Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

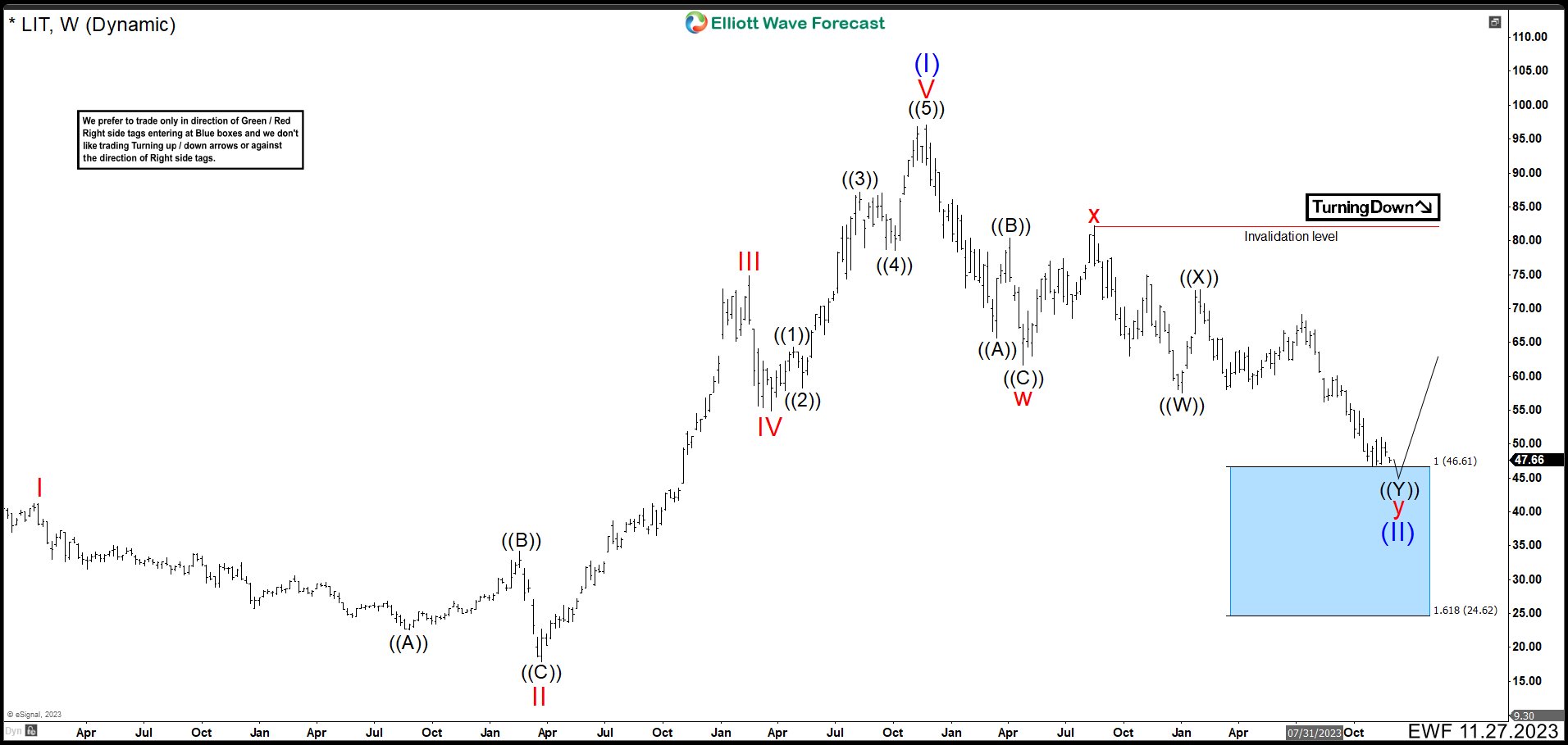

Lithium ETF (LIT) Should Be Ready For A Rally

