Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

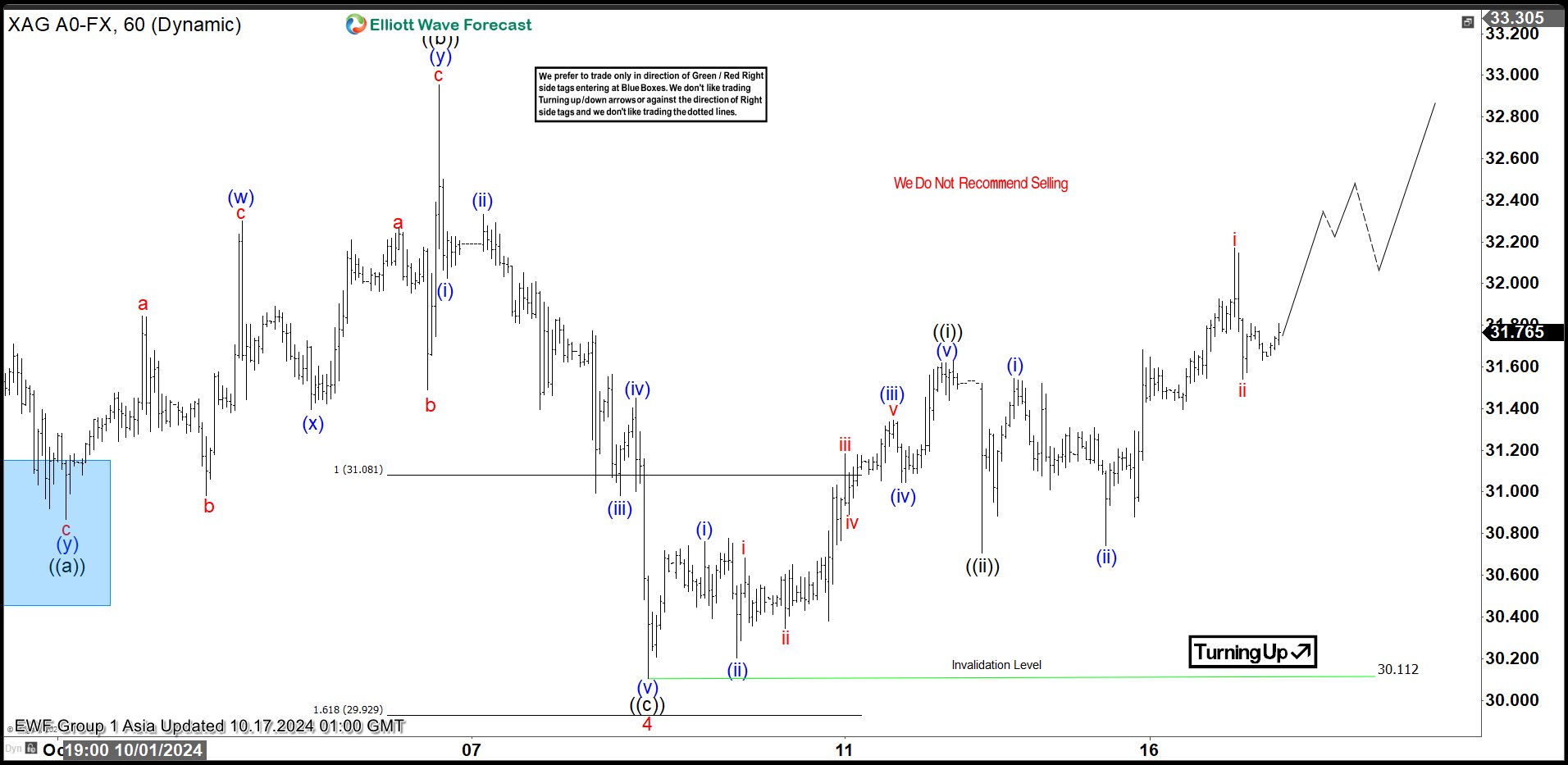

Elliott Wave Intraday View in Silver (XAGUSD) Favoring the Upside

Read MoreSilver (XAGUSD) is looking to resume higher to end 5 waves rally from August 8, 2024. This article and video look at the Elliott Wave path.

