Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

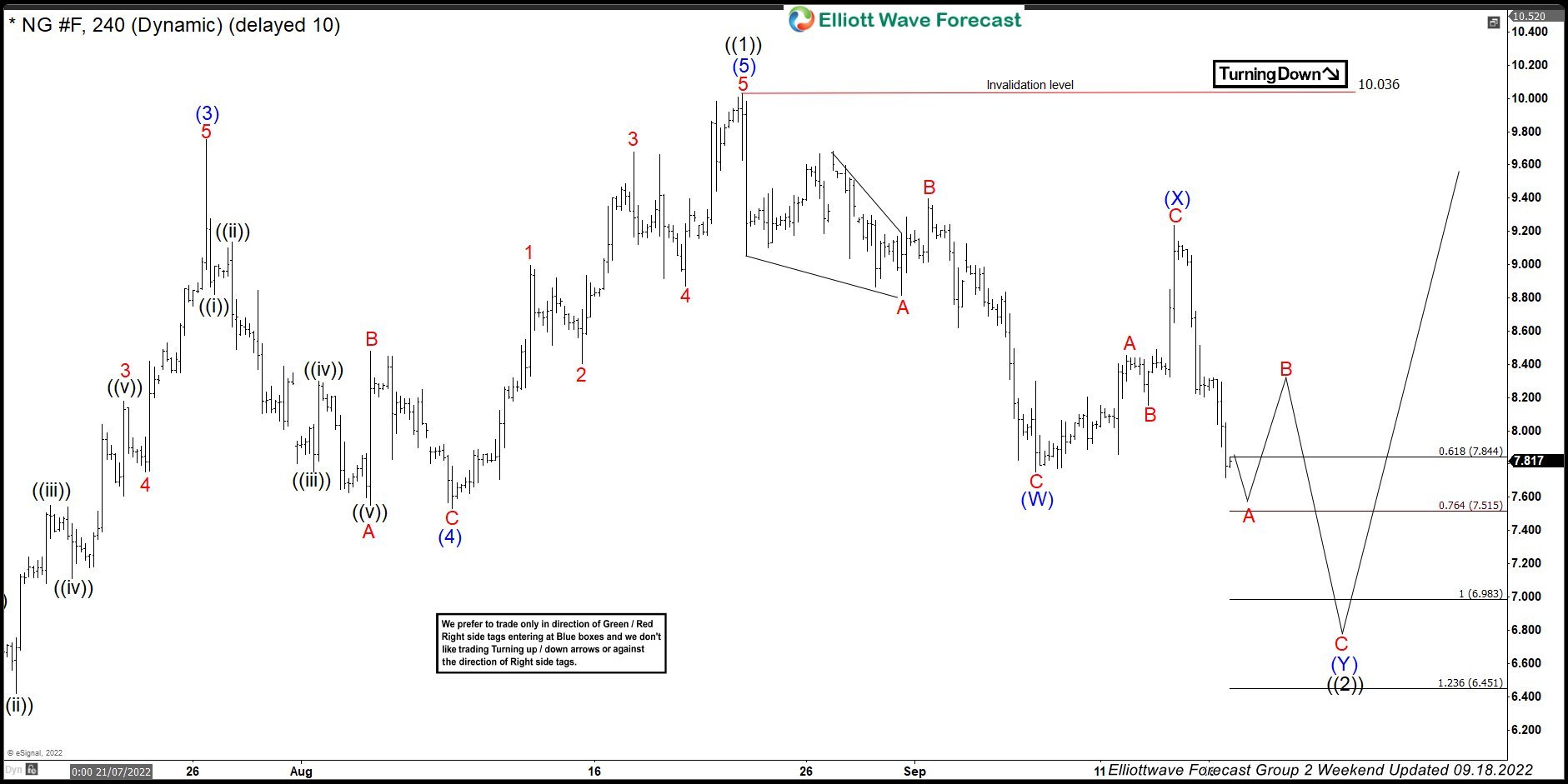

Natural Gas $NG_F Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Natural Gas $NG_F . As our members know, Natural Gas futures has been showing incomplete bearish sequences in the cycle from the August 23rd peak. We recommended members to avoid buying the commodity. Cycle from […]

