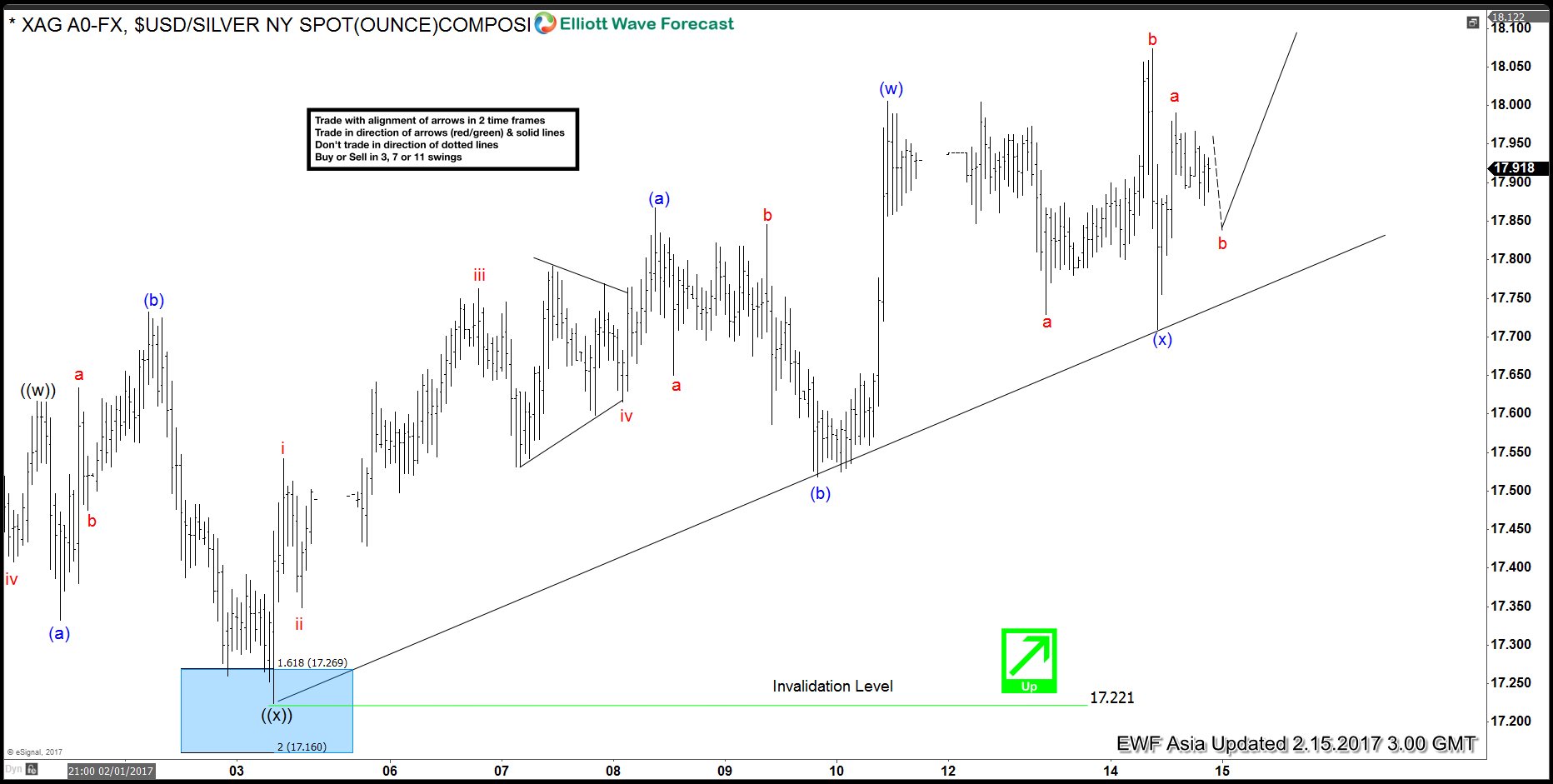

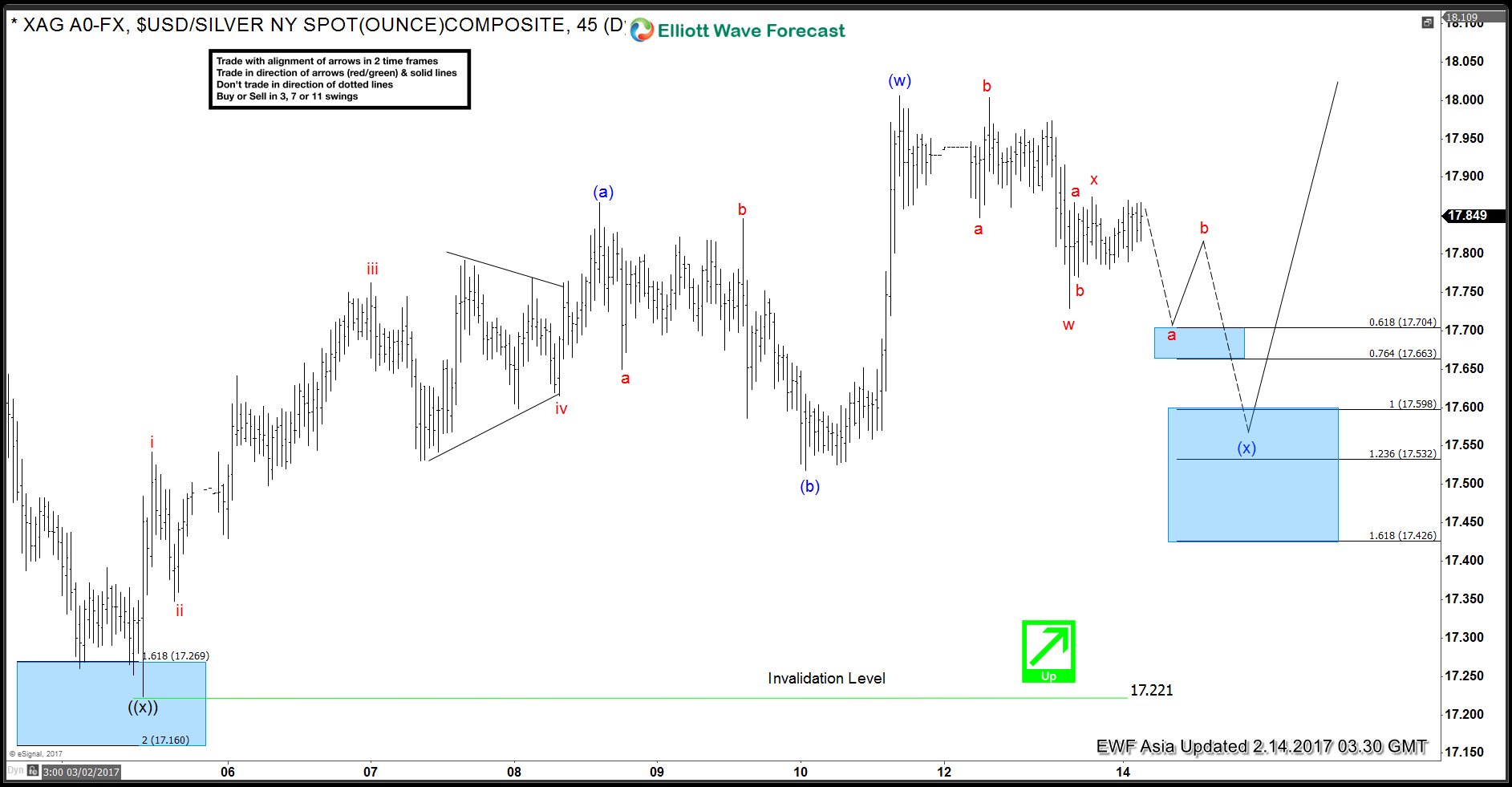

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

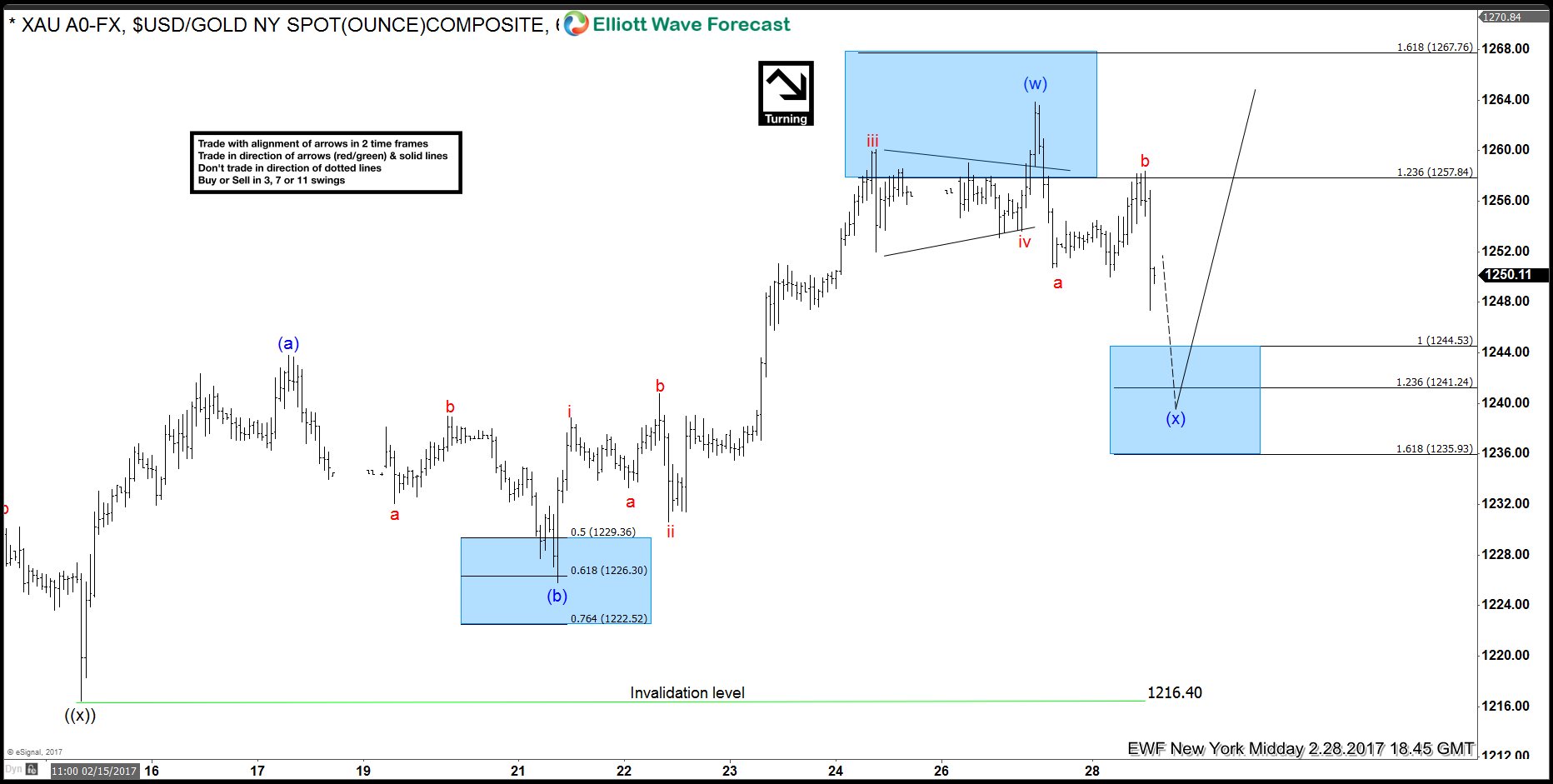

Gold Elliott Wave Intraday analysis

Read MoreHello fellow traders. In this blog we’re going to take a look at Gold elliott wave chart and explain the structure in a few sentences. Before we explain current price action, we’re going to take a quick look at the 02/24 chart. As you might remember, in our last blog “ Gold Elliott wave Zigzag […]