-

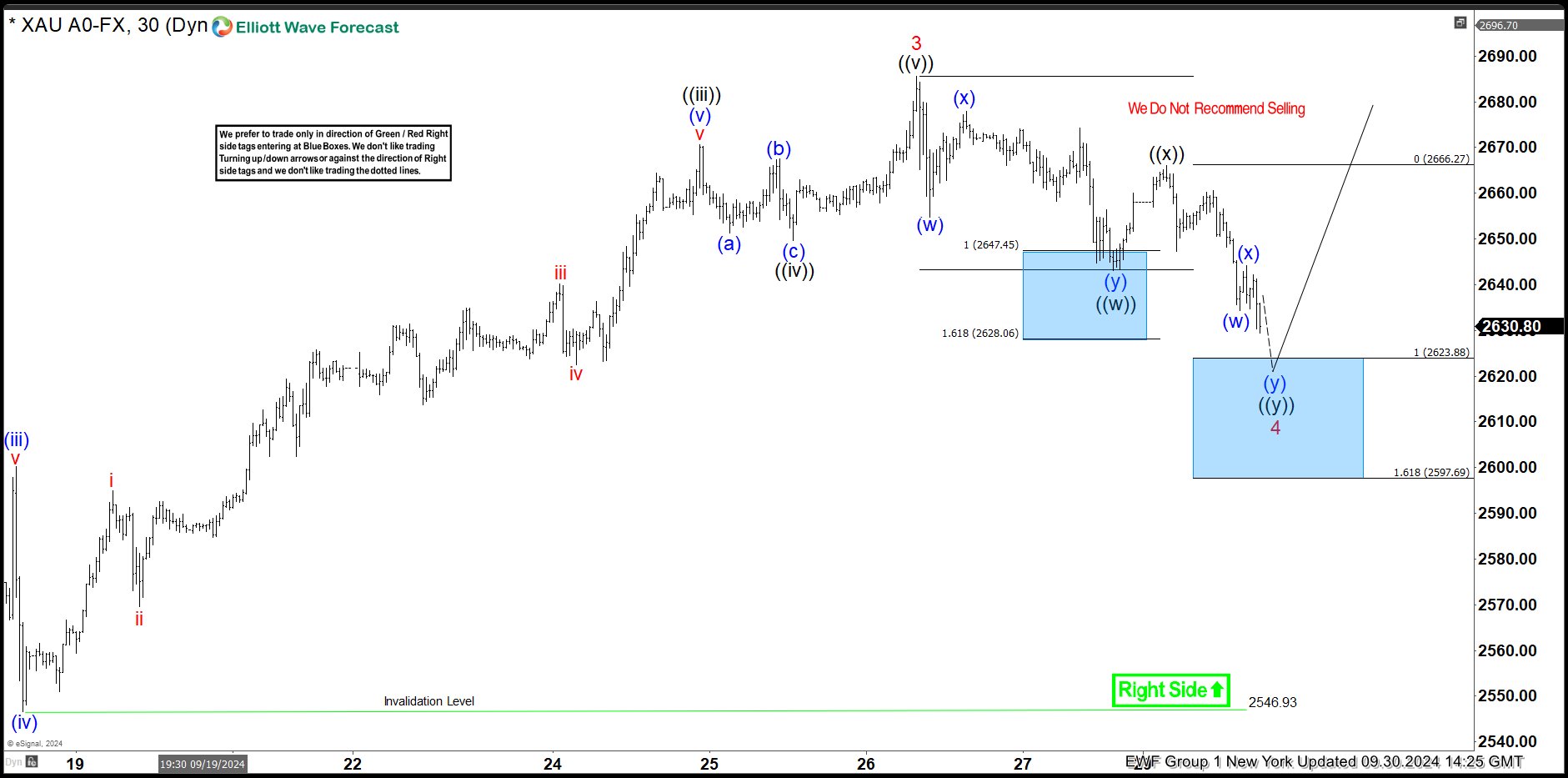

XAUUSD Perfectly Reacting Higher From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of XAUUSD charts. In which, the gold perfectly reacting higher from the blue box area.

