Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

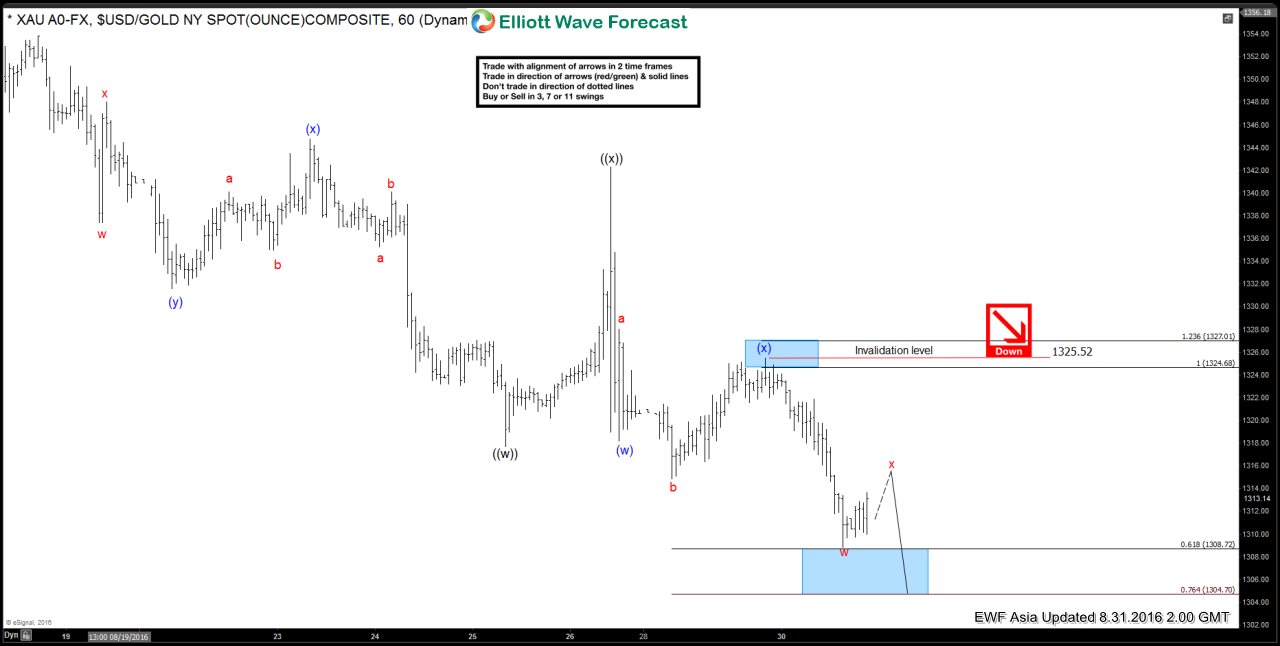

Gold $XAUUSD Short-term Elliott Wave Analysis 8.31.2016

Read MoreShort term Elliott wave count suggests that rally to 1342.26 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 1318.2 and wave (x) ended at 1325.52. While near term bounce in wave x stays below 1325.52, expect Gold to turn lower in wave (y) of ((y)) towards 1291 […]