-

Lithium ETF (LIT) is Under Pressure By Market Downtrend

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

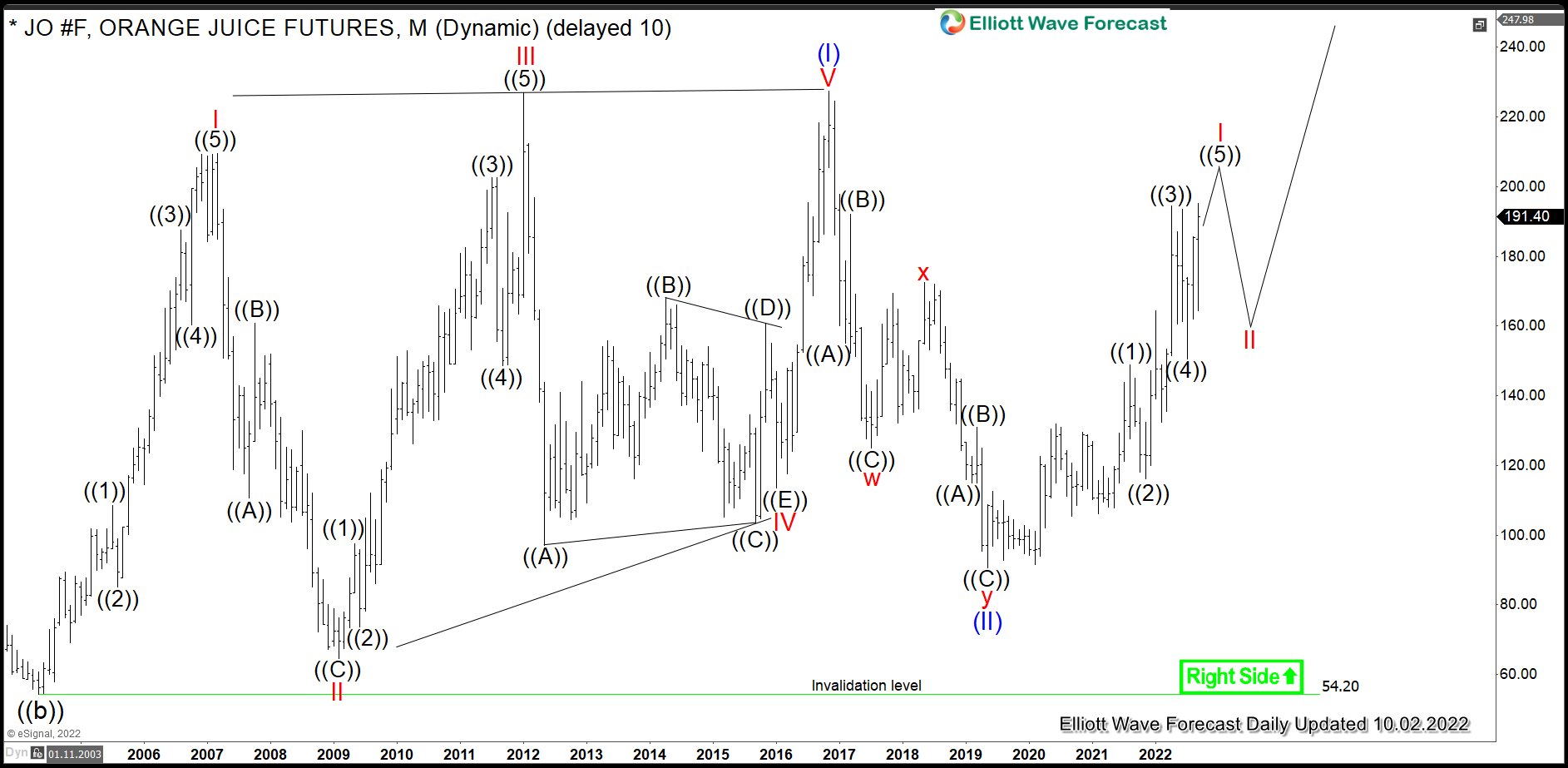

FCOJ: Frozen Concentrated Orange Juice is Bullish

Read MoreIn the previous articles from March and November 2021, we have discussed the price action and the outlook for the Frozen Concentrated Orange Juice. As it has been expected, the soft commodities have advanced. In particular, we saw commodities like coffee, cocoa, cotton and sugar extending higher. Hereby, orange juice futures OJ #F have rallied as well. Now, […]

