Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

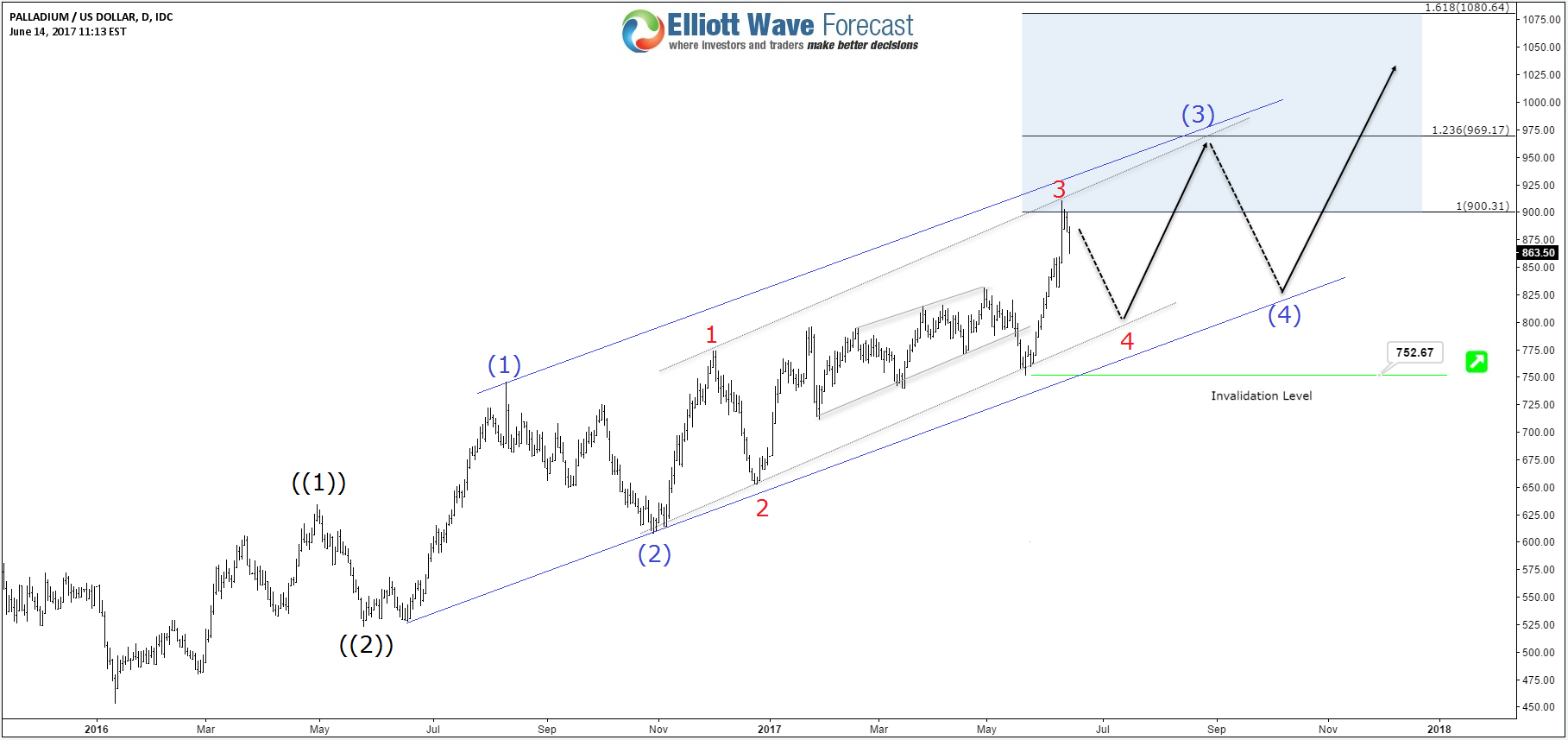

Palladium XPDUSD Elliott Wave Impulse

Read MoreIn our previous article, we talked about the Bullish Palladium XPDUSD which is supporting the commodity market for another leg to the upside. To be able to join for the move higher, we need to identify the potential scenarios and look for the next inflection areas using our Elliott Wave Theory charts. XPDUSD Elliott Wave View The move from January […]

