Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

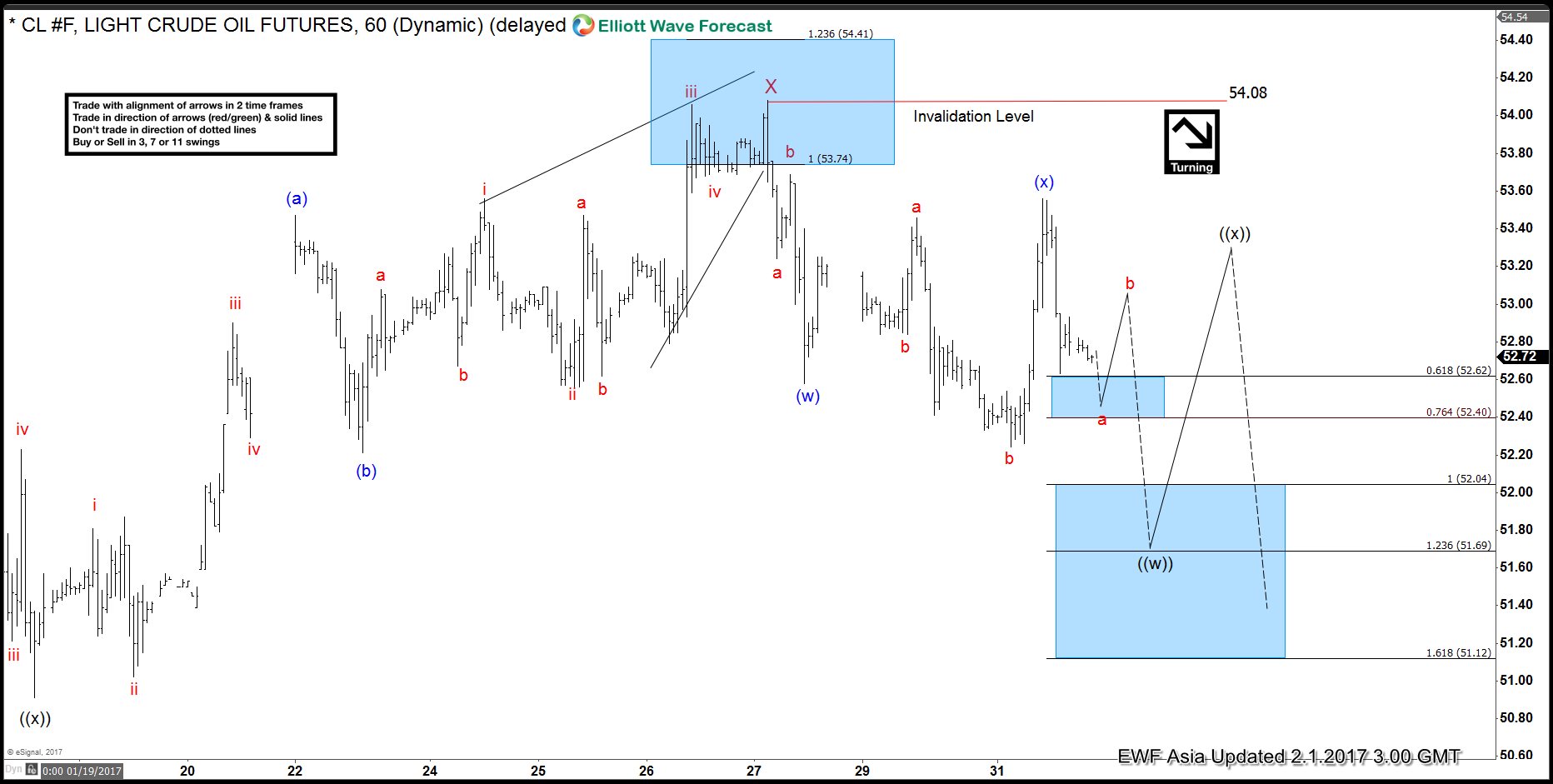

Crude Oil: Extension higher expected

Read MoreRevised view suggests that Crude Oil rally from 1/10 low (50.71) is unfolding as a diagonal where Minor wave 1 ended at 54.08 and Minor wave 2 is proposed complete at 52.22. Crude Oil has broken above 54.08, and thus showing a 5 swing sequence from 1/10 low and favoring more upside. Near term, while pullbacks […]