-

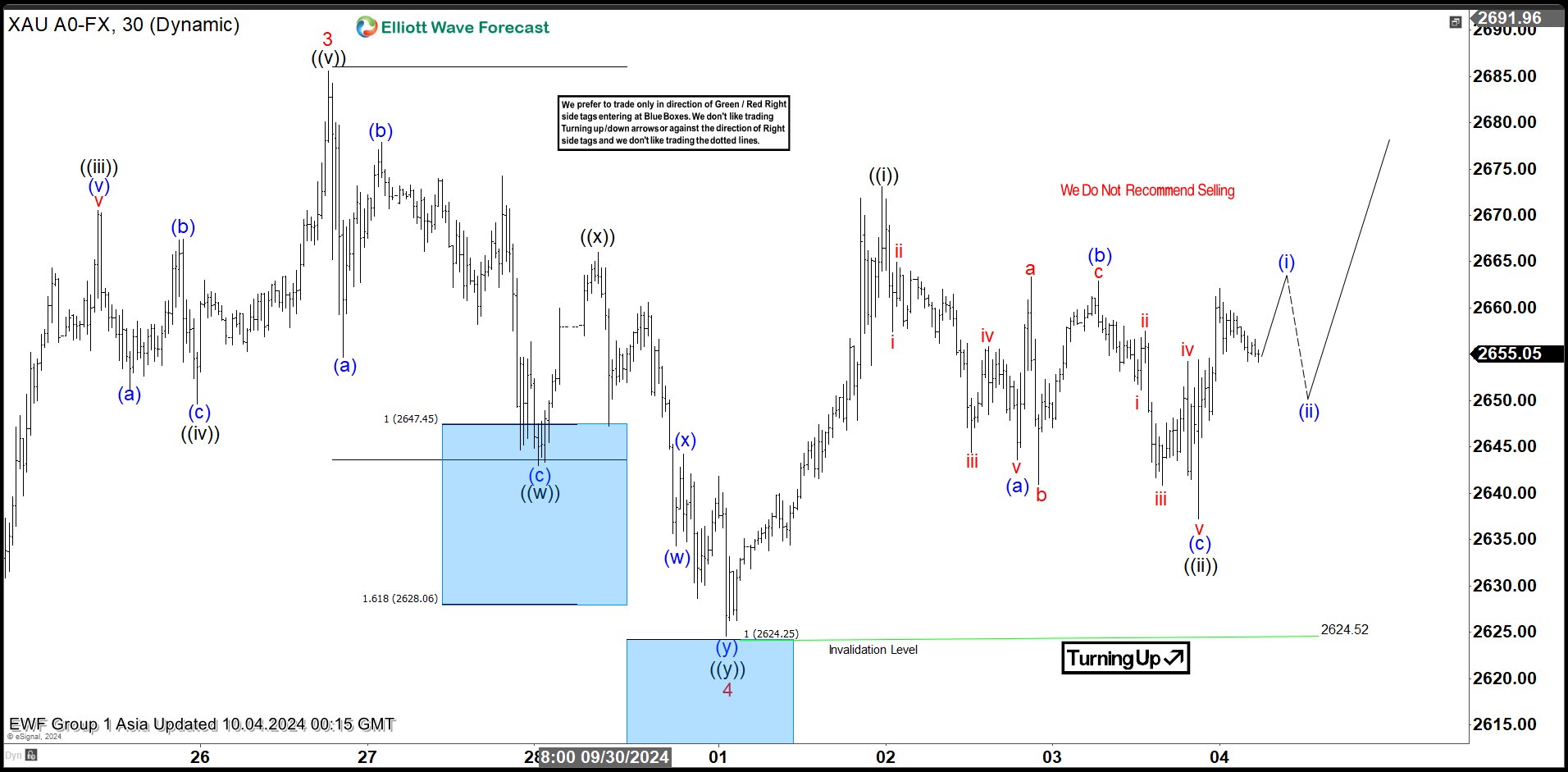

Gold Found Buyers Once Again At The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Gold charts. In which, the gold found buyers once again at the blue box area.

-

Intraday Elliott Wave View on Gold (XAUUSD) Looking to Resume Bullish Trend

Read MoreGold (XAUUSD) is looking to resume higher in impulsive structure. This article and video look at the Elliott Wave path of the metal.

