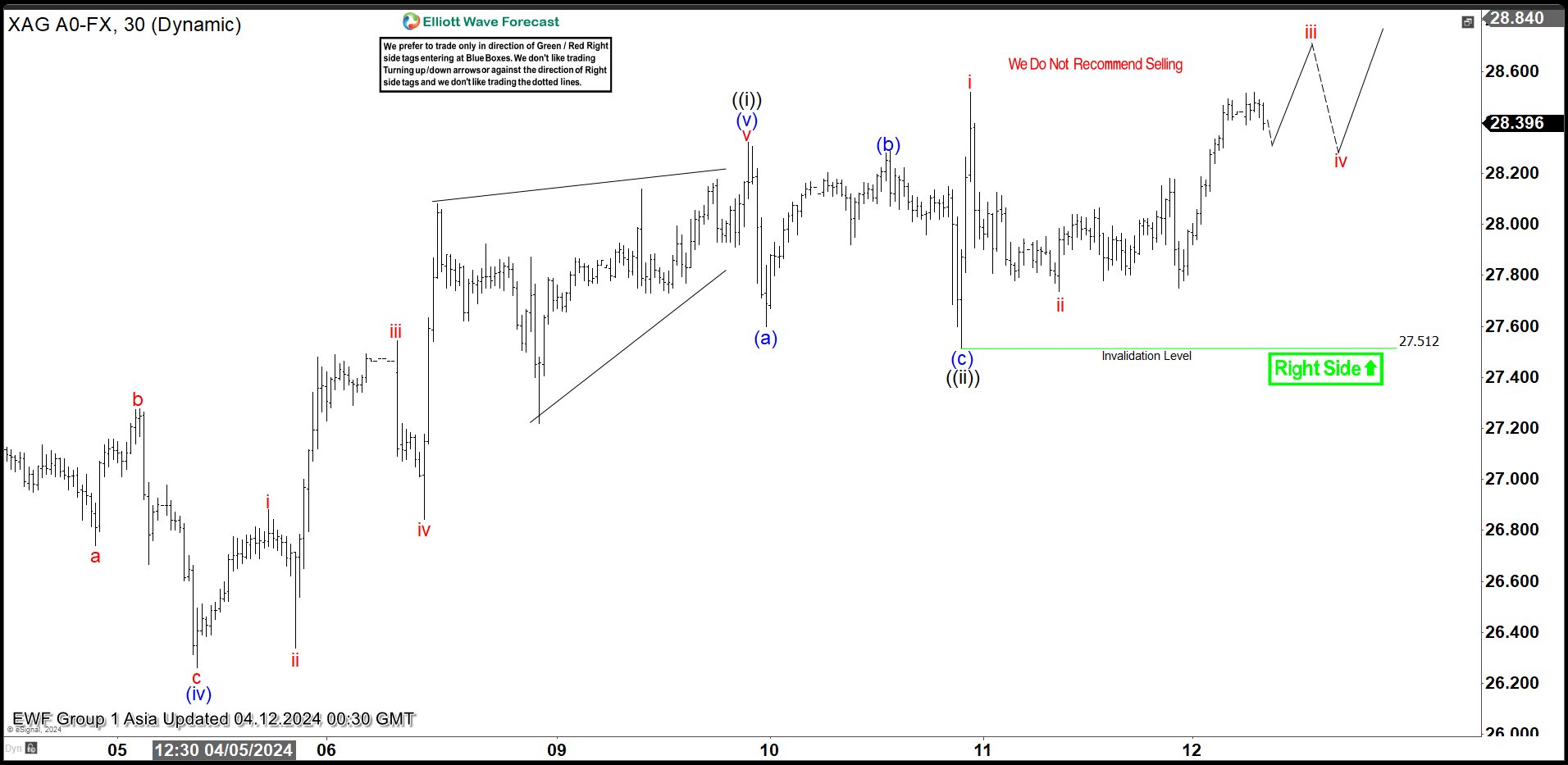

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Elliott Wave Expects Silver (XAGUSD) Pullback to Find Support

Read MoreSilver (XAGUSD) is looking to extend higher to complete impulsive structure from 5.2.2024 low. This article and video look at the Elliott Wave path.