-

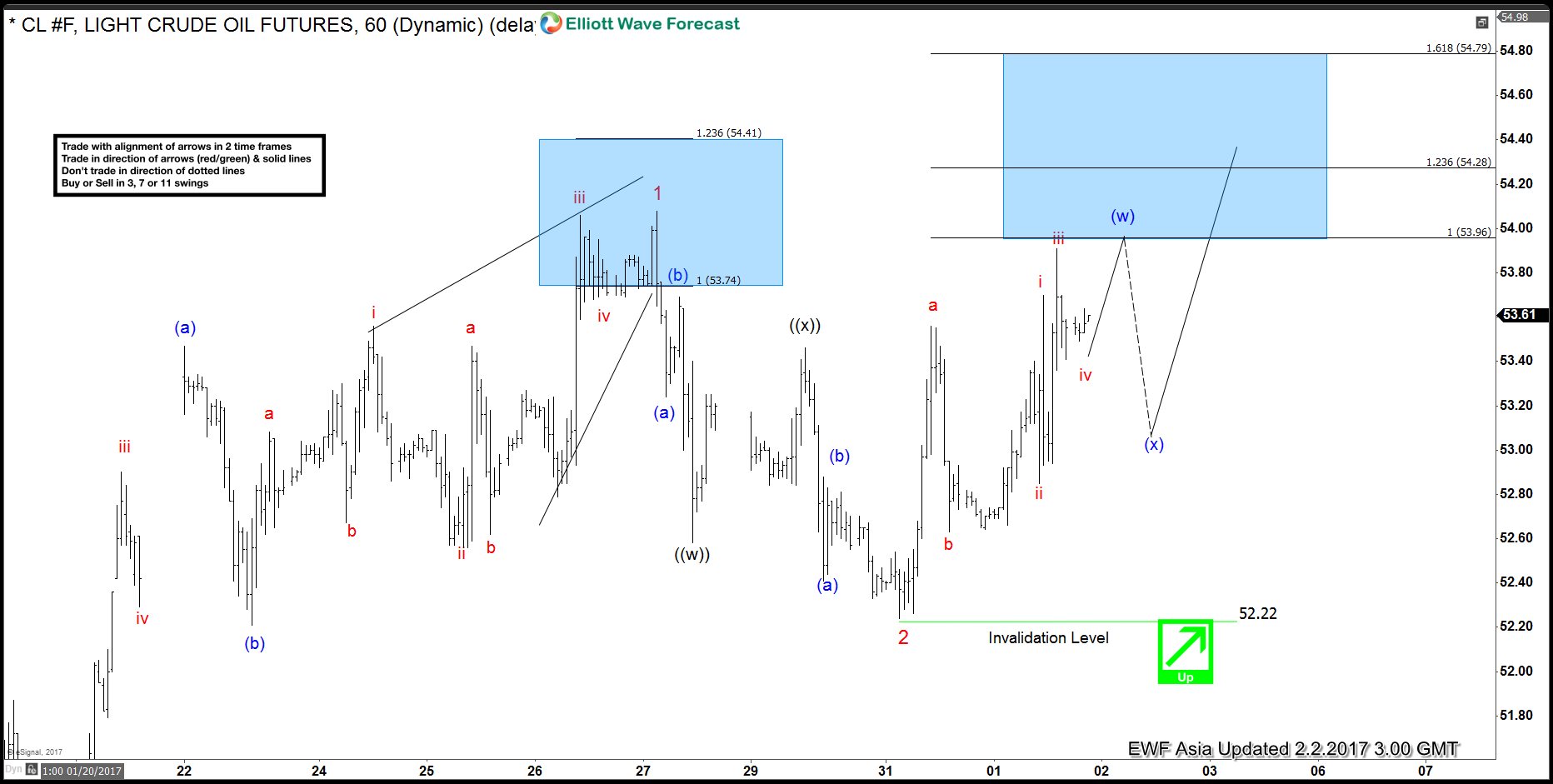

Crude Oil: The next leg higher has started

Read MoreRevised view suggests that Crude Oil rally from 1/10 low (50.71) is unfolding as a diagonal where Minor wave 1 ended at 54.08 and Minor wave 2 is proposed complete at 52.22. A break above 54.08 would add more conviction to the view that the next leg higher has started, until then a double correction in Minor […]

