Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

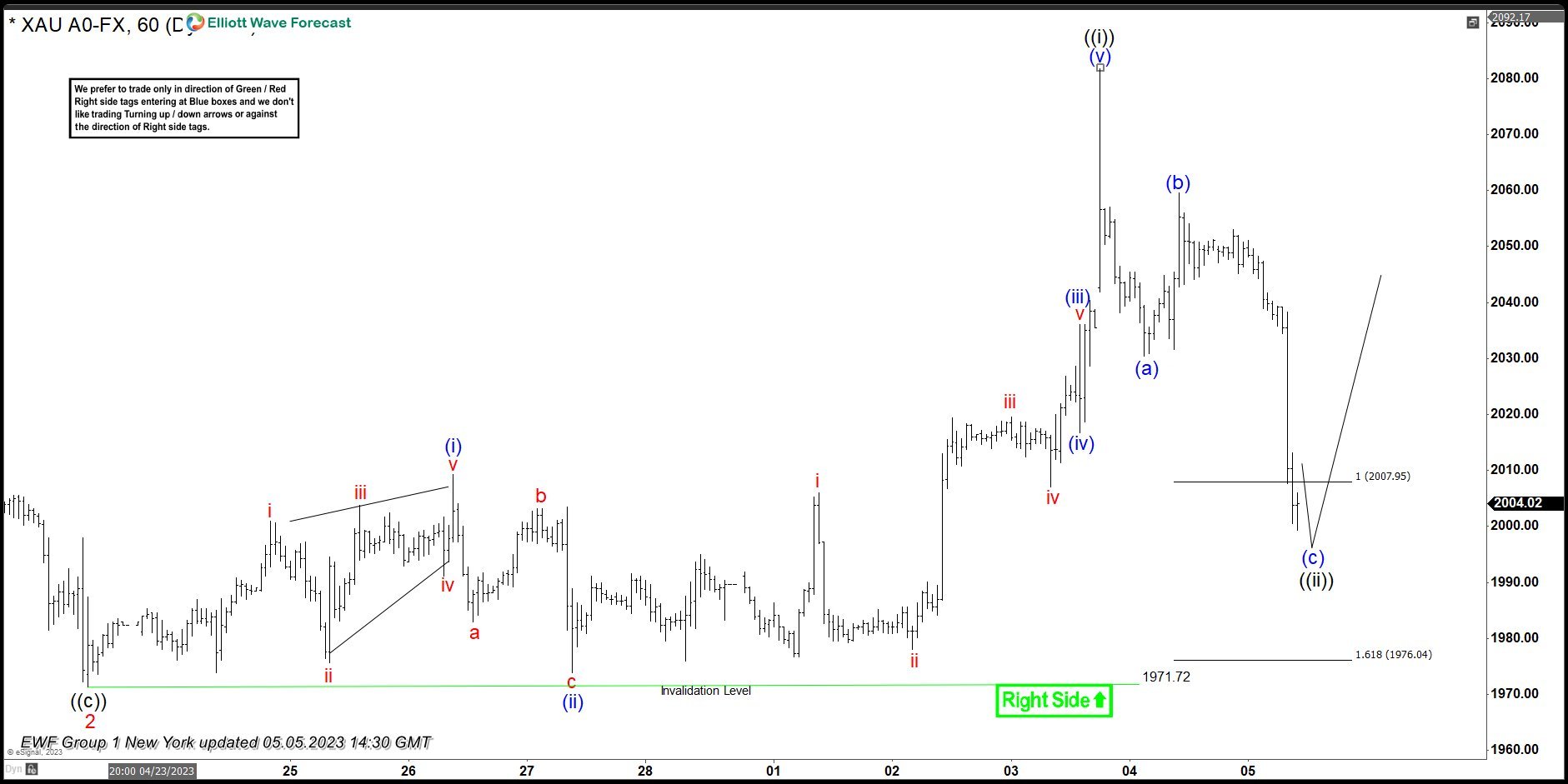

GOLD ( XAUUSD) Found Buyers After 3 Waves Pull Back

Read MoreIn this article we’re going to take a quick look at the Elliott Wave charts of GOLD, published in members area of the website. As our members know, we are favoring the long side in the commodity. GOLD is showing bullish sequences in the cycle from the 1614.3 low. We recommended members to avoid selling […]

-

Brent Crude (BZ) Still Looking for Bottoming Sign

Read MoreBrent Crude (BZ) is the leading global price benchmark for Atlantic basin crude oils. It is used to set the price of two-thirds of the world’s internationally traded crude oil supplies. It is one of the two main benchmark prices for purchases of oil worldwide, the other being West Texas Intermediate (WTI). Brent Crude formed significant low on 4.20.2020 […]

-

Elliott Wave View Suggests Silver (XAGUSD) Correction Still Ongoing

Read MoreSilver (XAGUSD) is correcting cycle from 3.10.2023 in a double three. This article and video look at the Elliott Wave path.