-

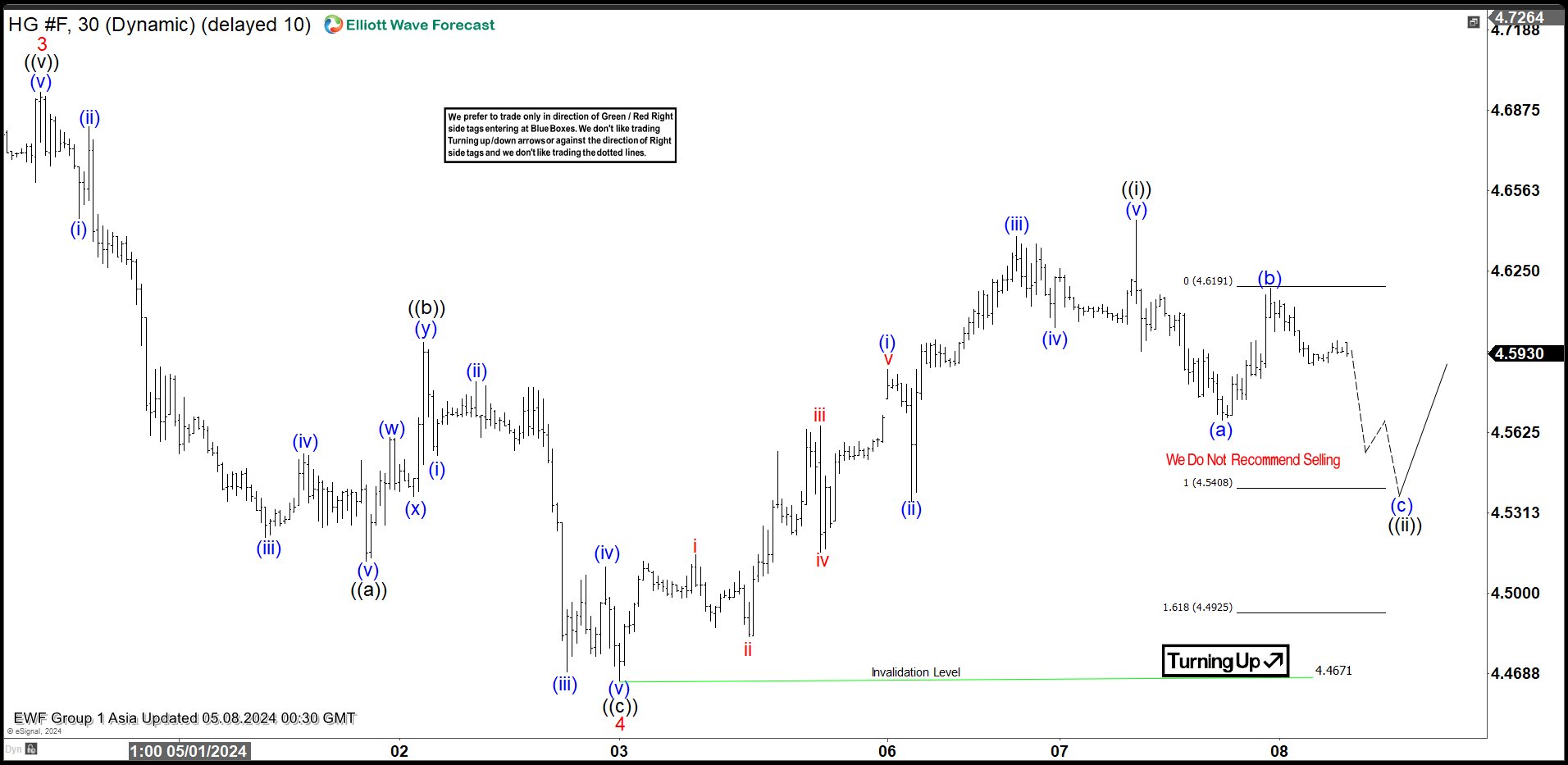

Copper (HG_F) Elliott Wave : Forecasting the Rally from the Equal Legs Zone

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Copper Futures HG_F, published in members area of the website. As our members know, Copper is showing impulsive bullish sequences in the cycle from the 3.6592 low. Consequently we are favoring the long positions at this stage. The […]

-

Elliott Wave Analysis: 7 Swing Correction in Gold (XAUUSD)

Read MoreGold (XAUUSD) is looking to correct lower in a 7 swing structure. This article and video look at the Elliott Wave path of the metal.