-

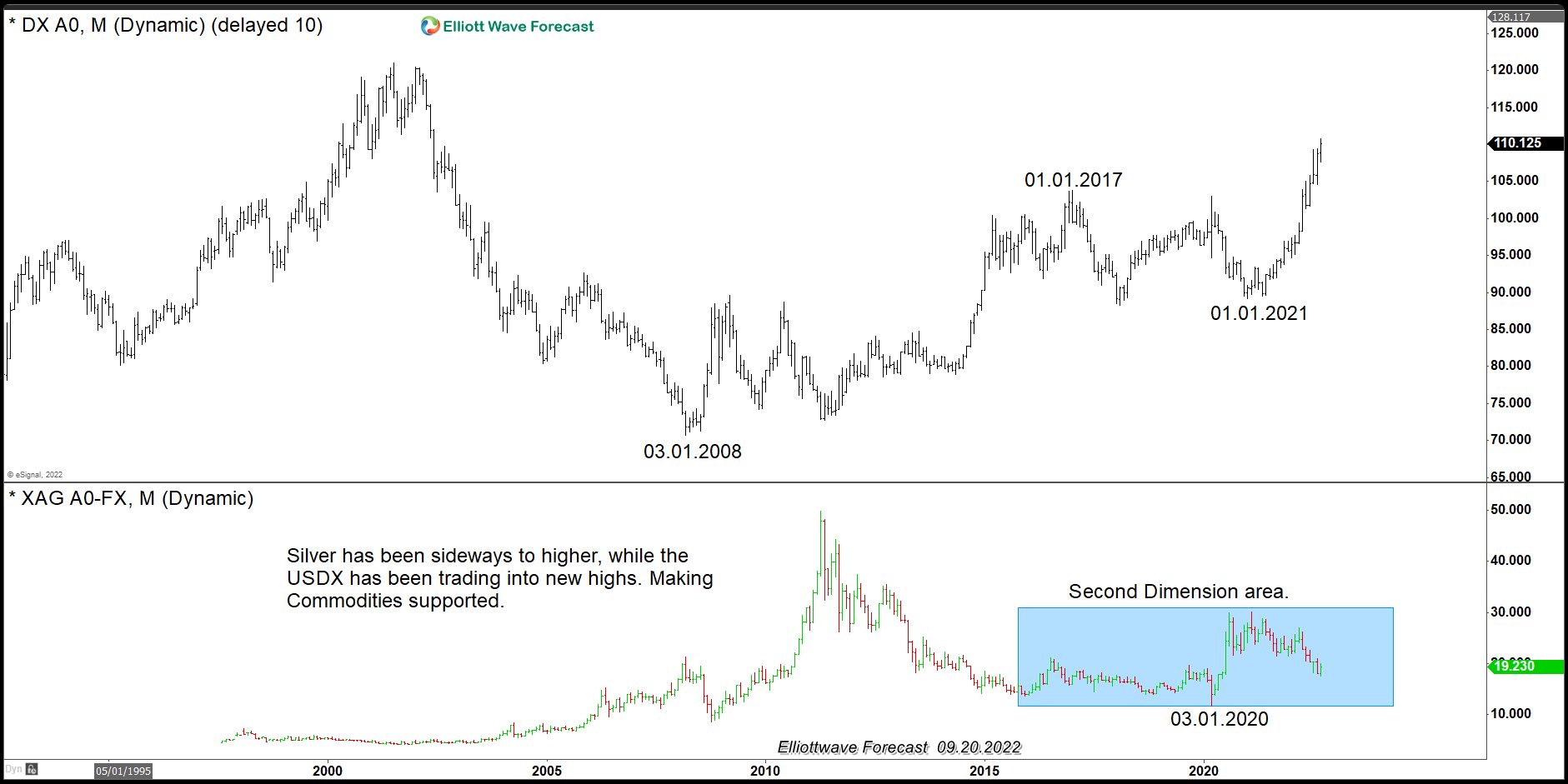

$USDX: The Index Structure Showing an Opportunity to Buy Commodities

Read MoreThe Dollar Index ($USDX) shows five waves since the low on 03.01.2008, which will provide many signals across the Marketplace. Below is a monthly chart of the Dollar Index $USDX Monthly Elliott Wave The monthly chart above shows the five waves advance from 3.1.2008 and the different degrees within the cycle. The idea is overall […]

