Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Gold XAU/USD : Selling the Bounces

Read MoreGold (XAU) topped out on the May 18/2015 high and since then it has reversed and been moving to the down side. We, at Elliottwave-Forecast, strive to keep our members on the right side of the markets and we encourage members to enter trades at precise selling/buying areas. Take a look at the charts below […]

-

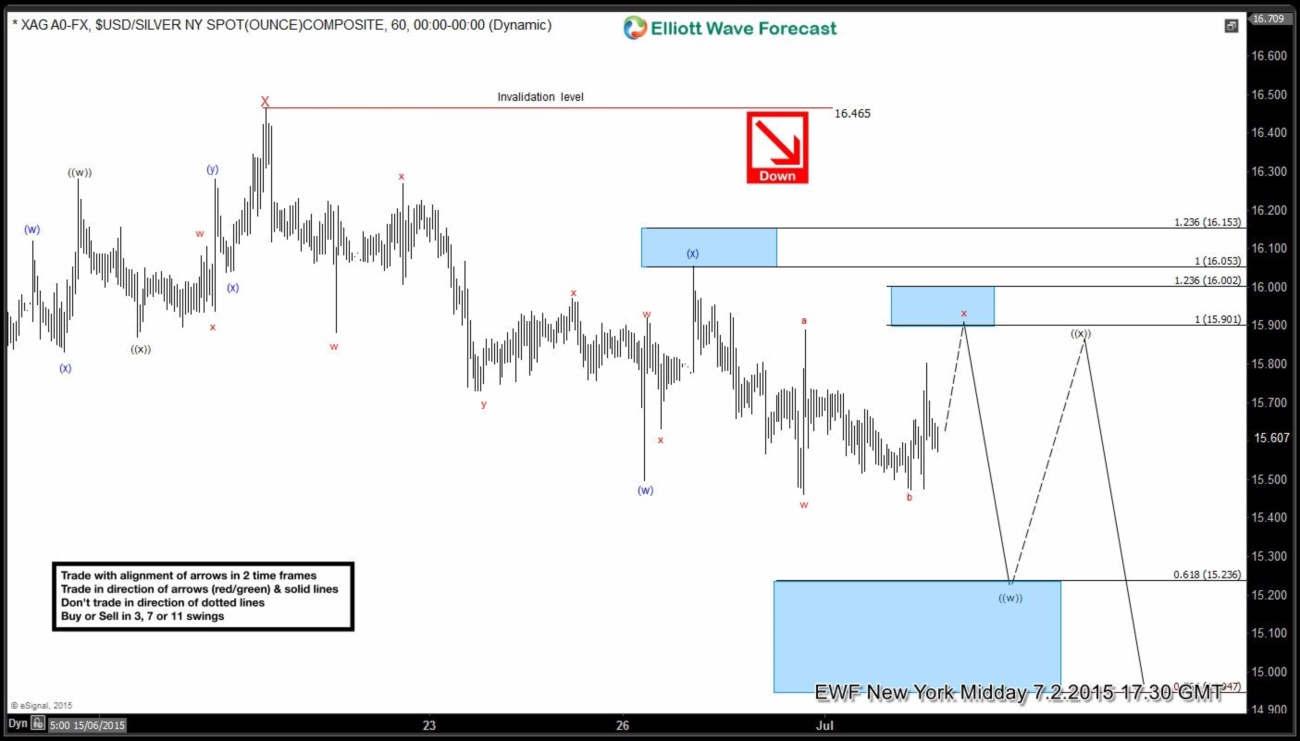

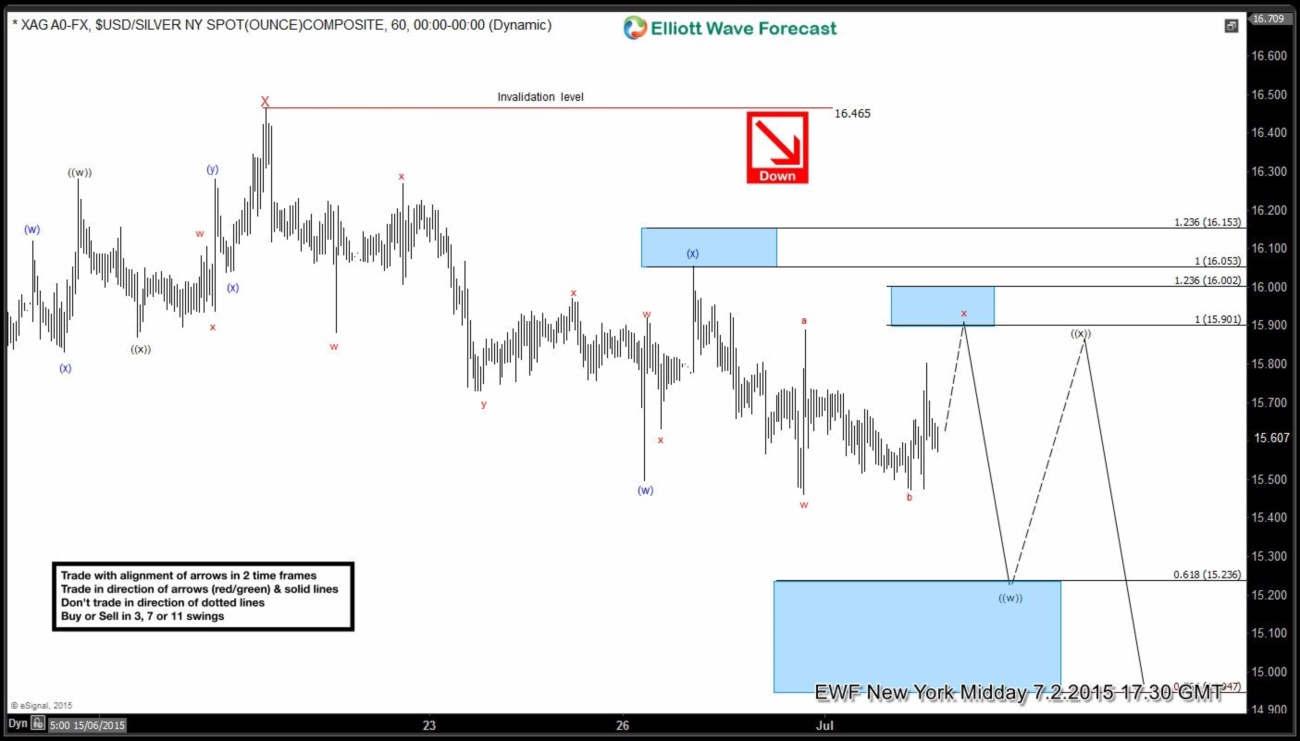

Silver (XAG) Short Term Elliott Wave Update 7.3.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.95 – 15.2. Revised short term Elliott Wave view suggests the internal of wave (y) is taking the form of a double corrective structure w-x-y where […]

-

Silver (XAG) Short Term Elliott Wave Update 7.3.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.95 – 15.2. Revised short term Elliott Wave view suggests the internal of wave (y) is taking the form of a double corrective structure w-x-y where […]

-

Silver (XAG) Short Term Elliott Wave Update 7.1.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.85 – 15.08. In our Chart of The Day 6.30.2015, we said the internal of wave (y) is also taking the form of a double corrective […]

