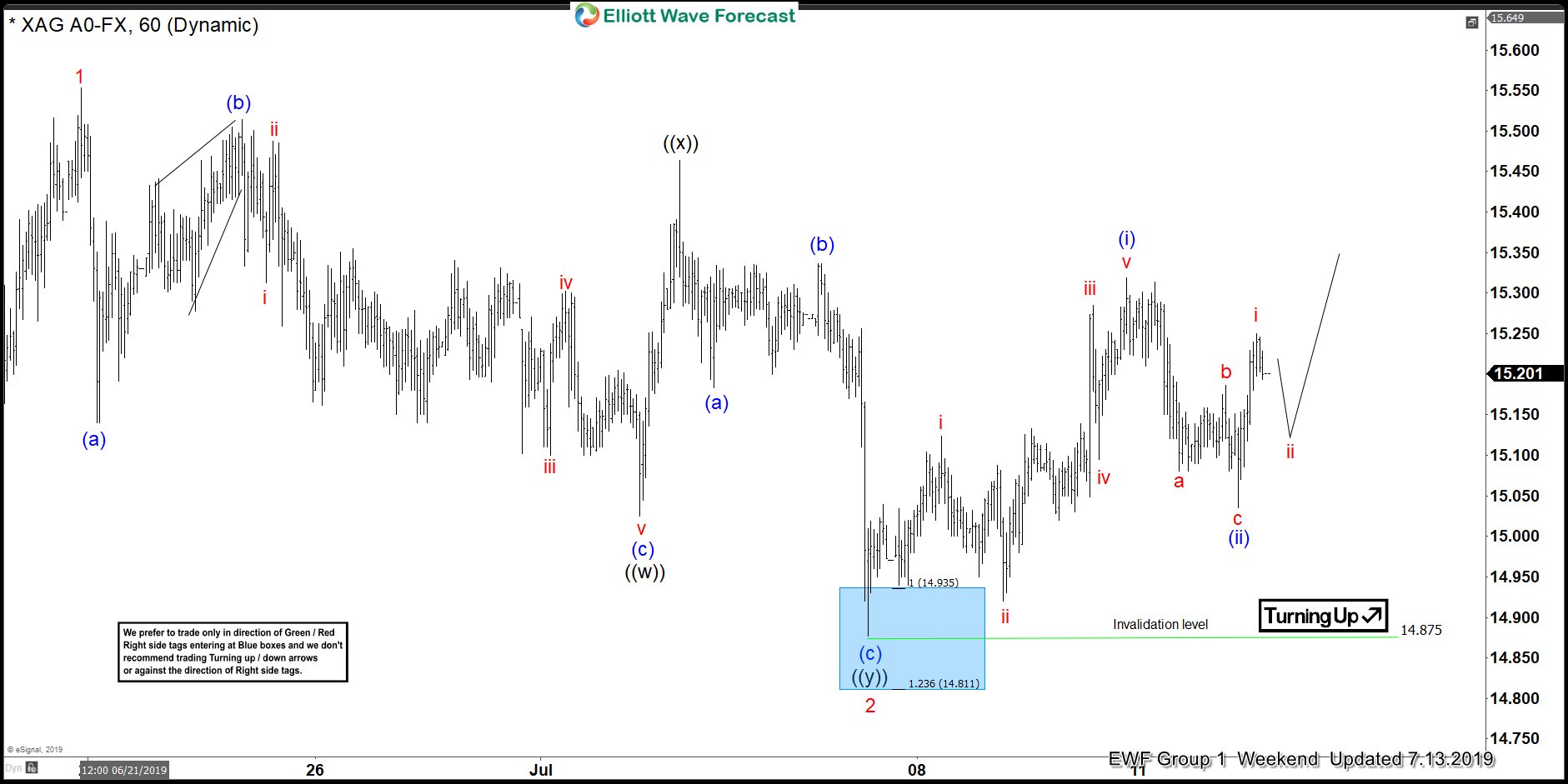

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

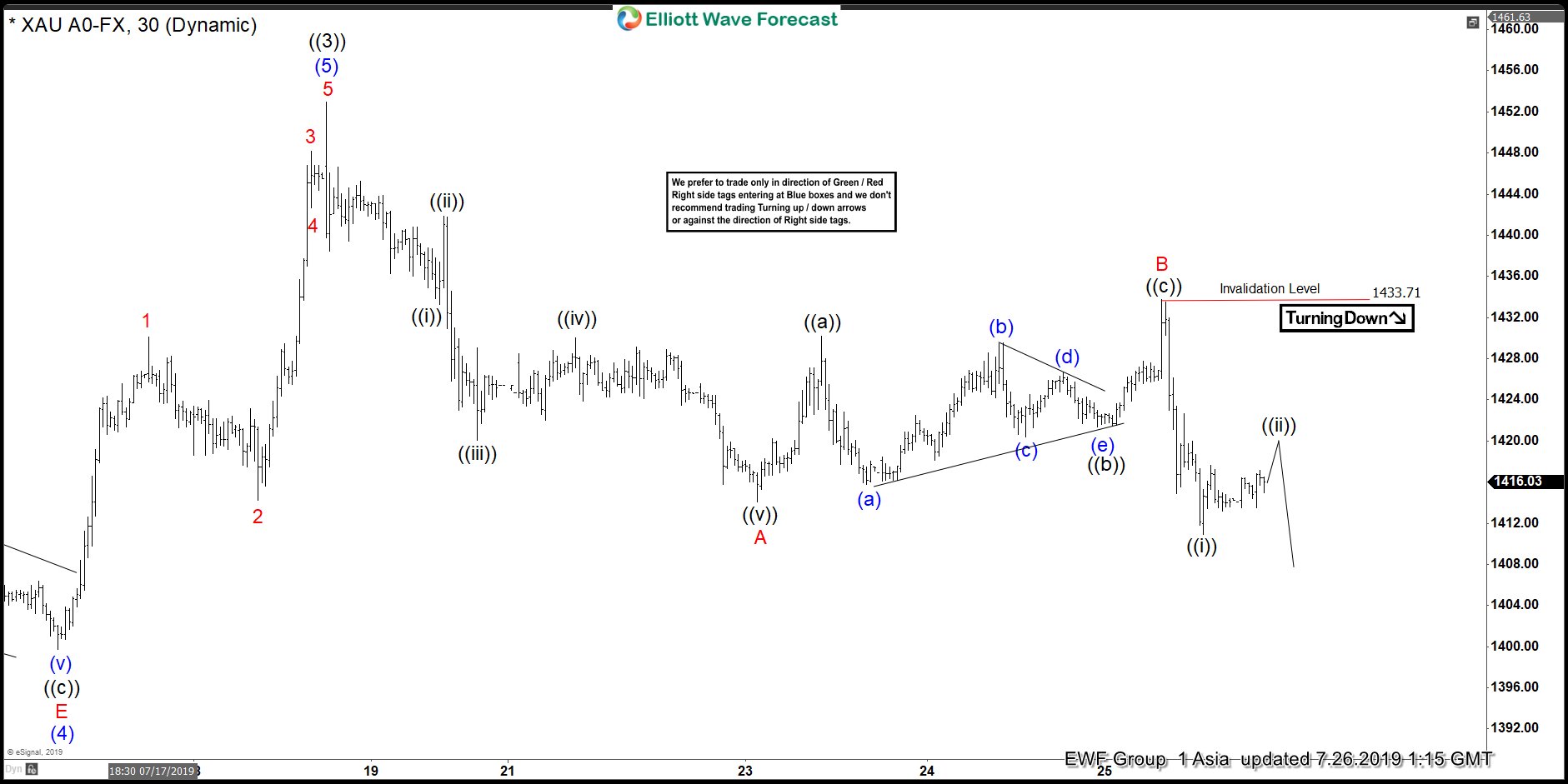

Elliott Wave View: Gold Resumes Wave 5 Rally

Read MoreGold has resumed higher in wave 5. The rally from Aug 1 is impulsive and while dips stay above there, the metal can extend higher.

-

Gold Reached The Biggest Extreme. What’s Next?

Read MoreGold has managed to reach it’s the biggest extreme from 2015 lows by reaching our target area at $1450. This article & video show the Elliott Wave path

