Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

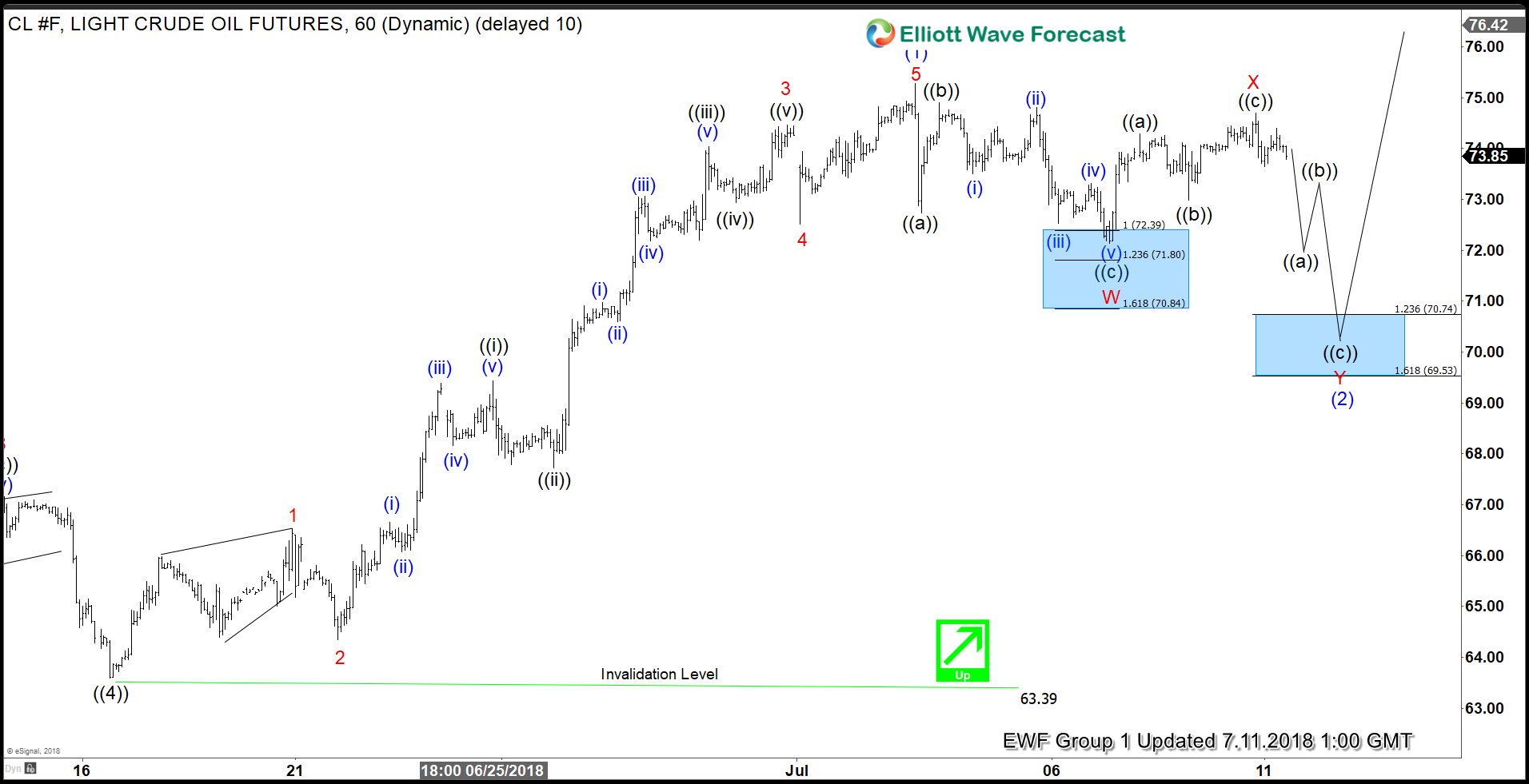

OIL Elliott Wave View: Providing Buying Opportunity Soon

Read MoreOIL short-term Elliott Wave view suggests that the pullback to $63.39 on 6/18/2018 low ended primary wave ((4)). Up from there, the instrument rallied strongly to the upside and went on to make new high for the year. A rally from there took place in the form of an Impulse Elliott wave structure with extension with lesser degree […]

