Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

COPPER Forecasting The Decline & Selling The Rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of COPPER. As our members know, COPPER has had cycle from the 13th October 2017 in progress as expanded Flat structure. The Commodity was missing another swing down to complete proposed pattern, approximately at 2.622-2.458 ( according to […]

-

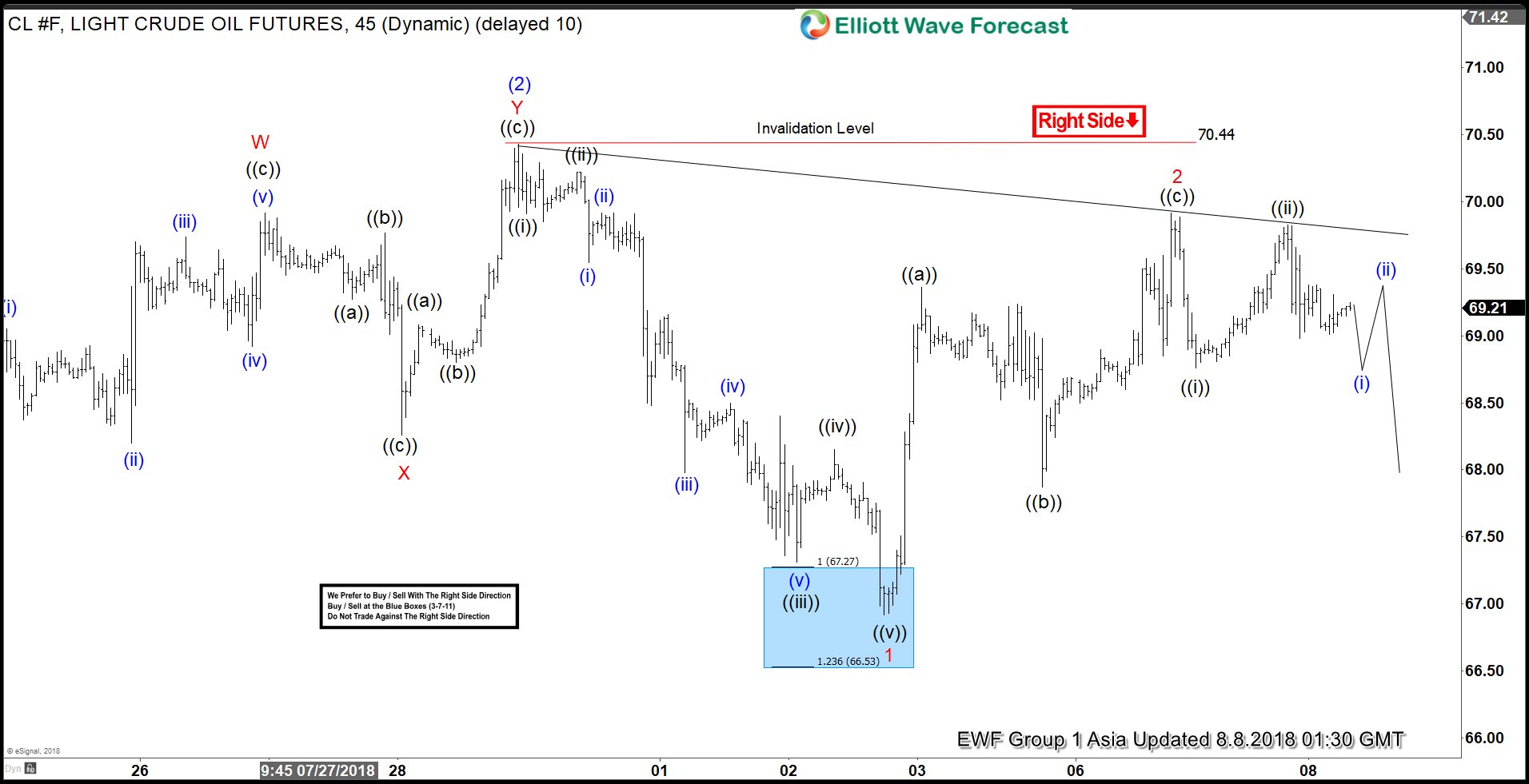

Oil Elliott Wave Analysis: Forecasting the Decline

Read MoreHello fellow traders. Today, we will have a look at some past Elliott Wave charts of Oil which we presented to our members. Below, you can find our 1-hour updated chart presented to our members on the 08/8/18. OIl suggested that the bounce to $70.44 high ended blue wave (2). The internals of that bounce took […]