-

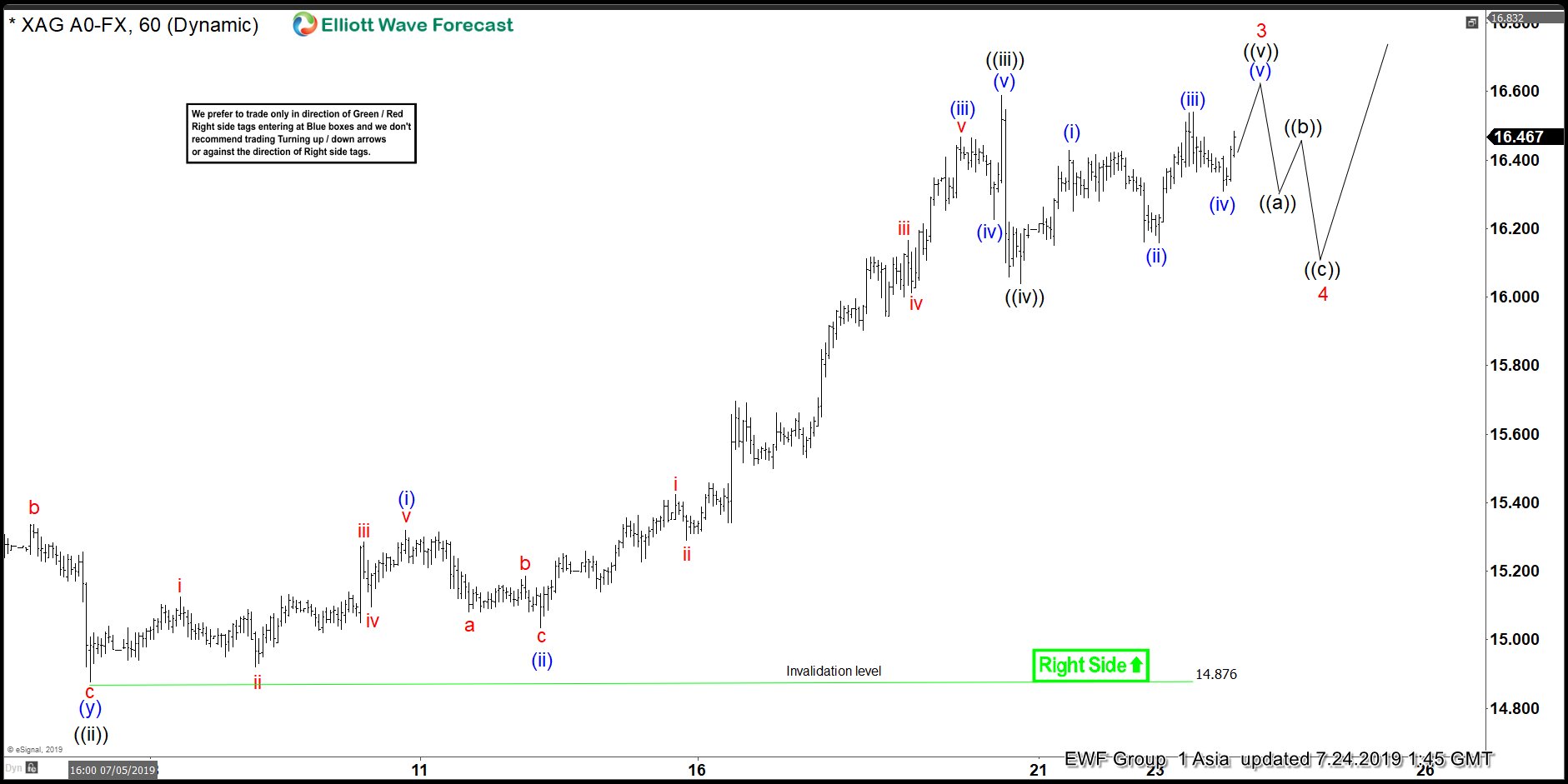

Silver Elliott Wave View: Impulse Move Favoring More Upside

Read MoreSilver rally from May 28, 2019 low is unfolding as an impulse Elliott wave structure favoring more upside to take place. The near-term pullback to $14.87 low ended wave ((ii)). Up from there, the metal made a strong rally to the upside and ended wave ((iii)) at $16.58 high. The internals of that rally unfolded […]

-

SILVER ( $XAGUSD ) Forecasting The Rally

Read MoreHello fellow traders. Recently we were forecasting the rally in commodities like SILVER and GOLD. As our members know, GOLD has been showing an incomplete sequence from August 16, 2018 low. Consequently, we were expecting SILVER to follow the same path due to strong correlation they have. We advised members to avoid selling those commodities […]

-

Elliott Wave View: Gold Should Extend Higher

Read MoreGold shows an incomplete sequence from August 16, 2018 low favoring further upside. Near term, pullback to 1385.34 ended wave (4). The yellow metal has resumed higher in wave (5). Internal of wave (5) is unfolding as a 5 waves impulse Elliott Wave structure. Up from 1385.34, wave 1 ended at 1427.16 and wave 2 […]

-

SUGAR ( $SB_F ) Forecasting The Decline After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of SUGAR ( $SB_F ) published in members area of the website. As our members know, the commodity made Elliott Wave Flat structure against the 12.95 high and gave us forecasted decline. In further text we’re […]