-

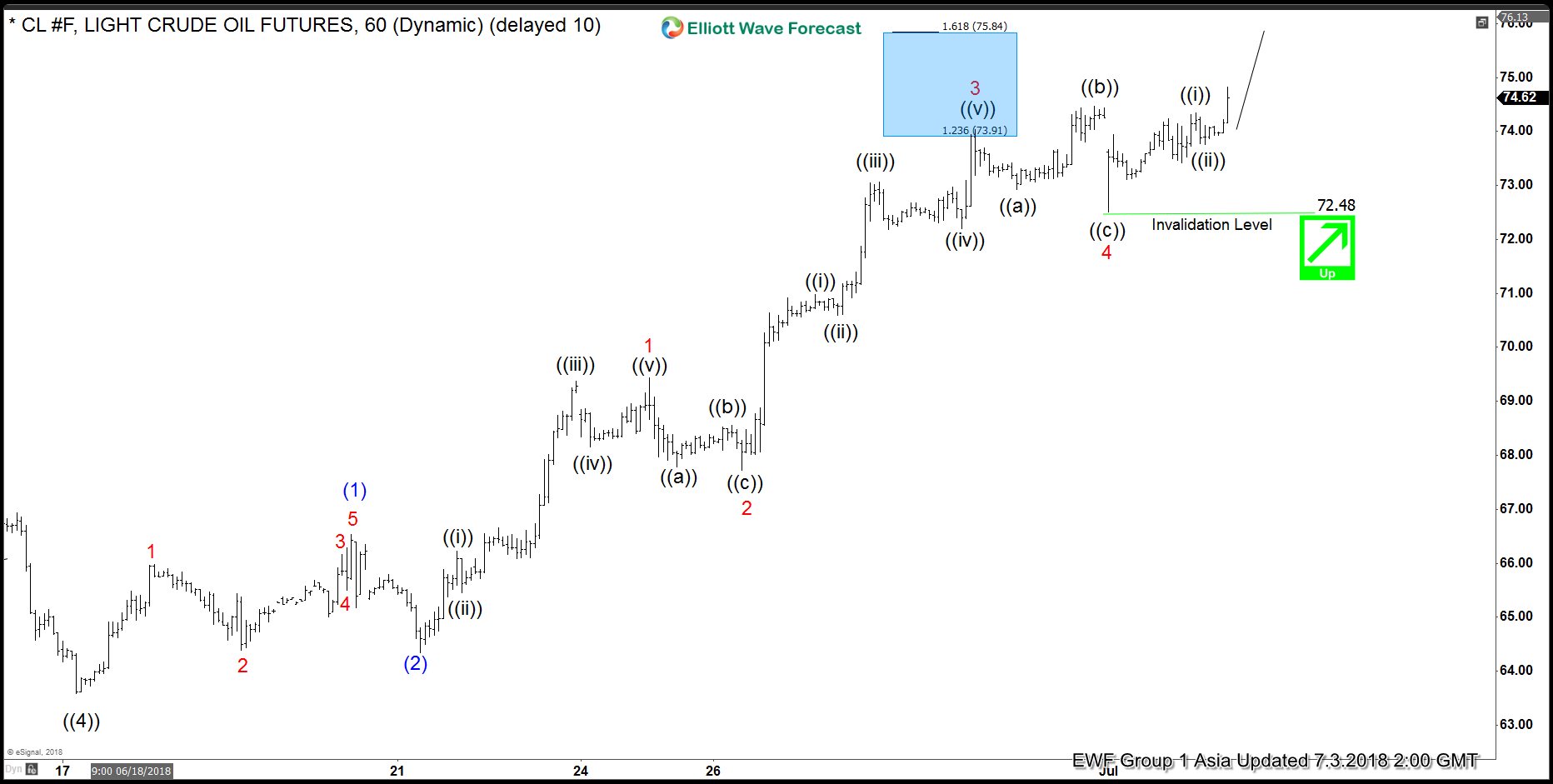

OIL Elliott Wave Analysis: Rallying Higher In An Impulse Structure

Read MoreOIL short-term Elliott Wave view suggests that the pullback to $63.59 on 6/18/2018 low ended primary wave ((4)). Up from there, the instrument reacting strongly to the upside and internals of that rally higher suggests that it’s taking place in an Impulse Elliott wave structure with extension with lesser degree oscillation showing the sub-division of 5 waves […]