-

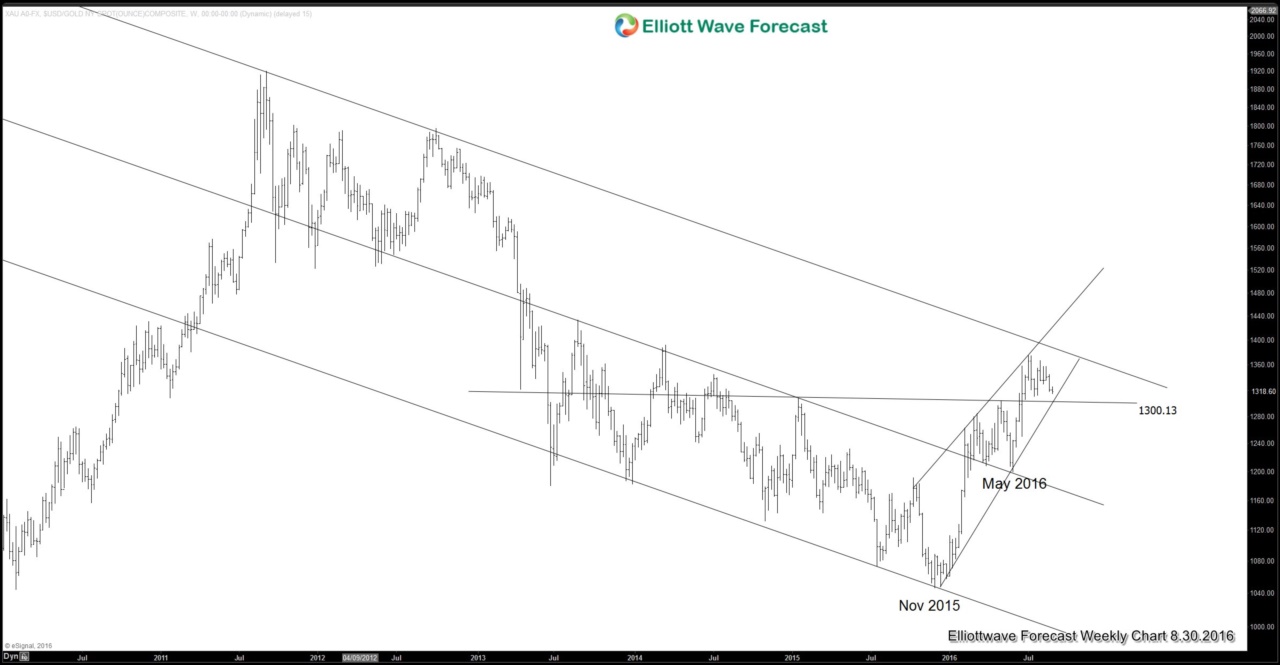

How far will USD rally? Gold may provide the answer

Read MoreFed Chairwoman Janet Yellen and other Fed members gave hawkish comments at Jackson Hole meeting last week, boosting the U.S. dollar against several currencies. Janet Yellen suggested that in light of the solid performance in the labor market, the case for an increase in federal funds rate has strengthened in recent months. However, she did not specifically say […]

-

$OIL Expanded flat correction

Read MoreExpanded Elliottwave Flat is a 3 wave corrective pattern which could often be seen in the market. Inner subdivisions are 3, 3, 5 and labelled as A, B, C. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Whereas , wave C is always a 5 waves structure, […]

-

Oil $CL_F Live Trading Room Setup from 8/10

Read MoreHere is a short clip from our Live Trading Room on August 10. Take a look at how we manage the trade and risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily for 1 hour starting at 7:00 AM EST , join us there for more insight into these proven […]