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

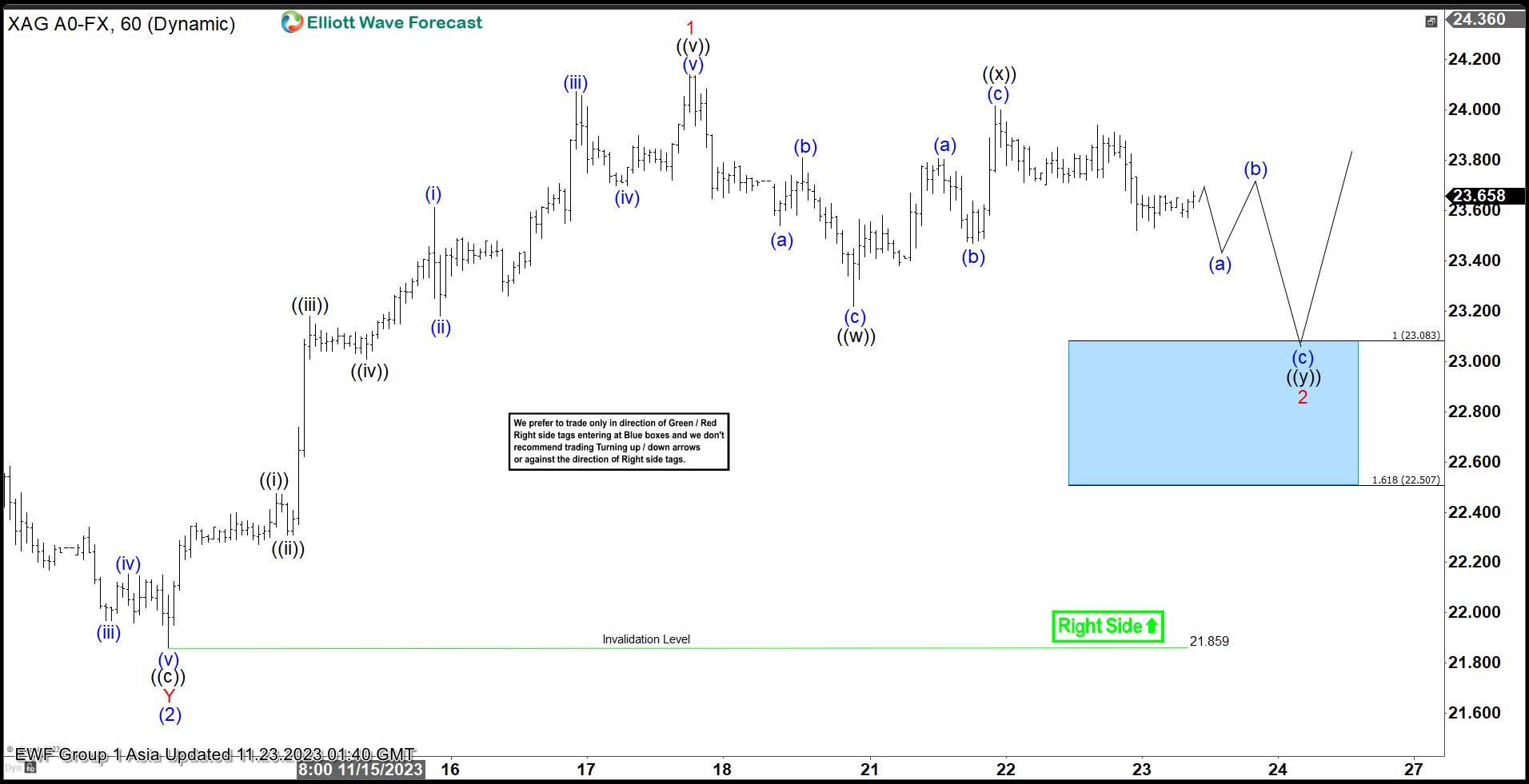

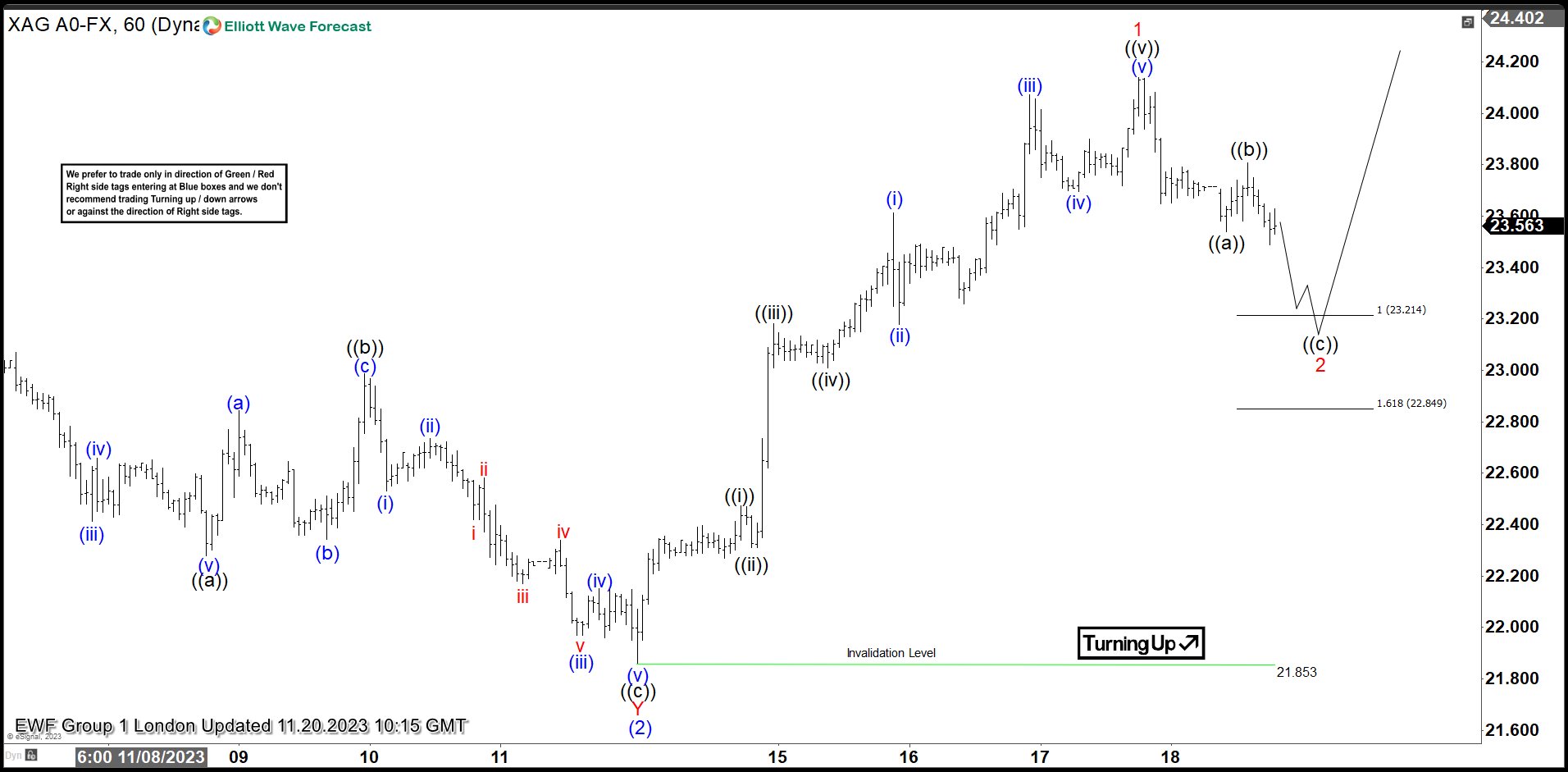

Silver (XAGUSD) Preparing for Breakout Higher

Read MoreSilver (XAGUSD) is correcting in a double three structure before it resumes higher. This article and video look at the Elliott Wave path