-

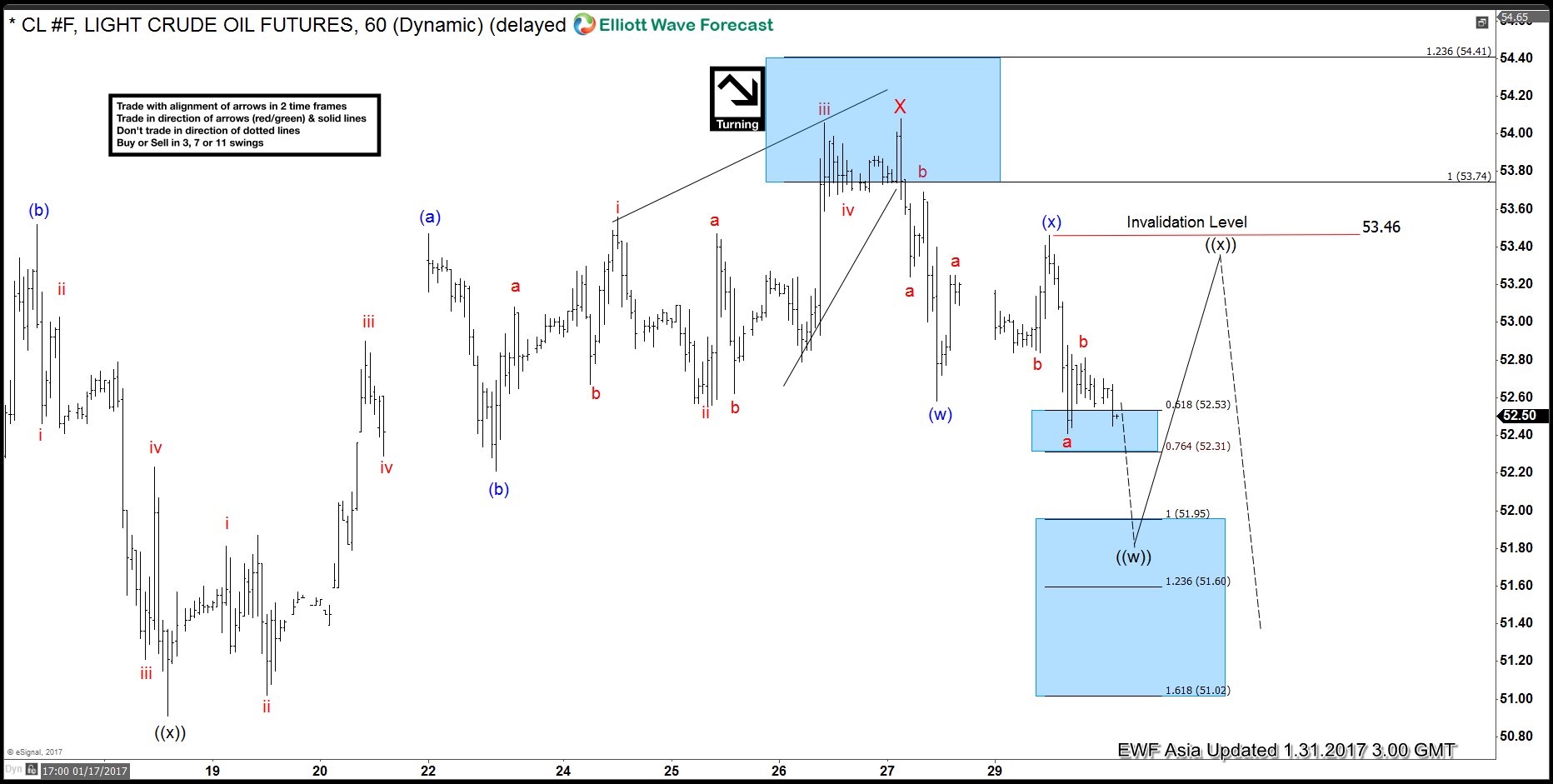

Oil CL_F: Correction Still in Progress – Elliott Wave Forecast

Read MoreRally to 55.24 completed Intermediate wave (W) and ended the cycle from 8/3/2016 low. From 55.24 high, oil turned lower to correct the cycle from 8/3 low as a double three structure where Minor wave W ended at 50.71 and Minor wave X ended at 54.08. Decline from 54.08 high is unfolding as a double […]

-

Oil CL_F: Buying Opportunity should come soon

Read MoreRally to 55.24 completed Intermediate wave (W) and ended the cycle from 8/3/2016 low. From 55.24 high, oil turned lower to correct the cycle from 8/3 low as a double three structure where Minor wave W ended at 50.71 and Minor wave X ended at 54.08. Decline from 54.08 high is showing a 5 swing […]