-

Bullish Palladium Supporting Commodities

Read MoreThe world is hooked on ‘Palladium’ because of its uses as an industrial metal and catalyst, the consumers are mainly automobile producers as it’s widely used in gasoline-based engine cars to curb harmful emissions from vehicles. Palladium surged +34% this year on expectations that supply will lag demand for a sixth straight year, beating the rest of […]

-

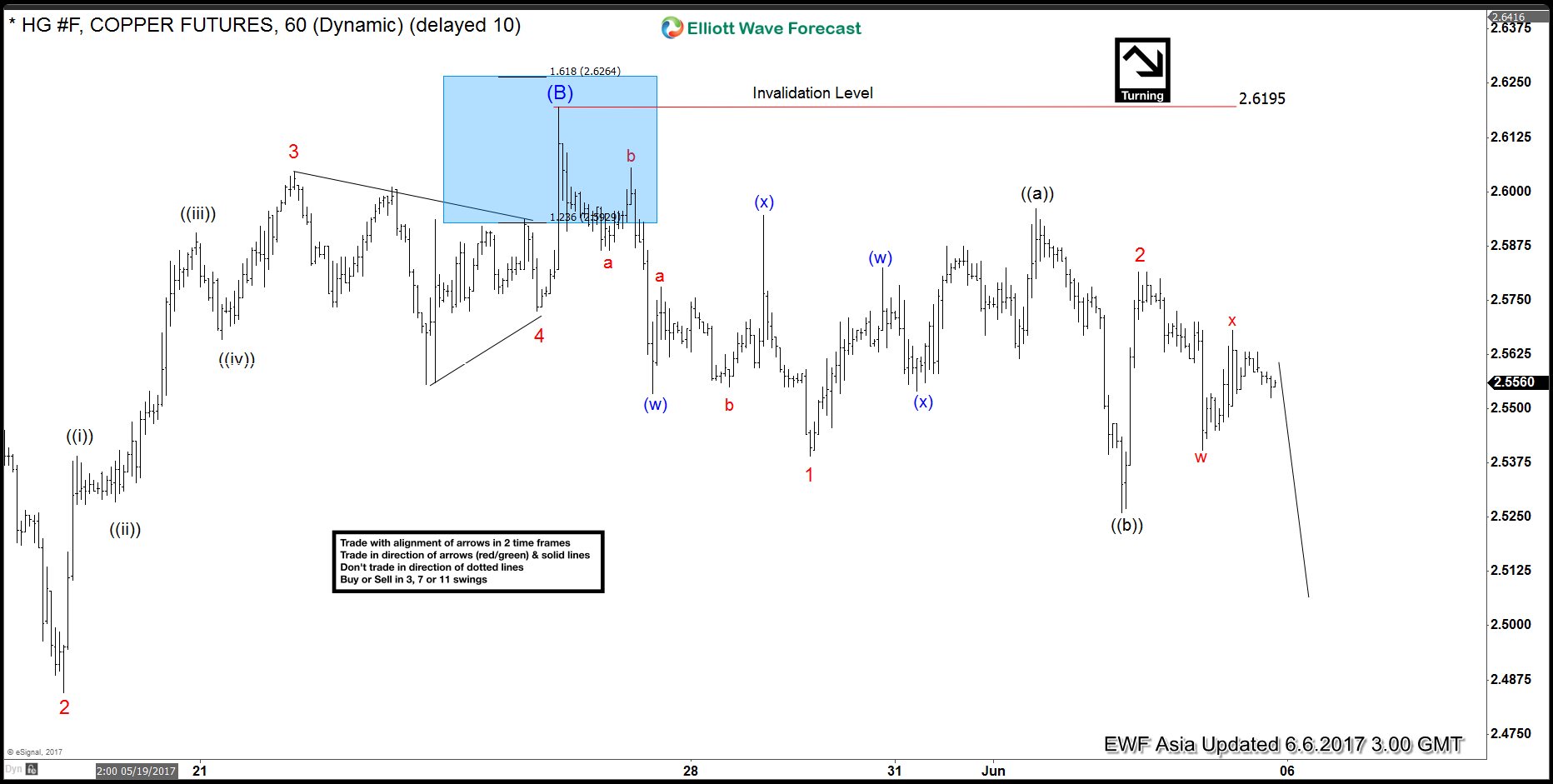

HG#F (Copper) Elliott Wave View: Extension lower

Read MoreHG#F (Copper) is showing 5 swings incomplete sequence from 2/13/2017 high, preferred Elliott wave view suggests rally to 2.619 completed 6th swing as a FLAT in wave (B) and metal has now resumed the decline in 7th swing. Decline from 2.619 is so far corrective so wave (C) is expected to take the form of […]