-

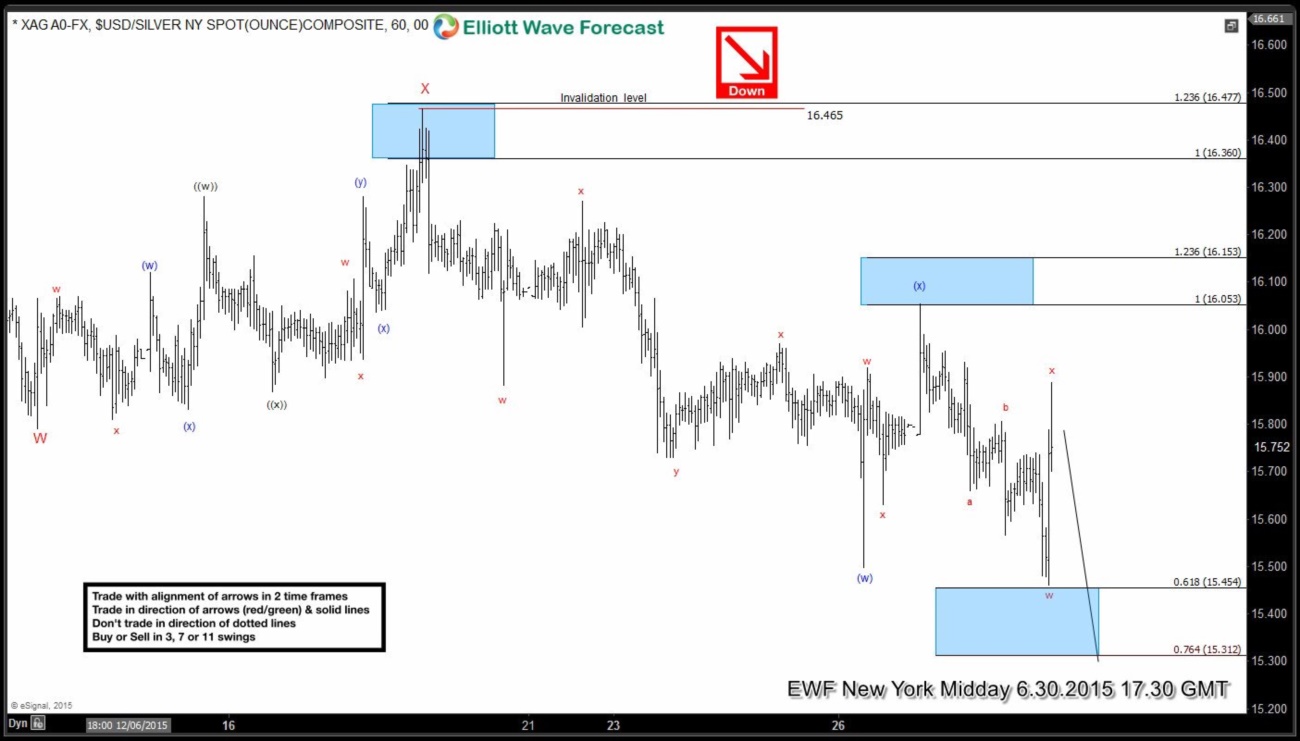

Silver (XAG) Short Term Elliott Wave Analysis 6.30.2015

Read MoreDecline from wave X at 16.46 is unfolding in double correction (w)-(x)-(y) where wave (w) ended at 15.5, wave (x) ended at 16.05, and wave (y) is in progress towards 14.85 – 15.08. The internal of wave (y) is also taking the form of a double corrective structure w-x-y where wave w is in progress towards […]

-

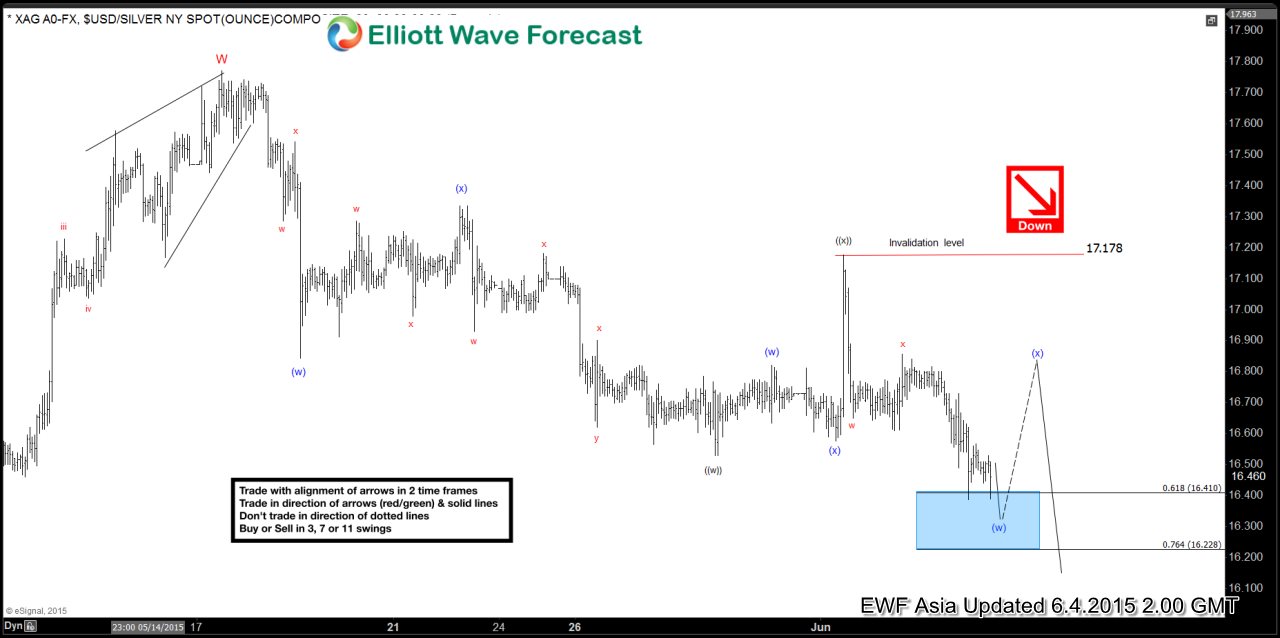

Silver Short Term Elliott Wave Analysis 6.4.2015

Read MoreRally to 17.77 completed wave W, and short term Elliott Wave view suggests wave X pullback is unfolding in the form of a double correction ((w))-((x))-((y)) where wave ((w)) ended at 16.565, wave ((x)) ended at 17.178, and wave ((y)) is currently in progress. Internal of wave ((y)) is taking the form of a double […]