Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

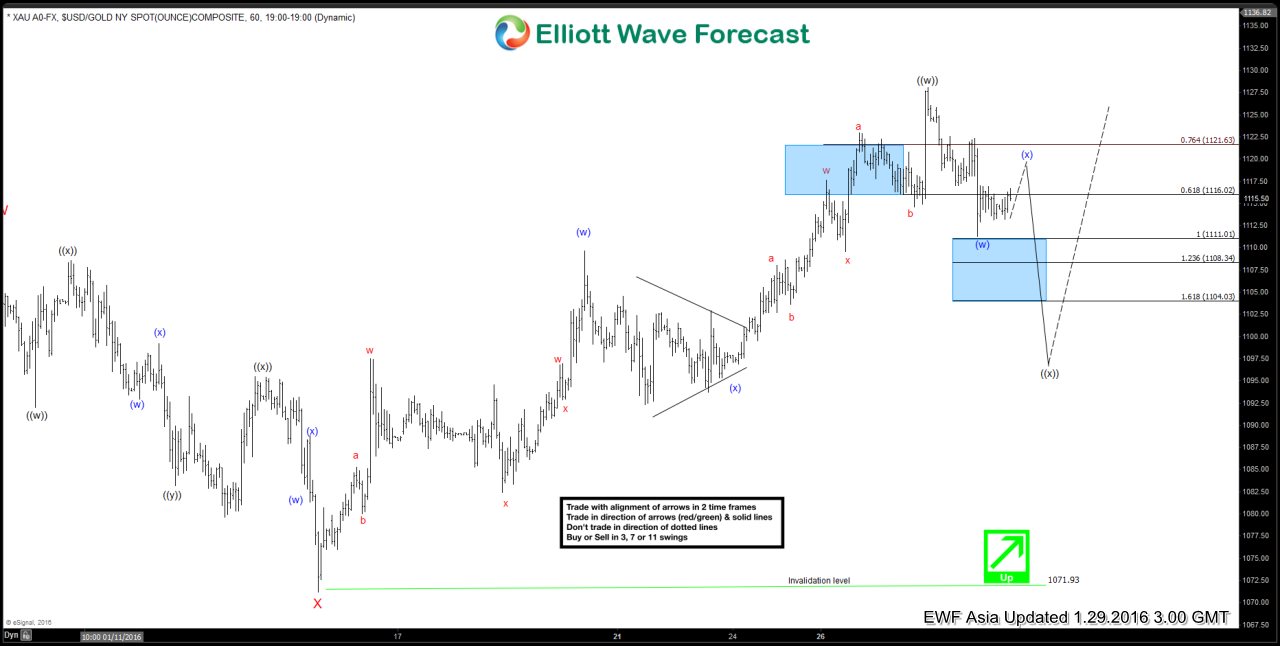

$XAU Gold Short Term Elliott Wave Analysis 01.29.2016

Read MoreShort term Elliottwave structure suggests the rally from wave X at 1071.31 is unfolding in a double three where wave ((w)) ended at 1128 and wave ((x)) pullback is in progress to correct rally from 1071.93. Internal of wave ((x)) is unfolding in double correction where wave (w) ended at 1111.3, wave (x) ended at […]