-

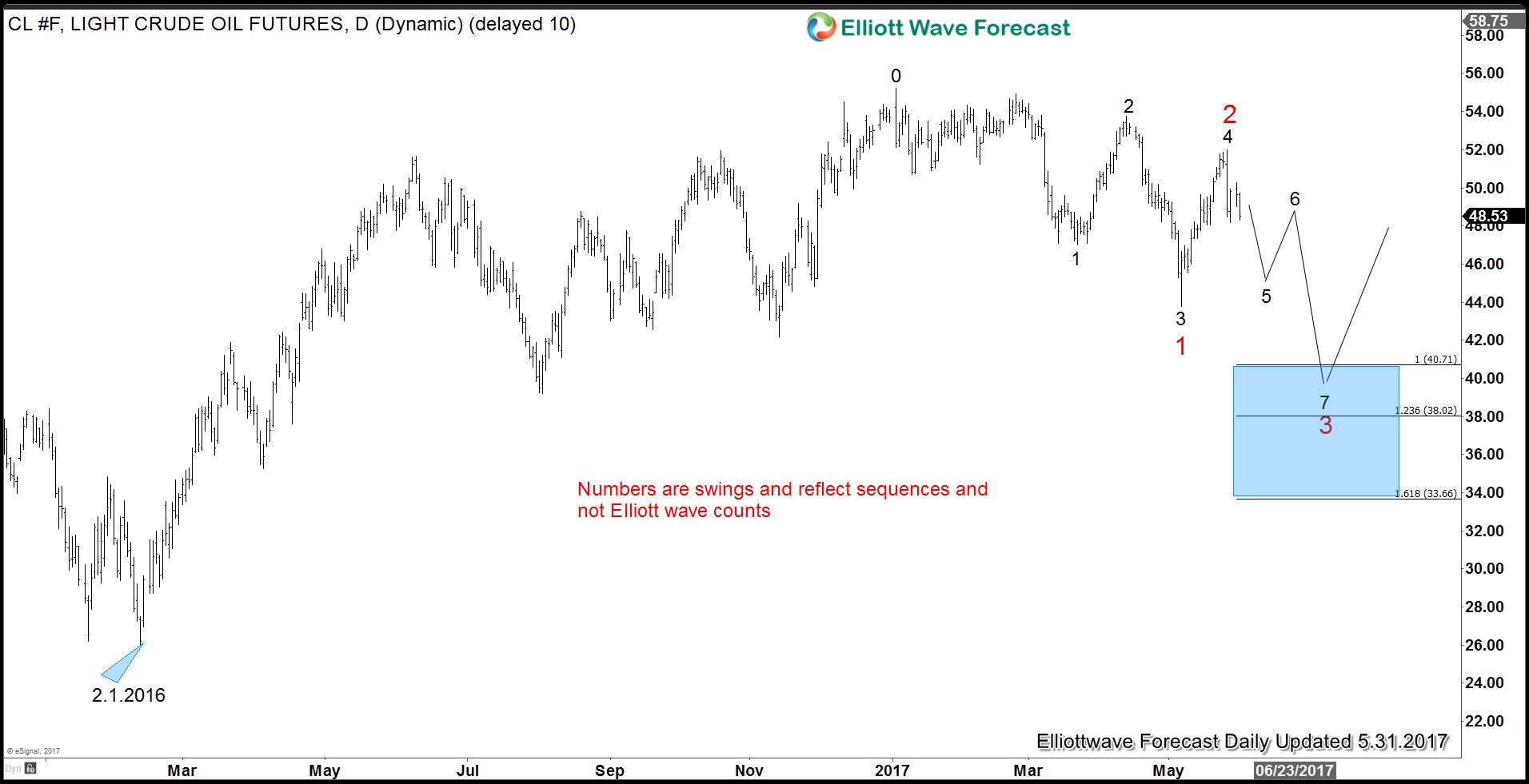

OPEC Meeting and Impact on Crude Oil

Read MoreOPEC ended its highly anticipated meeting on Vienna last Thursday to discuss about extending the production cut in Crude Oil. They have decided to extend the current agreement to cut production output by 1.8 million barrels per day by 9 more months to stabilize oil price. Oil prices plunged by more than 5 percent after the decision. […]

