Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.6.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a zigzag where wave (a) ended at 15.71, wave (b) ended at 15.01, and wave (c) of ((w)) ended at 16.87. Wave ((x)) pullback is in progress to correct the rally from 13.99 with a possible target of 14.82 […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.5.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a zigzag where wave (a) ended at 15.71, and wave (b) ended at 15.01. Wave (c) of ((w)) is expected to complete at 16.72 – 17.12 area, then it should pullback in wave ((x)) to correct the rally […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.4.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a triple three where wave (w) ended at 15.6, wave (x) ended at 15.01, wave (y) is proposed complete at 16.47, and 2nd wave (x) pullback is proposed complete at 15.88. While pullbacks stay above 15.88, and more […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.3.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a triple three where wave (w) ended at 15.6, wave (x) ended at 15.01, and wave (y) is proposed complete at 16.47. Second wave (x) pullback is currently in progress towards 15.56- 15.74 area as 3 swings correction before […]

-

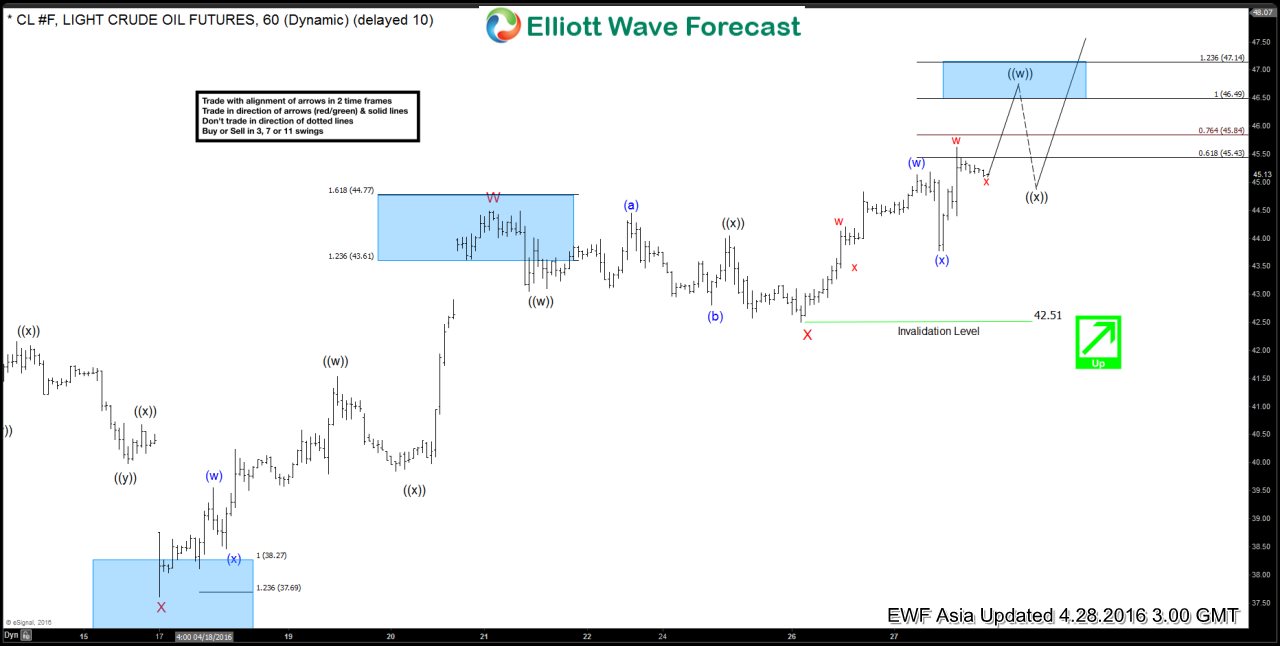

Oil Short-term Elliott Wave Analysis 4.29.2016

Read MoreShort term Elliottwave structure suggests that rally from 35.23 on 4/5 remains alive as a triple three where wave W ended at 42.42 on 4/13, wave X ended at 37.61 on 4/18, wave Y ended at 44.49 on 4/21, and 2nd wave X pullback is proposed complete at 42.51 on 4/28. Near term, cycle from 4/28 low is expected to complete soon with wave ((w)) […]

-

Oil Short-term Elliott Wave Analysis 4.28.2016

Read MoreShort term Elliottwave structure suggests that rally from 35.23 on 4/5 remains alive as a triple three where wave W ended at 42.42 on 4/13, wave X ended at 37.61 on 4/18, wave Y ended at 44.49 on 4/21, and 2nd wave X pullback is proposed complete at 42.51 on 4/28. Near term, while dips stay above 42.51, oil is favored to resume higher in wave […]