-

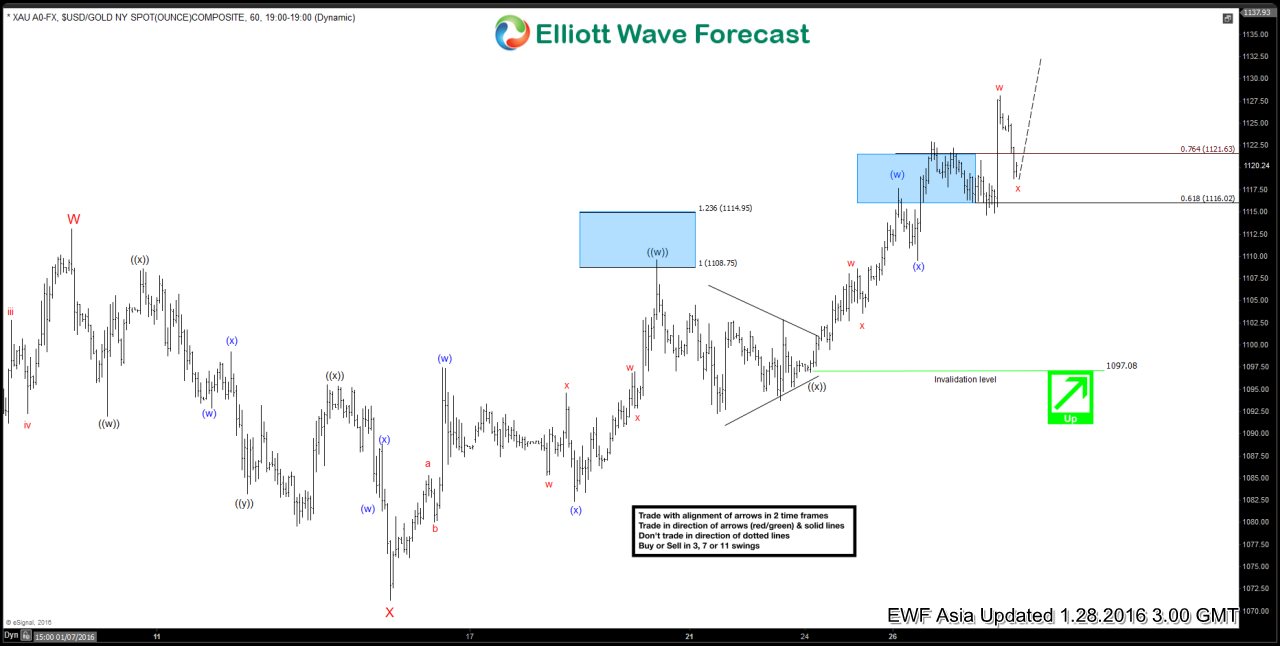

$XAU Gold Short Term Elliott Wave Analysis 01.28.2016

Read MoreShort term Elliottwave structure suggests the rally from wave X at 1071.31 is unfolding in a double three where wave ((w)) ends at 1109.6, wave ((x)) ends at 1092.29, and wave ((y)) is currently in progress. Internal of wave ((y)) is also unfolding as a double three where wave (w) ended at 1117.64, and wave (x) […]