-

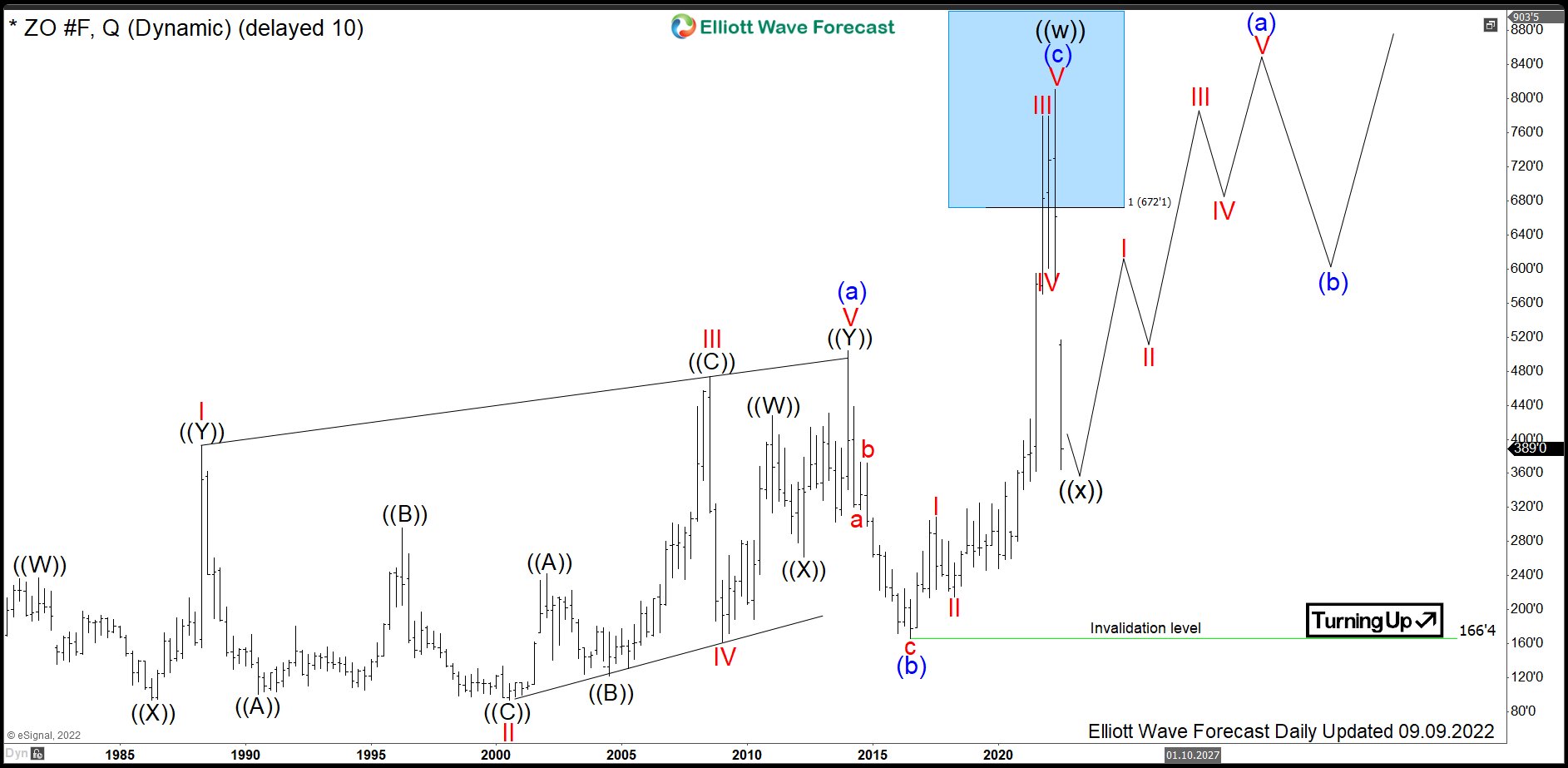

ZO #F: Oats Futures Trade Within Weekly Buying Area

Read MoreOats are one of the grain commodities, along with soft red wheat, hard red wheat, corn, soybeans and others. The oat (Avena sativa) is a species of cereal grain grown for its seed. While oats are suitable for human consumption as oatmeal and rolled oats, one of the most common uses is as livestock feed. Oats are a nutrient-rich food associated with lower blood cholesterol when consumed regularly. Since this […]

-

Elliott Wave View: Oil (CL) Has Reached Daily Support

Read MoreOil (CL) shows incomplete sequence from 7.19.2022 high & can see further downside. This article and video look at the Elliott Wave chart.