-

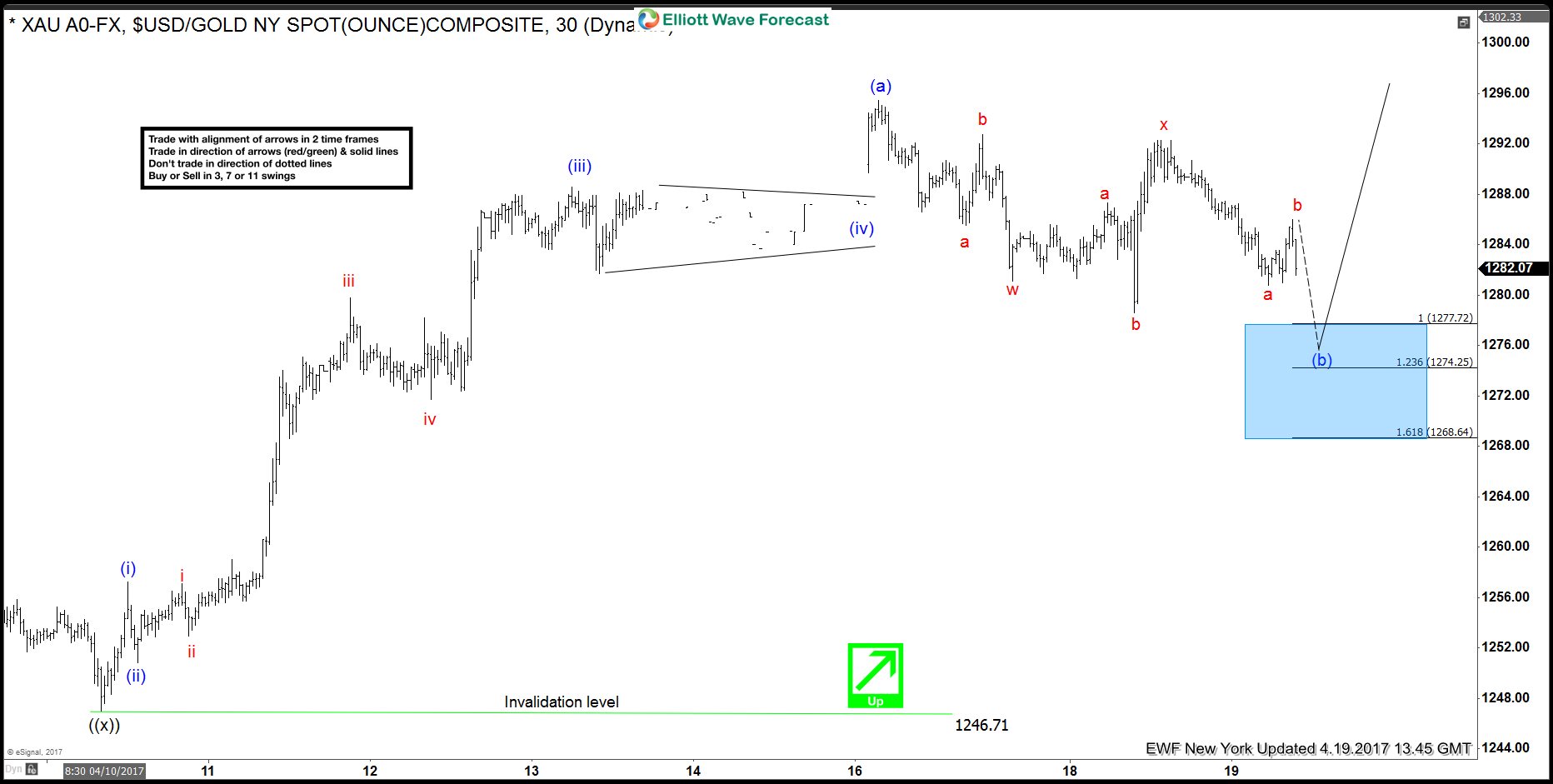

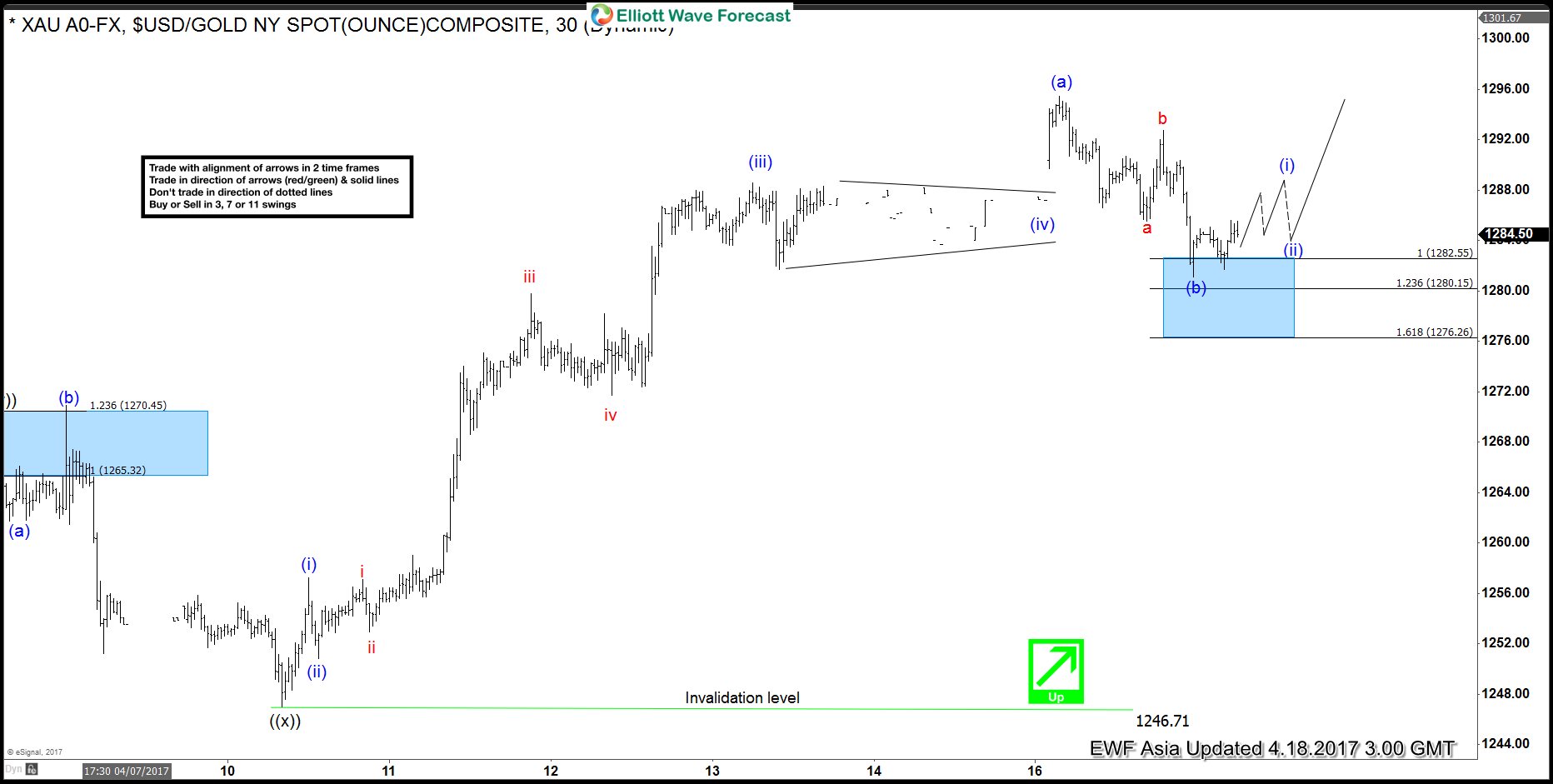

Gold Elliott Wave View: Pull back in progress

Read MoreShort term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) ended at 1295.6 peak. […]

-

Gold Elliott Wave View: Pullback completed

Read MoreShort term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) is unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) ended at yesterday’s […]