-

OIL (CL_F) Elliott Wave: Incomplete Sequences Forecasting The Path

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of Oil published in members area of the website. The commodity shows bullish sequences in the cycle from the 67.75 low. Consequently we are favoring the long side and recommending members to keep buying the dips in 3,7,11 swings when […]

-

Platinum (PL) Turning Higher

Read MorePlatinum (PL) looks to have formed a bottom and the metal has started to rally higher in the next bullish cycle. The metal still needs to break above 1348.2 to confirm that the next leg higher has started. Below we updated the Monthly and Daily Elliott Wave chart for the metal. Platinum (PL) Monthly Elliott […]

-

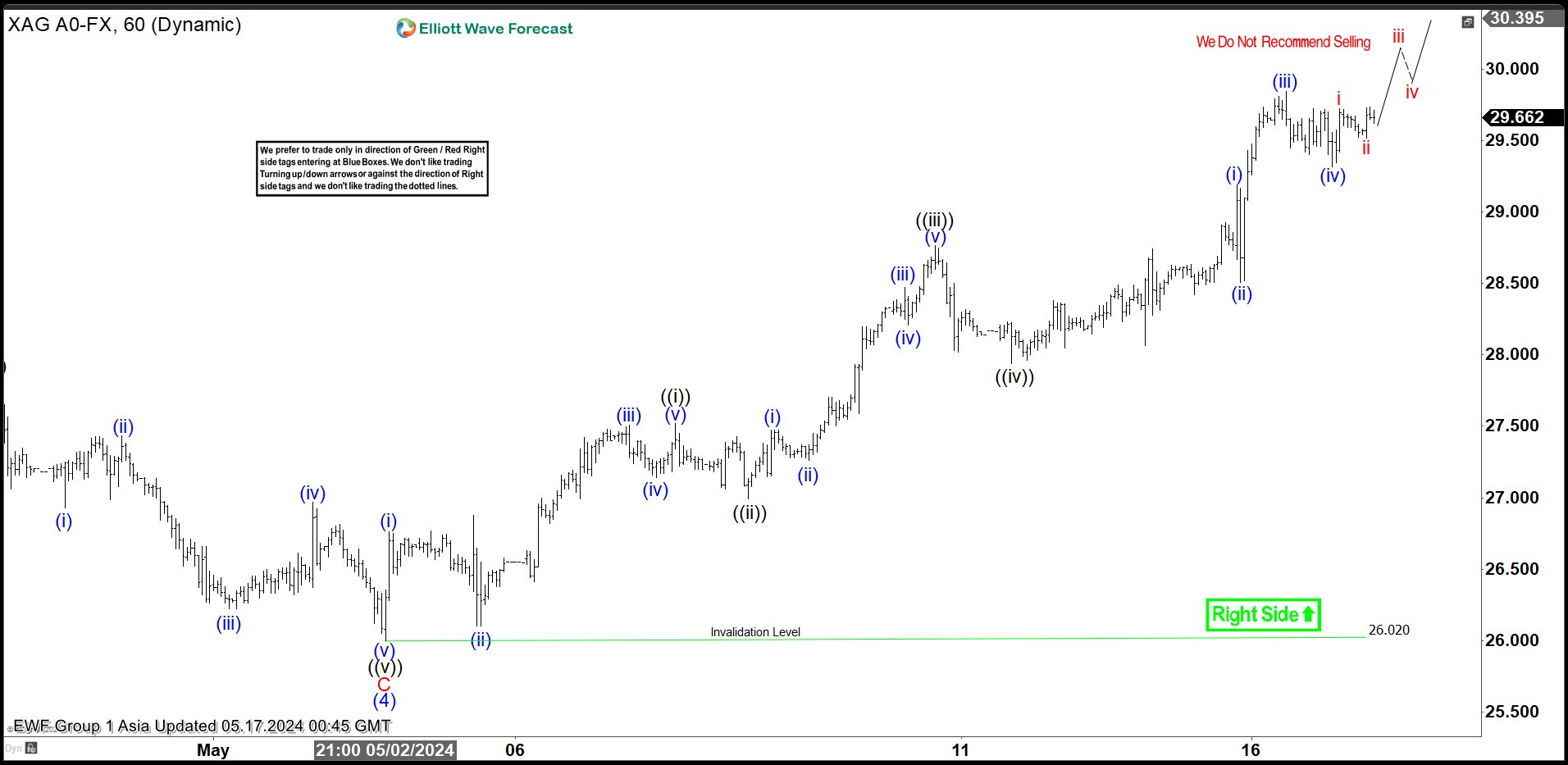

Silver (XAGUSD) Looking to Extend Higher in a Nest

Read MoreSilver (XAGUSD) is extending higher in a nesting impulse. This article and video look at the Elliott Wave path of the metal.