-

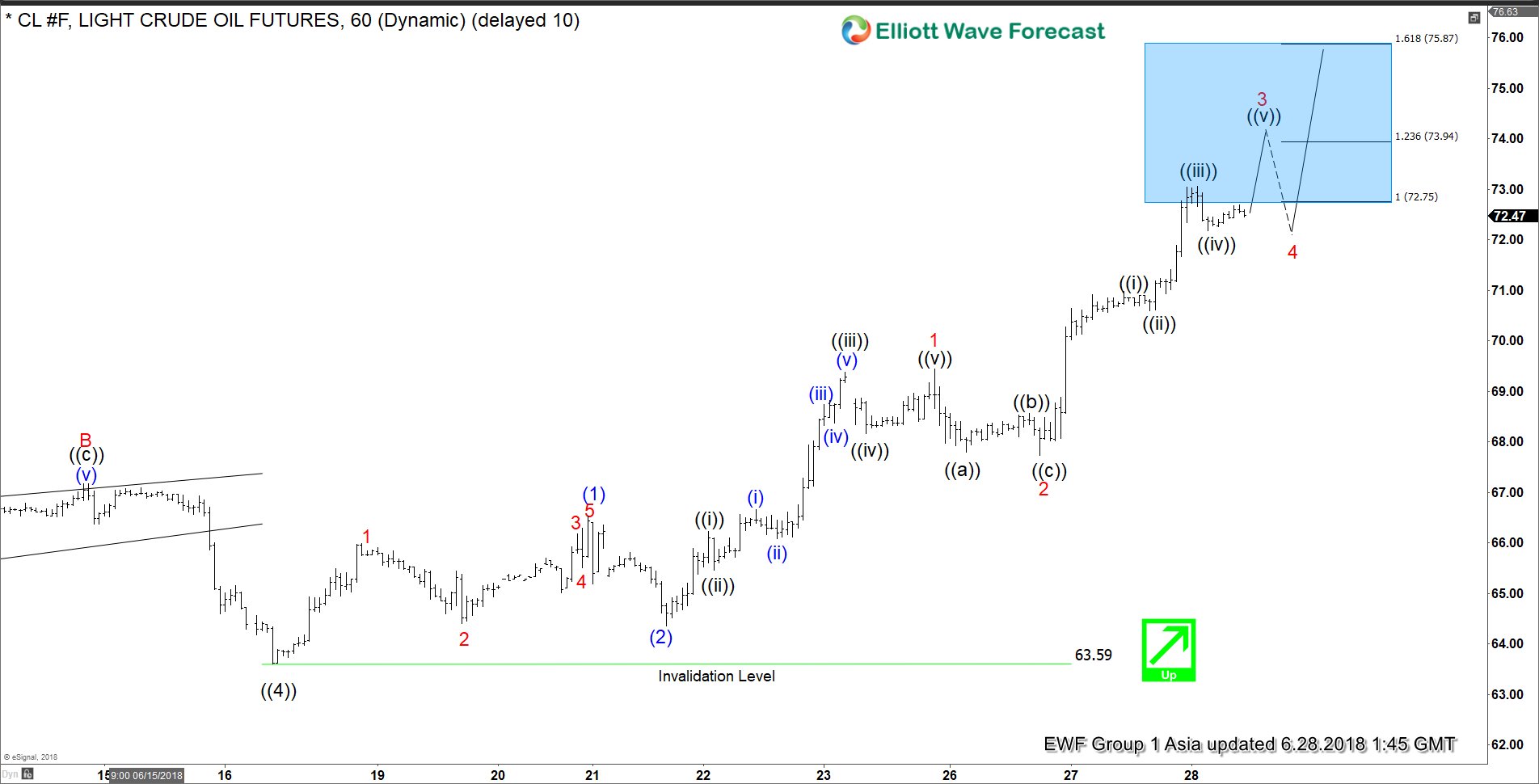

OIL Elliott Wave Impulse Structure Calling For More Upside

Read MoreOIL short-term Elliott Wave view suggests that the decline to $63.59 on 6/18/2018 low ended primary wave ((4)) pullback. Above from there, the instrument has rallied to new highs already. And confirming the next extension higher taking place in primary wave ((5)). The rally higher from $63.59 low is taking the form of Elliott wave […]

-

Soybean Hit 9 Year Low Due to Trade War

Read MoreEarly this week the price of Soybean futures (ZS_F) plunged to a new low in more than 9 years due to the tit-for-tat trade war between U.S. and China. Soybean Futures started to drop on Friday last week after Trump administration decided to go ahead with 25% tariff on $50 billion worth of goods from […]

-

(PA_F) Palladium Buying Opportunity Ahead?