-

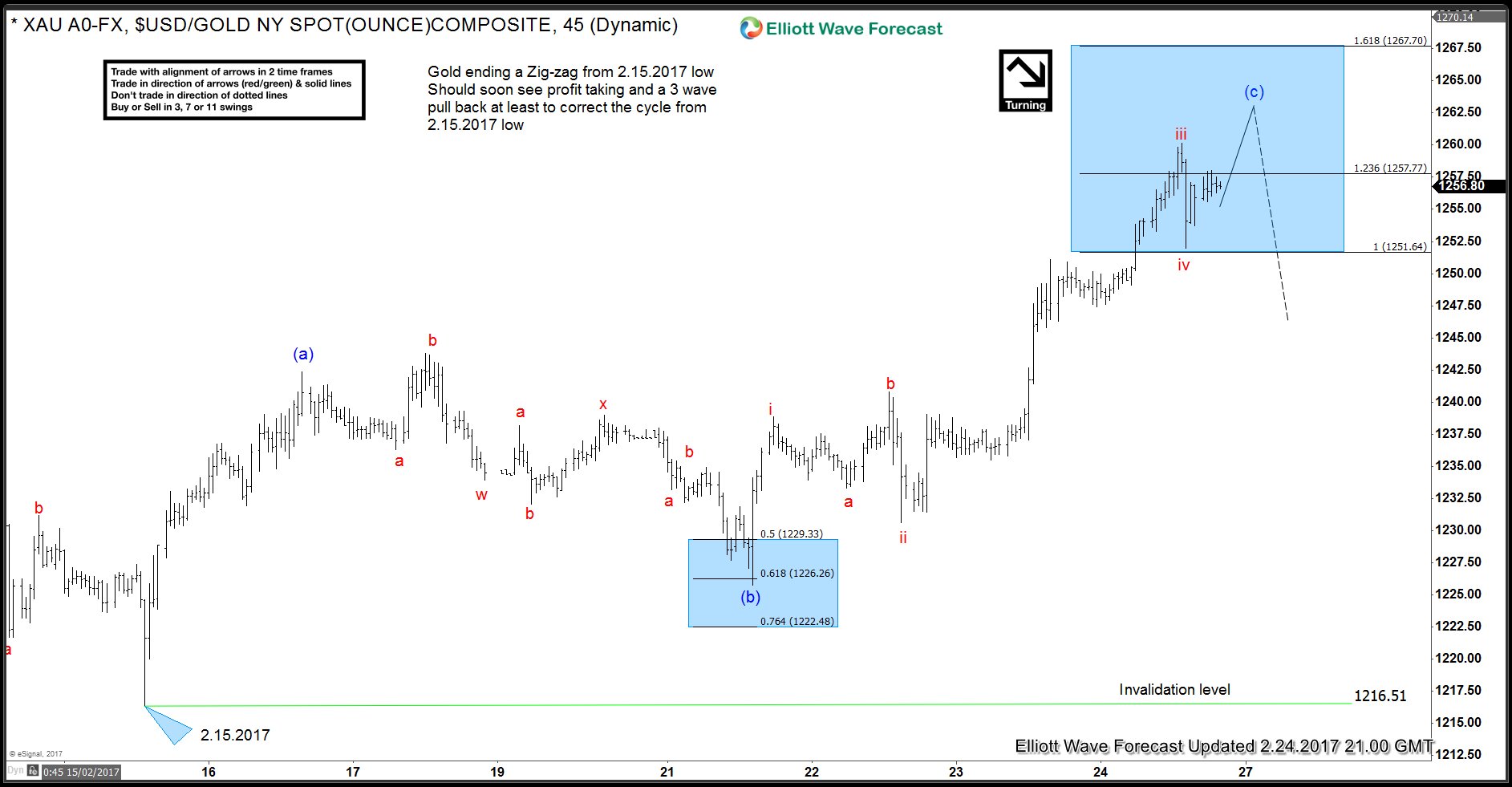

Gold Elliott wave Zigzag pattern

Read MoreIn this Technical blog, we are going to take a quick look at the Gold 1 hour chart from Feb 21,2017. In which the bounce from 2/15/2017 low (1216) appeared to be in 5 waves sequence & the bounce was impulsive rather then corrective sequence. Thus suggesting the cycle from 1216 low could be following the […]