-

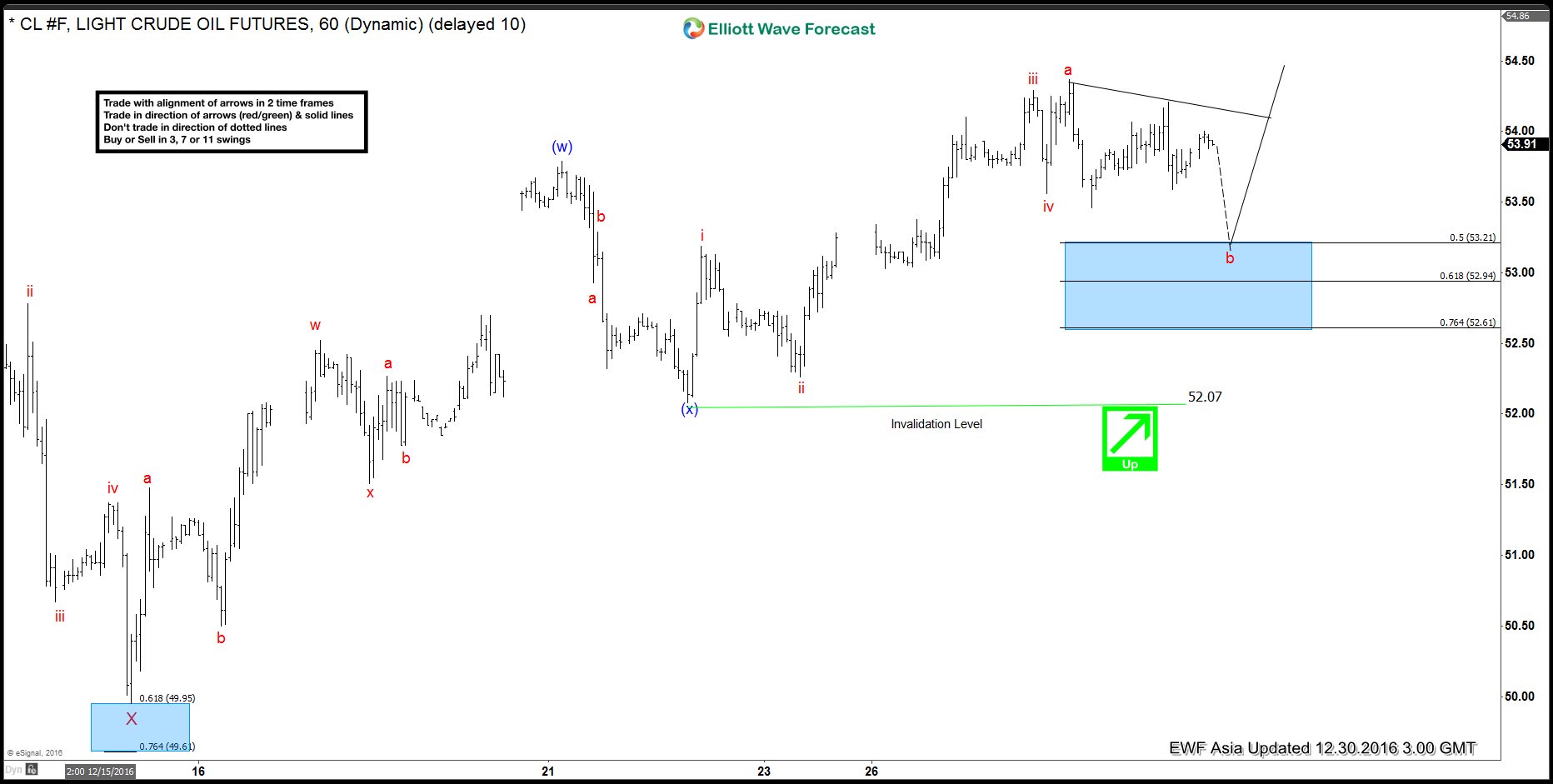

CL_F Elliott Wave Forecast 12.30.2016

Read MoreCL_F (Oil) is showing an incomplete 5 swing sequence from 2/8 low ($26.02), favoring for more upside. The latest rally up from 11/14 low ($42.2) is proposed to be unfolding as a triple three where wave W ended at $49.2, wave X ended at $44.82, wave Y ended at $54.51, and second wave X ended […]

