Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

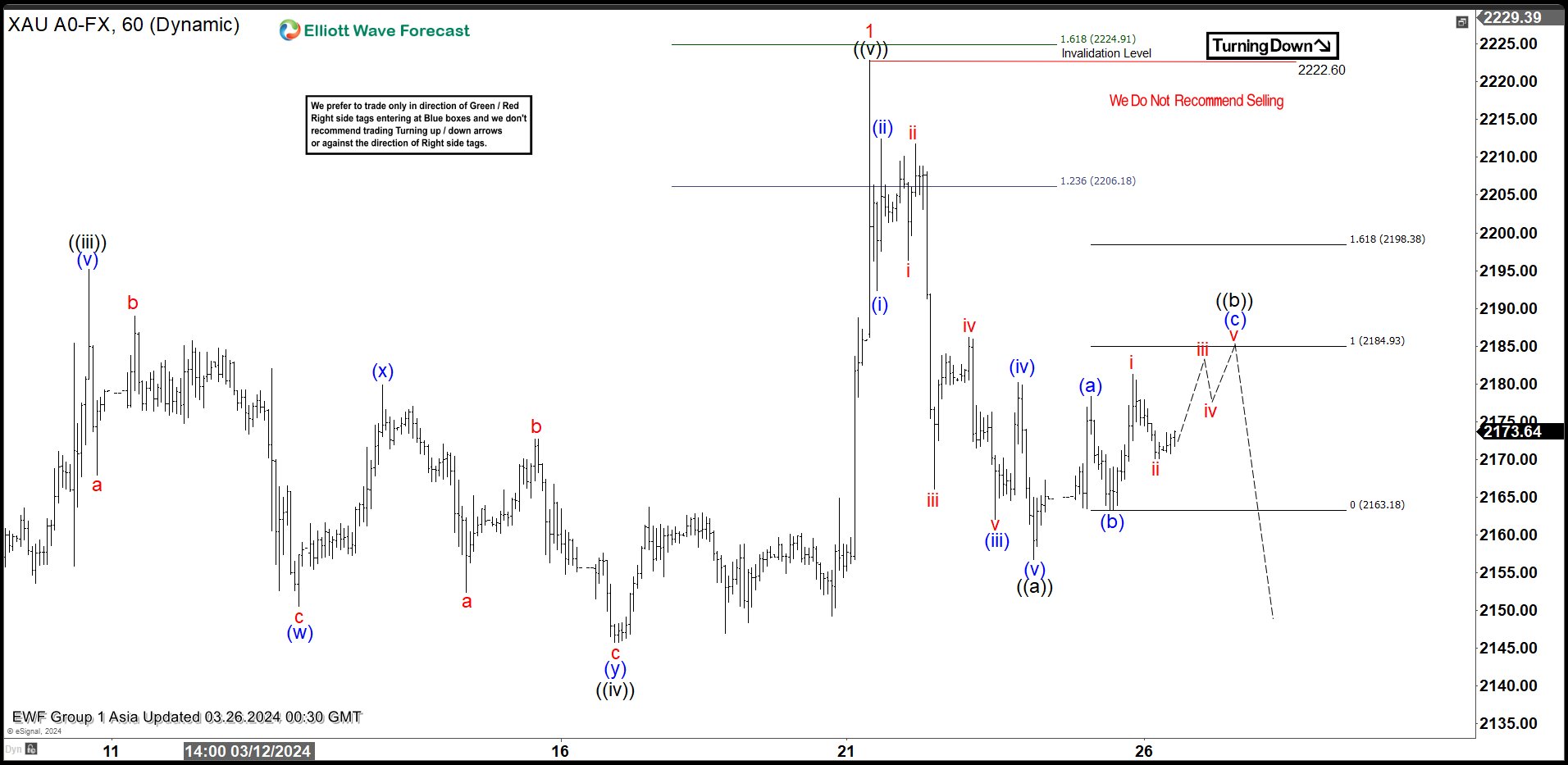

Gold (XAUUSD) Looking to do Larger Degree Correction

Read MoreGold (XAUUSD) is looking to do larger degree correction against cycle from 12.13.2023 low. This article and video look at the Elliott Wave path.