-

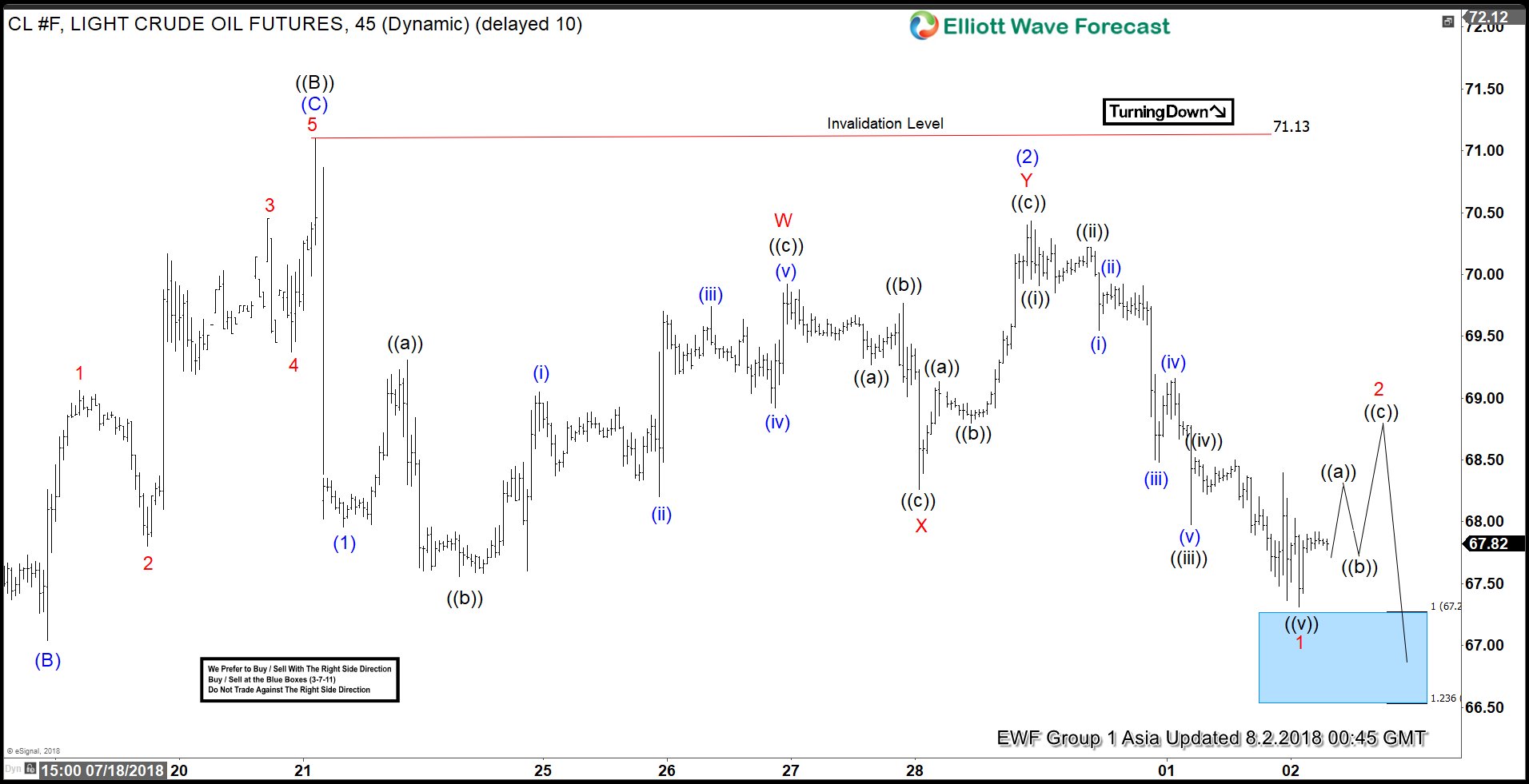

OIL Elliott Wave Analysis: Extending to the Downside

Read MoreOil ticker symbol: CL_F short-term Elliott wave analysis suggests that the bounce to $70.44 high ended intermediate wave (2). The internals of that bounce took place as Elliott wave double correction where Minor wave W ended in 3 swings at $69.92. From there, the pullback to $68.26 completed the Minor wave X in 3 swings. […]

