Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

$PA_F Palladium Weekly Bullish Swing Sequence

Read MoreThe $PA_F Palladium Weekly Bullish Swing Sequence Palladium is a bullish commodity. Firstly I’ll mention the attached Palladium chart below is only a swing sequence labeled chart. This is from the monthly time frame. The data goes back to the 1980’s. It should not be relevant of as what the structure of the wave and cycle up […]

-

Gold Elliott wave view: Double three

Read MoreShort term Gold Elliott Wave view suggests that the rally from 10/06 low (1260.52) to 10/16 peak (1306.35) ended intermediate wave (X) then the decline from there is unfolding as a a double three Elliott wave structure. As the structure of the 10/16 peak looks to be overlapping, hence suggesting its corrective structure, either W, X, Y or W, […]

-

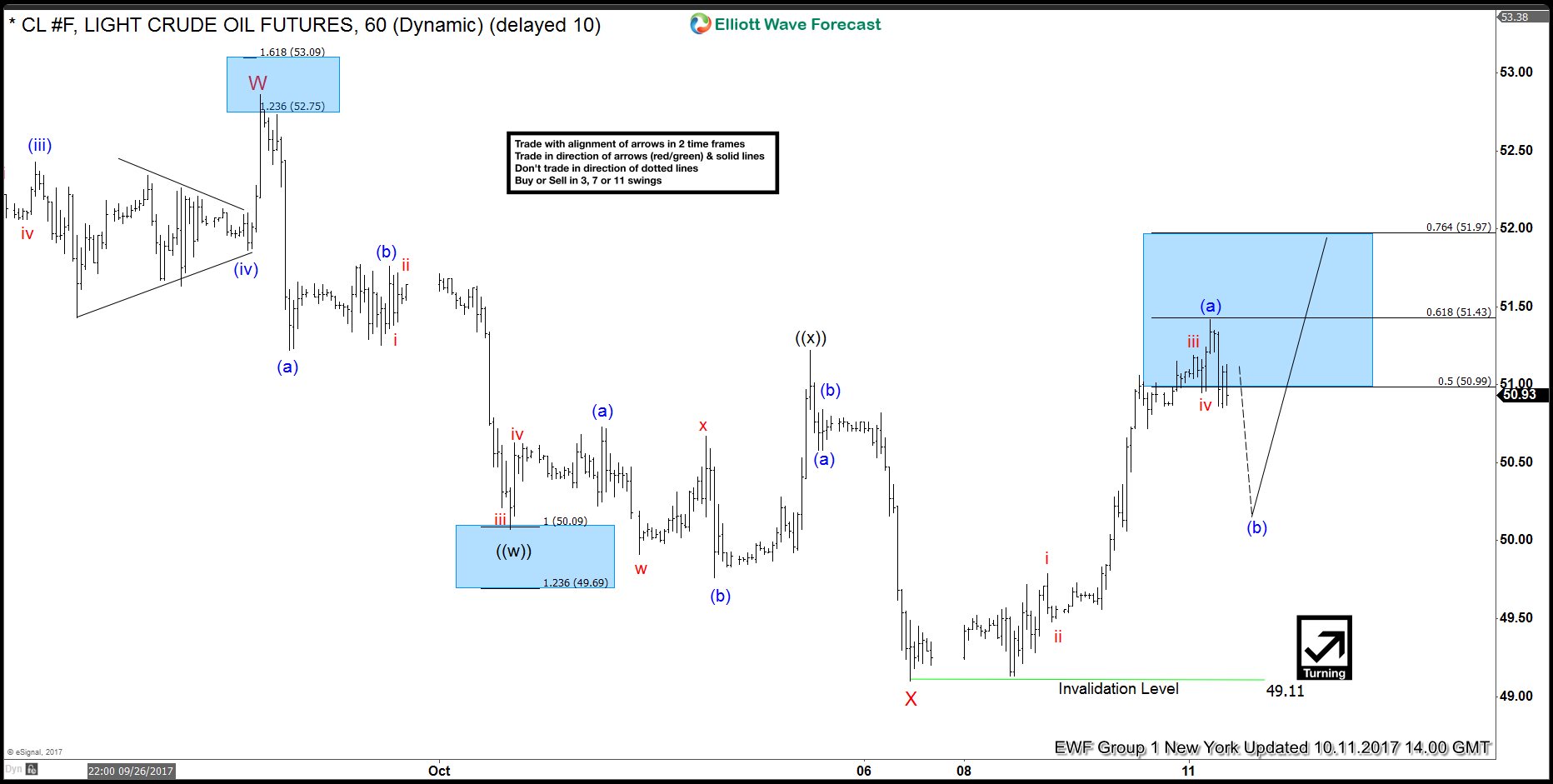

OIL (CL #F) forecasting the path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of OIL ( CL #F ) published in members area of www.elliottwave-forecast.com. In further text we’re going to get through short term price structures and explain the Elliott Wave view. OIL Elliott Wave 1 Hour New […]

