Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Silver (XAGUSD) Breaks Higher and Forms Elliott Wave Bullish Sequence

Read MoreSilver (XAGUSD) creates a bullish sequence from 9.1.2022 low. This article and video look at the Elliott Wave path for the metal.

-

HG_F: Copper Futures – Reaction Higher from Equal Legs Area

Read MoreHello Traders, in this article we will analyze how we were able to forecast here at Elliott Wave Forecast the reaction higher in HG_F (Copper Futures). Firstly, copper was trading within a cycle from 01.18.2023 in a pullback phase. Secondly, we had in place the first leg of the cycle including the connector in place. […]

-

Gold to Silver Ratio Has Started the Next Bearish Leg

Read MoreWith tense geopolitical situation between two world super powers, ongoing war, and banking crisis, there’s no shortage of black swan events. Gold and Silver have performed very well in this environment. After 3 years of consolidation, they look to have formed major low earlier this year and ready for the next bullish cycle. We will […]

-

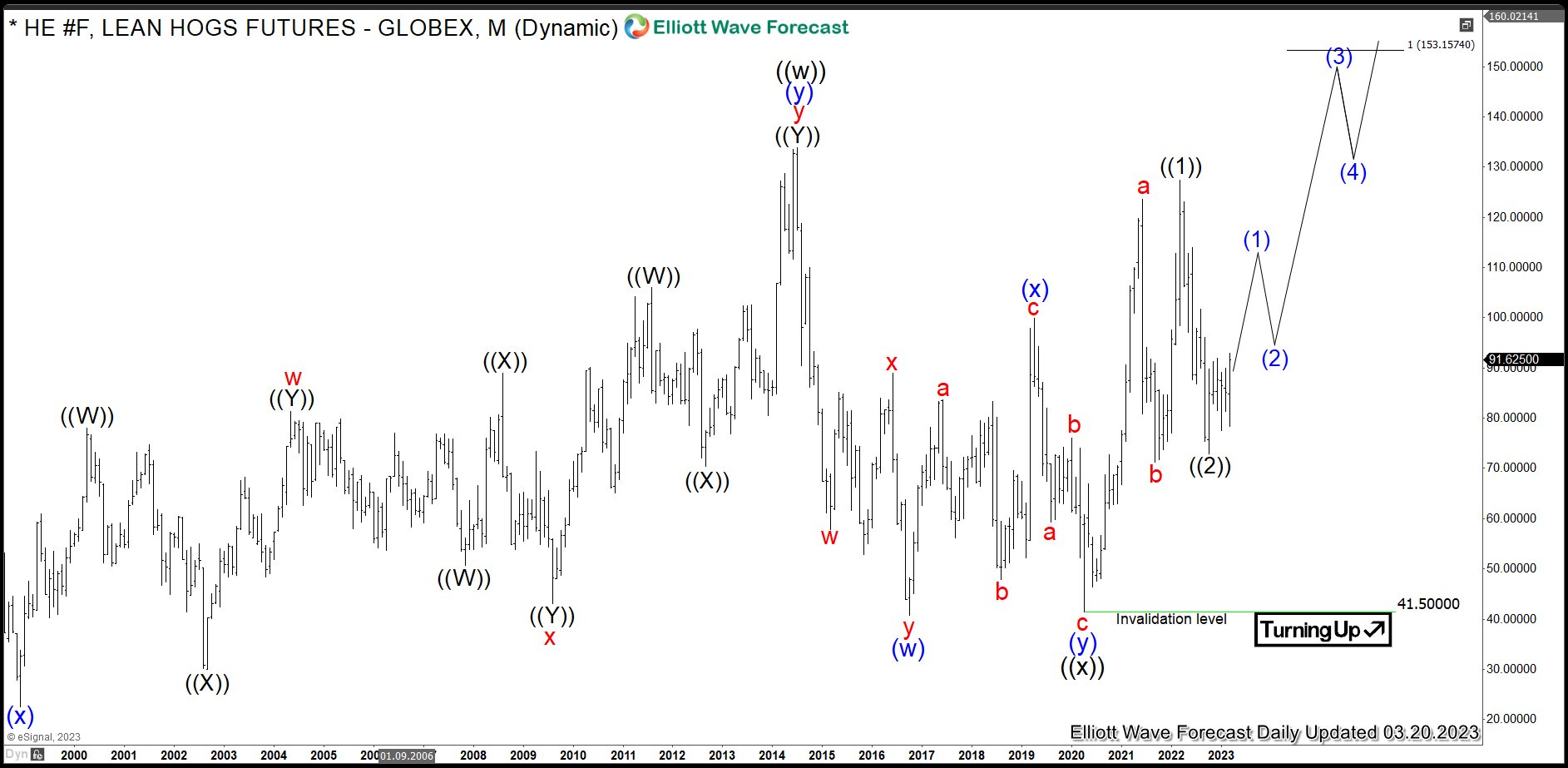

HE #F: Lean Hogs Reacting Higher from Blue Box Area

Read MoreLean Hogs is a livestock commodity within the agriculture asset class, along with live cattle, feeder cattle and pork cutouts. One can trade Lean Hogs futures at Chicago Mercantile Exchange in contracts of 40’000 pounds each under the ticker HE #F. As a matter of fact, the futures prices are widely used by U.S. pork […]