-

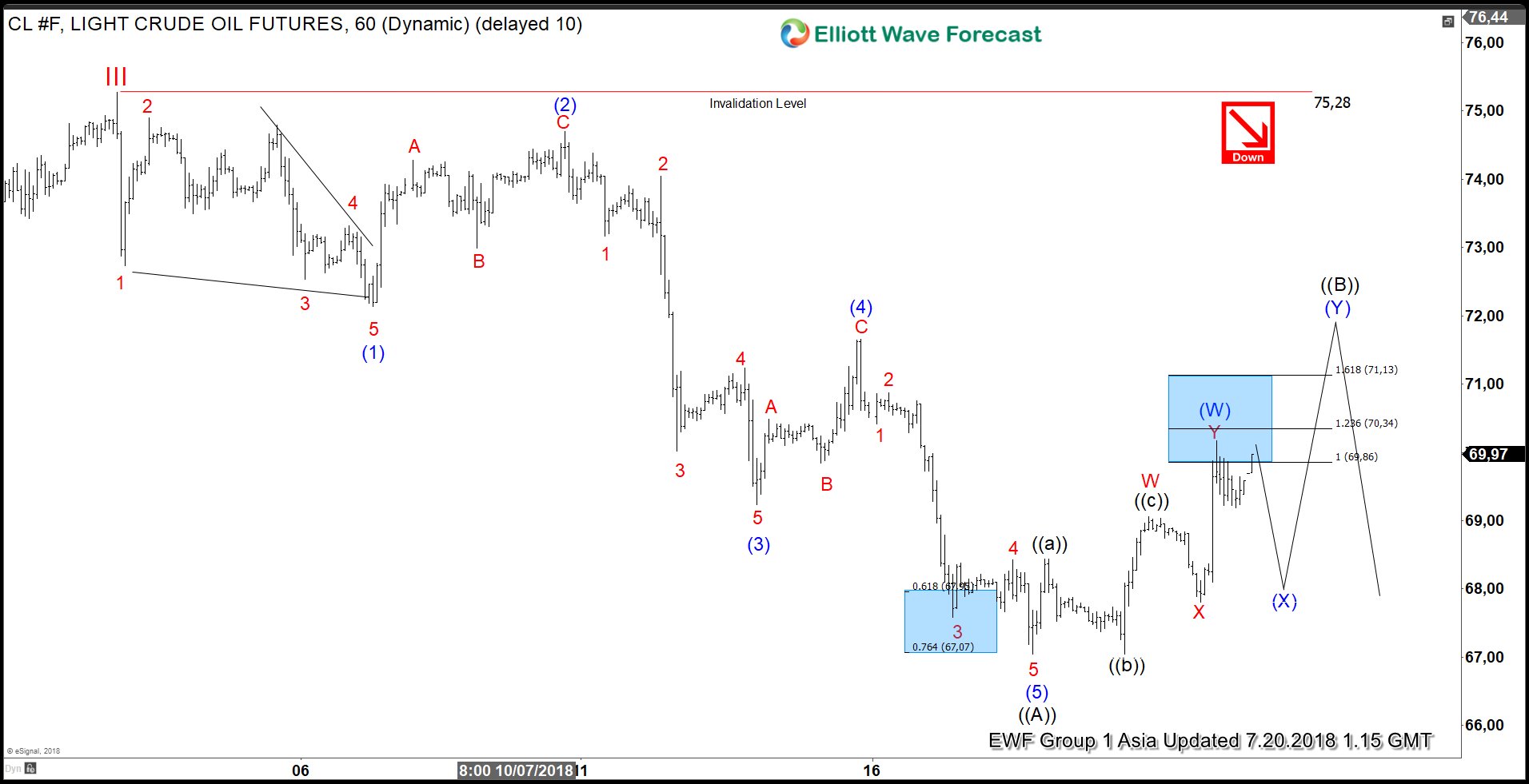

Elliott Wave Analysis: OIL Starting The Next Leg Lower

Read MoreOIL short-term Elliott wave analysis suggests that the bounce to $71.13 high ended primary wave ((B)) bounce against 7/03/2018 peak ($75.27). Primary wave ((C)) lower currently remains in progress as Elliott Wave impulse structure looking for more downside. Down from $71.13 high, the decline to $67.96 low ended intermediate wave (1) in 5 waves structure. […]

-

OIL Elliott Wave Analysis: Larger Correction Taking Place?