-

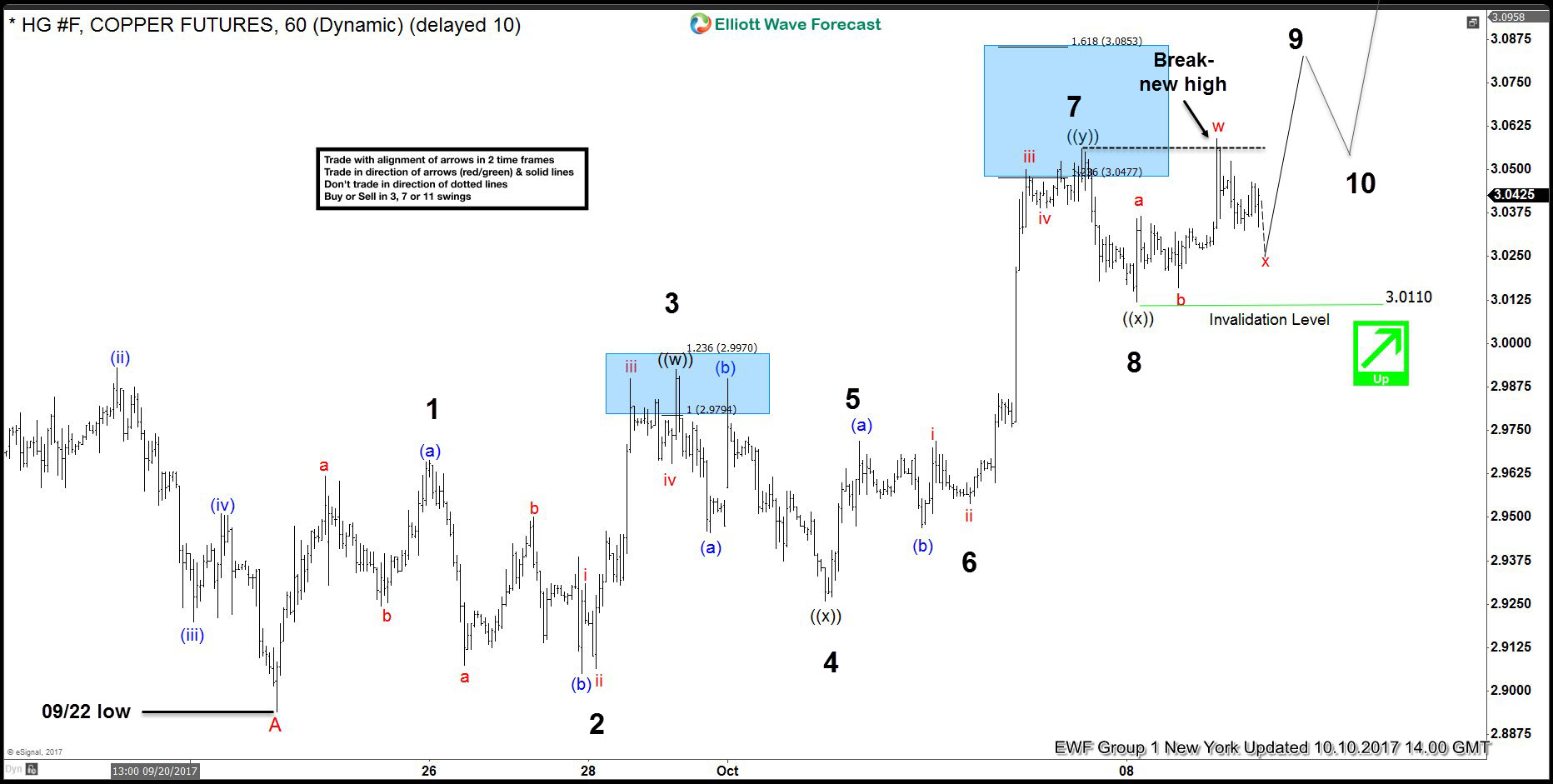

Copper swings sequences calling the rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Copper published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the short term Elliott Wave view. Copper Elliott Wave 1 Hour Chart 10.10.2017 As our members know, Copper […]