-

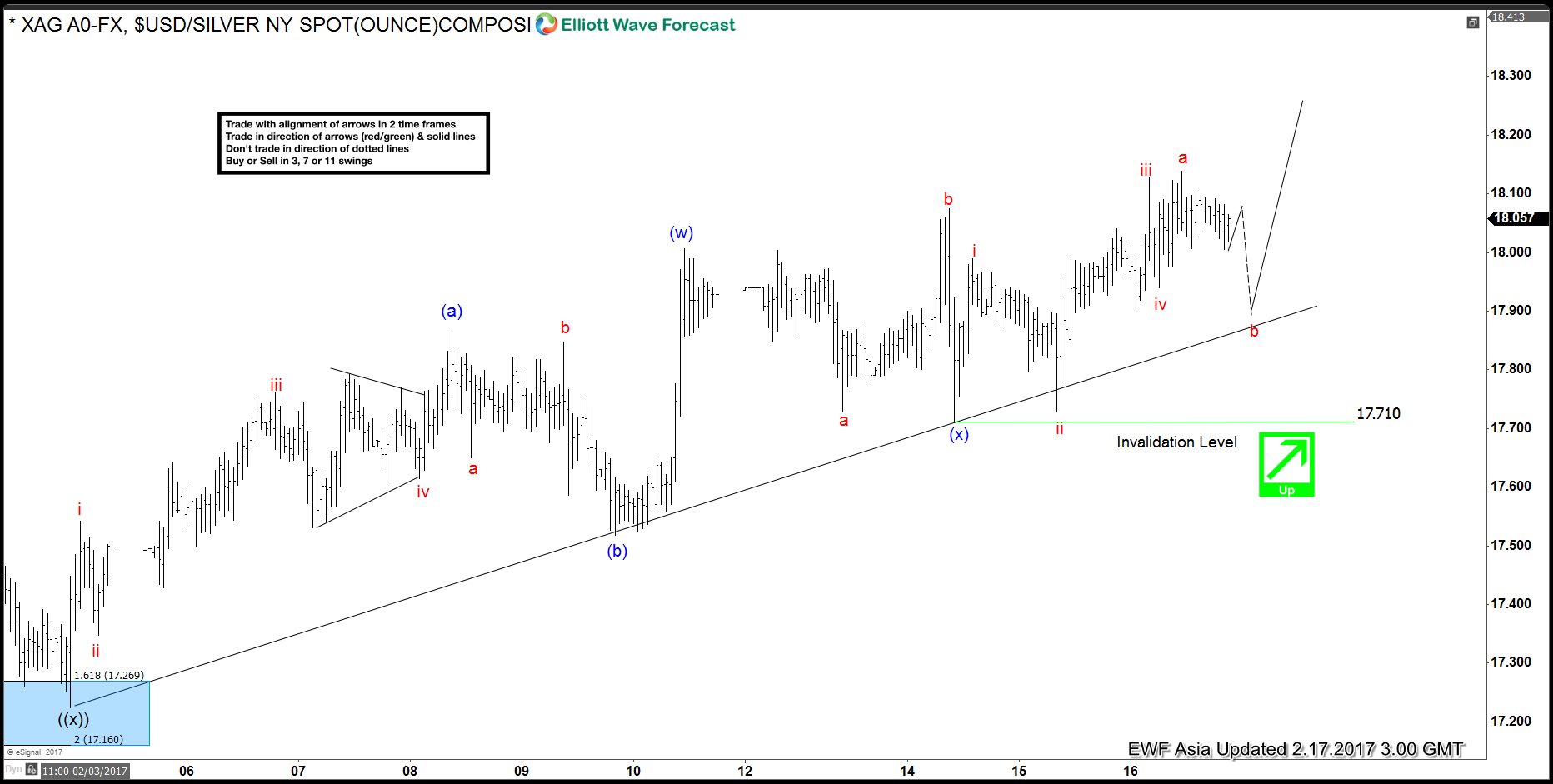

Silver Elliott Wave view: Extending higher

Read MorePreferred Elliott wave view in Silver suggest that the metal is showing a 7 swing Elliott wave bullish sequence (WXY) from 12/20 lows. Cycle from 1/27 low is also incomplete & favors more upside extension towards 18.31-18.71 area to reach the extreme from 12/20 lows. Near term, the pullback in Minute wave ((x)) ended in 3 […]

-

Silver Elliott wave view: Looking higher

Read MorePreferred Elliott wave view in Silver suggest that the metal is showing a 7 swing Elliott wave bullish sequence (WXY) from 12/20 lows. Cycle from 1/27 low is also incomplete & favors more upside extension towards 18.31-18.71 area to reach the extreme from 12/20 lows. Near term, the pullback in Minute wave ((x)) ended in 3 […]