-

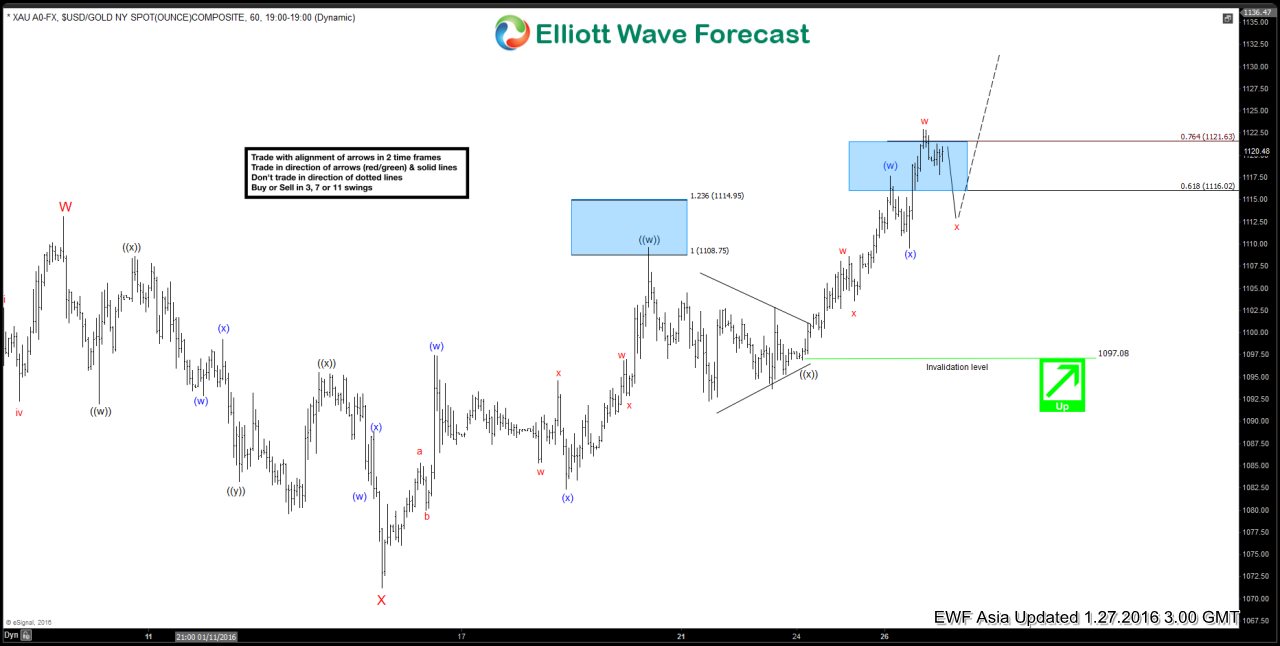

$XAU Gold Short Term Elliott Wave Analysis 01.27.2016

Read MoreShort term Elliottwave structure suggests the rally from 107.31 is unfolding in a double three where wave ((w)) ends at 1109.6, wave ((x)) ends at 1092.29, and wave ((y)) is currently in progress. Internal of wave ((y)) is also unfolding as a double three where wave (w) ended at 1117.64, and wave (x) pullback is proposed complete […]

