Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

OIL ($CL_F) Elliott Wave : Calling The Decline From Equal Legs Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL . As our members know, OIL is having bearish sequences in the cycle from the 123.8 peak. Current view is calling for further weakness against the 101.9 pivot in first degree. Recently the commodity […]

-

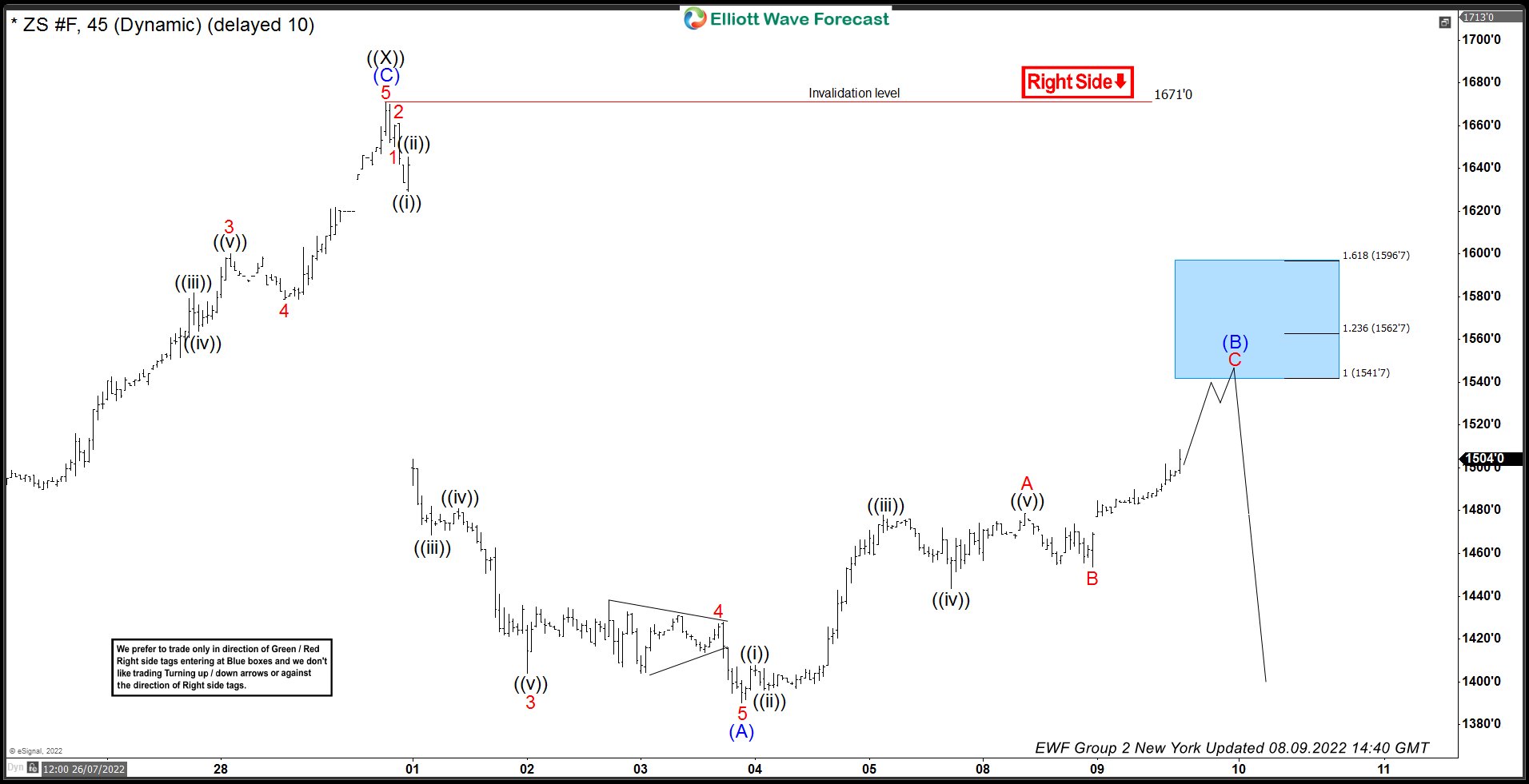

ZS_F Forecasting The Rally And Selling In Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of ZS_F (Soybean futures) published in members area of the website. As our members knew, we’ve been favoring the short side in ZS_F (Soybean futures) due to incomplete bearish sequence down from June 9, 2022 peak against July 29, 2022 peak. […]

-

Platinum (PL) May Still See Further Downside

Read MoreThe Fed has raised interest rates four times this year to fight inflation. They hiked by 0.25 basis point in March, the first hike in more than three years. Then they hiked further 50 basis point in May, 0.75% in June, and another 0.75% in July. This takes the current benchmark rate to 2.25 – […]

-

Elliott Wave View: Silver (XAGUSD) Impulsive Rally Suggests Further Upside

Read MoreSilver (XAGUSD) rally from 7.14.2022 low is impulsive favoring further upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: 5 Waves Rally in Gold

Read MoreGold (XAUUSD) rally from 7.21.2022 is impulsive and should see more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Dollar Index (DXY) Resumes Higher

Read MoreDollar Index (DXY) has ended correction and started the next leg higher. This article and video look at the Elliott Wave path.