-

ZL #F: Soybean Oil Provides a Long Opportunity in 3 Swings Pullback

Read MoreSoybean Oil is one of the grain & oilseed commodities, along with wheat, soybeans, corn, rice, oats and others. Just behind palm oil, it is the second most used vegetable oil, basically, for frying and baking. Also, soybean oil finds applications medically and, when processed, for printing inks and oil paints. One can trade Soybean […]

-

CL_F (Crude Oil) Looking To Complete Impulse Elliott Wave Sequence Before Pullback Starts

Read MoreCL_F (Crude Oil) favors higher in 5 wave Impulse Elliott Wave sequence as wave 1 before pullback starts. It placed (B) at $64.12 low on 3/20/2023. Above (B) low, it placed ((i)) at $71.67 high & ((ii)) at $66.82 low. ((ii)) was 0.618 Fibonacci retracement of ((i)). It favored ended ((iii)) at $81.81 high on […]

-

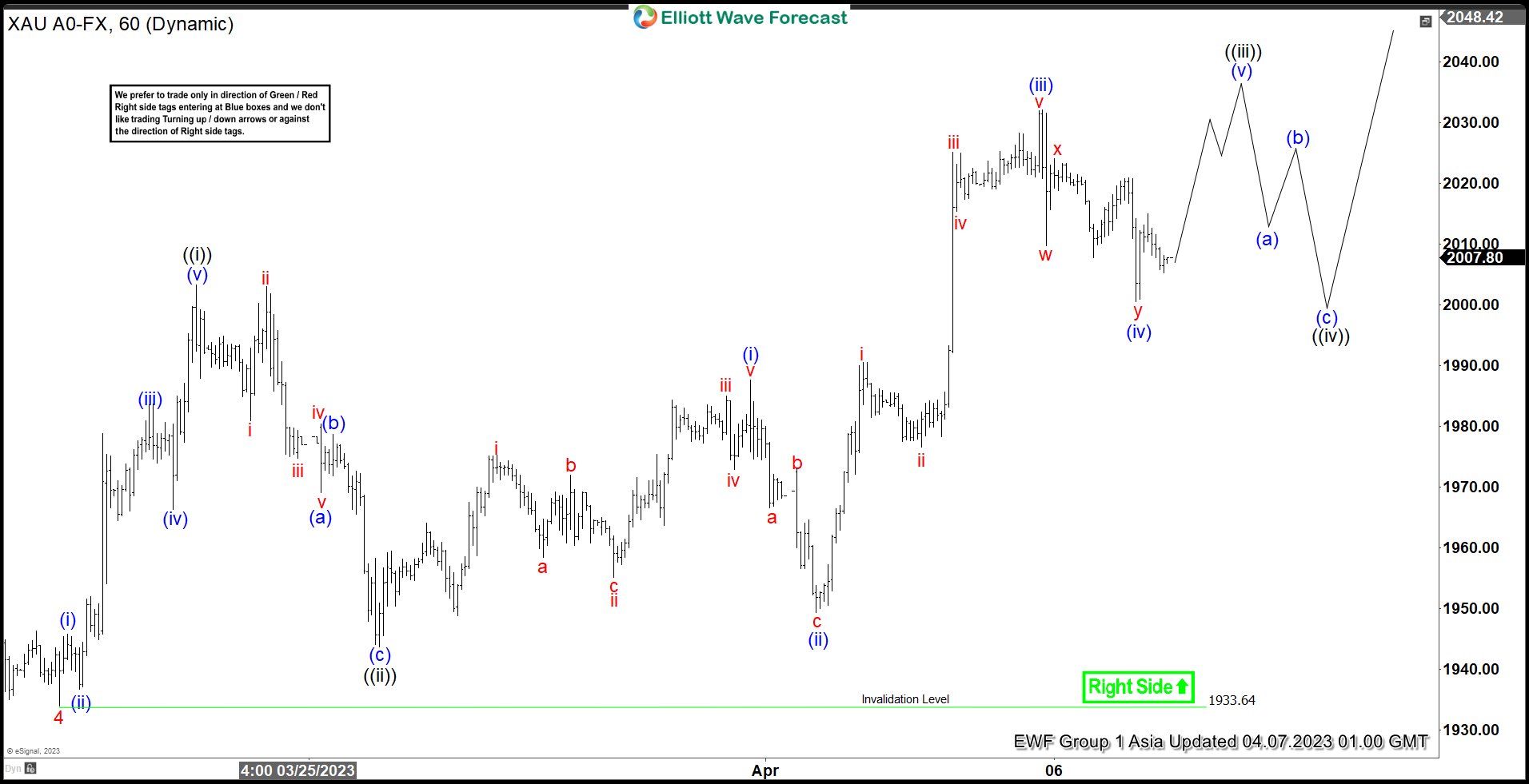

Gold (XAUUSD) Elliott Wave Bullish Sequence Favors Higher

Read MoreGold (XAUUSD) shows bullish sequence from 9.28.2022 low favoring more upside. This article and video look at the Elliott Wave path.