-

DJ Commodity Index is supporting Higher GOLD

Read MoreThe Dow Jones Commodity Index is a broad measure of the commodity futures market that emphasizes diversification and liquidity through a equal-weighted approach. It doesn’t allow any sector to make up more than 33% of its portfolio or any single commodity to make up more than 15%. Gold is the top weighted commodity of the […]

-

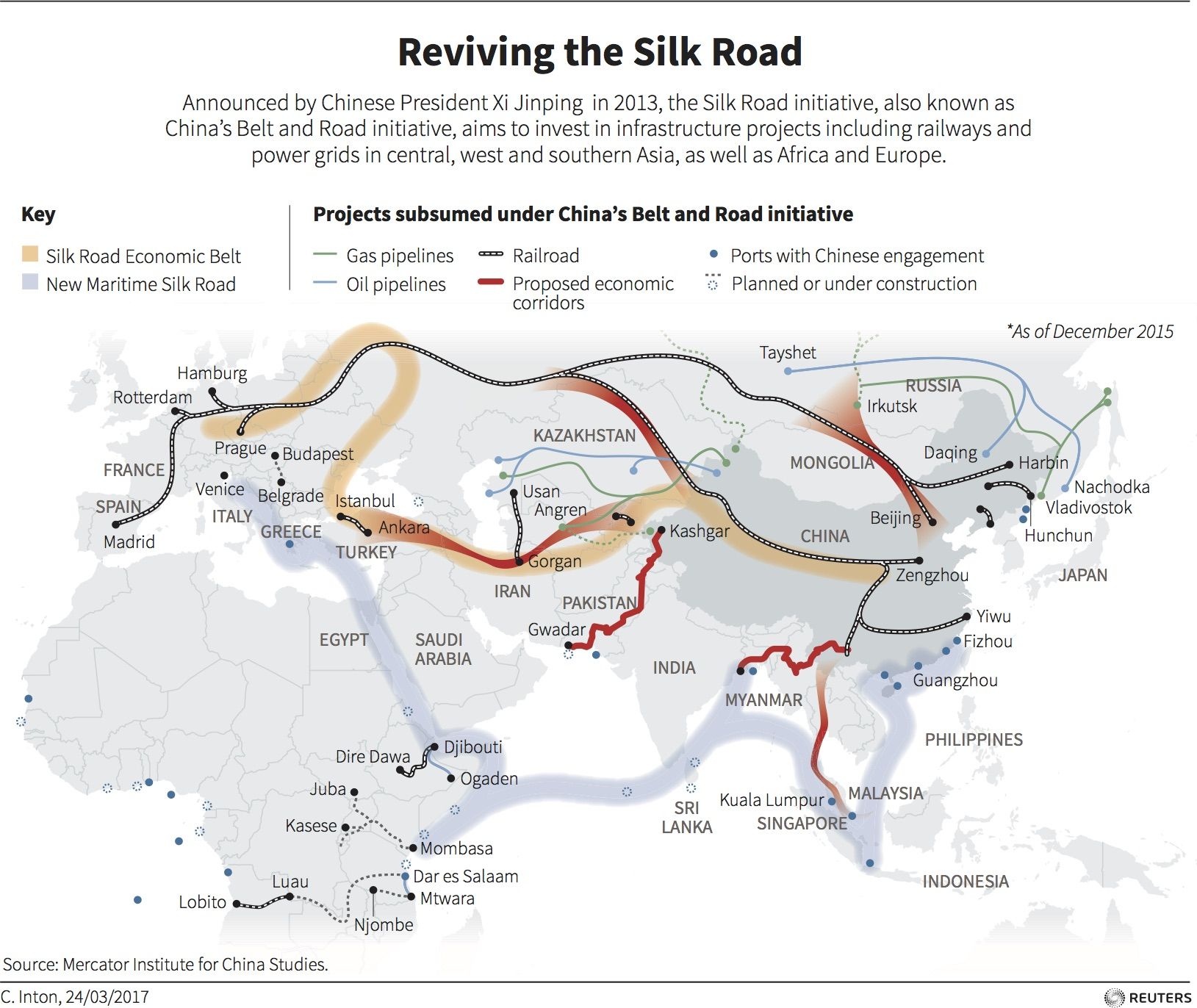

China’s One Belt One Road (OBOR) is Bullish Commodities

Read MoreWhat is OBOR (One Belt One Road) One Belt One Road (OBOR) is an initiative originally coming from China’s president Xi Jinping in 2013. The plan is the single biggest initiative since the opening up of China to foreign investment. President Xi called it a “project of the century”. In America, globalization has lost its […]