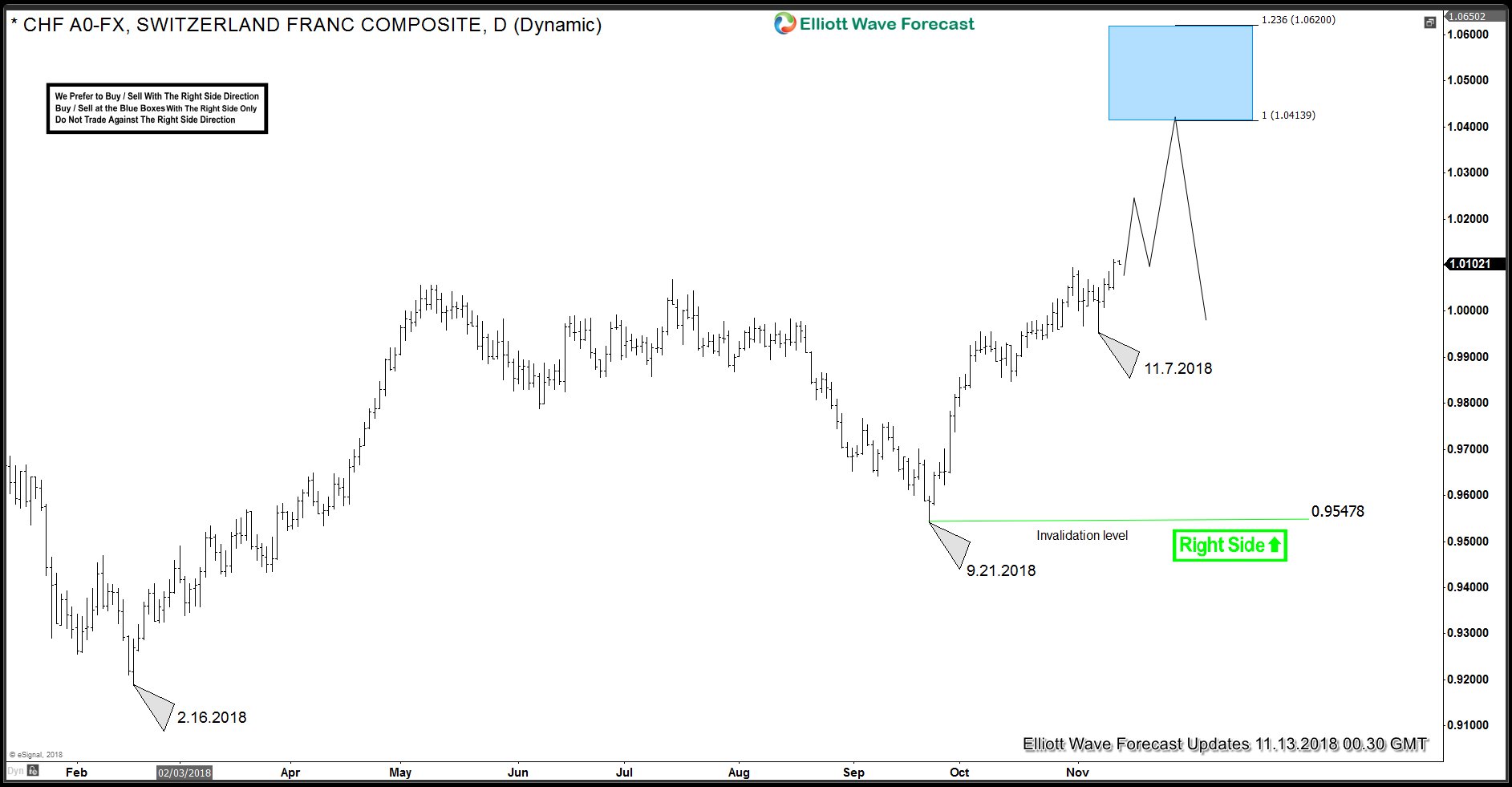

USDCHF Could Provide The Timing to Buy Pull back in Palladium

USDCHF also has incomplete sequences from 2.16.2018 and 9.21.2018 lows. As far as dips hold above 11.7.2018 low and more importantly above 9.21.2018 low, we expect the pair to see more upside toward 1.0413 – 1.0620. From there, US Dollar should get weak and USDCHF should turn lower in larger 3 swings at least. This area could provide the timing to buy the pull back in Palladium

Back