-

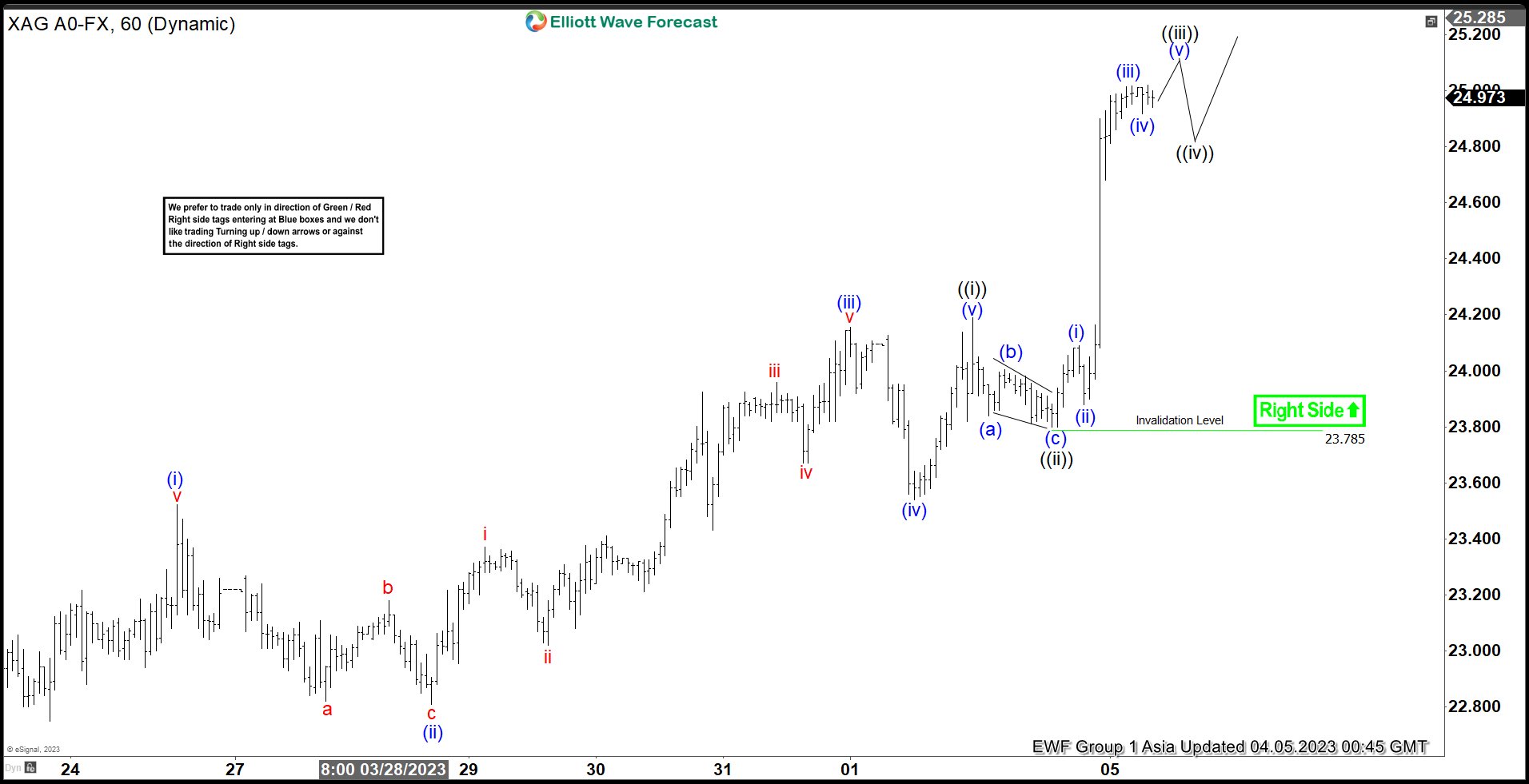

XAGUSD: Silver reaction higher from equal legs area

Read MoreHello Traders, in this article we will analyze how XAGUSD (Silver), reacted higher from equal legs area. With the cycle from 02.02.2023 decline in Silver having a clear connector we were able to project the area in which we were expecting a reaction to take place. Here at Elliott Wave Forecast, we call these areas, […]

-

Bullish Elliott Wave Outlook in Gold (XAUUSD)

Read MoreGold (XAUUSD) rallies from 2.28.2023 low as an impulse favoring more upside. This article and video look at the Elliott Wave path.