-

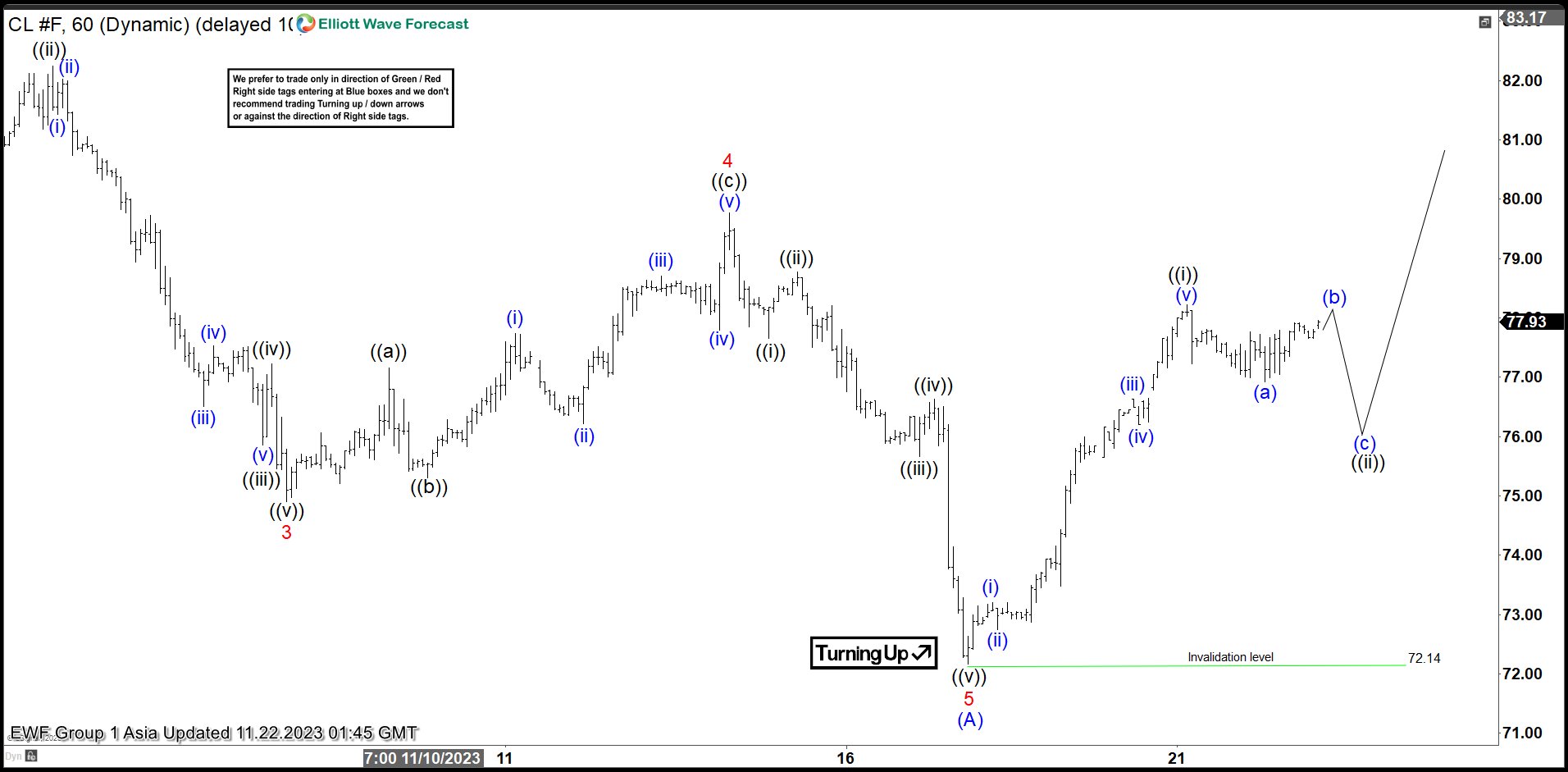

Oil (CL) Short Term Impulsive Structure Suggests Further Upside

Read MoreOil (CL) shows impulsive rally from 11.17.2023 low favoring more upside. This article and video look at the Elliott Wave path.

-

Silver XAGUSD Found Intraday Buyers At The Equal Legs Area

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of Silver, published in members area of the website. As our members know Silver has recently made a short term 3 waves pull back that has reached its target area and found buyers. In the further text […]