-

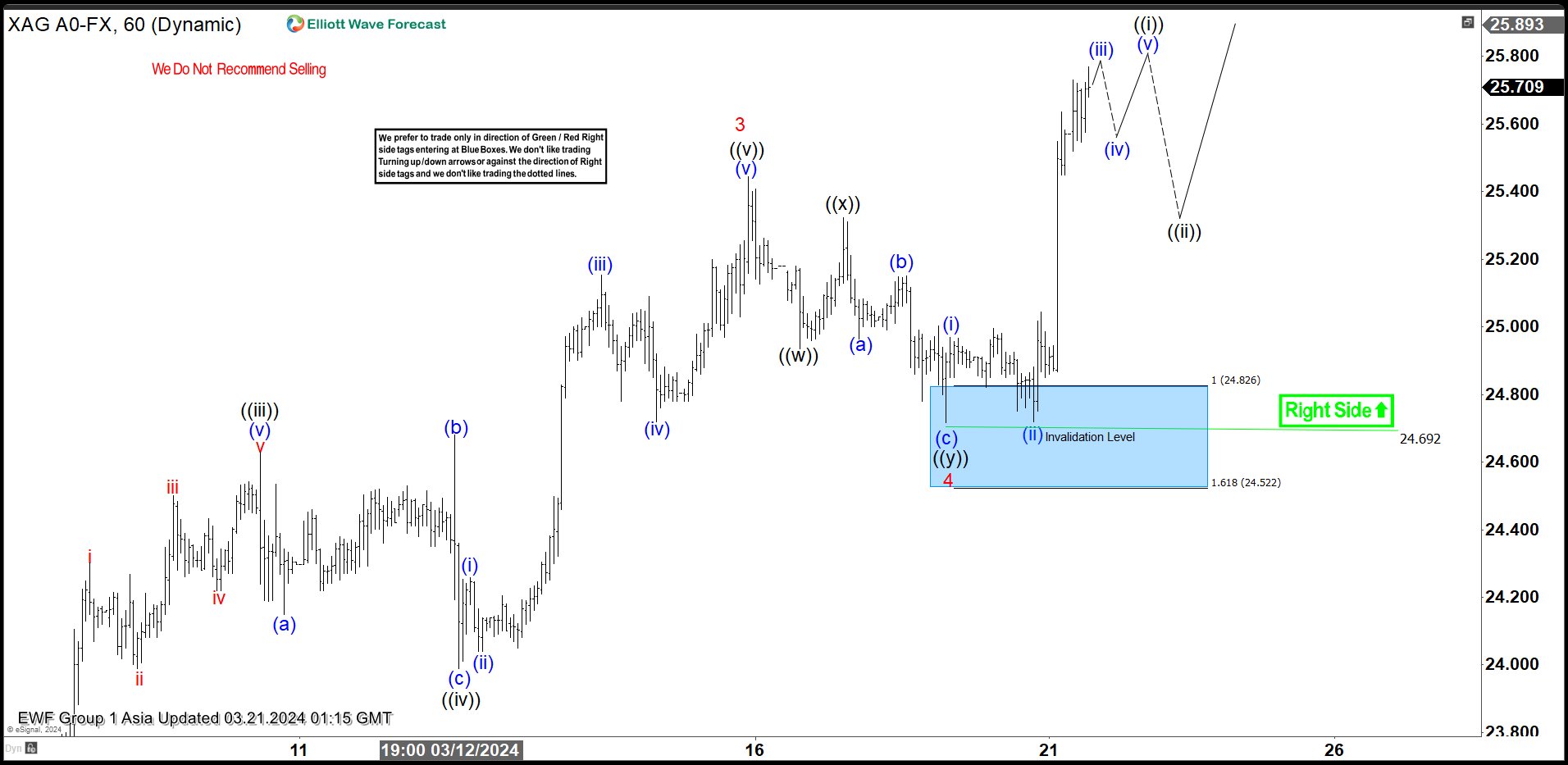

Silver (XAGUSD) Should Continue to Extend Higher

Read MoreSilver (XAGUSD) rallies as an impulse and should continue to extend higher. This article and video look at the Elliott Wave path.