-

Gold-to-Silver Ratio (AUG) Still Waiting for the Next Direction

Read MoreGold-to-Silver Ratio has always been a useful tool to forecast the direction the underlying metals (i.e. Gold and Silver). We can calculate the ratio simply as Gold price divided by Silver price. The average gold-silver ratio was 47:1 in the 20th century. In the 21st century, the ratio has ranged mainly between 50:1 and 70:1. […]

-

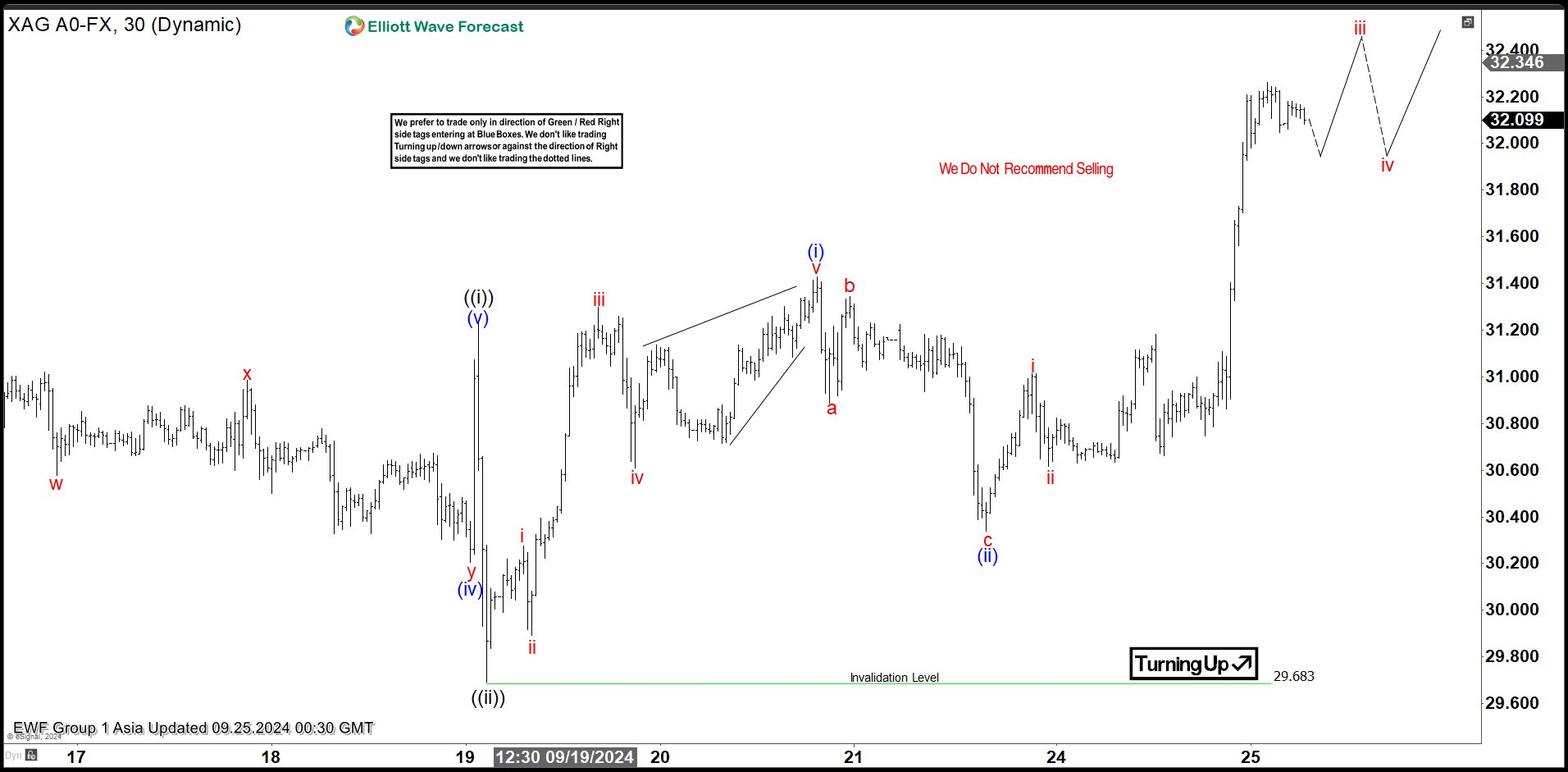

Elliott Wave Expects Silver (XAGUSD) to Continue Bullish move

Read MoreSilver (XAGUSD) is about to break above previous peak on 5.20.2024 high which confirms the bullish outlook. This article shows Elliott Wave path.