-

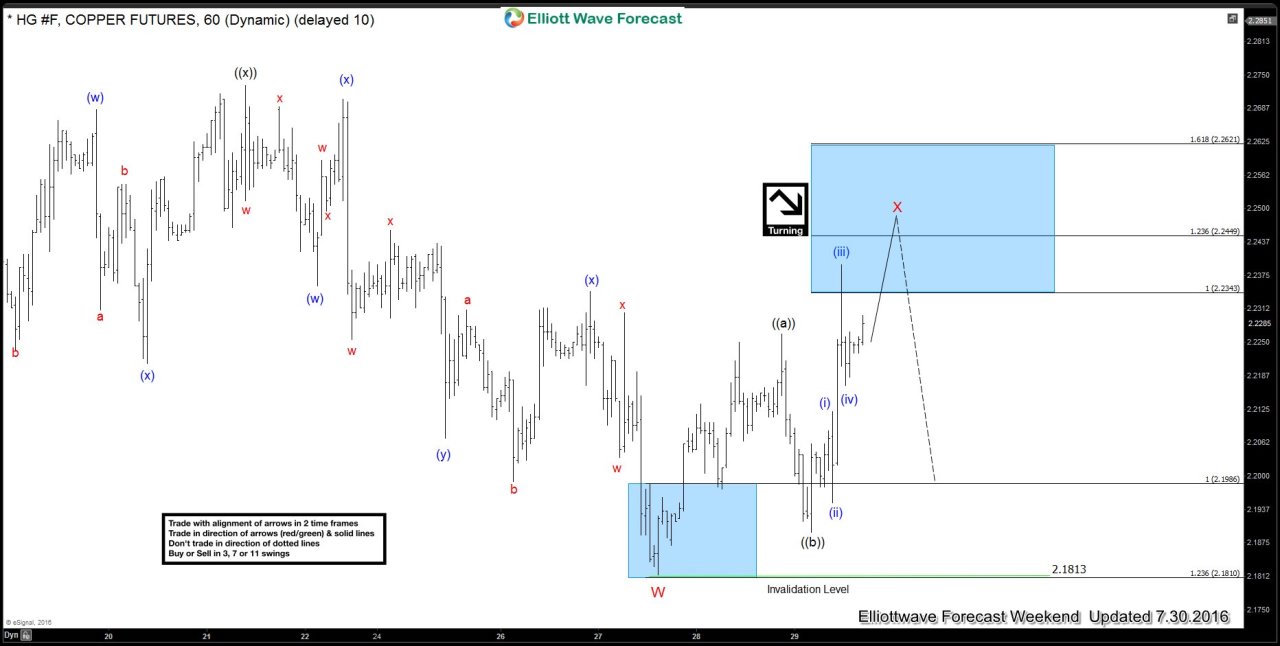

Elliottwaves forecasting the decline in Copper ( $HG #F)

Read MoreDuring the last days of July 2016 Copper Futures has been forming very interesting price patterns. Our Elliott Wave and Cycle analysis suggested the price has been correcting the decline from the 07/12 peak, looking for 2.233-2.260 area where sellers would be appear. Copper was proposed to reach the mentioned area and complete wave X […]

-

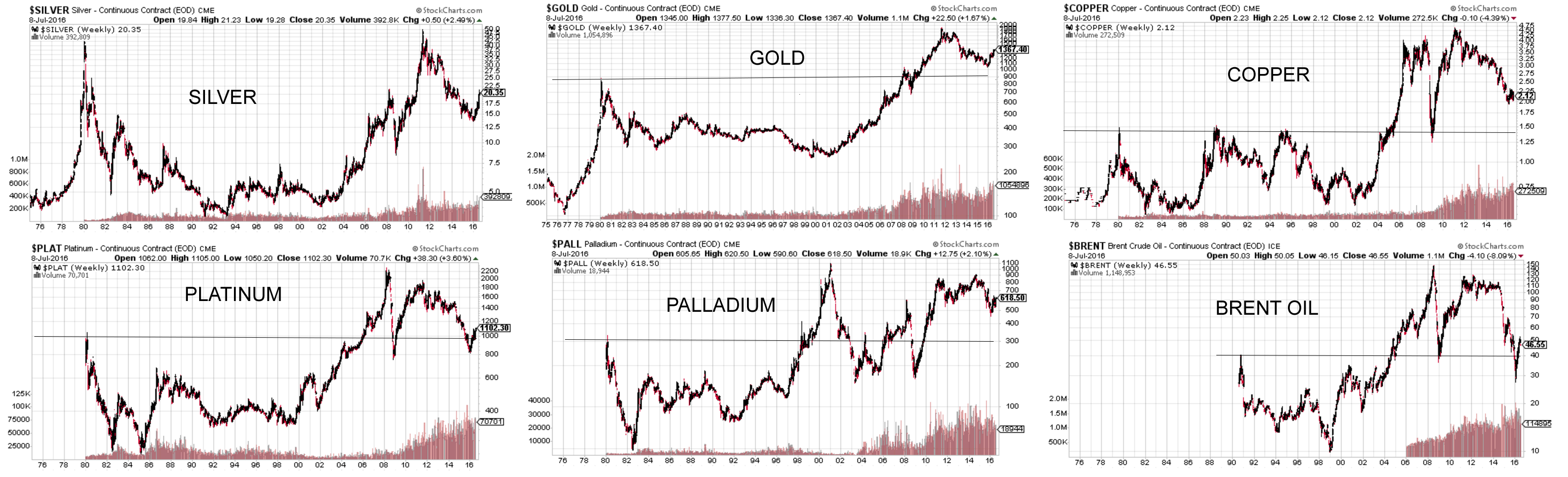

The Bullish Outlook for Silver: Is it the most undervalued metal?

Read MoreSilver’s Intrinsic Monetary Value Silver is a unique metal which belongs to the category of Precious Metal. Along with Gold, Silver has been used as money for thousands of years. It was the Roman Empire in 330 BCE who first used gold and silver in a widespread currency system. Under the Roman currency system, denarius is the name of a […]