Read MorePalladium ended a cycle from January 2016 low (452.63) and the pull back should be a Palladium Buying Opportunity. Rally from January 2016 low can be counted as an Elliott Wave Impulse when rally to 776 completed wave ((1)), dip to 652.15 low completed wave ((2)), rally to 1023.95)completed wave ((3)), dip to 973.60 low […]

-

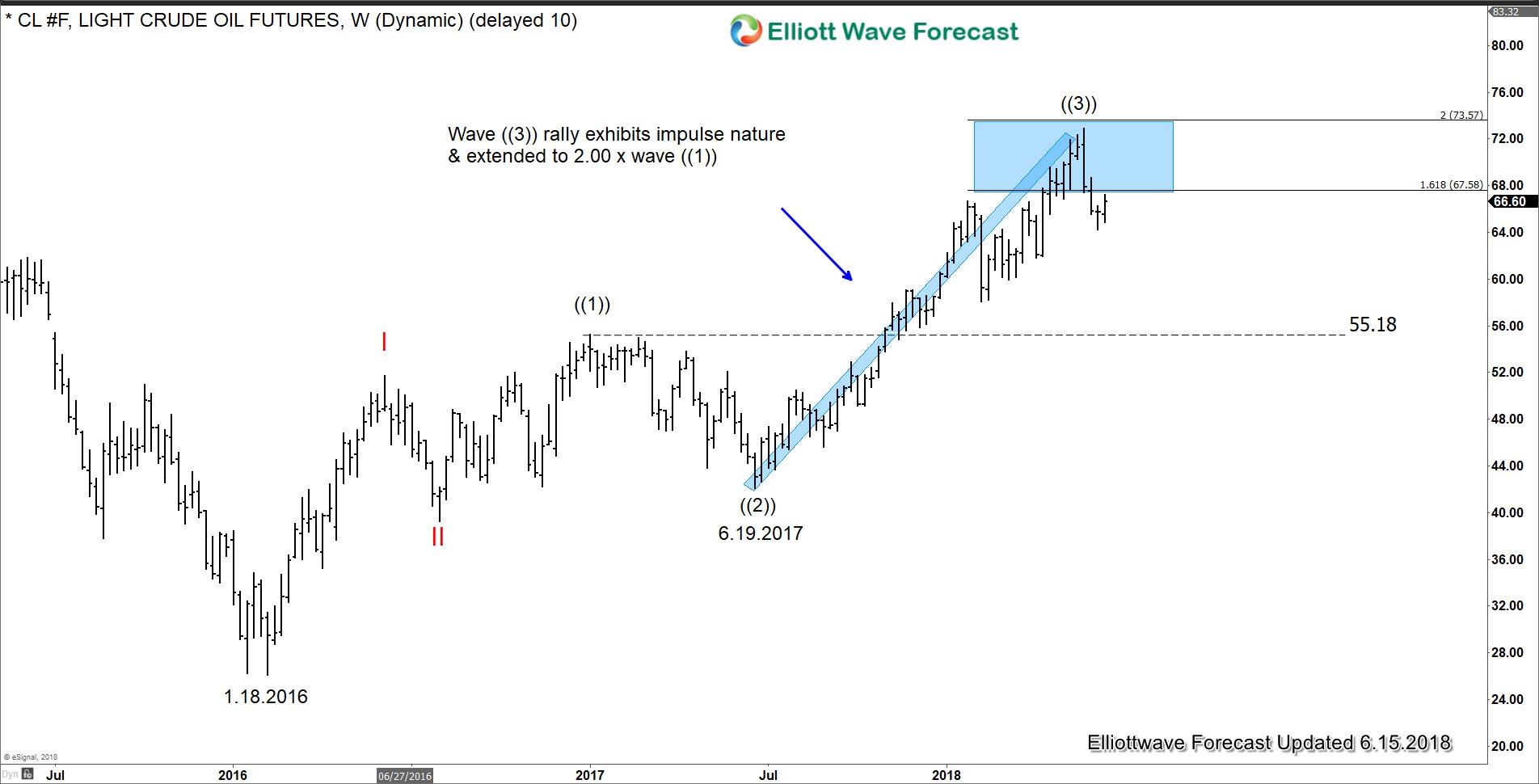

Oil Price on Holding Pattern Ahead of OPEC meeting

Read MoreThe Organization of the Petroleum Exporting Countries (OPEC) will meet in Vienna next week to discuss potential reduction or revision to the 1.8 million barrels/day production cut put in place in early 2017. After yearlong rise in oil and gasoline price, there’s a call to control the price from rising too far and too fast. […]