Read MoreOIL short-term Elliott wave analysis suggests that the rally to $75.28 high ended cycle degree wave III. Down from there, the larger correction in cycle degree wave IV is taking place in 3, 7 or 11 swings before Oil resumes higher. The internal of the first leg of the decline from $75.28 high took place […]

-

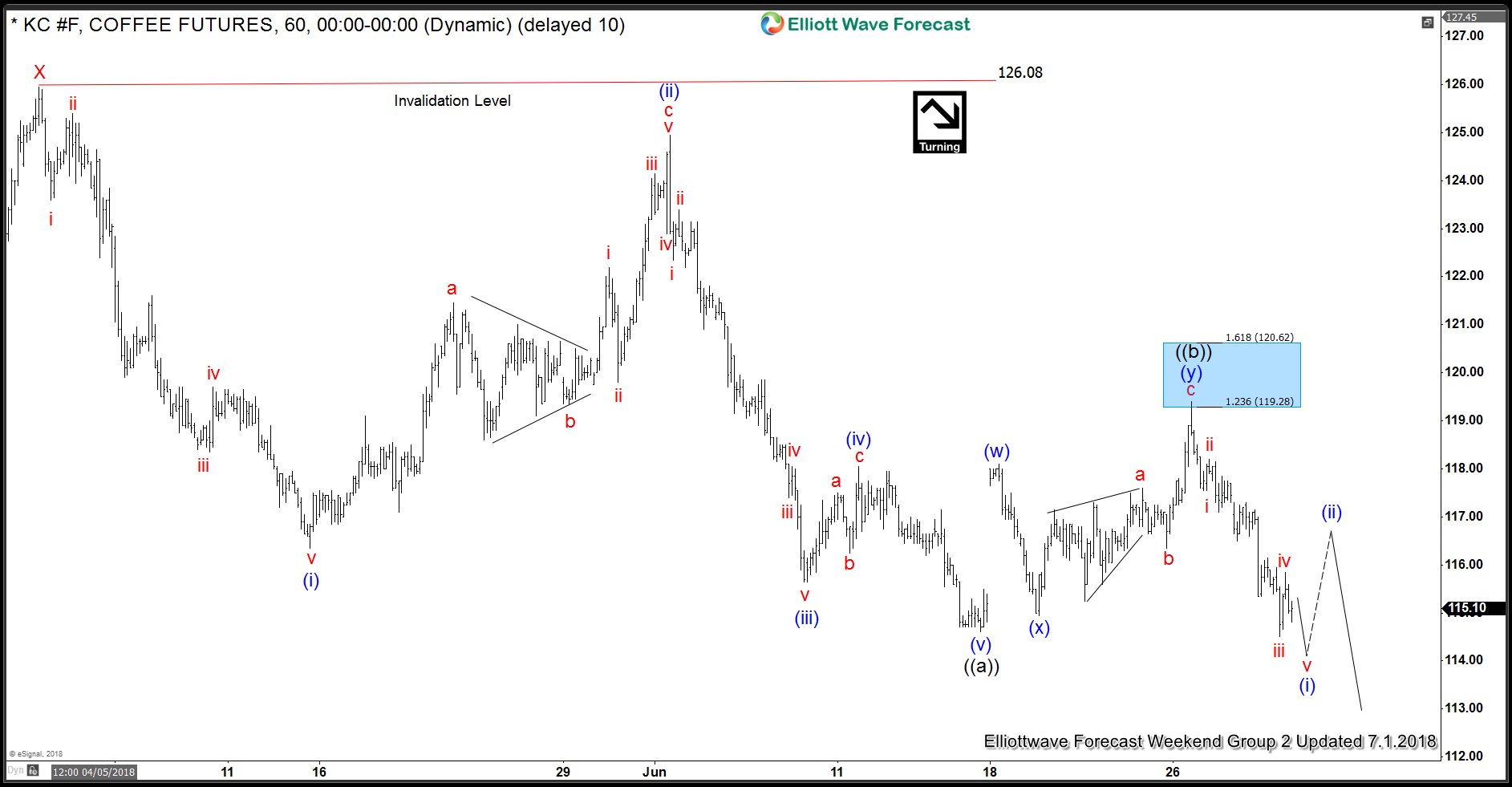

COFFEE Elliott Wave Analysis: Forecasting The Decline

Read MoreHello fellow traders. Today, we will have a look at some Elliott Wave charts of COFFEE which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 06/24/18 where COFFEE was in the progress of correcting cycle from 05/02 peak in 3-7 or 11 […]