-

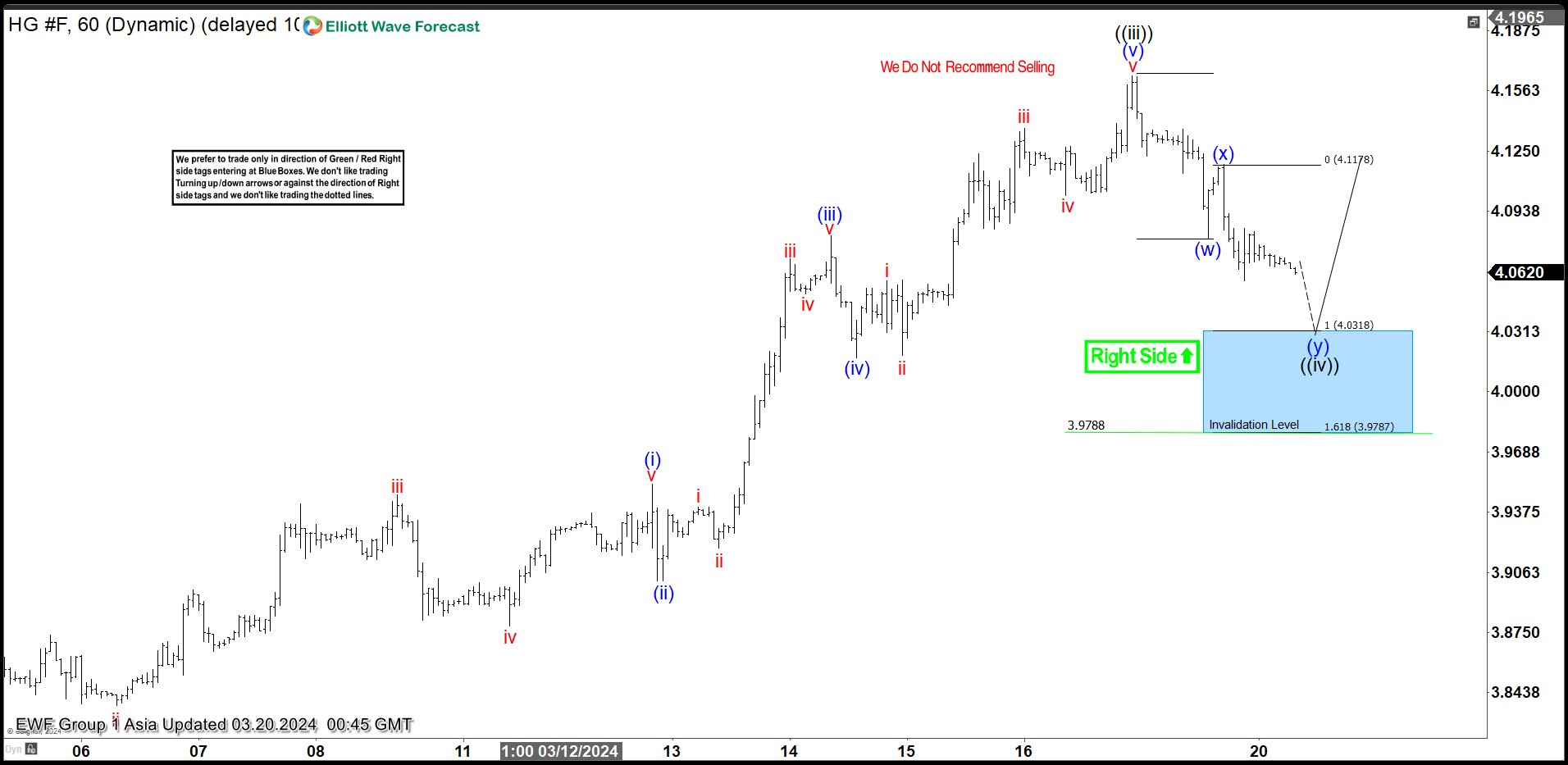

Copper (HG) Short Term Pullback Should Find Buyers

Read MoreCopper (HG) is pulling back in a double three Elliott Wave structure. This article and video look at the Elliott Wave path for the metal.