-

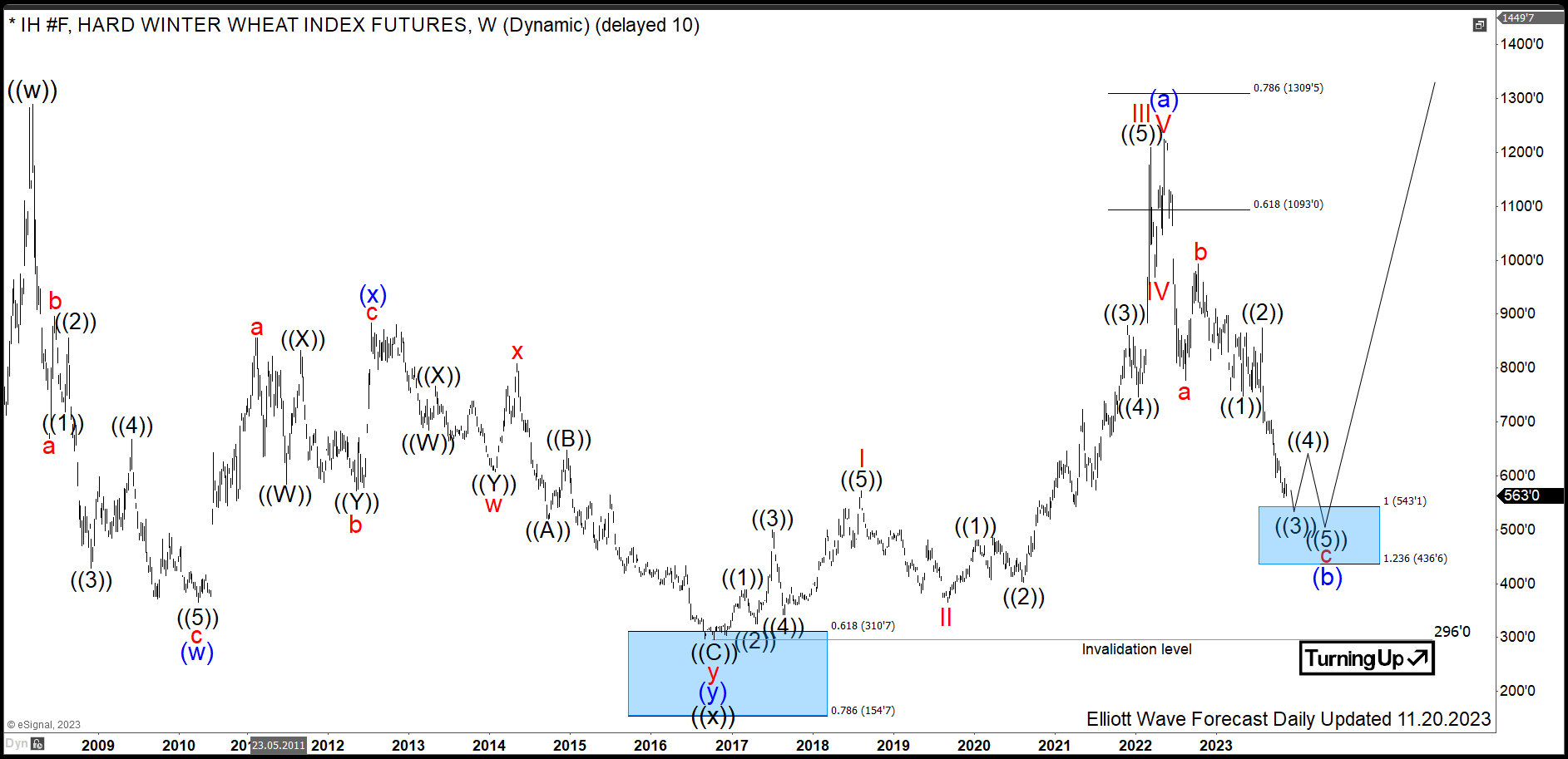

Hard Red Winter Wheat: Buying Weekly Pullbacks

Read MoreHard Red Winter Wheat is one of the grain commodities, along with soft red wheat, corn, soybeans and others. Within the wheat family, first of all, there is a fundamental difference between two wheat types. Soft wheat is low in protein and is basically used in cakes in pastries. By contrast, hard wheat has a […]

-

Platinum (PL) Ended Correction and Turning Higher

Read MorePlatinum (PL) may have ended the correction to the cycle from 9.1.2022 low and in the early stage of turning higher. If the pivot on September 2022 low at 796.8) breaks, it suggests a bigger correction against March 2020 low within wave (II) which is not our primary view at the moment. In the higher […]