-

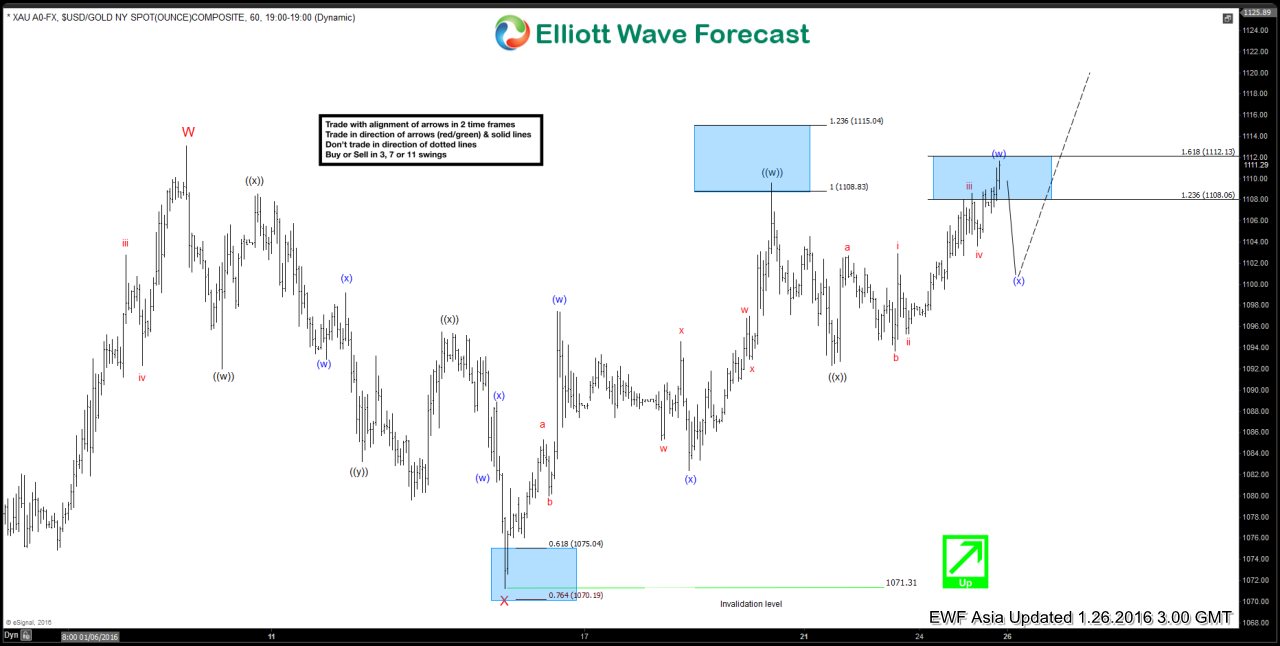

$XAU Gold Short Term Elliott Wave Analysis 01.26.2016

Read MoreRally from wave X at 107.31 is in 5 swing which suggests an incomplete sequence and likely need further upside in 7 swing. The rally from 107.31 is unfolding in a double three where wave ((w)) ends at 1109.6, wave ((x)) ends at 1092.29, and wave ((y)) is currently in progress. Internal of wave ((y)) is also unfolding […]

-

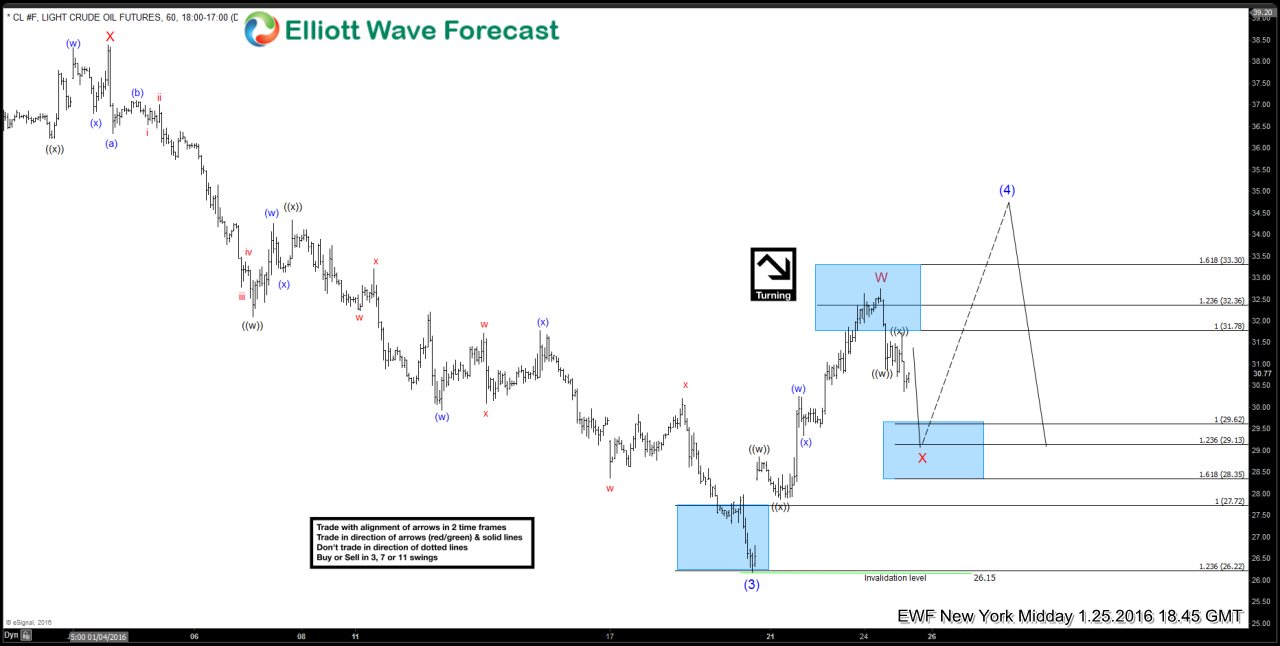

Crude Oil – Historical Cost of Production Levels

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. CL – […]

-

SILVER – GOLD VS US DOLLAR | Predicting the Reversal

Read MoreIntroduction | SILVER:XAG and GOLD:XAU Let’s start from what we know so far. Gold:XAUUSD has been devaluated by approximately 42% since 2011’s all times highs 1.920 level and Silver:XAGUSD has been devaluated by almost 73% respectively from 2011’s all times high 49.780 level. Plain and simple Gold has lost almost half of its value while […]