-

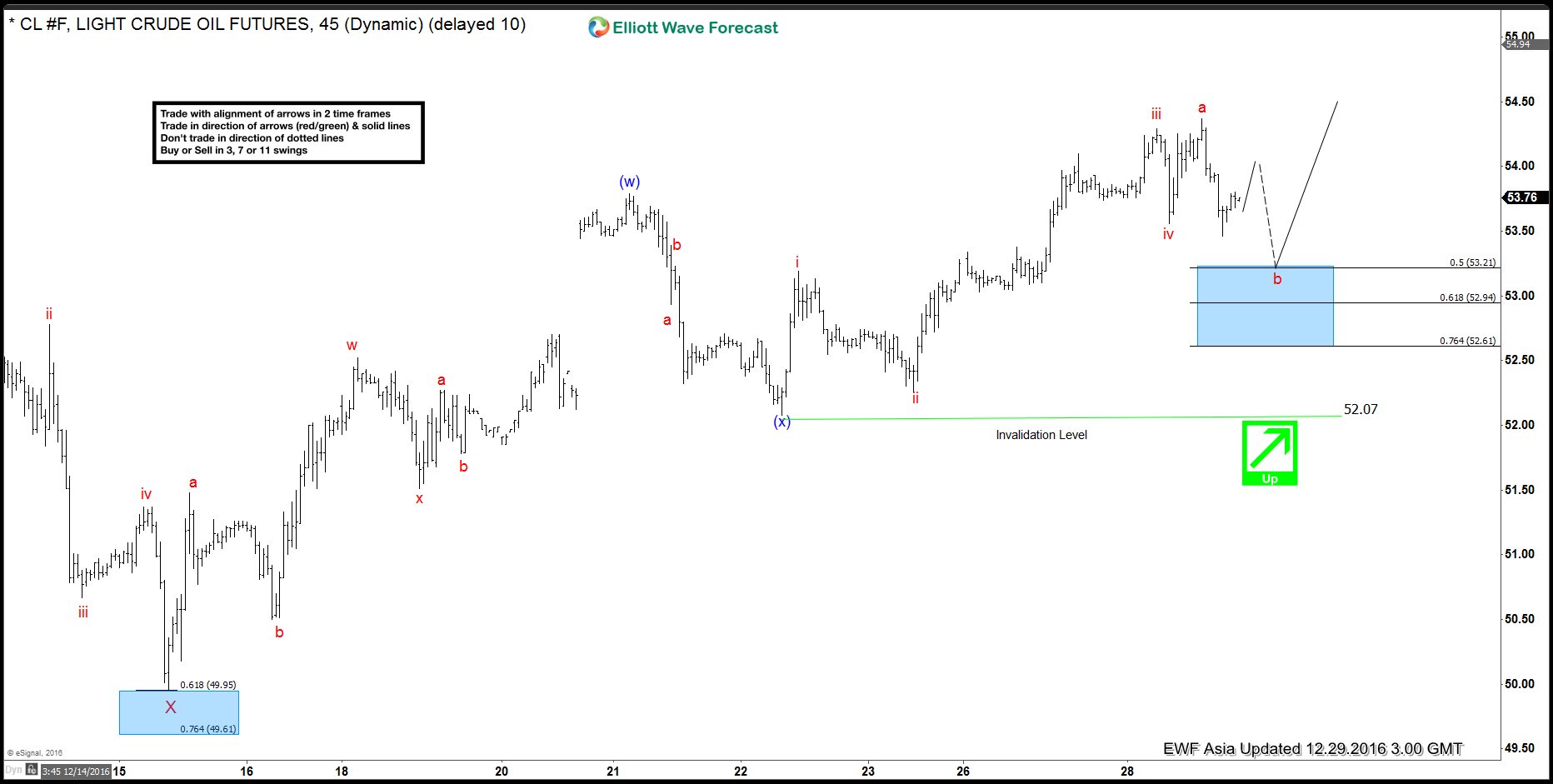

CL_F Elliott Wave Forecast 12.29.2016

Read MoreCL_F (Oil) is showing an incomplete 5 swing sequence from 2/8 low ($26.02), favoring for more upside. The latest rally up from 11/14 low ($42.2) is proposed to be unfolding as a triple three where wave W ended at $49.2, wave X ended at $44.82, wave Y ended at $54.51, and second wave X ended […]