-

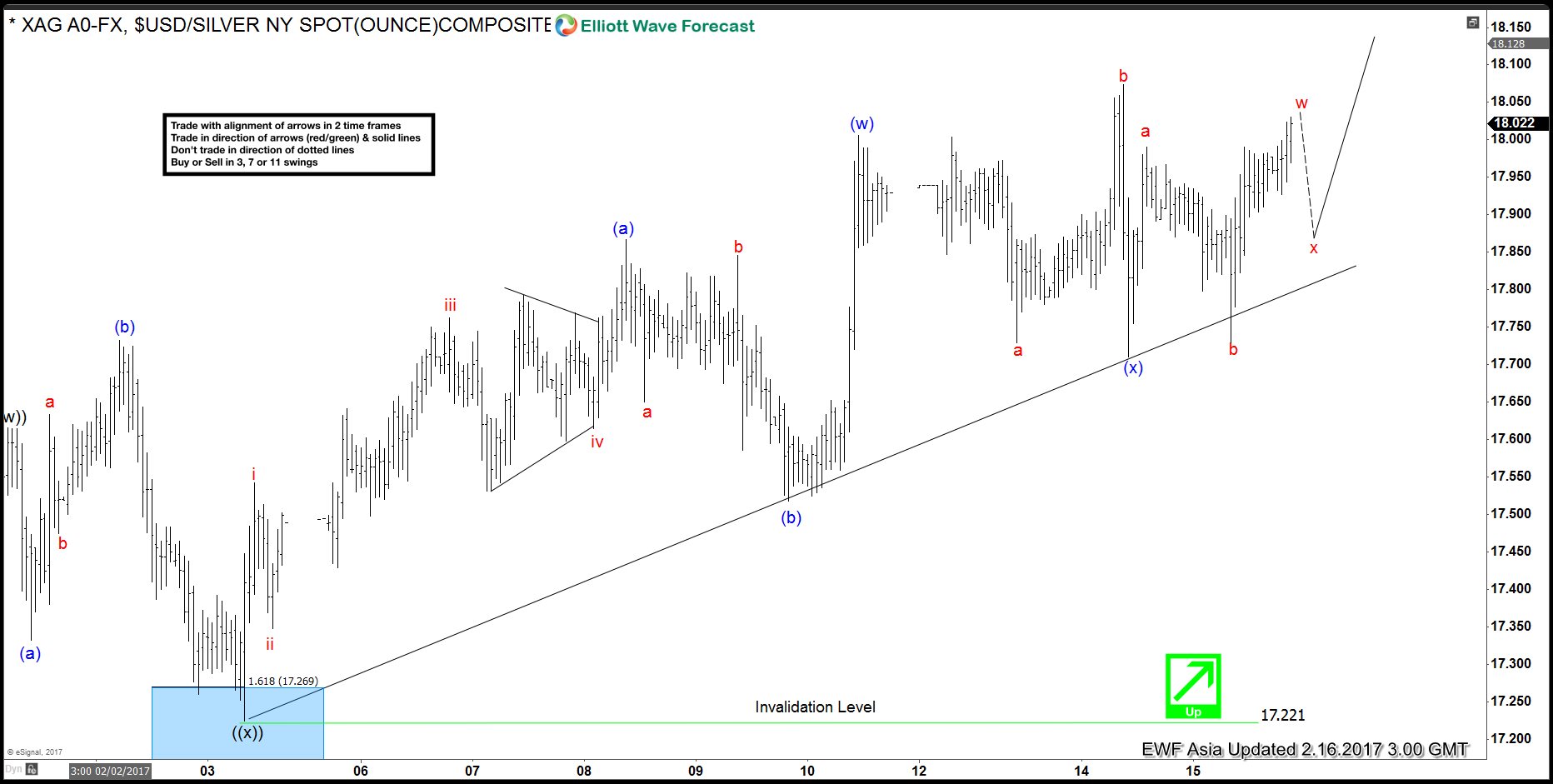

Silver Elliott wave view: Resuming higher

Read MorePreferred Elliott wave view in Silver suggest that the metal is showing the 7 swings bullish sequence from 12/20 lows, Also the cycle from 1/27 low is incomplete & favoring more upside extension towards 18.31-18.71 area to reach the extreme from 12/20 lows. Silver short term the pullback in minute wave ((x)) ended in 3 swings […]

-

Silver Elliott wave view: calling higher

Read MorePreferred Elliott wave view in Silver suggest that the metal is showing the 7 swings bullish sequence from 12/20 lows, Also the cycle from 1/27 low is incomplete & favoring more upside extension towards 18.31-18.71 area to reach the extreme from 12/20 lows. Silver short term the pullback in minute wave ((x)) ended in 3 swings […]