-

Platinum (PL) in Bottoming Process

Read MorePlatinum (PL) is still in the process of forming a bottom and the metal is trading sideways since 2021 peak at 1348.2. The metal still needs to break above 1348.2 to confirm that the next leg higher has started. Below we updated the Monthly and Daily Elliott Wave chart for the metal. Platinum (PL) Monthly […]

-

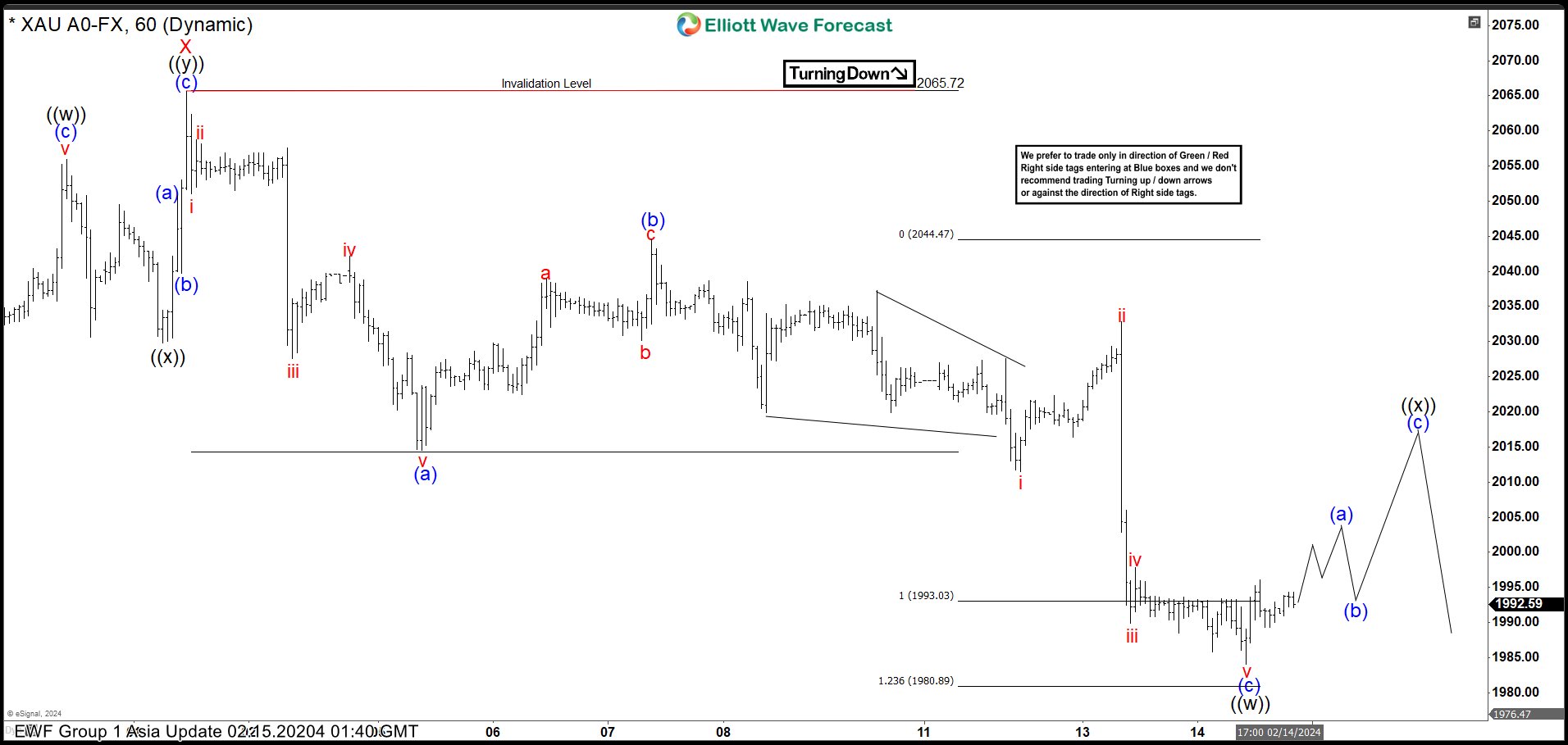

Gold (XAUUSD) May See Larger Degree Correction

Read MoreGold (XAUUSD) is correcting cycle from 10.6.2023 low in a double three. This article and video look at the Elliott Wave path.

-

Silver (XAGUSD) Looking to Extend Lower in Sideways Price Action

Read MoreSilver (XAGUSD) is looking to extend lower in sideways price action since last year. This article and video look at the Elliott Wave path.